Ncua Insurance Limits

The National Credit Union Administration (NCUA) is an independent federal agency that insures deposits in credit unions and works to ensure the safety and soundness of the credit union system in the United States. One of the key aspects of NCUA's role is the share insurance it provides, which offers protection to credit union members and fosters confidence in the industry.

This article will delve into the topic of NCUA insurance limits, exploring the coverage amounts, the mechanisms by which these limits are set, and the implications for credit union members and the financial sector as a whole. By understanding the insurance limits, we can gain insights into the stability and security measures within the credit union system.

Understanding NCUA Share Insurance

NCUA’s share insurance program is designed to protect the savings of credit union members by guaranteeing the repayment of funds up to a specified limit if a credit union fails or is unable to meet its financial obligations. This insurance program is a critical component of the credit union system, as it provides a safety net for members’ deposits, similar to the Federal Deposit Insurance Corporation (FDIC) insurance for banks.

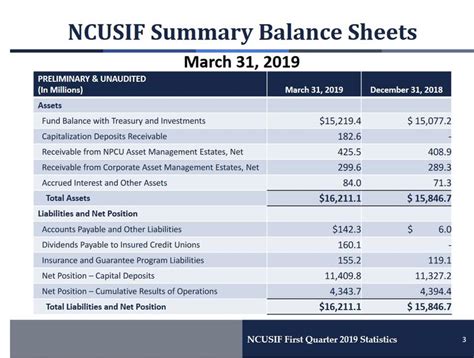

The NCUA National Credit Union Share Insurance Fund (NCUSIF) is a government-backed fund that backs the insurance provided to credit union members. The NCUSIF is supported by contributions from credit unions and is managed by the NCUA to ensure the fund remains healthy and capable of covering potential losses.

The insurance coverage provided by NCUA is not just limited to standard deposit accounts. It also extends to various types of accounts and financial products, including share accounts, certificates, and money market accounts. This comprehensive coverage ensures that credit union members can rely on the protection of their savings, regardless of the type of account they hold.

Key Features of NCUA Share Insurance

- The insurance coverage limit is a critical aspect of NCUA’s program. This limit defines the maximum amount that an individual member’s deposits are insured for in the event of a credit union failure.

- NCUA employs a member-by-member insurance approach, which means that each individual’s deposits are insured separately, up to the specified limit.

- The NCUSIF is backed by the full faith and credit of the United States government, providing an additional layer of security and stability to credit union members.

- The insurance program covers all federally insured credit unions, ensuring that members of these institutions have the same level of protection, regardless of the size or location of their credit union.

It's important to note that while NCUA insurance provides a robust safety net, it does not cover all financial risks. For instance, investments in stocks, bonds, mutual funds, and other securities are not insured by NCUA. Additionally, certain types of transactions, such as wire transfers and foreign currency transactions, may have specific coverage considerations.

Insurance Limits and Coverage Calculations

The insurance limits set by NCUA are designed to provide adequate protection to credit union members while also ensuring the financial stability of the credit union system. These limits are established through a careful evaluation of various factors, including economic conditions, the performance of the credit union industry, and the overall health of the financial sector.

The current insurance limit for single ownership accounts stands at $250,000. This means that if an individual has multiple accounts within a single credit union, the combined balance of those accounts is insured up to $250,000. Any amounts exceeding this limit are not insured by NCUA.

However, NCUA recognizes that many individuals hold multiple types of accounts and may have specific ownership structures. To address this, NCUA offers enhanced coverage for certain account categories, allowing for higher insurance limits in specific circumstances.

| Account Type | Insurance Limit |

|---|---|

| Single Ownership Accounts | $250,000 |

| Joint Accounts | $250,000 per owner |

| Revocable Trust Accounts | $250,000 per owner |

| IRAs and Certain Retirement Accounts | $250,000 per owner |

| Corporate Accounts (Business) | $250,000 per identifiable owner |

For example, in the case of joint accounts, the insurance coverage is provided separately for each account owner. So, if two individuals hold a joint account with a balance of $300,000, each owner's share is insured up to $250,000, providing a total coverage of $500,000 for the account.

Similarly, revocable trust accounts and certain retirement accounts, such as IRAs, also enjoy separate insurance coverage for each owner, up to the $250,000 limit. This means that an individual with multiple IRAs can have each account insured separately, provided the balance in each account does not exceed the limit.

Insurance Coverage for Specific Account Types

NCUA’s insurance program covers a wide range of account types, providing peace of mind to credit union members. Here’s a breakdown of the insurance coverage for some specific account types:

- Basic Share Accounts: These are standard savings accounts held by individuals. The insurance coverage for basic share accounts is up to $250,000 per account owner.

- Share Draft Accounts (Checking Accounts): Share draft accounts, which function similarly to traditional checking accounts, are also insured up to $250,000 per account owner.

- Share Certificates (CDs): Share certificates, which are time-based savings accounts, offer higher interest rates in exchange for a commitment to keep funds in the account for a specified period. The insurance coverage for share certificates is also up to $250,000 per account owner.

- Money Market Accounts: Money market accounts provide higher interest rates than traditional savings accounts and allow a limited number of transactions. These accounts are also insured up to $250,000 per account owner.

- IRA and Retirement Accounts: As mentioned earlier, IRAs and certain retirement accounts are insured separately for each owner, up to $250,000 per owner.

Protecting Your Deposits: Tips and Considerations

While NCUA’s insurance program provides a robust safety net for credit union members, it’s essential for individuals to understand their deposit protection and take steps to maximize their coverage.

Understanding Account Ownership

The way an account is owned or titled can have a significant impact on the insurance coverage it receives. NCUA recognizes different types of account ownership, and each type has its own insurance limit.

- Single Ownership Accounts: As the name suggests, these accounts are owned by a single individual. The insurance coverage for single ownership accounts is up to $250,000.

- Joint Accounts: Joint accounts are owned by two or more individuals. The insurance coverage for joint accounts is $250,000 per owner. This means that if there are two owners on a joint account, the total coverage is $500,000.

- Trust Accounts: Trust accounts are set up by an individual (the grantor) for the benefit of another person (the beneficiary). The insurance coverage for trust accounts depends on the type of trust and the ownership structure. For revocable trusts, the coverage is $250,000 per owner.

- Business Accounts: Business accounts are owned by a corporation or other business entity. The insurance coverage for business accounts is $250,000 per identifiable owner. This means that if a corporation has multiple accounts, each account is insured separately, and the coverage is $250,000 per identifiable owner (such as a partner or shareholder).

Maximizing Insurance Coverage

To ensure you maximize your insurance coverage, consider the following tips:

- Understand Your Account Ownership: Be aware of how your accounts are titled and owned. If you have multiple accounts, ensure that you understand the ownership structure and how it affects your insurance coverage.

- Utilize Multiple Accounts: If you have substantial savings, consider spreading your deposits across multiple accounts to maximize your insurance coverage. This way, you can ensure that each account is insured up to the $250,000 limit.

- Explore Joint Ownership: If you have a spouse or partner, consider opening joint accounts to double your insurance coverage. For example, a joint account with two owners would have a total coverage of $500,000.

- Consider Trust Accounts: If you have substantial assets or are planning for your estate, setting up a revocable trust account can provide additional insurance coverage. Each owner of the trust account is insured up to $250,000.

- Review Your Retirement Accounts: IRA and retirement accounts are insured separately for each owner. Ensure that you understand the insurance coverage for these accounts and consider spreading your retirement savings across multiple accounts to maximize protection.

The Future of NCUA Insurance: A Look Ahead

The NCUA’s insurance program has proven to be a vital component of the credit union system, offering stability and confidence to millions of credit union members. As the financial landscape continues to evolve, the NCUA remains committed to adapting its insurance policies to meet the changing needs of the industry and its members.

Ongoing Monitoring and Assessment

The NCUA continually monitors the financial health of credit unions and assesses the performance of the NCUSIF. This ongoing evaluation process ensures that the insurance limits and coverage rules remain appropriate and effective in safeguarding members’ deposits.

Through its Quarterly Monitoring Report, the NCUA provides updates on the financial performance of the NCUSIF, including its overall health and capital position. This report, along with other NCUA publications, offers transparency and keeps credit union members and stakeholders informed about the stability of the insurance fund.

Adaptive Policies and Future Considerations

The NCUA recognizes that the financial sector is dynamic, and it strives to adapt its policies to meet emerging challenges and opportunities. As such, the agency remains open to exploring enhancements to its insurance program to better serve the needs of credit union members.

Potential future considerations for the NCUA insurance program may include:

- Increased Insurance Limits: As the financial landscape evolves and the value of the dollar changes, the NCUA may consider adjusting insurance limits to keep pace with inflation and changing economic conditions.

- Enhanced Coverage for Specific Account Types: The NCUA could explore expanding insurance coverage for certain account types, such as providing higher limits for long-term savings accounts or offering additional protections for certain retirement vehicles.

- Digital Currency and Fintech Integration: With the rise of digital currencies and fintech innovations, the NCUA may need to adapt its insurance policies to address these new forms of financial instruments and ensure that members' deposits in these emerging areas are adequately protected.

- International Expansion: As credit unions increasingly engage in international operations and partnerships, the NCUA may need to consider how its insurance program can support and protect members' deposits in global ventures.

While these potential future developments are exciting, it's important to remember that the NCUA's primary focus remains on ensuring the safety and soundness of the credit union system. Any changes to insurance policies will be made with careful consideration of the industry's health and the best interests of credit union members.

Conclusion

The NCUA’s share insurance program is a cornerstone of the credit union system, providing peace of mind to millions of members across the United States. By understanding the insurance limits, coverage calculations, and ownership considerations, individuals can maximize the protection of their deposits and navigate the credit union landscape with confidence.

As the financial sector continues to evolve, the NCUA remains dedicated to ensuring the stability and security of the credit union system, and its insurance program will undoubtedly play a pivotal role in achieving this goal.

Frequently Asked Questions

What happens if a credit union fails, and I have deposits exceeding the insurance limit?

+

If a credit union fails, the NCUA steps in to resolve the situation and protect members’ deposits. However, if your deposits exceed the insurance limit, you may experience a loss on the amounts exceeding the limit. It’s important to review your account balances and ownership structures to ensure you are within the insurance limits.

Are there any special considerations for business accounts in terms of insurance coverage?

+

Yes, business accounts are insured up to 250,000 per identifiable owner. This means that if a corporation has multiple accounts, each account is insured separately, and the coverage is 250,000 per identifiable owner, such as a partner or shareholder.

Can I open multiple accounts at different credit unions to maximize my insurance coverage?

+

Yes, you can open multiple accounts at different credit unions to maximize your insurance coverage. Each credit union is insured separately, so you can have up to 250,000 in insurance coverage at each institution.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How often are NCUA insurance limits reviewed and updated?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>NCUA insurance limits are periodically reviewed and updated to ensure they remain adequate and reflective of the current economic climate. The last significant update to the insurance limits was in 2010, when the limit was increased from 100,000 to $250,000 per account owner.

Are there any plans to increase the insurance limits in the future?

+

While there are no immediate plans to increase the insurance limits, NCUA remains committed to monitoring the financial landscape and assessing the need for any adjustments. The agency will make any necessary changes to ensure the continued stability and protection of credit union members’ deposits.