National Insurance No

The National Insurance number is a unique identifier assigned to individuals in the United Kingdom, serving as a vital component of the country's social security system. This number holds significant importance, as it is used to track an individual's contributions to various social welfare programs, including pensions, unemployment benefits, and healthcare services. Understanding the intricacies of the National Insurance system is essential for both employers and employees to ensure compliance with legal requirements and to maximize the benefits available under the social security framework.

The Significance of National Insurance Numbers

National Insurance numbers play a pivotal role in the UK’s social security system, providing a means to accurately record and manage an individual’s contributions. These contributions are essential for accessing a range of state benefits and services. The system ensures that individuals build up their entitlement to state pensions and other benefits over time, based on their employment and tax records.

For employers, National Insurance numbers are crucial for payroll processing and for reporting employee earnings to HM Revenue and Customs (HMRC). Employers must deduct National Insurance contributions from employee salaries and remit these contributions to HMRC alongside income tax deductions. Accurate handling of National Insurance numbers is, therefore, a critical aspect of payroll management and tax compliance.

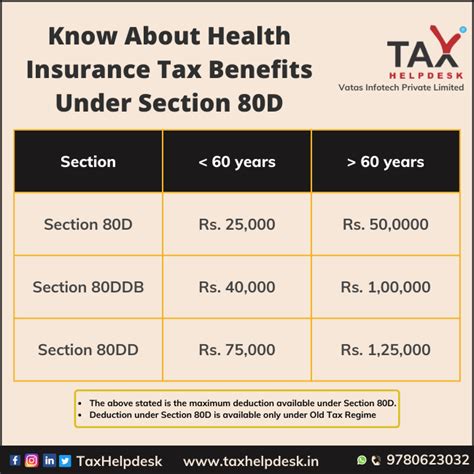

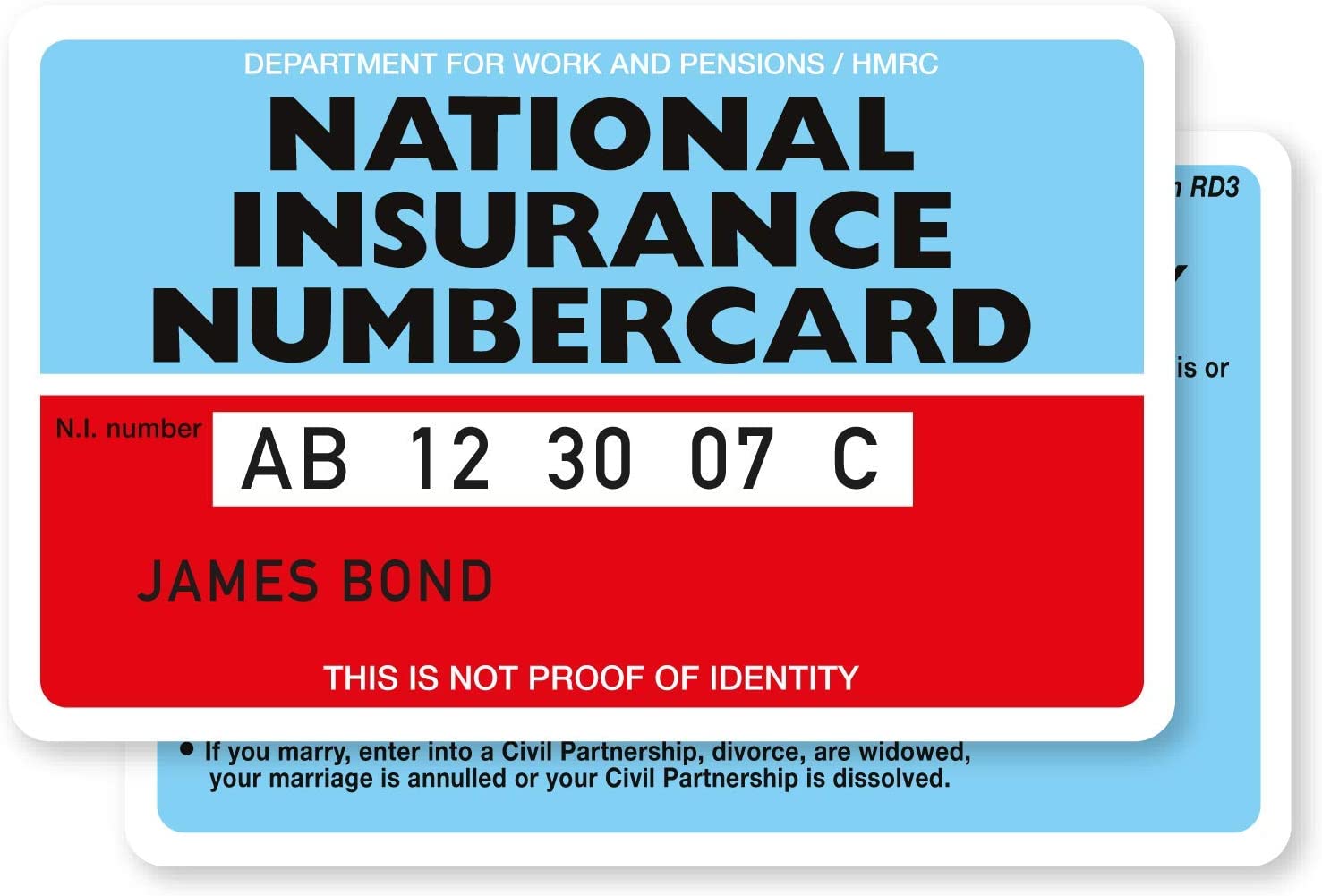

Understanding the National Insurance Number Structure

A National Insurance number is typically a nine-digit number, structured in the format QQ 12 34 56 C, where QQ represents two letters, 12 34 56 are six digits, and C is a single letter. The number is assigned to an individual shortly after they are born or when they become a UK resident. It remains with them throughout their working life and is used for various purposes, including tax records, benefit claims, and pension contributions.

The first two letters of the National Insurance number, QQ, indicate the individual's initial allocation. These letters are usually sequential, but for security reasons, HMRC does not disclose the specific allocation criteria. The six-digit number that follows is unique to each individual and serves as their personal identifier. The final letter, C, is a check letter used to verify the validity of the entire number. This check letter is calculated using a complex formula based on the other eight characters of the National Insurance number.

Acquiring and Using a National Insurance Number

Newborns in the UK are not automatically assigned a National Insurance number. However, when an individual reaches the age of 16, they can apply for one through HMRC. This process typically involves completing an application form, providing proof of identity and address, and sometimes appearing for an interview to verify the information provided.

Once an individual receives their National Insurance number, they must quote it whenever they start a new job, claim benefits, or register with a new GP surgery. It is a critical piece of information that employers and government agencies use to identify and track an individual's contributions and entitlements.

National Insurance Contributions: How They Work

National Insurance contributions are calculated based on an individual’s earnings. These contributions are used to fund various social security programs, including the State Pension, unemployment benefits, and the NHS. The amount an individual contributes depends on their earnings and employment status.

For employees, National Insurance contributions are typically deducted from their pay by their employer. Self-employed individuals, on the other hand, are responsible for calculating and paying their own contributions directly to HMRC. The contribution rates vary based on earnings and whether the individual is an employee or self-employed.

The Future of National Insurance: Potential Reforms

The National Insurance system in the UK has undergone several reforms over the years to adapt to changing economic and social conditions. While the current system provides a solid framework for social security, ongoing debates about potential reforms suggest that changes may be on the horizon.

Some proposed reforms include adjusting contribution rates to account for changing demographics and economic realities, introducing a more progressive contribution structure, and exploring ways to simplify the system for both employers and individuals. These potential changes aim to ensure the long-term sustainability of the social security system and to make it more equitable and efficient.

Digitalization and the Future of National Insurance

The UK government has also emphasized the importance of digitalization in the National Insurance system. Efforts are underway to streamline processes and enhance security by moving more services online. This includes the development of digital platforms for easier access to information and services related to National Insurance numbers and contributions.

Digitalization not only improves efficiency but also enhances security by reducing the risk of fraud and identity theft. It allows individuals to manage their National Insurance records and contributions more effectively, and it provides employers with streamlined tools for payroll processing and tax compliance.

Conclusion: The Enduring Relevance of National Insurance

Despite ongoing debates and potential reforms, the National Insurance system remains a cornerstone of the UK’s social security framework. It provides a critical mechanism for funding and accessing essential services and benefits, from healthcare to retirement pensions. Understanding the intricacies of the National Insurance system is vital for individuals and employers alike, as it ensures compliance with legal requirements and facilitates access to the full range of social security benefits.

As the UK continues to navigate economic and social changes, the National Insurance system will likely adapt to ensure it remains relevant and effective in the years to come. Whether through adjustments to contribution rates, structural reforms, or the embrace of digital technologies, the goal remains the same: to provide a robust social safety net for all UK residents.

How can I apply for a National Insurance number if I’m a new resident in the UK?

+To apply for a National Insurance number as a new resident, you need to complete an application form (available online or at your local Jobcentre Plus office). You’ll also need to provide proof of identity, age, and address. In some cases, you may be invited for an interview to verify your details. Once your application is approved, you’ll receive your National Insurance number in the mail.

What are the current National Insurance contribution rates for employees and the self-employed?

+The contribution rates vary based on earnings and employment status. For employees, the current National Insurance contribution rates are 12% on earnings between £9,880 and £50,270 per year, and 2% on earnings above £50,270. For the self-employed, the rates are 9% on profits between £9,880 and £50,270, and 2% on profits above £50,270.

How can I check my National Insurance contribution record and ensure I’m on track for a full State Pension?

+You can check your National Insurance contribution record by logging into your personal tax account on the HMRC website. This will show you the years for which you’ve made contributions and the amount you’ve paid. To ensure you’re on track for a full State Pension, you need to have at least 35 qualifying years of National Insurance contributions.