Out Of Pocket Health Insurance

In the complex world of healthcare, understanding your financial responsibilities is crucial. The concept of out-of-pocket expenses in health insurance can be a bit daunting, but with the right knowledge, you can navigate this aspect of healthcare with confidence. Let's delve into the intricacies of out-of-pocket costs, explore how they impact your healthcare journey, and discover strategies to manage them effectively.

Understanding Out-of-Pocket Health Insurance Costs

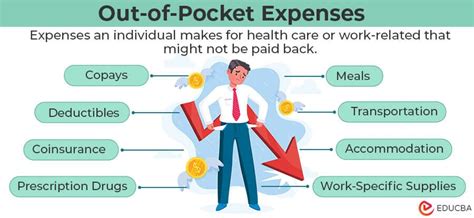

Out-of-pocket (OOP) costs are the expenses you, as an insured individual, are responsible for paying directly to healthcare providers. These costs are separate from your insurance premiums, which you pay regularly to maintain your health coverage. OOP expenses arise when you receive medical services, prescriptions, or treatments, and they can vary significantly depending on your insurance plan and the specific healthcare scenario.

Out-of-pocket expenses are an essential component of health insurance, as they represent the financial contribution an individual makes towards their healthcare. These costs can include a wide range of services and items, from deductibles and copayments to coinsurance and certain prescription medications. Understanding the types of OOP costs and how they are calculated is the first step toward managing your healthcare expenses effectively.

Types of Out-of-Pocket Costs

Here’s a breakdown of the primary types of out-of-pocket costs you may encounter:

- Deductibles: This is the amount you must pay out of pocket before your insurance coverage kicks in. For instance, if your deductible is 1,000, you'll need to pay the first 1,000 of your medical expenses before your insurance starts covering a portion of the costs.

- Copayments (Copays): Copays are fixed amounts you pay for specific services or prescriptions. For example, you might pay a 20 copay for a doctor's office visit or a 5 copay for a generic prescription drug.

- Coinsurance: After you’ve met your deductible, you may be responsible for a percentage of the remaining costs. This is known as coinsurance. For instance, if your coinsurance is 20%, you’ll pay 20% of the bill, and your insurance company will cover the remaining 80%.

- Prescription Drugs: Prescription medications often have their own set of OOP costs. These can include copays for generic or brand-name drugs, as well as any costs that exceed your prescription drug coverage limits.

- Other Services: Out-of-network services, certain procedures, and emergency room visits can also result in higher out-of-pocket expenses, as these may not be fully covered by your insurance plan.

The specific OOP costs you encounter will depend on your insurance plan's design, your healthcare needs, and the services you utilize. It's crucial to review your insurance policy carefully to understand what's covered and what your financial responsibilities are.

Managing Out-of-Pocket Health Insurance Costs

Effectively managing your out-of-pocket health insurance costs involves a combination of strategic planning, informed decision-making, and a thorough understanding of your insurance coverage. Here are some strategies to help you navigate this complex landscape.

Choose the Right Insurance Plan

The first step in managing your OOP costs is selecting an insurance plan that aligns with your healthcare needs and budget. Consider factors such as premium costs, deductibles, copays, and the network of providers covered by the plan. Plans with lower premiums often have higher deductibles, so if you anticipate frequent healthcare needs, a plan with a higher premium and lower OOP costs might be a better fit.

Review the plan's benefits summary carefully, paying attention to the details of coverage for specific services, prescriptions, and specialty care. This will help you anticipate potential out-of-pocket expenses and choose a plan that suits your healthcare requirements without breaking the bank.

Utilize In-Network Providers

Insurance plans typically have a network of providers, hospitals, and pharmacies with which they have negotiated discounted rates. Utilizing in-network providers can significantly reduce your out-of-pocket costs. Services received from out-of-network providers are often subject to higher copays and coinsurance, and they may not be covered at all in some cases.

Before scheduling an appointment or undergoing a procedure, verify that the provider is in your insurance network. If you're uncertain, it's always a good idea to contact your insurance company to confirm coverage and understand any potential out-of-pocket expenses.

Understand Your Benefits and Coverage

A comprehensive understanding of your insurance benefits is essential for managing your out-of-pocket costs effectively. Review your insurance policy or summary of benefits to familiarize yourself with the specifics of your coverage. This includes understanding your deductibles, copays, coinsurance rates, and any limits or exclusions in your plan.

If you have questions or need clarification on any aspect of your coverage, don't hesitate to reach out to your insurance company's customer service team. They can provide valuable insights into your plan's specifics and help you make informed decisions about your healthcare choices.

Shop Around for Prescription Drugs

Prescription medications can be a significant source of out-of-pocket expenses. To manage these costs, consider shopping around for the best prices. Generic drugs are often much more affordable than brand-name medications, so ask your doctor if a generic version is available for your prescription. You can also compare prices at different pharmacies to find the best deal.

Some insurance plans offer mail-order pharmacies, which can provide discounts on medications, especially for long-term prescriptions. Utilizing these services can help you save on prescription costs over time.

Explore Financial Assistance Programs

Many healthcare providers and pharmaceutical companies offer financial assistance programs for patients who cannot afford their out-of-pocket costs. These programs can provide discounts, reduced copays, or even free medications for eligible individuals. Don’t hesitate to inquire about these programs when discussing your treatment options with your healthcare provider.

Additionally, some insurance companies offer programs to help members manage their out-of-pocket expenses. These programs may include tools for budgeting healthcare costs, resources for finding in-network providers, or even discounts on certain services. Check with your insurance provider to see what resources they offer to help you manage your healthcare expenses.

The Impact of Out-of-Pocket Costs on Healthcare Decisions

Out-of-pocket costs can significantly influence the healthcare decisions individuals make. The financial burden of OOP expenses can lead to delayed or forgone care, especially for those with limited financial resources. This can result in the deterioration of health conditions and increased healthcare costs in the long run.

However, it's not all about the financial aspect. The stress and anxiety associated with high out-of-pocket costs can also impact an individual's overall well-being. The worry about financial responsibilities can detract from the focus on recovery and overall health, affecting the patient's experience and outcomes.

Therefore, it's crucial for healthcare providers, insurers, and policymakers to consider the impact of out-of-pocket costs on patient decision-making and overall health. Strategies to mitigate these financial burdens, such as expanded insurance coverage, improved cost transparency, and financial assistance programs, can play a significant role in ensuring that individuals receive the care they need without facing excessive financial strain.

Cost Transparency in Healthcare

One of the challenges in managing out-of-pocket costs is the lack of transparency in healthcare pricing. Often, patients are unaware of the costs associated with a particular service or procedure until after the fact, making it difficult to budget and plan for healthcare expenses effectively.

To address this issue, many healthcare providers and insurers are working towards providing cost estimates and transparency tools. These initiatives aim to give patients a clearer understanding of their potential out-of-pocket expenses before they receive care. By knowing the costs upfront, patients can make more informed decisions about their healthcare, ensuring that financial considerations do not impede necessary treatments.

Future Implications and Industry Insights

The landscape of out-of-pocket health insurance costs is evolving, and several trends and initiatives are shaping the future of healthcare financing.

Value-Based Care Models

Value-based care models, such as accountable care organizations (ACOs) and bundled payment systems, are gaining traction in the healthcare industry. These models aim to improve patient outcomes while reducing overall healthcare costs. In value-based care, providers are incentivized to deliver high-quality, efficient care, which can lead to lower out-of-pocket expenses for patients.

Under these models, providers are rewarded for keeping patients healthy and managing chronic conditions effectively. This shift in focus from volume-based to value-based care has the potential to reduce unnecessary procedures and tests, thereby lowering out-of-pocket costs for patients.

Consumer-Directed Health Plans (CDHPs)

Consumer-Directed Health Plans, often paired with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs), are becoming increasingly popular. These plans offer higher deductibles and lower premiums, giving consumers more control over their healthcare spending.

CDHPs are designed to encourage individuals to be more engaged in their healthcare decisions and to shop around for cost-effective services. By contributing to an HSA or HRA, individuals can save pre-tax dollars to cover their out-of-pocket expenses, providing a financial buffer for healthcare costs.

Improved Cost Transparency and Access to Information

The push for increased cost transparency in healthcare is gaining momentum. Initiatives like the Centers for Medicare & Medicaid Services (CMS) price transparency rule are aimed at making healthcare pricing more accessible and understandable for consumers. By providing clear and standardized pricing information, patients can make more informed decisions about their care and potentially negotiate better rates.

Additionally, the rise of digital health tools and platforms is making it easier for patients to access cost information. These tools allow individuals to compare prices for procedures, medications, and services across different providers, empowering them to choose the most cost-effective options.

Industry Innovations in Cost Management

The healthcare industry is witnessing a surge in innovations focused on cost management and consumer empowerment. From telemedicine services that reduce the need for in-person visits to digital health platforms that streamline administrative processes, these innovations are helping to lower the overall cost of healthcare.

Furthermore, the use of predictive analytics and machine learning is enabling healthcare providers to better anticipate patient needs and manage resources more efficiently. By optimizing resource allocation and reducing waste, these technologies have the potential to significantly reduce out-of-pocket costs for patients.

How do I know if a healthcare provider is in my insurance network?

+You can check the provider’s status by visiting your insurance company’s website or contacting their customer service. They will have a directory of in-network providers, and you can search by name or location to verify if a particular provider is covered.

What happens if I go to an out-of-network provider?

+Out-of-network providers may charge higher rates, and your insurance company may only cover a portion of the cost or not cover it at all. This can result in higher out-of-pocket expenses for you. It’s always best to verify provider network status before receiving services.

Can I negotiate my out-of-pocket costs with healthcare providers?

+Yes, it’s possible to negotiate your out-of-pocket costs, especially if you’re paying cash or don’t have insurance coverage for a particular service. Many providers are open to negotiating prices, especially for patients who are willing to pay upfront or in a timely manner. It’s worth inquiring about potential discounts or payment plans.