Non Owners Vehicle Insurance

When it comes to the world of insurance, one often overlooked yet crucial coverage is Non-Owners Vehicle Insurance. This type of insurance policy provides protection for individuals who don't own a vehicle but still require liability coverage when driving someone else's car. It's an essential policy for those who frequently borrow or rent vehicles, ensuring they are financially safeguarded in the event of an accident. This article aims to delve into the intricacies of Non-Owners Vehicle Insurance, exploring its benefits, coverage, and how it can provide peace of mind for drivers without their own set of wheels.

Understanding Non-Owners Vehicle Insurance

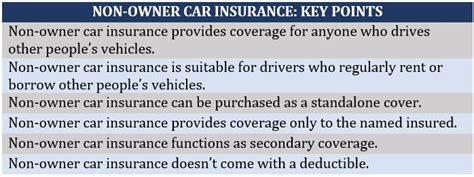

Non-Owners Vehicle Insurance, also known as Non-Owners Liability Insurance or Named Non-Owner Policy, is a specialized form of insurance designed for individuals who don’t own a personal vehicle but still need liability coverage while driving. This policy covers bodily injury and property damage that the insured may cause while operating a vehicle that they do not own. It’s an essential tool for those who frequently borrow cars from friends or family, rent vehicles, or even for ride-share drivers who use their own vehicles for work.

Key Benefits of Non-Owners Vehicle Insurance

One of the primary advantages of Non-Owners Vehicle Insurance is the peace of mind it offers. When you’re driving a borrowed or rented car, you’re typically covered by the owner’s insurance. However, if the owner’s policy has insufficient coverage or if there’s a dispute about who is at fault, you could be left financially responsible. This is where Non-Owners Insurance steps in, providing a safety net to protect you from potentially devastating financial consequences.

Another benefit is the flexibility it offers. Whether you’re a frequent traveler who often rents cars or someone who occasionally borrows a friend’s vehicle, this insurance policy can be tailored to your specific needs. You can choose the level of coverage that suits your budget and driving habits, ensuring you’re adequately protected without paying for coverage you don’t need.

Coverage and Policy Details

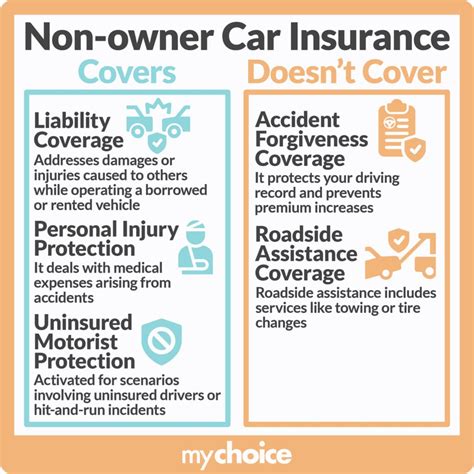

Non-Owners Vehicle Insurance typically includes liability coverage for bodily injury and property damage. This means that if you’re involved in an accident while driving a borrowed or rented car, your policy will cover the costs associated with injuries sustained by others and any damage caused to their property, up to the limits of your policy.

Some policies may also offer optional coverage for personal injury protection (PIP) or medical payments coverage. These coverages can help pay for your own medical expenses, lost wages, and other related costs, regardless of who is at fault in the accident. Additionally, uninsured and underinsured motorist coverage can provide protection if you’re involved in an accident with a driver who doesn’t have adequate insurance.

It’s important to note that Non-Owners Insurance does not provide coverage for damage to the vehicle you’re driving. This coverage is typically provided by the vehicle owner’s insurance policy or the rental car company’s insurance. However, if you’re involved in an at-fault accident, your Non-Owners Insurance may cover any lawsuits or legal fees that arise as a result.

Real-World Example and Testimonial

Imagine Sarah, a frequent traveler who often rents cars for her business trips. One day, while driving a rental car, she gets into an accident that results in significant property damage and bodily injuries to the other driver. Without Non-Owners Vehicle Insurance, Sarah would be personally liable for these costs, which could easily run into the tens of thousands of dollars. However, with her Non-Owners policy, she can rest assured that her insurance company will handle these expenses, protecting her personal finances from such a substantial blow.

“Having Non-Owners Insurance has given me the confidence to travel and rent cars without worrying about the financial repercussions of an accident. It’s an essential coverage for anyone who doesn’t own a vehicle but still needs the flexibility to drive occasionally. I highly recommend it for peace of mind and financial protection.”

Comparative Analysis: Non-Owners vs. Traditional Auto Insurance

While Non-Owners Vehicle Insurance provides crucial liability coverage, it’s important to understand how it differs from traditional auto insurance policies.

Coverage Comparison

Traditional auto insurance policies typically include comprehensive and collision coverage, which cover damage to your own vehicle. However, Non-Owners Insurance does not provide this type of coverage since it’s intended for drivers who don’t own a vehicle. Instead, it focuses on liability coverage, ensuring that you’re protected if you cause damage to others or their property while driving.

Another key difference is that Non-Owners Insurance often provides higher limits of liability coverage. This is because the policy is designed to protect you from catastrophic financial losses that could result from an at-fault accident. Traditional auto insurance policies may have lower liability limits, especially for basic coverage, which may not be sufficient in the event of a serious accident.

Cost Comparison

The cost of Non-Owners Vehicle Insurance can vary depending on several factors, including your driving record, the state you reside in, and the coverage limits you choose. Generally, Non-Owners policies are more affordable than traditional auto insurance since they don’t include coverage for the vehicle itself. This makes it an attractive option for those who don’t own a car but still need liability protection.

However, it’s important to note that the cost of Non-Owners Insurance can increase if you have a history of accidents or violations on your driving record. Additionally, the cost can also be influenced by the level of coverage you choose. Higher liability limits will typically result in a higher premium, so it’s important to find a balance between your budget and the level of protection you require.

Performance Analysis: Real-Life Scenarios

Let’s explore a couple of real-life scenarios to understand how Non-Owners Vehicle Insurance can provide protection and peace of mind.

Scenario 1: Borrowed Car Accident

John, a college student, frequently borrows his friend’s car to run errands and visit family. One day, while driving the borrowed car, he gets into an accident that results in significant property damage to the other vehicle and minor injuries to its occupants. Without Non-Owners Insurance, John would be personally liable for these costs, which could potentially impact his financial stability for years to come.

However, with his Non-Owners policy, John’s insurance company steps in to cover the costs associated with the accident. This includes repairing the other vehicle, covering medical expenses for the injured occupants, and potentially providing legal defense if needed. John’s personal finances remain intact, and he can continue his studies without the burden of substantial debt.

Scenario 2: Rental Car Coverage

Emily, a business professional, often travels for work and rents cars to get around. On one of her trips, she gets into a fender bender with a rental car. While the damage to the rental car is minor, the other driver involved in the accident claims to have sustained injuries and sues Emily for substantial damages.

Without Non-Owners Insurance, Emily would have to defend herself in court and potentially pay out of pocket for the legal fees and any settlement reached. However, with her Non-Owners policy, her insurance company provides legal representation and covers the costs associated with the lawsuit, up to the limits of her policy. This allows Emily to focus on her work without the stress of potential financial ruin.

Expert Insights and Future Implications

Non-Owners Vehicle Insurance is a niche but vital coverage that offers significant benefits to those who don’t own a vehicle but still need liability protection while driving. As the sharing economy continues to grow, with more people utilizing ride-sharing services and car-sharing platforms, the demand for Non-Owners Insurance is likely to increase.

Additionally, with the increasing complexity of automotive technology, the costs associated with accidents are likely to rise. This further underscores the importance of Non-Owners Insurance, as it provides a financial safety net for individuals who may be held liable for costly damages resulting from accidents.

Tips for Choosing the Right Non-Owners Policy

- Evaluate your specific needs: Consider your driving habits, the frequency with which you borrow or rent vehicles, and the potential risks associated with your driving. This will help you determine the appropriate level of coverage.

- Compare quotes: Shop around and compare quotes from different insurance providers to find the best coverage at the most competitive price.

- Understand the policy exclusions: Make sure you thoroughly understand what your policy does and does not cover. This includes knowing the limits of your liability coverage and any specific exclusions or limitations in your policy.

- Bundle with other policies: Some insurance providers offer discounts when you bundle Non-Owners Insurance with other policies, such as renters or homeowners insurance. This can be a cost-effective way to save on your premiums.

- Stay informed: Keep up-to-date with changes in the insurance industry, especially regarding Non-Owners policies. This will help you make informed decisions about your coverage and ensure you’re getting the best value for your money.

FAQ

Who needs Non-Owners Vehicle Insurance?

+

Non-Owners Vehicle Insurance is ideal for individuals who don’t own a vehicle but frequently drive borrowed or rented cars. This includes frequent travelers, ride-share drivers who use their own vehicles, and those who often borrow cars from friends or family.

What does Non-Owners Vehicle Insurance cover?

+

Non-Owners Insurance typically covers liability for bodily injury and property damage caused by the insured while driving a non-owned vehicle. It does not provide coverage for damage to the vehicle being driven.

Is Non-Owners Insurance more expensive than traditional auto insurance?

+

Non-Owners Insurance is generally more affordable than traditional auto insurance since it doesn’t include coverage for the vehicle itself. However, the cost can vary depending on factors like driving record and coverage limits.

Can I get Non-Owners Insurance if I have a poor driving record?

+

Yes, but a poor driving record may result in higher premiums for Non-Owners Insurance. Insurance companies take into account your driving history when determining your rates, so it’s important to shop around for the best coverage and price.

How can I get a quote for Non-Owners Vehicle Insurance?

+

You can request quotes for Non-Owners Insurance from various insurance providers, either online or through an insurance agent. Be sure to provide accurate information about your driving history and the coverage limits you’re interested in.