Travel Insurance Comparisons

Welcome to a comprehensive exploration of the world of travel insurance, a topic that is often overlooked but holds immense importance for travelers worldwide. In an era where travel is increasingly accessible, understanding the intricacies of travel insurance is crucial to ensure a smooth and secure journey. This article aims to provide an in-depth analysis of various travel insurance options, shedding light on the key features, benefits, and potential pitfalls to empower travelers with the knowledge they need to make informed decisions.

The Importance of Travel Insurance: A Necessity, Not an Option

Travel insurance is more than just a legal requirement in certain destinations; it is a vital component of responsible travel. The unpredictable nature of journeys, from sudden illnesses to unforeseen cancellations, highlights the need for a safety net that travel insurance provides. With the right coverage, travelers can rest assured that they are protected against a range of eventualities, minimizing the financial and logistical burdens that can accompany unexpected events.

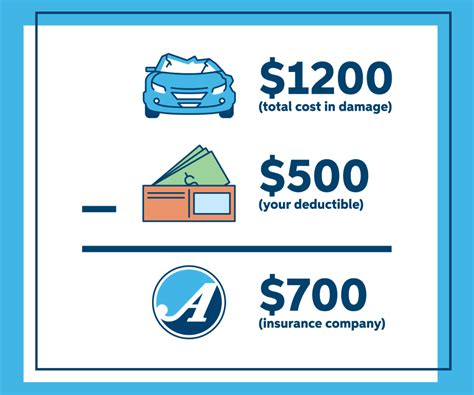

Consider, for instance, a scenario where a traveler is involved in an accident while abroad, requiring urgent medical attention. Without adequate travel insurance, the costs of such an incident could be staggering, potentially leaving the traveler with a heavy financial burden upon their return. On the other hand, with comprehensive travel insurance, the provider would cover the medical expenses, allowing the traveler to focus on their recovery without the added stress of financial worries.

Comparing Travel Insurance Policies: Unraveling the Complexities

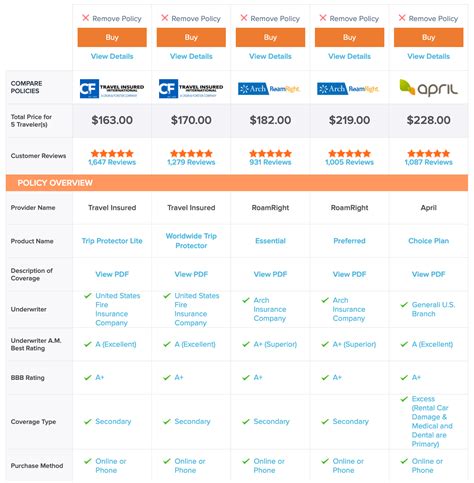

The market for travel insurance is vast and diverse, offering a plethora of options that can be overwhelming for even the most seasoned traveler. Each policy is unique, tailored to suit different travel needs and budgets. Understanding the key differences and similarities between these policies is essential to make an informed choice.

Coverage Levels: A Fine Balance

One of the primary considerations when comparing travel insurance policies is the level of coverage they provide. This includes both the types of events covered and the financial limits associated with each coverage category. For instance, while some policies offer extensive coverage for medical emergencies, they may have limited coverage for trip cancellations or interruptions. On the other hand, there are policies that provide robust coverage for trip cancellations but might fall short in terms of medical evacuation benefits.

| Policy | Medical Coverage | Trip Cancellation | Baggage Loss |

|---|---|---|---|

| Plan A | Up to $100,000 | $5,000 | $1,500 |

| Plan B | $50,000 | $8,000 | $2,000 |

| Plan C | $200,000 | $3,000 | $1,000 |

As seen in the table above, Plan A offers the highest medical coverage, which could be beneficial for travelers with pre-existing health conditions or those venturing to remote destinations with limited medical facilities. However, it falls short in trip cancellation coverage, which might be a concern for travelers with unpredictable schedules or those planning expensive trips.

Exclusions and Fine Print: Reading Between the Lines

While understanding the coverage levels is crucial, it is equally important to delve into the exclusions and fine print of each policy. These sections often contain crucial information that can significantly impact the overall value and usability of the insurance. For example, some policies may exclude coverage for certain activities deemed high-risk, such as adventure sports or extreme hiking, while others might have specific age restrictions or limitations on pre-existing conditions.

Consider the following scenario: a traveler purchases a policy that covers a range of activities, including skiing. However, upon further inspection of the fine print, it is revealed that the policy excludes coverage for injuries sustained while skiing off-piste. This exclusion could be detrimental for an adventurous skier who frequently explores beyond the marked trails. Therefore, a thorough understanding of the exclusions is essential to ensure that the policy aligns with the traveler's intended activities.

Additional Benefits: Going the Extra Mile

Apart from the standard coverage categories, many travel insurance policies offer additional benefits that can significantly enhance the travel experience. These benefits often include services like 24⁄7 emergency assistance, concierge services, or even coverage for trip delays and missed connections. While these add-ons might come at an additional cost, they can provide a significant peace of mind and convenience during unexpected situations.

For instance, imagine a traveler facing a delayed flight due to unforeseen weather conditions. With a travel insurance policy that covers trip delays, the traveler can receive compensation for additional expenses incurred during the delay, such as accommodation and meals. This benefit not only alleviates the financial burden but also ensures a more comfortable and stress-free experience during an otherwise frustrating situation.

Case Studies: Real-World Insights

To illustrate the practical implications of travel insurance, let’s explore a few real-world case studies that highlight the importance and impact of having adequate coverage.

Medical Emergency Abroad: A Lifeline in a Foreign Land

Mr. Johnson, a 65-year-old retiree, embarked on a solo trip to Europe, armed with a comprehensive travel insurance policy. During his stay in Paris, he suffered a sudden heart attack and was rushed to a local hospital. The medical expenses, including specialized treatment and surgery, amounted to over €50,000. Fortunately, Mr. Johnson’s travel insurance policy covered the entirety of these expenses, allowing him to receive the necessary treatment without worrying about the financial implications.

Trip Cancellation: Navigating the Unforeseen

Ms. Chen, an aspiring traveler, had booked a dream trip to South America, but unfortunately, a few weeks before her departure, her mother fell ill, requiring her immediate attention. Ms. Chen’s travel insurance policy included trip cancellation coverage, which allowed her to recover the majority of the non-refundable expenses associated with her canceled trip. This coverage not only provided her with financial relief but also gave her the peace of mind to focus on her family’s well-being without the added stress of financial loss.

Expert Insights: Navigating the Travel Insurance Landscape

Navigating the complexities of travel insurance requires a nuanced understanding of the market and the various options available. To gain further insights, we spoke to industry experts who shared their perspectives and advice for travelers.

Future Trends: Shaping the Travel Insurance Industry

As the travel industry continues to evolve, so too does the landscape of travel insurance. Several emerging trends are shaping the future of this sector, offering both challenges and opportunities for travelers and insurance providers alike.

Digitalization and Personalization: The Future of Travel Insurance

The rise of digital technologies has revolutionized the way travel insurance is purchased and managed. With the advent of mobile apps and online platforms, travelers can now easily compare policies, purchase coverage, and even file claims from the comfort of their homes. This trend towards digitalization is expected to continue, with insurance providers investing in innovative technologies to enhance the user experience and provide personalized coverage options.

Additionally, the concept of personalized travel insurance is gaining traction. This approach involves tailoring insurance policies to individual traveler profiles, taking into account factors such as age, medical history, travel frequency, and destination preferences. By offering customized coverage, insurance providers can better meet the unique needs of each traveler, providing a more efficient and effective solution.

Sustainability and Ethical Considerations: A Growing Priority

In recent years, there has been a growing emphasis on sustainability and ethical practices within the travel industry. This shift in mindset is also influencing the travel insurance sector, with travelers increasingly seeking out insurance options that align with their values and promote responsible travel practices.

Insurance providers are responding to this trend by offering policies that include sustainable travel benefits, such as carbon offsetting initiatives or support for local communities. By integrating sustainability into their offerings, insurance companies not only appeal to a wider range of travelers but also contribute to the broader goal of promoting responsible and ethical travel practices.

Conclusion: Empowering Travelers with Knowledge

Travel insurance is a vital component of any journey, providing a safety net against the unforeseen challenges that can arise during travel. By understanding the intricacies of travel insurance policies, from coverage levels to additional benefits, travelers can make informed decisions that align with their specific needs and travel plans.

As the travel insurance landscape continues to evolve, it is crucial for travelers to stay informed and adaptable. By keeping abreast of emerging trends and industry developments, travelers can ensure they are equipped with the most up-to-date knowledge to make the best choices for their travels. Ultimately, with the right travel insurance coverage, travelers can embark on their journeys with confidence, knowing they are protected and prepared for whatever lies ahead.

What is the ideal time to purchase travel insurance for my trip?

+It is generally recommended to purchase travel insurance as soon as you book your trip. This ensures that you are covered from the moment you make your travel plans, including any potential pre-departure emergencies or trip cancellations. Additionally, purchasing insurance early allows you to take advantage of any grace periods or additional benefits that may be offered by the insurance provider.

How do I choose the right travel insurance policy for my needs?

+Choosing the right travel insurance policy involves assessing your specific needs and travel plans. Consider factors such as the duration of your trip, the destinations you’ll visit, and the activities you’ll engage in. Evaluate the coverage levels, including medical, trip cancellation, and baggage loss, to ensure they align with your requirements. Additionally, read the fine print carefully to understand any exclusions or limitations that may apply.

Are there any common misconceptions about travel insurance that I should be aware of?

+Yes, there are a few common misconceptions about travel insurance. One prevalent misconception is that travel insurance is only necessary for long-haul or international trips. In reality, travel insurance can be beneficial for any journey, regardless of its duration or destination. Another misconception is that travel insurance is expensive. While premium rates can vary, there are often affordable options available, especially when purchased in advance.

What should I do if I need to file a claim during my trip?

+If you need to file a claim during your trip, it is important to act promptly and follow the procedures outlined by your insurance provider. Typically, you will need to notify the insurance company as soon as possible, provide detailed information about the incident, and submit any required documentation. It is beneficial to keep a record of all communication and interactions with the insurance provider for future reference.