Professional Liability Insurance Meaning

Professional liability insurance, often referred to as errors and omissions insurance (E&O), is a crucial aspect of risk management for businesses and professionals across various industries. It provides a safety net for individuals and entities that offer specialized services, protecting them from potential financial losses arising from client lawsuits alleging negligence, errors, or omissions in the course of their professional duties.

The Importance of Professional Liability Insurance

In today’s complex and litigious business landscape, professionals face an increasing risk of being sued for their work. Even the most cautious and competent individuals can make mistakes or be accused of negligence. Professional liability insurance acts as a vital safeguard, ensuring that businesses and professionals can continue operating without fear of financial ruin due to legal action.

This type of insurance is especially critical for industries where errors or oversights can have significant consequences. For instance, in the medical field, a misdiagnosis or incorrect treatment plan could lead to severe patient harm. Similarly, architects and engineers can face lawsuits if their designs or calculations result in structural failures. Professional liability insurance provides a means to mitigate the financial risks associated with such scenarios.

Coverage and Benefits

Professional liability insurance offers a range of benefits that are tailored to the specific needs of professionals. Here are some key aspects of the coverage it provides:

- Legal Defense Costs: One of the primary benefits is the coverage of legal expenses. If a client files a lawsuit against the insured professional, the insurance policy will cover the costs associated with hiring lawyers, court fees, and other legal expenses.

- Compensation for Client Losses: In the event that a court finds the insured professional liable for errors or omissions that resulted in financial losses for the client, the insurance policy will provide compensation to the client. This helps protect the professional's finances and reputation.

- Risk Mitigation and Prevention: Professional liability insurance carriers often provide resources and guidance to help policyholders reduce the likelihood of errors and claims. This may include risk management training, access to legal resources, and best practice guidelines.

- Protection for Businesses and Individuals: This insurance is available for both businesses and sole proprietors. It can cover a range of professionals, including consultants, advisors, accountants, lawyers, medical professionals, and more.

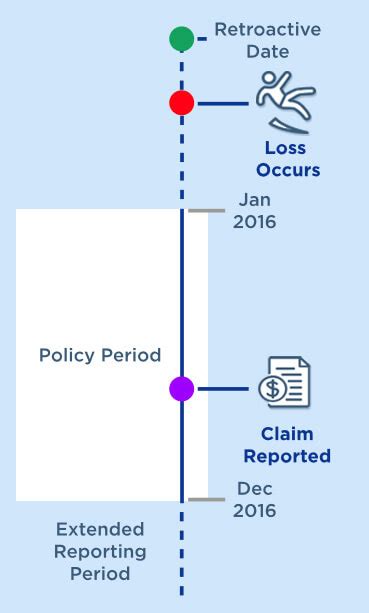

- Retroactive and Extended Reporting: Some policies offer retroactive coverage, which can protect professionals for claims arising from work performed before the policy was in place. Extended reporting periods are also available, allowing professionals to report claims after their policy has expired.

Key Considerations for Professionals

When selecting a professional liability insurance policy, there are several important factors to consider:

Policy Limits and Deductibles

Policy limits refer to the maximum amount the insurance company will pay for a single claim or for all claims during the policy period. It’s crucial to choose limits that align with the potential risks and financial exposure of your profession. Deductibles, on the other hand, are the portion of a claim that the insured must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lead to lower premiums, but it’s essential to consider your financial capacity to handle larger deductibles.

| Policy Type | Coverage Limits | Deductible Options |

|---|---|---|

| Standard Policy | $1,000,000 per claim; $3,000,000 aggregate | $1,000; $2,500; $5,000 |

| High-Limit Policy | $2,000,000 per claim; $6,000,000 aggregate | $2,500; $5,000; $10,000 |

Coverage Territory

Professional liability insurance policies typically have geographical restrictions. It’s important to ensure that your policy covers the areas where you operate or provide services. For professionals with global clients or those who frequently travel, a policy with a wider coverage territory may be necessary.

Exclusions and Endorsements

Insurance policies often have standard exclusions, which are specific situations or types of claims that are not covered. It’s crucial to review these exclusions carefully to understand the limitations of your coverage. Additionally, endorsements (also known as riders) can be added to policies to extend or customize coverage to fit your specific needs.

Case Study: Professional Liability Insurance in Action

Consider the case of Dr. Emily Johnson, a renowned cardiologist in a major metropolitan area. Despite her extensive experience and expertise, Dr. Johnson made a critical error in diagnosing a patient’s heart condition, leading to severe complications. The patient filed a lawsuit seeking compensation for medical expenses, pain and suffering, and lost wages.

Fortunately, Dr. Johnson had a robust professional liability insurance policy in place. The policy covered the legal costs associated with defending the lawsuit, which included expert witness fees, court fees, and attorney fees. Additionally, the policy provided compensation to the patient for the losses incurred due to Dr. Johnson's error, helping to resolve the claim and prevent further financial strain on Dr. Johnson's practice.

This case study highlights the importance of professional liability insurance in protecting professionals from the financial risks associated with errors and omissions. Without such coverage, professionals like Dr. Johnson could face significant financial burdens and potential career setbacks.

The Future of Professional Liability Insurance

As industries evolve and technology advances, the landscape of professional liability insurance is also changing. Insurers are increasingly incorporating risk management strategies and data analytics to better understand and mitigate potential risks. This includes the use of artificial intelligence and machine learning to identify trends and patterns in claims data, helping insurers offer more tailored and cost-effective coverage.

Furthermore, the rise of remote work and digital services has expanded the reach of professionals, creating new risks and challenges. Professional liability insurers are adapting to these changes by offering coverage for cyber risks and providing resources to help professionals navigate the unique challenges of the digital workplace.

In conclusion, professional liability insurance is an essential component of risk management for professionals across various industries. It provides a crucial layer of protection against financial losses arising from errors and omissions, allowing professionals to focus on delivering their expertise with confidence and peace of mind.

What is the difference between professional liability insurance and general liability insurance?

+While both types of insurance provide liability coverage, they differ in the types of risks they cover. General liability insurance protects businesses from third-party claims, such as bodily injury or property damage caused by the business’s operations. On the other hand, professional liability insurance specifically covers claims arising from errors, omissions, or negligence in the professional services provided by the insured. It’s tailored to the unique risks faced by professionals in their specific fields.

How much does professional liability insurance cost?

+The cost of professional liability insurance varies depending on several factors, including the profession, the coverage limits chosen, the insurer, and the insured’s claim history. For example, a lawyer practicing in a high-risk specialty like medical malpractice may pay more for insurance compared to a general practitioner. It’s important to shop around and compare quotes to find the most suitable and cost-effective policy for your needs.

Can I customize my professional liability insurance policy?

+Yes, many professional liability insurance policies can be customized to fit the specific needs of the insured. This may include adding endorsements or riders to extend coverage for unique risks or situations. It’s important to work with an insurance broker or agent who understands your profession and can guide you in selecting the right coverage options.