Medical Insurance Family Plans

In the world of healthcare, ensuring the well-being of your entire family is a top priority. Medical insurance family plans offer a comprehensive solution to safeguard the health of your loved ones. These plans are designed to provide coverage for multiple family members, offering peace of mind and financial protection during times of medical need. With the rising costs of healthcare, having a solid family health insurance plan is more crucial than ever. In this article, we will delve into the world of medical insurance family plans, exploring their benefits, coverage options, and how they can be tailored to meet the unique needs of your family.

The Importance of Family Health Insurance

Family health insurance plans are a cornerstone of modern healthcare, offering a safety net for families of all sizes and compositions. With the increasing complexity of medical treatments and the ever-rising costs associated with them, having comprehensive health coverage is no longer a luxury but a necessity. These plans provide a sense of security, knowing that your family’s health is protected, regardless of unforeseen circumstances.

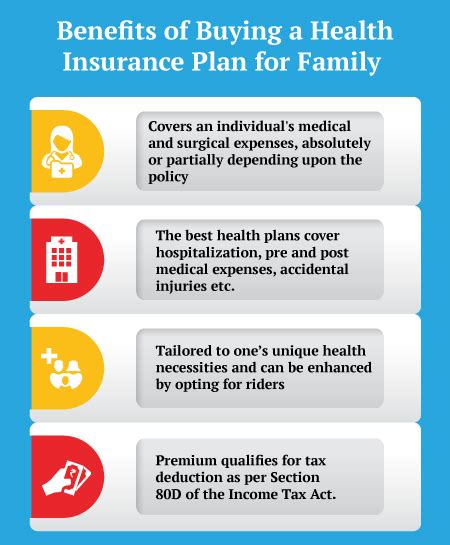

One of the key advantages of family health insurance is the ability to cover a wide range of medical services. From routine check-ups and preventive care to more complex procedures and hospitalizations, these plans ensure that your family receives the medical attention they need without the burden of excessive out-of-pocket expenses. Furthermore, family plans often include additional benefits such as dental and vision coverage, prescription drug plans, and even mental health services, ensuring a holistic approach to healthcare.

Understanding Medical Insurance Family Plans

Medical insurance family plans are designed with the understanding that each family is unique and has diverse healthcare needs. These plans offer a flexible and customizable approach to coverage, allowing families to choose the level of protection that suits their specific requirements. Here’s a closer look at some key aspects of family health insurance plans:

Coverage Options

Family health insurance plans typically offer a variety of coverage options to cater to different family sizes and needs. These may include:

- Individual Coverage: Each family member can have their own individual plan, providing personalized benefits and coverage limits.

- Spouse Coverage: Plans often extend coverage to spouses or partners, ensuring they receive the same level of protection as the primary policyholder.

- Dependent Coverage: Children and other dependents can be added to the plan, with coverage tailored to their age and specific healthcare needs.

- Family Coverage: This option provides a comprehensive plan that covers all family members under a single policy, offering convenience and cost-effectiveness.

Premium Costs and Contributions

The cost of family health insurance plans can vary based on several factors, including the level of coverage chosen, the age and health status of family members, and the geographical location. Generally, family plans offer discounted rates compared to individual plans, making them a more affordable option for families. Additionally, some plans allow for flexible payment options, such as monthly or annual premiums, to suit different financial situations.

Benefit Packages

Family health insurance plans offer a wide range of benefit packages to choose from. These packages typically include:

- Inpatient and Outpatient Care: Coverage for hospitalizations, surgeries, and outpatient treatments, including specialist consultations and diagnostic tests.

- Preventive Care: Regular check-ups, vaccinations, and screenings to promote early detection and prevent future health issues.

- Prescription Drugs: Coverage for a wide range of prescription medications, often with preferred pharmacy networks to ensure cost-effective access.

- Maternity and Newborn Care: Specialized coverage for prenatal care, childbirth, and postnatal care, ensuring a healthy start for the newest family member.

- Dental and Vision: Optional add-ons for dental and vision coverage, providing regular check-ups, cleanings, and corrective procedures.

Network Providers and Choice of Healthcare Facilities

Family health insurance plans often have a network of preferred healthcare providers and facilities, ensuring that policyholders receive quality care at a discounted rate. These networks can include hospitals, clinics, laboratories, and individual healthcare professionals. Policyholders have the flexibility to choose their preferred healthcare providers within the network, allowing for personalized care and continuity of treatment.

| Family Plan | Premium Cost | In-Network Coverage |

|---|---|---|

| Basic Family Plan | $350/month | 80% of medical expenses covered |

| Standard Family Plan | $420/month | 90% of medical expenses covered |

| Comprehensive Family Plan | $550/month | 100% of medical expenses covered |

Tailoring Your Family Health Insurance Plan

One of the significant advantages of family health insurance plans is the ability to customize coverage to meet your family’s unique circumstances. Here are some considerations when tailoring your family plan:

Assessing Family Health Needs

Before selecting a family health insurance plan, take the time to assess the specific healthcare needs of each family member. Consider factors such as pre-existing conditions, age-related health concerns, and any specialized treatments or medications required. By understanding these needs, you can choose a plan that provides adequate coverage without unnecessary expenses.

Choosing the Right Level of Coverage

Family health insurance plans come in various levels of coverage, ranging from basic plans with limited benefits to comprehensive plans offering extensive coverage. Consider the balance between the cost of the plan and the level of coverage it provides. While comprehensive plans may be more expensive, they offer greater peace of mind and financial protection in the event of unexpected medical emergencies.

Utilizing Additional Benefits and Services

Family health insurance plans often include a range of additional benefits and services beyond basic medical coverage. These can include wellness programs, telemedicine services, and access to health and wellness apps. Taking advantage of these additional benefits can further enhance your family’s overall health and well-being, promoting a healthier lifestyle.

The Future of Family Health Insurance

As healthcare continues to evolve, so do the options and innovations in family health insurance plans. Here’s a glimpse into the future of family health insurance:

Digital Health and Telemedicine

The integration of digital health technologies and telemedicine is revolutionizing the way families access healthcare. Family health insurance plans are increasingly incorporating telemedicine services, allowing policyholders to consult with healthcare professionals remotely. This not only enhances convenience but also expands access to specialized care, especially in rural or remote areas.

Personalized Medicine and Genetic Testing

Advancements in genetic testing and personalized medicine are shaping the future of healthcare. Family health insurance plans may begin to offer coverage for genetic testing and counseling, enabling families to identify potential health risks and take proactive measures to prevent or manage them. This personalized approach to healthcare could lead to more effective and targeted treatment plans.

Focus on Preventive Care and Wellness

The emphasis on preventive care and wellness is gaining momentum in the healthcare industry. Family health insurance plans are likely to place a greater focus on promoting healthy lifestyles and preventing illnesses before they occur. This may include expanded coverage for wellness programs, nutrition counseling, and mental health services, empowering families to take control of their health and well-being.

Frequently Asked Questions

Can I include my extended family members in a family health insurance plan?

+

While traditional family health insurance plans typically cover immediate family members (spouses, children, and sometimes parents), some providers offer extended family coverage options. These may include grandparents, siblings, or other close relatives. It’s essential to review the specific plan details to understand the coverage limits for extended family members.

How do I choose the right family health insurance plan for my family’s needs?

+

Choosing the right family health insurance plan involves several considerations. Assess your family’s current and potential future healthcare needs, including any pre-existing conditions or specialized treatments. Evaluate the coverage options, premium costs, and network providers to find a plan that offers the right balance of benefits and affordability. Additionally, consider any additional services or perks that align with your family’s lifestyle and health goals.

Are there any tax benefits associated with family health insurance plans?

+

Yes, in many countries, there are tax incentives and deductions available for families with health insurance. These tax benefits can help offset the cost of premiums and make family health insurance more affordable. It’s advisable to consult with a tax professional or financial advisor to understand the specific tax implications and potential savings associated with your family health insurance plan.

What happens if a family member develops a pre-existing condition after enrolling in a family health insurance plan?

+

If a family member develops a pre-existing condition after enrolling in a family health insurance plan, the coverage for that condition may be subject to certain limitations or exclusions. However, most plans offer some level of protection for pre-existing conditions, especially if the condition is properly disclosed and managed. It’s crucial to review the plan’s policy regarding pre-existing conditions to understand the coverage options and any potential waiting periods.

Can I switch to a different family health insurance plan if my current plan doesn’t meet my family’s needs?

+

Yes, you have the option to switch to a different family health insurance plan if your current plan doesn’t align with your family’s evolving needs. Open enrollment periods or special enrollment events due to life changes (such as marriage, divorce, or the birth of a child) provide opportunities to explore alternative plans. However, it’s important to carefully review the terms and conditions of your current plan to understand any potential penalties or restrictions associated with switching providers.

Medical insurance family plans are a powerful tool to protect the health and well-being of your loved ones. By understanding the coverage options, tailoring the plan to your family’s needs, and staying informed about the latest advancements in healthcare, you can ensure that your family receives the care they deserve, both now and in the future.