Motorcycle Insureance

Motorcycle insurance is a crucial aspect of motorcycle ownership, offering protection and peace of mind to riders. With a wide range of coverage options and varying state regulations, understanding the ins and outs of motorcycle insurance is essential for every rider. In this comprehensive guide, we will delve into the world of motorcycle insurance, exploring the key components, coverage types, and factors that influence policy costs. By the end of this article, you'll have the knowledge to make informed decisions and navigate the often complex world of motorcycle insurance with confidence.

Understanding the Basics of Motorcycle Insurance

Motorcycle insurance, much like auto insurance, provides financial protection in the event of an accident, theft, or other unforeseen circumstances. However, the unique nature of motorcycles brings specific considerations to the insurance landscape. Let’s break down the fundamental aspects of motorcycle insurance.

Coverage Types

Motorcycle insurance policies offer various coverage options, each designed to address different risks. Here’s a breakdown of the most common types:

- Liability Coverage: This coverage is essential and often mandatory. It protects you financially if you’re found at fault in an accident, covering the costs of injuries or damages caused to others.

- Comprehensive Coverage: Comprehensive insurance provides protection against non-collision incidents, such as theft, vandalism, weather damage, or collisions with animals.

- Collision Coverage: As the name suggests, this coverage kicks in when your motorcycle is involved in a collision, regardless of fault. It covers the costs of repairing or replacing your bike.

- Uninsured/Underinsured Motorist Coverage: This coverage comes into play when an at-fault driver lacks sufficient insurance to cover the damages they cause. It ensures you’re protected even if the other driver is uninsured or underinsured.

- Medical Payments Coverage: Also known as MedPay, this coverage pays for medical expenses resulting from a motorcycle accident, regardless of fault.

Factors Influencing Insurance Costs

The cost of motorcycle insurance can vary significantly depending on several factors. Understanding these influences can help you make more informed decisions and potentially reduce your insurance premiums.

- Rider’s Age and Experience: Younger riders and those with less riding experience often face higher insurance costs due to the perceived higher risk associated with inexperience.

- Type of Motorcycle: The make, model, and age of your motorcycle play a role in insurance costs. High-performance bikes or classic motorcycles may attract higher premiums due to their value or potential for riskier riding.

- Riding History: Your driving record, including any accidents or violations, can impact your insurance rates. A clean driving record is often rewarded with lower premiums.

- Coverage Amounts: The more coverage you choose, the higher your premiums are likely to be. However, it’s essential to strike a balance between coverage and cost to ensure adequate protection.

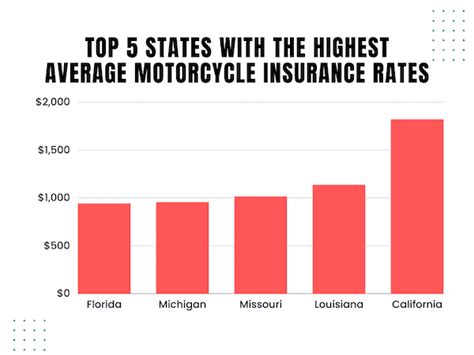

- Location and Usage: Where you live and how often you ride can affect your insurance rates. High-traffic areas or regions with a higher incidence of theft or accidents may result in higher premiums.

Tailoring Your Motorcycle Insurance Policy

One of the advantages of motorcycle insurance is the ability to customize your policy to fit your specific needs and circumstances. Here’s how you can tailor your insurance coverage:

Optional Add-Ons

Beyond the standard coverage types, there are optional add-ons available to enhance your policy. These add-ons can provide additional protection and peace of mind.

- Roadside Assistance: This add-on provides emergency services like towing, flat tire changes, or fuel delivery if you’re stranded on the road.

- Custom Parts and Equipment Coverage: If you’ve invested in custom upgrades or specialized equipment for your motorcycle, this coverage ensures they’re protected in the event of an accident or theft.

- Trip Interruption Coverage: For riders who embark on long-distance trips, this coverage can reimburse expenses incurred due to trip interruptions caused by mechanical issues or accidents.

Choosing the Right Deductible

When selecting your motorcycle insurance policy, you’ll need to choose a deductible - the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums, but it’s essential to ensure you can afford the deductible in the event of a claim.

Bundling Policies

Bundling your motorcycle insurance with other policies, such as auto or home insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, so it’s worth exploring this option.

Tips for Saving on Motorcycle Insurance

While motorcycle insurance is essential, it’s understandable that riders want to keep costs as low as possible without sacrificing coverage. Here are some tips to help you save on your insurance premiums:

Shop Around

Don’t settle for the first insurance quote you receive. Compare rates from multiple providers to find the best deal. Online insurance marketplaces can be a great starting point for comparing quotes.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go insurance, offers a unique approach to motorcycle insurance. It tracks your riding habits and mileage, and you pay premiums based on your actual usage. This can be a cost-effective option for riders who don’t ride frequently.

Take Advantage of Discounts

Many insurance providers offer discounts for a variety of reasons. Common discounts include safe rider courses, anti-theft devices, and multi-policy bundles. Be sure to inquire about all available discounts to maximize your savings.

Maintain a Clean Riding Record

A clean riding record is not only important for your safety but also for keeping your insurance premiums low. Avoid traffic violations and accidents to maintain a positive record.

Understanding Claims and Settlements

In the unfortunate event of an accident or other covered incident, understanding the claims process is crucial. Here’s a step-by-step guide to help you navigate the claims settlement process:

Reporting a Claim

Contact your insurance provider as soon as possible after an accident or incident. They will guide you through the necessary steps to initiate a claim. Be prepared to provide details about the incident and any relevant documentation.

Assessment and Settlement

Once your claim is filed, an adjuster will evaluate the damages and determine the settlement amount. This process may involve an inspection of your motorcycle and a review of any relevant evidence. It’s important to cooperate fully with the adjuster to ensure a smooth settlement process.

Disputing a Claim

If you disagree with the settlement amount or the adjuster’s findings, you have the right to dispute the claim. Contact your insurance provider and explain your concerns. In some cases, mediation or arbitration may be necessary to reach a resolution.

The Future of Motorcycle Insurance

The insurance industry is evolving, and motorcycle insurance is no exception. As technology advances, we can expect to see new trends and innovations shaping the landscape of motorcycle insurance.

Telematics and Data Analytics

Telematics technology, which uses sensors and data analytics to monitor driving behavior, is gaining traction in the insurance industry. This technology can provide real-time insights into riding habits, allowing insurance providers to offer more personalized and data-driven policies.

Enhanced Safety Features

The development of advanced safety features in motorcycles, such as anti-lock braking systems (ABS) and electronic stability control (ESC), is influencing insurance rates. Motorcycles equipped with these features often qualify for lower insurance premiums due to their enhanced safety capabilities.

Green Initiatives

With a growing focus on environmental sustainability, we can expect to see insurance providers offering incentives for riders who opt for electric or hybrid motorcycles. These initiatives aim to promote eco-friendly transportation while providing cost savings to riders.

Conclusion

Motorcycle insurance is a critical component of responsible riding. By understanding the coverage options, factors influencing costs, and the claims process, riders can make informed decisions to protect themselves and their bikes. As the insurance industry continues to evolve, staying informed about emerging trends and technologies will empower riders to make the most of their insurance policies.

What is the average cost of motorcycle insurance?

+

The average cost of motorcycle insurance can vary significantly based on factors such as location, riding experience, and the type of motorcycle. As of 2023, the average annual premium for motorcycle insurance in the United States is around 500, but it can range from 200 to over $1,000 depending on individual circumstances.

Do I need motorcycle insurance if I only ride occasionally?

+

Yes, even if you ride infrequently, motorcycle insurance is essential. It provides financial protection in the event of an accident, theft, or other unexpected incidents. Additionally, many states require a minimum level of insurance coverage for motorcycles.

Can I get discounts on my motorcycle insurance policy?

+

Absolutely! Insurance providers offer various discounts to riders. These can include safe rider discounts, multi-policy discounts (if you bundle your motorcycle insurance with other policies), and discounts for anti-theft devices or safety courses. It’s worth inquiring about these discounts when shopping for insurance.