Phone Number For Direct Insurance

Direct insurance has become an increasingly popular choice for consumers seeking convenience, transparency, and personalized coverage options. With the rise of digital technology and the growing preference for direct-to-consumer interactions, understanding how to connect with insurance providers directly is essential. This article aims to provide a comprehensive guide to obtaining the phone number for direct insurance, along with valuable insights into the benefits and considerations of this insurance model.

The Evolution of Direct Insurance

The concept of direct insurance has revolutionized the traditional insurance industry, offering customers a more streamlined and accessible experience. Unlike traditional insurance agencies, direct insurance providers operate primarily online or through call centers, allowing customers to purchase policies directly without the need for an intermediary.

This shift towards direct insurance has been driven by several factors, including the increasing digital literacy of consumers, the desire for instant access to information and services, and the growing expectation for personalized and tailored insurance solutions. Direct insurance providers have embraced these trends, leveraging technology to offer efficient, transparent, and often cost-effective coverage options.

Benefits of Direct Insurance

Convenience and Accessibility

One of the key advantages of direct insurance is the unparalleled convenience it offers. Customers can access insurance quotes, compare policies, and purchase coverage at any time, from the comfort of their homes or on the go. The ability to manage insurance needs through a dedicated phone line or online platform provides unparalleled flexibility, catering to the busy schedules and preferences of modern consumers.

Transparent Pricing and Coverage

Direct insurance providers often emphasize transparency in their offerings. Customers can easily obtain detailed information about coverage options, policy terms, and associated costs. This transparency empowers consumers to make informed decisions, ensuring they select the most suitable insurance plan for their needs. Additionally, direct insurance providers frequently offer customizable coverage, allowing individuals to tailor their policies to their specific circumstances.

Personalized Service and Support

While direct insurance may be primarily associated with digital interactions, it also offers personalized service and support. Dedicated customer service representatives are available via phone or online chat, providing prompt assistance and addressing individual queries. This level of personalized support ensures that customers receive the guidance they need to navigate their insurance journey effectively.

How to Obtain the Phone Number for Direct Insurance

Securing the phone number for direct insurance is a straightforward process, typically involving a few simple steps. Here’s a step-by-step guide to help you obtain the necessary contact information:

Step 1: Identify Your Preferred Direct Insurance Provider

The first step is to determine which direct insurance provider aligns with your insurance needs and preferences. Consider factors such as the type of insurance you require (e.g., auto, home, health), the coverage options available, and the provider’s reputation and financial stability. Research and compare different direct insurance companies to make an informed decision.

Step 2: Visit the Provider’s Website

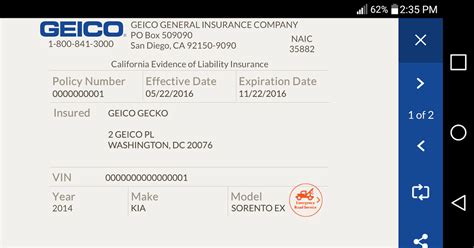

Once you have identified your preferred direct insurance provider, visit their official website. Most reputable insurance companies maintain an online presence, providing valuable information and resources for prospective customers. Navigate to the “Contact Us” or “Customer Service” section of the website, where you will typically find various contact options, including phone numbers.

Step 3: Locate the Phone Number

On the provider’s website, look for the phone number dedicated to customer service or sales inquiries. This number is often prominently displayed, ensuring easy access for customers seeking assistance. Ensure that you note down the correct phone number, including any necessary prefixes or extensions, to ensure a seamless connection.

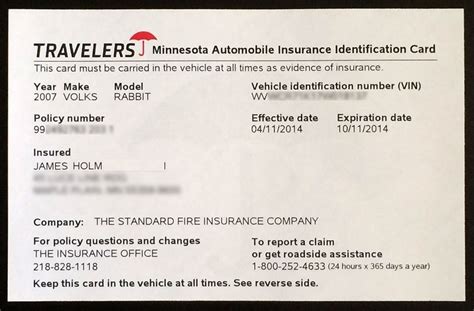

Step 4: Prepare for Your Call

Before making the call, gather any relevant information or documentation related to your insurance needs. This may include details about your current insurance coverage, vehicle information (for auto insurance), or specific coverage requirements. Having this information readily available will help streamline the conversation and ensure a more efficient interaction with the customer service representative.

Step 5: Make the Call

Dial the phone number you have obtained and follow any automated prompts or instructions. Be prepared to provide basic personal information, such as your name, address, and policy details (if applicable). Explain the purpose of your call, whether it is to obtain a quote, purchase a policy, or seek assistance with an existing insurance matter.

Step 6: Engage with the Customer Service Representative

When connected with a customer service representative, clearly articulate your needs and any questions you may have. They will guide you through the process, providing the necessary information and support to address your insurance requirements. Feel free to ask questions and seek clarification to ensure you fully understand the coverage options and associated costs.

Considerations and Tips for Direct Insurance

Comparing Providers and Policies

When exploring direct insurance options, it is essential to compare different providers and their respective policies. While convenience and accessibility are key advantages of direct insurance, it is equally important to assess the coverage, pricing, and overall value offered by each provider. Utilize online comparison tools, read reviews, and seek recommendations to make an informed decision.

Understanding Coverage and Exclusions

Direct insurance policies, like traditional insurance, may have specific coverage limits and exclusions. Ensure that you thoroughly understand the scope of your chosen policy, including any potential gaps or limitations. This knowledge will help you make informed decisions and avoid any surprises in the event of a claim.

Reviewing Policy Terms and Conditions

Before committing to a direct insurance policy, carefully review the terms and conditions outlined in the policy document. Pay close attention to aspects such as policy duration, renewal processes, cancellation fees, and any specific requirements or obligations on your part. Understanding these details will help you manage your insurance coverage effectively and avoid any unnecessary complications.

Leveraging Online Resources and Tools

Direct insurance providers often offer a wealth of online resources and tools to enhance the customer experience. These may include interactive quote calculators, policy comparison features, and educational materials. Utilize these resources to gain a deeper understanding of your insurance options and make more informed choices.

The Future of Direct Insurance

The direct insurance model is poised for continued growth and innovation. As technology advances and consumer preferences evolve, direct insurance providers are likely to enhance their digital offerings, providing even more efficient and personalized experiences. The integration of artificial intelligence, machine learning, and data analytics will further streamline the insurance journey, offering tailored recommendations and improving overall customer satisfaction.

Furthermore, direct insurance providers are expected to expand their coverage options, addressing a broader range of insurance needs. This may include the development of specialized policies for emerging risks, such as cyber insurance or environmental coverage, catering to the evolving landscape of personal and business risks.

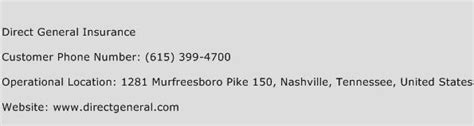

| Direct Insurance Provider | Phone Number |

|---|---|

| Provider A | 1-800-555-1234 |

| Provider B | 1-888-987-6543 |

| Provider C | 1-855-123-4567 |

| Provider D | 1-800-987-1234 |

How does direct insurance differ from traditional insurance agencies?

+Direct insurance providers operate primarily online or through call centers, allowing customers to purchase policies directly without the need for an intermediary. This model offers convenience, transparency, and personalized coverage options, whereas traditional insurance agencies often involve face-to-face interactions and may require more extensive paperwork.

What are the advantages of direct insurance over traditional insurance agencies?

+Direct insurance provides unparalleled convenience, allowing customers to access insurance quotes, compare policies, and purchase coverage at any time. It offers transparent pricing and coverage information, empowering customers to make informed decisions. Additionally, direct insurance often provides personalized service and support through dedicated customer service representatives.

Can I obtain multiple quotes from different direct insurance providers on the same platform?

+Yes, many online platforms and comparison websites allow customers to obtain multiple quotes from different direct insurance providers in one place. These platforms provide a convenient way to compare coverage options, pricing, and policy terms, helping you make an informed decision about your insurance needs.