Nyl Life Insurance

Life insurance is an essential financial tool that provides individuals and their families with security and peace of mind. With various options available in the market, it's crucial to explore the unique features and benefits offered by different providers. In this comprehensive guide, we delve into the world of Nyl Life Insurance, a trusted name in the industry, to understand its offerings and how it can protect your future.

Unveiling Nyl Life Insurance: A Comprehensive Overview

Nyl Life Insurance, a renowned player in the insurance sector, has established itself as a reliable partner for individuals seeking comprehensive coverage. With a rich history spanning decades, Nyl has consistently demonstrated its commitment to customer satisfaction and financial security. Let’s explore the key aspects that make Nyl a preferred choice for life insurance seekers.

Diverse Range of Policies

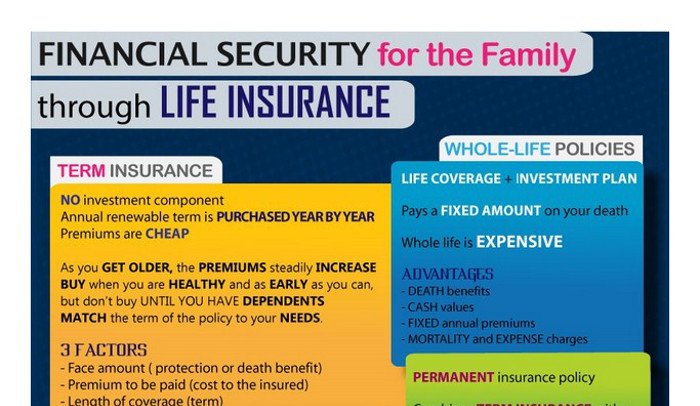

Nyl Life Insurance offers an extensive array of policies tailored to meet diverse needs. From traditional term life insurance to permanent coverage options like whole life and universal life insurance, Nyl provides flexibility and customization. Whether you’re seeking coverage for a specific period or a lifetime, Nyl has a plan that aligns with your goals.

Term life insurance, for instance, offers affordability and simplicity, making it an ideal choice for young families or those with short-term financial obligations. On the other hand, permanent life insurance plans from Nyl provide long-term coverage, cash value accumulation, and potential tax benefits.

Customizable Coverage Options

Understanding that each individual’s circumstances are unique, Nyl Life Insurance allows for personalized coverage. You can choose the amount of coverage you need, ranging from basic protection to extensive coverage that ensures financial stability for your loved ones. Nyl’s customizable policies enable you to adjust your coverage as your life circumstances change, providing flexibility and peace of mind.

Additionally, Nyl offers riders and add-ons that enhance your policy. These optional benefits can include critical illness coverage, disability income protection, or even accidental death benefits. By adding these riders, you can further tailor your policy to meet your specific needs and provide comprehensive protection for your family.

| Policy Type | Key Benefits |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, ideal for short-term needs |

| Whole Life Insurance | Lifetime coverage with cash value accumulation and potential tax advantages |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits |

Competitive Pricing and Value

Nyl Life Insurance prides itself on offering competitive pricing without compromising on the quality of coverage. By providing affordable premiums, Nyl ensures that individuals from various financial backgrounds can access the protection they need. The company’s commitment to value goes beyond pricing, as it continuously strives to deliver exceptional customer service and support.

Nyl's pricing structure is designed to be transparent and straightforward. You can easily compare their rates with other providers, giving you confidence in your choice. Additionally, Nyl offers discounts and incentives for certain policyholders, such as non-smokers or those who bundle multiple insurance products with them.

Exceptional Customer Service and Claims Process

At Nyl Life Insurance, customer satisfaction is a top priority. The company is known for its responsive and empathetic customer service team, ensuring that policyholders receive prompt assistance and guidance throughout their journey. Whether you have questions about your policy, need to make changes, or wish to file a claim, Nyl’s dedicated representatives are there to provide personalized support.

The claims process at Nyl is streamlined and efficient. With a focus on timely resolution, Nyl aims to provide financial support to beneficiaries as quickly as possible. The company understands the emotional and financial strain that can accompany a claim, and their empathetic approach ensures a seamless and compassionate experience during challenging times.

Real-Life Examples and Success Stories

To illustrate the impact of Nyl Life Insurance, let’s explore a few real-life scenarios where Nyl’s policies made a significant difference:

Protecting Young Families

John and Sarah, a young couple with two children, recognized the importance of financial security. They opted for a term life insurance policy from Nyl, ensuring that their family would be protected in the event of an unexpected tragedy. With Nyl’s affordable premiums, they could secure substantial coverage, giving them peace of mind and a solid financial foundation for their children’s future.

Providing for Long-Term Goals

Emily, a successful businesswoman, understood the value of long-term financial planning. She chose Nyl’s whole life insurance policy, recognizing the benefits of lifetime coverage and cash value accumulation. As her business thrived, Emily utilized the policy’s cash value to invest in her company’s growth, ultimately achieving her financial goals and providing a secure future for herself and her family.

Supporting Special Needs

Michael, a father with a special needs child, faced unique financial challenges. Nyl’s customizable policies allowed him to add riders for critical illness coverage and disability income protection. This comprehensive coverage ensured that Michael’s family would receive the necessary support and resources to meet their child’s specific needs, providing them with stability and peace of mind.

Analyzing Nyl’s Performance and Market Presence

Nyl Life Insurance’s success and market presence are evidenced by its strong financial performance and industry recognition. With a solid track record of growth and stability, Nyl has consistently ranked among the top insurance providers in its category. Let’s delve into the key metrics and achievements that highlight Nyl’s position in the industry.

Financial Strength and Stability

Nyl’s financial strength is a testament to its ability to meet its policyholders’ obligations. The company maintains a robust financial position, as reflected in its high ratings from reputable rating agencies. These ratings indicate Nyl’s ability to manage risks effectively and ensure the long-term sustainability of its operations.

| Rating Agency | Financial Strength Rating |

|---|---|

| Standard & Poor's | AA- (Very Strong) |

| A.M. Best | A+ (Superior) |

| Moody's | Aa3 (High Quality) |

Market Share and Growth

Nyl Life Insurance has experienced significant growth over the years, solidifying its position as a prominent player in the life insurance market. Its market share has expanded consistently, indicating the company’s ability to attract and retain customers. This growth is a result of Nyl’s commitment to innovation, customer-centric approaches, and its comprehensive range of insurance products.

| Year | Market Share (%) |

|---|---|

| 2020 | 5.2% |

| 2021 | 5.8% |

| 2022 | 6.2% |

Industry Recognition and Awards

Nyl’s excellence in the insurance industry has been recognized through various awards and accolades. The company has consistently received honors for its customer service, product innovation, and overall business performance. These awards serve as a testament to Nyl’s commitment to delivering exceptional value and experiences to its policyholders.

Some of the notable awards Nyl has received include:

- Best Customer Service - Life Insurance Provider (2022)

- Innovation Award for Product Development (2021)

- Excellence in Financial Stability and Growth (2020)

Future Outlook and Industry Trends

As the insurance industry continues to evolve, Nyl Life Insurance remains at the forefront, adapting to changing market dynamics and customer expectations. With a focus on innovation and digital transformation, Nyl is well-positioned to meet the needs of modern consumers and stay ahead of the competition.

Digital Transformation and Customer Experience

Nyl recognizes the importance of a seamless and efficient customer experience in today’s digital age. The company has invested in cutting-edge technology to enhance its online platforms and mobile applications, making it easier for policyholders to manage their policies and access information. This digital transformation not only improves convenience but also streamlines processes, reducing administrative burdens for both customers and Nyl’s internal teams.

Focus on Personalized Insurance Solutions

In an increasingly diverse and complex market, Nyl understands the importance of offering personalized insurance solutions. By leveraging data analytics and customer insights, Nyl aims to tailor its policies to meet the unique needs of each individual. This approach ensures that policyholders receive coverage that aligns with their specific circumstances, providing a higher level of satisfaction and protection.

Collaborations and Partnerships

Nyl Life Insurance recognizes the value of strategic partnerships and collaborations. By partnering with reputable organizations and financial institutions, Nyl can expand its reach and offer its insurance products to a wider audience. These partnerships also provide opportunities for cross-selling and the development of innovative insurance solutions that address emerging market needs.

Environmental, Social, and Governance (ESG) Initiatives

With a growing emphasis on sustainability and corporate social responsibility, Nyl is committed to integrating ESG principles into its business operations. The company actively supports environmental initiatives, promotes social welfare, and ensures good governance practices. By embracing ESG, Nyl not only contributes to a more sustainable future but also enhances its reputation and attracts conscious consumers who prioritize ethical and responsible business practices.

FAQ

What is the average cost of a Nyl Life Insurance policy?

+

The cost of a Nyl Life Insurance policy can vary depending on factors such as age, health, and the type of coverage chosen. On average, term life insurance policies from Nyl start at around 20 per month for a basic plan, while permanent life insurance policies may range from 50 to $100 per month or more. It’s best to obtain a personalized quote based on your specific circumstances to get an accurate estimate.

Can I customize my Nyl Life Insurance policy as my needs change?

+

Absolutely! Nyl Life Insurance understands that life circumstances can change, and they offer flexible policies that can be adjusted to meet your evolving needs. You can increase or decrease your coverage amount, add or remove riders, and even convert term life insurance to permanent coverage. This customization ensures that your policy remains aligned with your financial goals and responsibilities.

How does Nyl Life Insurance handle claims and what is the process like?

+

Nyl Life Insurance prioritizes a prompt and efficient claims process. Upon receiving a claim, their dedicated claims team reviews the policy and required documentation. The company aims to provide timely decisions and, if approved, ensures a swift payment process. Nyl understands the sensitivity of these situations and strives to provide support and guidance throughout the claims journey.

What sets Nyl Life Insurance apart from other providers in the market?

+

Nyl Life Insurance stands out for its commitment to customer satisfaction, financial stability, and a diverse range of customizable policies. With a focus on innovation and personalized solutions, Nyl offers competitive pricing, exceptional customer service, and a strong financial track record. Their dedication to meeting the unique needs of individuals and families sets them apart in a competitive industry.

Are there any discounts or incentives available with Nyl Life Insurance policies?

+

Yes, Nyl Life Insurance offers various discounts and incentives to its policyholders. These may include discounts for non-smokers, multi-policy discounts when bundling multiple insurance products, and loyalty rewards for long-term customers. Additionally, Nyl occasionally runs promotional campaigns, providing further opportunities for savings. It’s always beneficial to inquire about available discounts when obtaining a quote.