Premium House Insurance

Securing your home and valuables is an essential aspect of modern life, and premium house insurance offers an invaluable peace of mind for homeowners. With an increasing number of natural disasters, thefts, and unforeseen events, having robust insurance coverage is more critical than ever. This article delves into the world of premium house insurance, exploring its features, benefits, and the security it provides to homeowners. By understanding the nuances of this insurance type, you can make informed decisions to safeguard your most valuable asset – your home.

Understanding Premium House Insurance

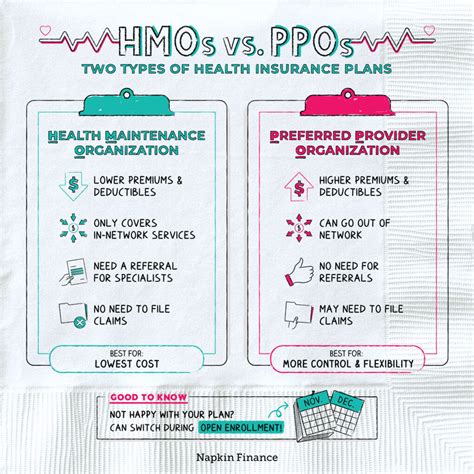

Premium house insurance, often referred to as high-value home insurance, is tailored to meet the unique needs of homeowners with properties and possessions that exceed standard coverage limits. This type of insurance is designed to provide comprehensive protection for high-value homes, valuable possessions, and the liabilities that come with them. It offers an extensive range of coverage options, customizable to the specific requirements of each homeowner.

One of the key differentiators of premium house insurance is the customizable coverage it offers. Unlike standard home insurance policies, which often provide a set of predefined coverage limits, premium policies allow homeowners to tailor their coverage to their specific needs. This flexibility ensures that the policy aligns perfectly with the homeowner's assets and risks, providing peace of mind and comprehensive protection.

Key Features of Premium House Insurance

- Higher Coverage Limits: Premium house insurance offers significantly higher coverage limits for both the structure of the home and its contents. This is particularly beneficial for homeowners with expensive homes, unique architectural features, or high-value possessions like artwork, jewelry, or collectibles.

- Specialized Coverage Options: These policies often include specialized coverage options that cater to unique risks. For instance, they may offer coverage for fine art, antiques, or high-value electronics, which are typically excluded or have limited coverage in standard policies. Additionally, they might provide coverage for unique circumstances like damage caused by flooding, earthquakes, or even vandalism.

- Personal Liability Coverage: Premium house insurance policies often include higher liability limits, which can be crucial for homeowners who frequently host guests or events on their property. This coverage protects the homeowner from lawsuits and legal fees resulting from accidents or injuries that occur on their premises.

- Replacement Cost Coverage: Many premium policies offer replacement cost coverage, ensuring that the homeowner receives the full cost of replacing the damaged property, rather than just its depreciated value. This is particularly valuable for high-value homes and possessions, as it ensures the homeowner can restore their property to its pre-loss condition without incurring additional costs.

- Enhanced Loss Assessment Coverage: This type of insurance may also provide enhanced loss assessment coverage, which covers the homeowner’s share of expenses in the event of a loss that affects the entire community, such as a fire or storm that damages multiple homes in a neighborhood.

Benefits of Premium House Insurance

The benefits of premium house insurance are numerous and far-reaching. Firstly, it provides comprehensive protection for high-value homes and possessions, ensuring that homeowners can recover financially in the event of a loss. The customizable coverage options allow homeowners to tailor their policy to their specific needs, providing a level of flexibility not often found in standard home insurance policies.

Secondly, premium house insurance often includes enhanced customer service and claim handling. Insurers offering these policies typically have dedicated teams that specialize in high-value home insurance, ensuring that homeowners receive personalized attention and support. This often results in faster claim processing times and more efficient resolutions.

Lastly, premium house insurance can offer additional benefits such as concierge services, identity theft protection, and even pet coverage. These added perks further enhance the overall value of the insurance policy, providing homeowners with a more comprehensive suite of services.

Case Studies: Real-World Applications of Premium House Insurance

To better understand the practical applications of premium house insurance, let’s explore a couple of real-world case studies.

Case Study 1: High-Value Home in a Disaster-Prone Area

Imagine a homeowner, Mr. Johnson, who resides in a coastal area prone to hurricanes. His home, valued at over $2 million, includes unique architectural features and high-end finishes. Additionally, he owns a significant collection of artwork and antiques, worth several hundred thousand dollars.

Given the location and the value of his home and possessions, Mr. Johnson opted for a premium house insurance policy. This policy provided him with comprehensive coverage, including protection against hurricane damage, flood damage (which is typically excluded from standard policies), and coverage for his valuable artwork and antiques. The policy also included higher liability limits, ensuring that he was protected in the event of any accidents or injuries on his property.

When a hurricane struck his area, causing significant damage to his home and its contents, Mr. Johnson was able to file a claim with his insurance provider. Thanks to the premium house insurance policy, he received a full replacement cost for his home and its contents, allowing him to restore his property to its pre-loss condition. The specialized coverage for his artwork and antiques ensured that these valuable possessions were also fully covered, providing him with financial stability and peace of mind during a challenging time.

Case Study 2: Homeowner with Unique Risks

Ms. Smith, a homeowner in a suburban area, has a unique situation. She frequently hosts large events at her home, which has led to an increased risk of accidents and injuries on her property. Additionally, she owns a high-end home theater system, valued at over $50,000, and a significant collection of rare books.

Understanding her unique risks, Ms. Smith opted for a premium house insurance policy. This policy provided her with higher liability limits, ensuring that she was protected in the event of any accidents or injuries during her events. The policy also included specialized coverage for her home theater system and rare books, providing her with peace of mind that her valuable possessions were adequately protected.

One evening, during a large gathering at her home, a guest tripped and fell, sustaining minor injuries. Ms. Smith was able to file a claim with her insurance provider, and thanks to the higher liability limits of her premium house insurance policy, she was covered for the medical expenses and legal fees associated with the incident. This real-world application of premium house insurance highlights how it can provide comprehensive protection for homeowners with unique risks and valuable possessions.

Performance Analysis and Future Implications

Premium house insurance has consistently demonstrated its value in providing robust protection for high-value homes and possessions. Its performance is evident in the efficient claim handling processes and the comprehensive coverage it offers, ensuring that homeowners can recover financially from various types of losses.

Looking ahead, the future of premium house insurance appears promising. With the increasing value of homes and possessions, as well as the rising frequency and severity of natural disasters, the demand for comprehensive coverage is likely to grow. Insurers are expected to continue developing innovative products and services to meet these evolving needs, ensuring that homeowners have the protection they require.

Furthermore, advancements in technology are expected to play a significant role in the future of premium house insurance. Insurers are increasingly leveraging data analytics and artificial intelligence to enhance risk assessment and claims management processes. This not only improves the efficiency of insurance operations but also allows for more accurate and tailored coverage options, benefiting homeowners seeking comprehensive protection.

Conclusion

Premium house insurance is an invaluable tool for homeowners with high-value properties and possessions. Its customizable coverage, specialized options, and enhanced customer service make it a superior choice for those seeking comprehensive protection. By understanding the unique features and benefits of premium house insurance, homeowners can make informed decisions to safeguard their assets and ensure their peace of mind.

Frequently Asked Questions

What is considered a “premium” house insurance policy?

+

A premium house insurance policy is designed for homeowners with high-value properties and possessions. It offers higher coverage limits, specialized options for unique risks, and enhanced customer service. These policies are tailored to provide comprehensive protection for valuable homes and assets.

How does premium house insurance differ from standard home insurance?

+

Premium house insurance differs from standard home insurance in several ways. It offers higher coverage limits, specialized coverage options for unique risks, and often includes enhanced customer service and claim handling. Standard home insurance policies typically have lower coverage limits and may not include specialized coverage for high-value items.

What types of coverage are typically included in a premium house insurance policy?

+

A premium house insurance policy typically includes coverage for the structure of the home, personal belongings, personal liability, and additional living expenses. It may also offer specialized coverage options for high-value items like fine art, jewelry, or collectibles. The specific coverage options can be customized to meet the unique needs of the homeowner.

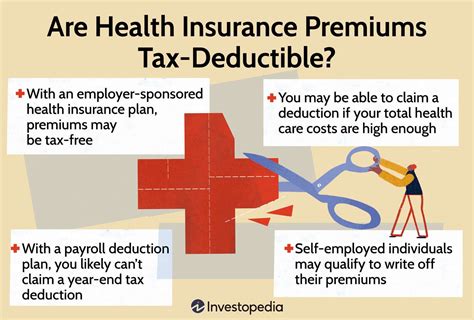

How much does premium house insurance cost?

+

The cost of premium house insurance can vary significantly depending on factors such as the value of the home, the location, the coverage limits, and the insurer. Generally, premium house insurance policies are more expensive than standard home insurance policies due to the higher coverage limits and specialized coverage options they offer.

How can I determine if I need premium house insurance?

+

If you own a high-value home, have valuable possessions, or face unique risks such as living in a disaster-prone area, premium house insurance may be a wise investment. It’s important to carefully assess your needs and risks, and consult with an insurance professional to determine the appropriate level of coverage for your situation.