Identity Thief Insurance

Identity theft is a growing concern in the digital age, with individuals' personal information becoming increasingly vulnerable to unauthorized access and misuse. As a result, the demand for identity theft protection and insurance services has skyrocketed. This article explores the concept of identity thief insurance, delving into its definition, how it works, and its importance in safeguarding individuals and businesses in the modern world.

Understanding Identity Thief Insurance

Identity thief insurance, also known as identity theft protection or identity recovery insurance, is a specialized insurance product designed to provide comprehensive support and assistance to individuals who fall victim to identity theft. It offers a range of services and benefits aimed at mitigating the financial and emotional impact of identity theft incidents.

In the digital realm, where personal data is constantly shared and stored, the risk of identity theft is ever-present. From online shopping and social media interactions to medical records and financial transactions, our digital footprints can be exploited by malicious individuals seeking to assume our identities for personal gain.

Identity thief insurance steps in as a crucial safeguard, offering victims a dedicated team of experts to guide them through the complex process of identity recovery. This specialized insurance recognizes the unique challenges posed by identity theft and provides tailored solutions to restore individuals' peace of mind and financial stability.

How Identity Thief Insurance Works

Identity thief insurance operates as a proactive and reactive measure, offering both prevention and recovery services. Here’s a breakdown of how it works:

Prevention Measures

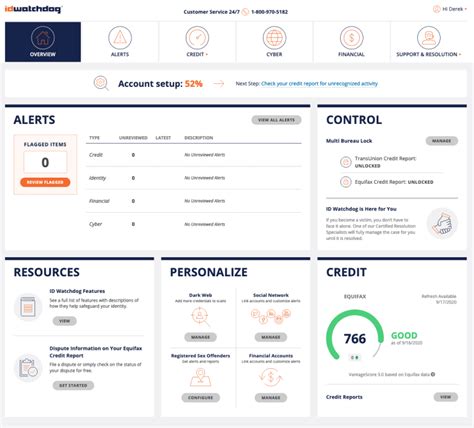

- Credit Monitoring: Insurers often provide real-time credit monitoring services, alerting policyholders to any suspicious activities or changes in their credit reports. This early detection can help identify potential identity theft attempts before they cause significant damage.

- Identity Theft Alerts: Policyholders receive notifications about potential threats to their identity, such as data breaches or phishing scams. These alerts empower individuals to take immediate action to protect their personal information.

- Secure Data Storage: Identity thief insurance providers offer secure digital storage solutions for sensitive documents and personal information, ensuring that only authorized individuals can access this data.

- Educational Resources: Many insurance companies provide educational materials and workshops to help individuals understand the risks of identity theft and implement best practices for safeguarding their information.

Recovery Assistance

In the event of an identity theft incident, identity thief insurance offers a comprehensive recovery process:

- Dedicated Case Managers: Policyholders are assigned a personal case manager who guides them through the entire recovery process, providing expert advice and support.

- Identity Theft Investigation: The insurer’s team of investigators works to uncover the extent of the identity theft, identifying affected accounts and fraudulent activities.

- Fraud Resolution: The insurer assists in resolving fraudulent transactions, disputes, and claims with financial institutions, credit bureaus, and government agencies.

- Credit Repair: Identity thief insurance often includes credit repair services, helping individuals restore their credit scores and reputation after identity theft incidents.

- Lost Document Replacement: Policyholders receive assistance in replacing stolen or lost identity documents, such as driver’s licenses, passports, and social security cards.

- Legal Support: In cases where identity theft leads to legal issues, the insurer may provide legal referrals and support to help victims navigate the legal system.

The Importance of Identity Thief Insurance

Identity thief insurance plays a vital role in protecting individuals and businesses from the devastating consequences of identity theft. Here’s why it’s crucial:

Financial Protection

Identity theft can result in significant financial losses for victims. From unauthorized purchases and loan applications to drained bank accounts, the financial impact can be devastating. Identity thief insurance provides financial reimbursement for covered losses, offering victims a safety net during their recovery.

Peace of Mind

Dealing with identity theft can be emotionally draining and time-consuming. Identity thief insurance takes the burden off victims, providing them with a dedicated team to handle the complex and stressful recovery process. This peace of mind allows individuals to focus on their daily lives while their identity is being restored.

Comprehensive Recovery

Identity thief insurance offers a holistic approach to recovery, addressing all aspects of identity theft. From credit repair to legal support, the insurance ensures that victims receive the necessary resources and expertise to fully recover their identities and financial stability.

Business Protection

Identity theft is not limited to individuals; businesses are also at risk. Identity thief insurance for businesses helps protect their reputation and financial health by offering similar recovery services and prevention measures. This ensures that businesses can continue operating smoothly without the disruption caused by identity theft incidents.

Early Detection and Prevention

The prevention measures provided by identity thief insurance are crucial in identifying and mitigating identity theft risks. By monitoring credit reports and providing timely alerts, insurers enable individuals to take immediate action, minimizing the potential impact of identity theft attempts.

Real-World Impact and Success Stories

Identity thief insurance has proven its effectiveness in real-world scenarios, with numerous success stories highlighting its value:

Case Study 1: Financial Recovery

Mr. Johnson, a victim of identity theft, had his personal information stolen and used to open multiple credit accounts. He faced significant financial losses and damage to his credit score. With the help of identity thief insurance, he received expert guidance and financial reimbursement, allowing him to recover his losses and rebuild his credit.

Case Study 2: Rapid Response

Ms. Smith, a busy professional, fell victim to a data breach. With identity thief insurance, she received immediate notifications about the breach and was guided through the necessary steps to protect her identity. The rapid response and proactive measures prevented any further damage and ensured her peace of mind.

Case Study 3: Business Protection

A small business, XYZ Inc., experienced a cybersecurity breach that resulted in the theft of customer data. Identity thief insurance for businesses stepped in, providing the company with expert guidance and support to contain the breach, notify affected customers, and restore their reputation. The insurance also covered the costs of credit monitoring for customers, demonstrating the insurer’s commitment to protecting both the business and its customers.

Choosing the Right Identity Thief Insurance

When selecting identity thief insurance, it’s essential to consider your specific needs and the features offered by different providers. Here are some key factors to evaluate:

Coverage and Limits

Examine the coverage limits and what is included in the policy. Look for comprehensive coverage that addresses all potential risks, including credit monitoring, fraud resolution, and lost document replacement.

Response Time

Inquire about the insurer’s response time in the event of an identity theft incident. A prompt response is crucial to minimize the impact and expedite the recovery process.

Expertise and Experience

Research the insurer’s track record and the expertise of their case managers and investigators. Look for providers with a proven history of successful identity theft recoveries and a dedicated team of professionals.

Additional Benefits

Some identity thief insurance policies offer additional benefits, such as cyber insurance coverage, identity theft insurance for children, or legal support services. Consider your specific needs and choose a policy that aligns with your requirements.

Reputation and Reviews

Read reviews and seek recommendations from trusted sources to ensure the insurer has a good reputation and delivers on its promises. Customer feedback can provide valuable insights into the quality of service and support.

Future Trends and Developments

As technology advances and the threat landscape evolves, identity thief insurance is likely to adapt and innovate to meet the changing needs of individuals and businesses. Here are some potential future developments:

AI-Powered Prevention

Artificial intelligence (AI) and machine learning algorithms can enhance identity thief insurance by improving detection and prevention capabilities. AI-powered systems can analyze vast amounts of data to identify patterns and anomalies, enabling insurers to provide more accurate and timely alerts.

Blockchain Integration

The integration of blockchain technology into identity thief insurance could revolutionize the way personal data is stored and protected. Blockchain’s decentralized and immutable nature can enhance data security and provide an additional layer of protection against identity theft.

Enhanced Mobile Apps

Mobile apps are becoming an integral part of identity thief insurance, providing policyholders with convenient access to their accounts and real-time notifications. Future developments may include more advanced features, such as biometric authentication and enhanced security protocols, to further protect users’ data.

Expanded Coverage for Emerging Risks

As new technologies emerge, so do new risks. Identity thief insurance providers will likely expand their coverage to address emerging threats, such as synthetic identity theft and deepfake technologies. This proactive approach will ensure that individuals and businesses remain protected in a rapidly changing digital landscape.

Partnerships and Collaborations

To enhance their services and reach, identity thief insurance providers may collaborate with other industry players, such as cybersecurity companies, credit bureaus, and law enforcement agencies. These partnerships can strengthen the overall response to identity theft incidents and improve the efficiency of recovery processes.

Frequently Asked Questions

How does identity thief insurance differ from traditional insurance policies?

+

Identity thief insurance is specifically designed to address the unique challenges of identity theft. Unlike traditional insurance policies, it focuses on providing dedicated recovery services, credit monitoring, and fraud resolution assistance. Traditional insurance policies may offer some coverage for financial losses due to identity theft, but they often lack the specialized support and prevention measures provided by identity thief insurance.

Is identity thief insurance only for individuals, or can businesses benefit from it too?

+

Identity thief insurance is available for both individuals and businesses. While individuals can protect their personal identities, businesses can safeguard their operations and customer data. Business identity thief insurance provides similar recovery services and prevention measures, ensuring that companies can continue running smoothly even in the face of identity theft incidents.

What should I do if I suspect I’m a victim of identity theft?

+

If you suspect identity theft, it’s crucial to act promptly. Contact your financial institutions, credit bureaus, and law enforcement agencies to report the incident. Additionally, if you have identity thief insurance, reach out to your insurer immediately. They will guide you through the necessary steps and provide expert assistance to mitigate the impact of the theft.

How can I prevent identity theft from happening in the first place?

+

Prevention is key when it comes to identity theft. Some proactive measures include using strong and unique passwords, enabling two-factor authentication, regularly monitoring your credit reports, and being cautious about sharing personal information online. Additionally, consider investing in identity thief insurance, which provides credit monitoring and alerts to help detect potential threats early on.

Are there any limitations or exclusions in identity thief insurance policies?

+

Like any insurance policy, identity thief insurance may have certain limitations and exclusions. It’s important to carefully review the policy terms and conditions to understand what is and isn’t covered. Common exclusions may include certain types of fraud, such as employment-related identity theft or fraudulent activities committed by family members or authorized users.