Pet Insurance Rates

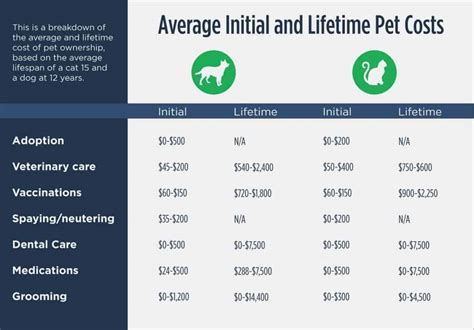

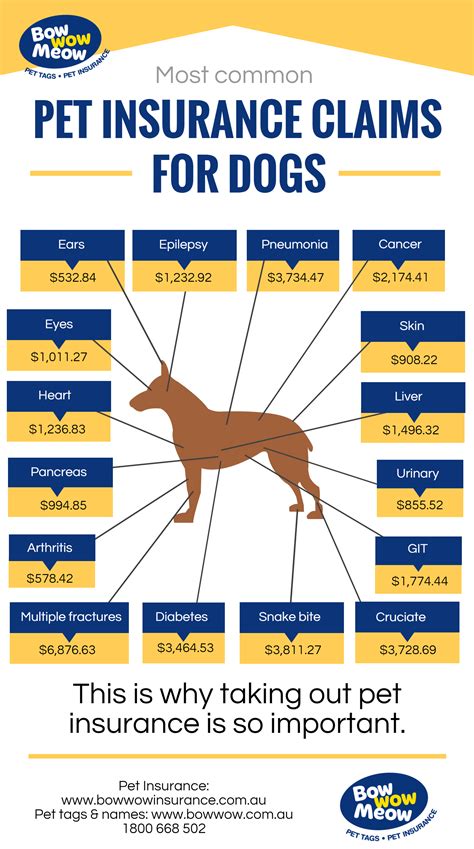

In the world of pet ownership, the unexpected is always just around the corner. From minor injuries to serious health conditions, our furry friends can require veterinary care that can sometimes be financially burdensome. Pet insurance has emerged as a popular solution to provide financial protection and peace of mind for pet owners. However, understanding pet insurance rates and the factors that influence them is crucial for making informed decisions about coverage.

Understanding Pet Insurance Rates

Pet insurance rates are the costs associated with purchasing and maintaining a pet insurance policy. These rates can vary significantly depending on various factors, including the type of pet, their age, breed, location, and the level of coverage desired. Unlike traditional health insurance, pet insurance typically operates on a reimbursement basis, where policyholders pay for veterinary expenses upfront and then submit claims to their insurance provider for reimbursement.

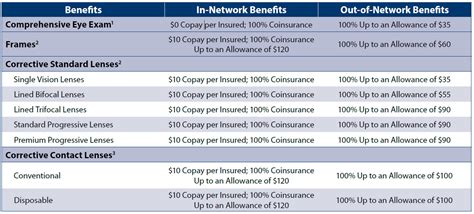

The structure of pet insurance plans can vary. Some plans offer comprehensive coverage, including accidents, illnesses, routine care, and even wellness services like vaccinations and dental care. Others may focus primarily on accidents and illnesses, with limited or no coverage for routine care. The cost of these plans is directly influenced by the scope of coverage, with more comprehensive plans typically commanding higher premiums.

One of the key factors affecting pet insurance rates is the breed and age of the pet. Certain breeds are predisposed to specific health conditions, which can increase the risk of costly veterinary treatments. Additionally, as pets age, they become more susceptible to health issues, leading to higher insurance rates. Younger pets, on the other hand, are often considered lower-risk and may qualify for more affordable rates.

Factors Influencing Pet Insurance Rates

There are several key factors that insurance providers consider when determining pet insurance rates:

- Breed and Size: As mentioned earlier, certain breeds are more prone to specific health issues. Additionally, larger breeds may require more expensive treatments due to their size.

- Age: Younger pets generally have lower insurance rates as they are less likely to develop age-related health problems. However, as pets age, their insurance premiums tend to increase.

- Location: The cost of veterinary care can vary significantly based on geographic location. Areas with higher living costs may also have higher veterinary expenses, which can impact insurance rates.

- Level of Coverage: The scope of coverage plays a significant role in determining rates. Policies with more comprehensive coverage, including accident, illness, and routine care, will typically be more expensive than those with limited coverage.

- Deductibles and Co-Pays: Pet insurance policies often come with deductibles and co-pays, which can influence overall rates. Higher deductibles and co-pays may result in lower monthly premiums, while lower deductibles and co-pays can increase the cost of insurance.

- Pre-Existing Conditions: Pets with pre-existing health conditions may face challenges in obtaining insurance or may have higher rates. Insurance providers may exclude coverage for these conditions or offer limited coverage options.

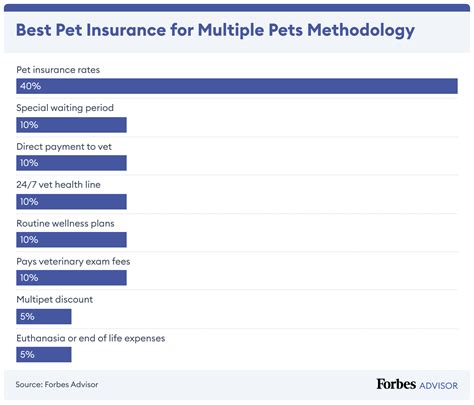

It's important to note that while these factors are common considerations, insurance providers may have their own unique rating systems and methodologies. Some providers may offer discounts for multiple pets or loyalty programs, while others may have specific breed-related rate structures.

| Breed | Size | Average Monthly Premium |

|---|---|---|

| Small Breed (e.g., Chihuahua) | Under 20 lbs | $30 - $50 |

| Medium Breed (e.g., Labrador Retriever) | 20 - 50 lbs | $40 - $60 |

| Large Breed (e.g., Great Dane) | Over 50 lbs | $50 - $80 |

Performance Analysis and Comparative Insights

To gain a comprehensive understanding of pet insurance rates, let’s delve into some real-world examples and comparative data. By analyzing actual insurance policies and their associated costs, we can uncover valuable insights into the performance and value of pet insurance coverage.

Case Study: Comparison of Pet Insurance Policies

Imagine we have three pet owners, each with a different breed of dog and unique insurance needs. Let’s explore their experiences with pet insurance and the rates they encountered:

-

Owner A: Golden Retriever (Medium Breed)

- Age: 3 years old

- Policy: Comprehensive coverage, including accident, illness, and routine care

- Monthly Premium: $45

- Annual Deductible: $250

- Reimbursement Rate: 80%

-

Owner B: French Bulldog (Small Breed)

- Age: 2 years old

- Policy: Accident and illness coverage only

- Monthly Premium: $35

- Annual Deductible: $300

- Reimbursement Rate: 75%

-

Owner C: German Shepherd (Large Breed)

- Age: 5 years old

- Policy: Comprehensive coverage with wellness benefits

- Monthly Premium: $60

- Annual Deductible: $150

- Reimbursement Rate: 90%

From this case study, we can observe several key insights:

- Breed and size have a significant impact on insurance rates. Owner C, with a large breed dog, pays a higher premium than the other two owners.

- The level of coverage influences rates. Owner A's comprehensive policy costs slightly more than Owner B's basic accident and illness coverage.

- Age plays a role, with Owner A's younger dog having a lower premium compared to Owner C's older dog.

- The reimbursement rate and deductible also affect the overall value of the policy. Owner C's higher reimbursement rate may provide better value for certain veterinary expenses.

Comparative Analysis: Insurance Providers and Their Rates

To further illustrate the variation in pet insurance rates, let’s examine a comparative analysis of three leading insurance providers and their average rates for different breeds:

| Provider | Breed (Medium) | Breed (Large) | Breed (Giant) |

|---|---|---|---|

| Provider X | $42 | $58 | $72 |

| Provider Y | $48 | $62 | $80 |

| Provider Z | $52 | $68 | $85 |

This analysis highlights the varying rates offered by different providers. While Provider X has the most competitive rates for medium and large breeds, Provider Z's rates are higher across the board. This emphasizes the importance of comparing multiple providers to find the best value for your pet's insurance needs.

Future Implications and Expert Insights

As the pet insurance industry continues to evolve, several trends and factors will shape the future of pet insurance rates and coverage.

Trends Shaping the Future of Pet Insurance

Here are some key trends and developments that will influence pet insurance rates and the industry as a whole:

- Rising Veterinary Costs: The cost of veterinary care is expected to continue rising, driven by advancements in medical technology and specialized treatments. This will likely lead to increased insurance rates to cover these higher expenses.

- Focus on Wellness and Preventative Care: There is a growing awareness of the benefits of proactive veterinary care. Insurance providers may offer more comprehensive wellness packages, including routine care and preventative treatments, which could influence the structure and cost of insurance policies.

- Innovation in Insurance Products: The pet insurance industry is continuously innovating. We may see the introduction of new insurance products, such as customizable policies, pet-specific plans, or even insurance plans tailored to specific breeds, further diversifying rate structures.

- Technological Advancements: The use of technology, such as telemedicine and online claim submission, may streamline the insurance process and reduce administrative costs. This could potentially lead to more affordable insurance options for pet owners.

Expert Recommendations for Pet Owners

Based on the insights and trends discussed, here are some expert recommendations for pet owners navigating the world of pet insurance:

- Research and Compare: Take the time to research and compare multiple insurance providers. Consider not only the rates but also the coverage offered, deductibles, and reimbursement rates. Look for providers that align with your pet's specific needs and budget.

- Consider Comprehensive Coverage: While basic accident and illness coverage may seem sufficient, comprehensive plans that include routine care and wellness benefits can provide long-term savings. Weigh the potential costs of unexpected illnesses or injuries against the cost of comprehensive coverage.

- Understand Pre-Existing Conditions: If your pet has a pre-existing condition, thoroughly understand how it may impact your insurance options. Some providers may offer coverage with limitations or exclusions, while others may decline coverage altogether. Seek providers that specialize in covering pre-existing conditions.

- Utilize Preventative Care: Embrace the benefits of preventative care to keep your pet healthy and reduce the risk of costly illnesses. Regular veterinary check-ups, vaccinations, and dental care can help identify potential health issues early on, potentially saving you money in the long run.

In conclusion, understanding pet insurance rates and the factors that influence them is crucial for making informed decisions about your pet's healthcare coverage. By staying informed about industry trends, comparing providers, and considering comprehensive coverage options, pet owners can navigate the world of pet insurance with confidence and ensure the best possible care for their beloved companions.

Can I get pet insurance for pre-existing conditions?

+Yes, some insurance providers offer coverage for pre-existing conditions, but it may come with limitations or exclusions. It’s important to carefully review the policy details and understand the specific coverage for pre-existing conditions before purchasing.

How do deductibles and co-pays work in pet insurance?

+Deductibles and co-pays are cost-sharing mechanisms in pet insurance. The deductible is the amount you pay out of pocket before the insurance coverage kicks in. Co-pays, on the other hand, are a percentage or a fixed amount you pay for each claim. Higher deductibles and co-pays can lead to lower monthly premiums, while lower deductibles and co-pays result in higher premiums.

What are the benefits of comprehensive pet insurance coverage?

+Comprehensive pet insurance coverage offers a wide range of benefits, including coverage for accidents, illnesses, and routine care. It provides peace of mind by covering unexpected veterinary expenses and can also include wellness benefits like vaccinations, dental care, and even alternative therapies. Comprehensive coverage ensures your pet receives the best possible care without worrying about financial constraints.