Obamacare Insurance Cost

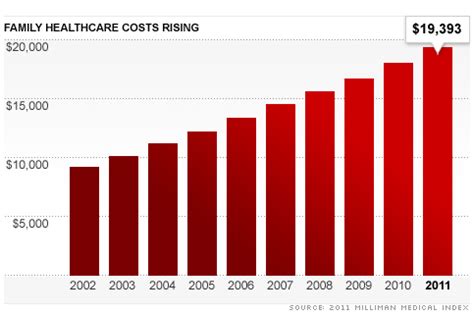

The Affordable Care Act, commonly known as Obamacare, was signed into law in 2010 with the goal of making healthcare more accessible and affordable for Americans. One of the key aspects of the legislation was the introduction of health insurance marketplaces, where individuals and families could shop for and purchase health insurance plans. As the implementation of Obamacare progressed, questions and concerns arose regarding the cost of insurance plans and their affordability for different segments of the population.

Understanding Obamacare Insurance Costs

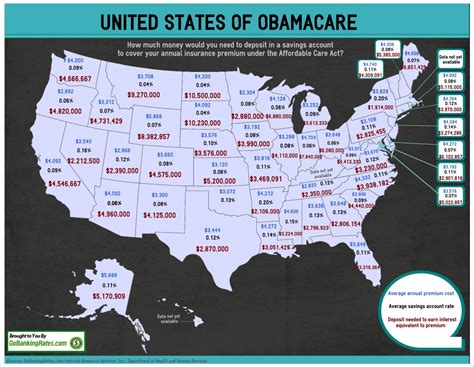

The cost of Obamacare insurance plans can vary significantly depending on several factors, including the state, the insurer, the chosen plan, and individual characteristics. The Affordable Care Act introduced a range of regulations and subsidies to make insurance more affordable and to ensure that a minimum level of coverage is provided.

Factors Influencing Insurance Costs

One of the primary factors influencing insurance costs is the state in which the individual resides. Each state has its own insurance marketplace, and the cost of plans can vary considerably between states. This variation is due to differences in the healthcare landscape, including the number of insurers, the competitiveness of the market, and the overall cost of healthcare services in the state.

The chosen insurance plan also plays a significant role in determining the cost. Obamacare mandates that all plans offered on the marketplace provide a minimum level of coverage, known as Essential Health Benefits. These benefits include items such as emergency services, hospitalization, prescription drugs, and maternity care. However, plans can vary in their metal level, which indicates the proportion of costs covered by the plan. Bronze plans, for instance, cover 60% of costs on average, while Platinum plans cover 90%.

| Metal Level | Average Cost Sharing |

|---|---|

| Bronze | 60% |

| Silver | 70% |

| Gold | 80% |

| Platinum | 90% |

Another factor is the insurer. Different insurance companies offer varying plans with different networks of healthcare providers and different cost structures. Some insurers may offer more competitive rates, while others may have a more comprehensive network of providers, which can affect the overall cost and convenience of the plan.

Affordability Measures

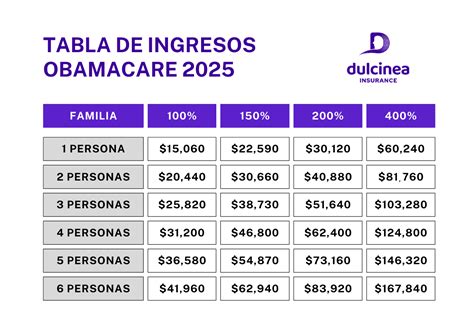

To make insurance more affordable, the Affordable Care Act introduced several key measures. Premium Tax Credits are available to individuals and families with incomes between 100% and 400% of the federal poverty level. These credits can reduce the cost of insurance premiums, making insurance more accessible for lower-income households. The credits are provided in the form of advance payments, which are paid directly to the insurance company to reduce the monthly premium.

Additionally, Cost-Sharing Reductions are available for individuals with incomes up to 250% of the federal poverty level. These reductions lower the out-of-pocket costs for deductibles, copayments, and coinsurance. This means that individuals with lower incomes may pay significantly less for healthcare services, even with a lower-cost Bronze plan.

Analyzing Obamacare Insurance Costs: A Real-World Example

To better understand the cost of Obamacare insurance plans, let’s consider a real-world example. Jane, a 35-year-old single individual living in California, is looking to purchase health insurance on the state’s marketplace, Covered California. Jane’s annual income is $40,000, which is 200% of the federal poverty level for her age and household size.

Based on her income, Jane is eligible for a Premium Tax Credit, which reduces her monthly premium. She also qualifies for Cost-Sharing Reductions, which lower her out-of-pocket costs. With these subsidies in place, Jane can choose from a range of plans offered by different insurers on the Covered California marketplace.

After comparing plans, Jane decides on a Silver plan offered by Health Net. This plan has a monthly premium of $450, but with her Premium Tax Credit, her monthly cost is reduced to $270. Additionally, with her Cost-Sharing Reductions, her out-of-pocket maximum is limited to $2,500, ensuring that her healthcare costs remain manageable.

This example illustrates how Obamacare's subsidies can significantly reduce the cost of insurance for eligible individuals. Without these subsidies, Jane's monthly premium and out-of-pocket costs would be considerably higher, potentially making insurance unaffordable.

Performance Analysis: Obamacare’s Impact on Insurance Affordability

Since the implementation of Obamacare, there has been a significant increase in the number of Americans with health insurance coverage. According to a report by the U.S. Department of Health and Human Services, the uninsured rate dropped from 16.0% in 2010 to 7.9% in 2020. This decrease is largely attributed to the Affordable Care Act’s measures to make insurance more affordable and accessible.

However, the impact of Obamacare on insurance costs is not uniform across all demographics. A study by the Kaiser Family Foundation found that while Obamacare has reduced the uninsured rate among lower-income individuals, those with higher incomes have seen their insurance costs rise. This is due to the structure of the law, which provides subsidies primarily for those with lower incomes.

Despite this disparity, Obamacare has been successful in achieving its primary goal of reducing the number of uninsured Americans. The law has also helped to stabilize the individual insurance market, particularly in states that have taken an active role in implementing the legislation.

Future Implications and Potential Changes

The future of Obamacare and its impact on insurance costs remains uncertain. The law has faced numerous legal challenges and political opposition, with attempts to repeal or significantly alter its provisions. However, the Affordable Care Act has survived these challenges and remains in place.

Looking ahead, there are several potential changes that could impact insurance costs. One possibility is the expansion of Medicaid, which could provide coverage for more low-income individuals, further reducing the uninsured rate. Additionally, there may be efforts to enhance the affordability of insurance for those with higher incomes, potentially through tax credits or other subsidies.

Furthermore, the continued development of Healthcare.gov, the federal insurance marketplace, could improve the shopping experience and provide more transparency and competition among insurers. This could lead to more affordable options and greater choice for consumers.

Despite the uncertainties, Obamacare has already made significant strides in improving insurance affordability and accessibility for millions of Americans. The law's impact will continue to be felt as the healthcare landscape evolves and new policies are implemented.

How can I find out if I’m eligible for Obamacare subsidies?

+

To determine your eligibility for Obamacare subsidies, you can use the Healthcare.gov eligibility calculator. This tool takes into account your income, household size, and state of residence to estimate your potential savings through Premium Tax Credits and Cost-Sharing Reductions.

What happens if I don’t have health insurance under Obamacare?

+

Under Obamacare, there is a requirement to have health insurance, known as the individual mandate. If you don’t have qualifying health coverage, you may face a tax penalty. However, there are exemptions available for certain situations, such as financial hardship or religious beliefs.

Can I still get insurance outside of the Obamacare marketplace?

+

Yes, you can purchase insurance directly from an insurance company or through a broker. However, if you purchase insurance outside of the marketplace, you won’t be eligible for Obamacare subsidies, which are only available for plans purchased on the marketplace.