Insurance And Florida

In the sunny state of Florida, the world of insurance is a complex and essential topic that impacts millions of residents and businesses. With its unique climate, natural disasters, and vibrant tourism industry, Florida presents a distinct set of insurance considerations. From homeowners facing hurricane risks to healthcare professionals navigating a unique healthcare system, understanding insurance in Florida is crucial. This comprehensive guide aims to shed light on the various aspects of insurance within this dynamic state, providing valuable insights for residents, business owners, and anyone interested in learning more about this critical aspect of life in Florida.

Understanding the Unique Insurance Landscape of Florida

Florida’s insurance market is shaped by a combination of factors, including its geographical location, a diverse population, and a dynamic economy. The state’s vulnerability to hurricanes and other natural disasters significantly influences insurance policies and premiums. Additionally, Florida’s unique healthcare system, with its focus on tourism and a large elderly population, presents distinct challenges and opportunities for healthcare insurance providers.

Let's delve deeper into the key aspects of insurance in Florida, exploring the specific challenges and solutions unique to this captivating state.

Homeowners Insurance: Navigating Florida’s Natural Disaster Risks

Homeowners in Florida face a unique set of challenges when it comes to insurance. The state’s susceptibility to hurricanes, tropical storms, and flooding events makes finding adequate coverage a priority. Here’s an overview of the key considerations for homeowners:

- Hurricane Coverage: Most standard homeowners insurance policies in Florida include coverage for wind damage, which is essential given the state's hurricane-prone climate. However, it's crucial to understand the specific terms and limits of this coverage, as it can vary significantly between policies.

- Flood Insurance: Flooding is a common occurrence in many parts of Florida, yet it's often not covered by standard homeowners policies. Residents should consider purchasing separate flood insurance, either through the National Flood Insurance Program (NFIP) or private insurers, to protect their homes and belongings.

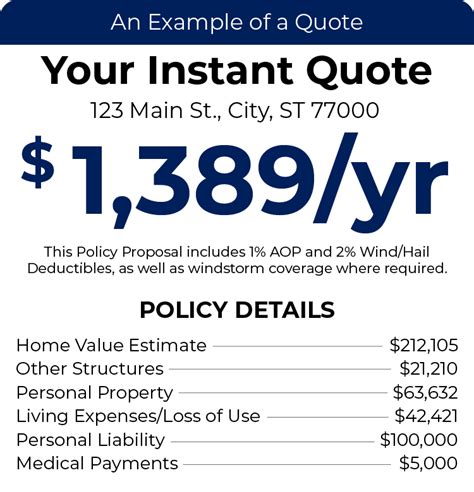

- Deductibles and Premiums: Insurance premiums in Florida can be higher than in other states due to the increased risk of natural disasters. Additionally, policies often come with higher deductibles, which can impact the financial preparedness of homeowners in the event of a claim.

- Windstorm Deductibles: Many Florida insurance policies have separate windstorm deductibles, which can be a percentage of the home's value or a set dollar amount. Understanding these deductibles is crucial, as they can significantly affect the out-of-pocket costs for homeowners after a hurricane or tropical storm.

- Policy Limits and Coverage: Reviewing policy limits and coverage options is essential to ensure that your home and belongings are adequately protected. This includes understanding coverage for personal belongings, additional living expenses, and potential liability risks.

| Key Statistic | Value |

|---|---|

| Number of Homeowners Policies in Florida | Approximately 8.2 million (as of 2021) |

| Average Homeowners Insurance Premium in Florida | $2,319 (one of the highest in the nation) |

| Average Flood Insurance Premium through NFIP | $700 per year |

Healthcare Insurance: Florida’s Distinct Healthcare Landscape

Florida’s healthcare system is unique, with a large population of retirees and a thriving tourism industry. This dynamic creates specific challenges and opportunities for healthcare insurance providers and consumers alike.

- Medicare and Medicaid: Florida has a high percentage of residents eligible for Medicare, the federal health insurance program for seniors and certain disabled individuals. Additionally, the state's Medicaid program plays a significant role in providing healthcare coverage to low-income residents. Understanding the interplay between these government programs and private insurance is essential for many Floridians.

- Health Insurance Options: For those not eligible for government-sponsored programs, Florida offers a range of private health insurance options. These plans vary widely in terms of coverage, deductibles, and premiums, making it crucial for residents to carefully evaluate their options.

- Healthcare Tourism: Florida's reputation as a healthcare destination attracts many international patients seeking specialized medical treatments. This unique aspect of the state's healthcare landscape presents opportunities for providers and challenges for insurance companies in terms of coverage and reimbursement.

- Telehealth Services: With the state's diverse population and geographic spread, telehealth services have become increasingly popular in Florida. These services offer convenient access to healthcare, particularly for residents in rural areas or those with mobility issues.

Auto Insurance: Driving Safely in Florida

Florida’s roads present a unique set of challenges for drivers, from the state’s busy highways to the potential for severe weather conditions. Auto insurance is mandatory in Florida, and understanding the specific requirements and coverage options is crucial.

- Minimum Liability Coverage: Florida law requires drivers to carry a minimum amount of liability insurance to cover bodily injury and property damage in the event of an accident. The minimum limits are $10,000 for property damage, $10,000 for personal injury protection (PIP), and $10,000 for bodily injury liability per person/$20,000 per accident.

- Optional Coverage: In addition to the minimum liability coverage, drivers can opt for additional coverage, such as collision, comprehensive, and uninsured/underinsured motorist coverage. These optional coverages provide protection for various scenarios, including accidents with uninsured drivers, theft, or damage caused by natural disasters.

- Personal Injury Protection (PIP): Florida's no-fault insurance system requires drivers to carry PIP coverage, which provides medical benefits and lost wage compensation up to the policy limits. This coverage applies regardless of who is at fault in an accident.

- DUI and SR-22 Insurance: Drivers with a DUI conviction in Florida are typically required to file an SR-22 form with the Department of Highway Safety and Motor Vehicles. This form proves that the driver has the minimum liability insurance coverage required by the state. SR-22 insurance often comes with higher premiums and more stringent conditions.

Business Insurance: Protecting Florida’s Vibrant Economy

Florida’s economy is diverse, with a mix of tourism, agriculture, technology, and healthcare industries. Each sector faces its own set of risks, making business insurance a critical component of any company’s operations in the state.

- General Liability Insurance: This coverage is essential for protecting businesses from a range of risks, including property damage, bodily injury, and personal and advertising injury. It's particularly important for businesses that interact with the public, such as retail stores or restaurants.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage is crucial for professionals such as doctors, lawyers, and accountants. It protects against claims of negligence, errors, or omissions in the provision of professional services.

- Workers' Compensation Insurance: Florida law requires most employers to carry workers' compensation insurance to cover medical expenses and lost wages for employees injured on the job. The specific requirements vary based on the number of employees and the nature of the business.

- Cyber Liability Insurance: With the increasing prevalence of cyber threats, businesses in Florida, especially those in the tech and healthcare sectors, should consider cyber liability insurance. This coverage protects against data breaches, hacking, and other cyber-related risks.

Conclusion: A Comprehensive Approach to Insurance in Florida

Navigating the insurance landscape in Florida requires a comprehensive understanding of the state’s unique challenges and opportunities. From homeowners facing hurricane risks to healthcare providers catering to a diverse population, insurance plays a critical role in protecting individuals and businesses alike. By staying informed and working with experienced professionals, Floridians can ensure they have the coverage they need to navigate the state’s dynamic environment.

FAQ

What are the key factors influencing insurance rates in Florida?

+Insurance rates in Florida are influenced by a variety of factors, including the state’s vulnerability to natural disasters like hurricanes and tropical storms. Additionally, the large elderly population and the unique healthcare system impact healthcare insurance rates. The cost of living and the state’s vibrant economy also play a role in determining insurance premiums.

How can I find the best homeowners insurance policy in Florida?

+To find the best homeowners insurance policy in Florida, it’s essential to compare policies from multiple insurers. Consider factors such as coverage limits, deductibles, and the specific risks you want to protect against, like hurricane or flood damage. Working with an experienced insurance agent who understands the Florida market can also be beneficial.

What are the options for healthcare insurance in Florida for those not eligible for Medicare or Medicaid?

+For Floridians not eligible for Medicare or Medicaid, there are several options for healthcare insurance. These include private health insurance plans offered by various insurers, as well as the healthcare plans available through the state’s healthcare marketplace. It’s important to carefully evaluate these options based on your specific healthcare needs and budget.

Are there any unique considerations for auto insurance in Florida due to the state’s climate and driving conditions?

+Yes, Florida’s climate and driving conditions present unique considerations for auto insurance. The state’s vulnerability to hurricanes and tropical storms means that comprehensive coverage for natural disasters is essential. Additionally, the high volume of traffic and the potential for severe weather conditions highlight the importance of adequate liability coverage.