Pet Insurance For Dogs Cost

Pet insurance has become an increasingly popular way for pet owners to manage the financial risks associated with their furry companions' healthcare. With veterinary costs rising, many dog owners are seeking ways to provide comprehensive care for their dogs without breaking the bank. In this comprehensive guide, we delve into the world of pet insurance for dogs, exploring the costs, coverage options, and the potential benefits it can bring to both dogs and their owners.

Understanding the Costs of Pet Insurance for Dogs

The cost of pet insurance for dogs can vary significantly depending on several factors, including the age and breed of the dog, the level of coverage chosen, and the geographical location. It’s essential to understand these variables to make an informed decision about pet insurance.

Age and Breed Factors

One of the primary factors influencing the cost of pet insurance is the age and breed of the dog. Puppies and young dogs are generally cheaper to insure, as they are less likely to develop health issues. As dogs age, their insurance premiums may increase due to the higher risk of age-related ailments. Additionally, certain breeds are predisposed to specific health conditions, which can impact insurance costs. For instance, breeds like Bulldogs and Pugs, known for their brachycephalic (short-nosed) traits, often face higher premiums due to their susceptibility to respiratory issues.

Here's a table outlining the average annual premiums for different age groups and common dog breeds:

| Age Group | Average Annual Premium |

|---|---|

| Puppies (0-1 year) | $300 - $500 |

| Young Adults (1-4 years) | $400 - $650 |

| Mature Dogs (5-9 years) | $550 - $800 |

| Senior Dogs (10+ years) | $700 - $1,200 |

Coverage Options and Their Impact

The level of coverage selected plays a vital role in determining the cost of pet insurance. Pet insurance plans typically offer various coverage options, each with its own set of benefits and costs. Understanding these options is key to finding the right balance between affordability and comprehensive care.

Here's a breakdown of common coverage options and their potential costs:

- Accident-Only Coverage: This basic plan covers injuries and accidents but not illnesses. It is typically the most affordable option, with annual premiums ranging from $150 to $300.

- Accident and Illness Coverage: This comprehensive plan covers both accidents and illnesses, providing the most extensive coverage. Premiums for this plan can range from $400 to $1,000 annually, depending on the dog's age and breed.

- Wellness Plans: Some insurers offer wellness plans that cover routine care such as vaccinations, check-ups, and preventive treatments. These plans can add an additional $100 to $300 to the annual premium.

- Specific Condition Coverage: Certain insurers provide coverage for specific conditions, such as cancer or joint issues. These plans can be beneficial for breeds prone to such ailments but may carry higher premiums.

Analyzing the Benefits of Pet Insurance

While the cost of pet insurance is a significant consideration, it's equally important to evaluate the potential benefits it can bring. Pet insurance can provide peace of mind and ensure that dog owners can access the best possible care for their pets without financial strain.

Peace of Mind and Financial Protection

One of the primary advantages of pet insurance is the peace of mind it offers. Dog owners no longer have to worry about unexpected veterinary bills wiping out their savings. With insurance coverage, they can focus on their dog's health and well-being, knowing that a substantial portion of the costs will be covered.

Additionally, pet insurance can protect against financial emergencies. For instance, if a dog suddenly develops a serious illness or is involved in an accident, the associated veterinary expenses can be substantial. Pet insurance can help mitigate these costs, ensuring that owners don't have to choose between their financial stability and their dog's health.

Enhanced Veterinary Care and Early Detection

Pet insurance encourages regular veterinary check-ups and early detection of potential health issues. With insurance coverage, owners are more likely to schedule routine visits, which can lead to the identification of health problems in their early stages. Early detection often results in more effective and less costly treatments, benefiting both the dog's health and the owner's wallet.

Covering Chronic Conditions and Specialized Care

Certain dogs may require ongoing care for chronic conditions or specialized treatments. Pet insurance can provide coverage for these situations, ensuring that owners can access the necessary care without financial burden. This is particularly beneficial for dogs with long-term ailments or those requiring advanced medical procedures.

Comparing Pet Insurance Providers

With numerous pet insurance providers in the market, it's essential to compare different options to find the best fit for your dog. Each provider offers unique plans and coverage, so evaluating their offerings is crucial.

Key Considerations for Provider Selection

When comparing pet insurance providers, consider the following factors:

- Coverage Options: Evaluate the range of coverage options offered by each provider. Look for plans that align with your dog's specific needs and potential health risks.

- Premiums and Deductibles: Compare the annual premiums and deductibles across providers. Ensure that the costs are within your budget and provide the coverage you require.

- Reputation and Customer Service: Research the provider's reputation and customer satisfaction ratings. Check for reviews and testimonials to gauge their reliability and responsiveness.

- Claim Process and Reimbursement: Understand the claim process and reimbursement procedures. Look for providers with efficient claim handling and prompt reimbursements.

- Additional Benefits: Some providers offer extra perks like coverage for alternative therapies, prescription medications, or even travel insurance. Consider these additional benefits when making your decision.

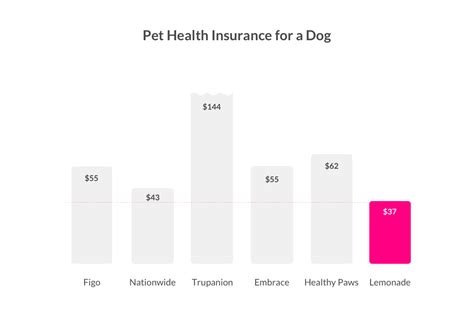

Popular Pet Insurance Providers and Their Offerings

Here's a glimpse at some of the top pet insurance providers and their unique features:

- ASPCA Pet Insurance: Offers accident and illness coverage, with the option to add wellness plans. Known for its comprehensive coverage and competitive pricing.

- Embrace Pet Insurance: Provides accident and illness coverage, along with a unique "Wellness Rewards" program that rewards policyholders for maintaining their dog's health.

- Healthy Paws Pet Insurance: Specializes in accident and illness coverage, with no payout limits and a simple, straightforward claims process. Known for its high customer satisfaction ratings.

- Petplan: Offers customizable coverage plans, allowing policyholders to choose their deductible and reimbursement levels. Provides coverage for hereditary and chronic conditions.

Maximizing the Value of Pet Insurance

To get the most out of your pet insurance, it's essential to understand how to navigate the coverage process and make the most of your policy.

Understanding Your Policy and Exclusions

Carefully read through your policy to understand the coverage details and any exclusions. While most insurance plans cover a wide range of illnesses and accidents, certain pre-existing conditions or elective procedures may be excluded. Knowing these exclusions in advance can help you plan your dog's healthcare effectively.

Choosing the Right Veterinarian

Select a veterinarian who accepts your pet insurance plan. Many insurers have networks of preferred providers, and using these veterinarians can streamline the claims process and ensure prompt reimbursements. If your preferred veterinarian is not in the network, you may still be able to use their services, but the claims process may be more complex.

Submitting Claims and Reimbursements

Familiarize yourself with the claims process and required documentation. Most insurers require you to submit itemized invoices, prescription details, and other relevant paperwork. Ensure you understand the timeline for submitting claims and the reimbursement process to avoid any delays.

The Future of Pet Insurance

The pet insurance industry is evolving, with new technologies and innovative approaches shaping the future of pet healthcare. As more pet owners recognize the value of insurance, the market is adapting to meet their needs.

Technology-Driven Innovations

Advancements in technology are revolutionizing the pet insurance landscape. Insurers are leveraging data analytics and artificial intelligence to personalize coverage and improve risk assessment. Additionally, mobile apps and online platforms are making it easier for policyholders to manage their policies, submit claims, and track reimbursements.

Preventive Care and Wellness Initiatives

There is a growing emphasis on preventive care and wellness initiatives in the pet insurance industry. Insurers are offering incentives and discounts for policyholders who prioritize their dog's health through regular check-ups, vaccinations, and preventive treatments. This shift towards preventive care not only benefits the dogs' well-being but also helps insurers manage costs by reducing the incidence of costly illnesses.

Customized Coverage and Flexible Plans

Pet insurance providers are recognizing the need for customized coverage plans that cater to the unique needs of different dog breeds and age groups. Flexible plans that allow policyholders to adjust their coverage levels and deductibles based on their changing circumstances are becoming more prevalent. This level of customization ensures that pet owners can find the right balance between cost and coverage.

FAQ

Can I insure an older dog with pre-existing conditions?

+Yes, some pet insurance providers offer coverage for older dogs with pre-existing conditions. However, the coverage may be limited, and the premiums could be higher. It's essential to compare plans and read the policy details carefully to understand the extent of coverage.

Are there any discounts available for multiple pets?

+Yes, many pet insurance providers offer discounts when you insure multiple pets. This can be a cost-effective option for households with multiple dogs or other pets.

What is the typical waiting period for pet insurance coverage to kick in?

+The waiting period can vary between providers, but it typically ranges from 14 to 30 days. During this period, any new conditions that arise are not covered. However, accidents and illnesses that occurred before the waiting period will usually be covered once the policy takes effect.

Can I switch pet insurance providers if I'm not satisfied with my current plan?

+Yes, you have the freedom to switch pet insurance providers. However, it's important to note that pre-existing conditions may not be covered by a new provider, and you may have to serve another waiting period. Research and compare plans thoroughly before making a switch.

Are there any government subsidies or tax benefits for pet insurance?

+Currently, there are no government subsidies specifically for pet insurance. However, depending on your country's tax laws, you may be able to claim a portion of your pet insurance premiums as a medical expense deduction. It's best to consult a tax professional for guidance on your specific situation.

As the pet insurance industry continues to evolve, it’s an exciting time for pet owners to explore the options available. With the right coverage, dog owners can provide their furry companions with the best possible care, ensuring a long and healthy life together.