Md Insurance

Welcome to this comprehensive guide on Maryland insurance, where we delve into the intricacies of the insurance landscape within the state of Maryland. From understanding the unique insurance requirements to exploring the best practices for securing adequate coverage, this article aims to provide valuable insights for residents and businesses alike.

Understanding Maryland Insurance Requirements

Maryland, like most states, has specific insurance regulations and requirements that residents and businesses must adhere to. These regulations are in place to ensure the financial protection and security of individuals and entities within the state. Let’s explore the key aspects of Maryland insurance requirements.

Mandatory Insurance Coverages

In Maryland, certain types of insurance are mandatory by law. The state requires all registered vehicles to carry minimum levels of liability insurance to protect against bodily injury and property damage claims arising from accidents. The current minimum coverage amounts are as follows:

- Bodily Injury Liability: 30,000 per person and 60,000 per accident

- Property Damage Liability: $15,000 per accident

These mandatory coverages provide a basic level of protection for drivers and ensure that they can meet their financial obligations in the event of an accident. It’s important to note that these minimums may not be sufficient for all drivers, especially those with significant assets to protect. Many experts recommend carrying higher liability limits to provide more comprehensive coverage.

Uninsured and Underinsured Motorist Coverage

Maryland also requires drivers to carry uninsured and underinsured motorist coverage, known as UM/UIM coverage. This coverage protects drivers in the event of an accident with an uninsured or underinsured driver. UM/UIM coverage ensures that policyholders can receive compensation for their injuries and damages, even if the at-fault driver lacks sufficient insurance.

Personal Injury Protection (PIP)

Maryland offers the option of purchasing Personal Injury Protection (PIP) coverage, which provides additional medical and income benefits for policyholders and their passengers in the event of an accident. PIP coverage can help cover medical expenses, lost wages, and other related costs, regardless of who is at fault in the accident. It’s an optional coverage, but it can provide valuable financial protection.

Other Insurance Considerations

Beyond the mandatory auto insurance requirements, Maryland residents and businesses should consider additional insurance coverages to protect their assets and livelihoods. This includes:

- Homeowners or Renters Insurance: Protects against property damage, theft, and liability claims for homeowners and renters.

- Business Insurance: Crucial for businesses to safeguard against various risks, including property damage, liability claims, and business interruption.

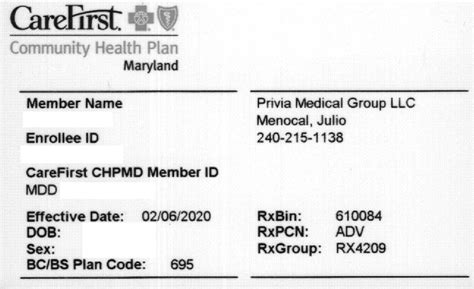

- Health Insurance: Provides coverage for medical expenses and is essential for maintaining overall well-being.

- Life Insurance: Offers financial protection for loved ones in the event of a policyholder’s death.

Securing the Best Insurance Coverage in Maryland

With a solid understanding of Maryland’s insurance requirements, the next step is to secure the best insurance coverage tailored to your needs. Here are some best practices to help you navigate the insurance landscape effectively.

Compare Multiple Insurance Providers

The insurance market in Maryland is competitive, with numerous providers offering a range of policies. Take the time to compare quotes and coverage options from multiple insurers. This allows you to find the best value for your insurance needs. Online comparison tools and insurance brokers can be valuable resources for gathering quotes and assessing different policies.

Understand Your Coverage Options

Insurance policies can be complex, with various coverage options and add-ons. Take the time to understand the different components of your policy, such as deductibles, coverage limits, and exclusions. Ensure that your policy aligns with your specific needs and provides adequate protection. Consult with insurance professionals who can guide you through the process and answer any questions you may have.

Consider Additional Coverages

Beyond the mandatory insurance requirements, consider your unique circumstances and risks. For example, if you have valuable possessions or collections, you may want to explore specialty insurance policies to protect them. Similarly, if you own a business, assess the specific risks associated with your industry and consider specialized business insurance coverage.

Review Your Policy Regularly

Life circumstances and insurance needs can change over time. It’s important to review your insurance policies annually or whenever significant life events occur. This ensures that your coverage remains up-to-date and aligned with your current needs. Regular policy reviews can help identify gaps in coverage and allow you to make necessary adjustments.

Take Advantage of Discounts

Insurance providers often offer discounts to policyholders who meet certain criteria. These discounts can help reduce your insurance premiums. Common discounts include safe driver discounts, multi-policy discounts (bundling auto and home insurance), and loyalty discounts for long-term customers. Be sure to inquire about available discounts when obtaining quotes.

Performance Analysis and Customer Satisfaction

When choosing an insurance provider, it’s essential to consider their performance and reputation. Here’s a brief analysis of key performance indicators and customer satisfaction metrics for insurance companies in Maryland.

| Insurance Provider | Financial Strength Rating | Customer Satisfaction Index |

|---|---|---|

| Allstate | A+ (Superior) | 4.4/5 |

| State Farm | A++ (Superior) | 4.2/5 |

| Geico | A++ (Superior) | 4.1/5 |

| Progressive | A (Excellent) | 4.0/5 |

| Erie Insurance | A+ (Superior) | 4.3/5 |

These ratings and indices provide a snapshot of the financial stability and customer satisfaction levels associated with leading insurance providers in Maryland. When selecting an insurance company, it's beneficial to research and compare these metrics to ensure you choose a reputable and reliable provider.

Future Implications and Trends

The insurance industry in Maryland, like many other states, is evolving to meet the changing needs and risks of its residents and businesses. Here are some key trends and future implications to consider:

Digital Transformation

The insurance industry is embracing digital technologies to enhance customer experiences and streamline processes. Online quoting and policy management platforms are becoming increasingly popular, allowing for faster and more convenient interactions between insurers and policyholders. This digital transformation is expected to continue, with insurers investing in innovative technologies to stay competitive.

Climate Change and Natural Disasters

Maryland, like many coastal states, is vulnerable to the impacts of climate change and natural disasters. As extreme weather events become more frequent, insurers are adjusting their risk assessment models and coverage options to account for these changing conditions. This may lead to shifts in insurance rates and the availability of certain types of coverage, particularly for properties in high-risk areas.

Cybersecurity and Data Privacy

With the increasing reliance on digital technologies, cybersecurity and data privacy have become critical concerns for insurers and policyholders alike. Insurance companies are investing in robust cybersecurity measures to protect sensitive customer information. Additionally, new regulations and standards, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are shaping how insurers handle and protect customer data.

Telematics and Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining traction in the auto insurance market. This innovative approach to insurance pricing uses real-time data from vehicles to assess driving behavior and risk. Insurers offering usage-based insurance may provide discounts to safe drivers and adjust premiums based on actual driving habits. This trend is expected to continue, offering policyholders more personalized and potentially cost-effective insurance options.

Health Insurance Innovations

The health insurance landscape is constantly evolving, with insurers introducing new products and services to meet the changing healthcare needs of Maryland residents. This includes the expansion of telemedicine services, which allow for remote consultations and treatment, as well as the integration of wearable technology and health tracking apps to encourage healthier lifestyles and provide personalized insurance plans.

FAQ

What are the minimum liability insurance requirements in Maryland for auto insurance?

+

In Maryland, the minimum liability insurance requirements for auto insurance are 30,000 for bodily injury per person, 60,000 for bodily injury per accident, and $15,000 for property damage per accident.

Are there any discounts available for insurance policies in Maryland?

+

Yes, insurance providers in Maryland often offer discounts to policyholders. Common discounts include safe driver discounts, multi-policy discounts (bundling auto and home insurance), and loyalty discounts for long-term customers.

How often should I review my insurance policies in Maryland?

+

It is recommended to review your insurance policies annually or whenever significant life events occur. This ensures that your coverage remains up-to-date and aligned with your changing needs.

What are some key performance indicators for insurance companies in Maryland?

+

Key performance indicators for insurance companies in Maryland include financial strength ratings, such as A+, A++, and A (indicating superior and excellent ratings), and customer satisfaction indices, which provide an overview of customer experiences with different insurers.

Are there any emerging trends in the Maryland insurance market?

+

Yes, the Maryland insurance market is experiencing trends such as digital transformation, with insurers investing in online platforms for quoting and policy management. Additionally, there is a focus on climate change and natural disasters, leading to adjustments in risk assessment and coverage options. Cybersecurity and data privacy are also critical considerations, along with the rise of usage-based insurance and health insurance innovations.