Low Cost Insurance California

When it comes to finding low-cost insurance in California, it's important to understand the unique market dynamics and regulations that shape the insurance landscape in the Golden State. California's diverse population, extensive road networks, and specific legal requirements create a complex environment for insurance providers and policyholders alike. This article aims to delve into the intricacies of securing affordable insurance coverage in California, offering practical insights and expert advice to navigate the state's insurance market effectively.

Understanding the California Insurance Market

California is renowned for its stringent insurance regulations, designed to protect consumers and promote fair practices. The California Department of Insurance (CDI) oversees the insurance industry, ensuring compliance with state laws and addressing consumer concerns. As a result, insurance providers in California must adhere to strict guidelines, which can influence the cost and availability of insurance policies.

One notable feature of the California insurance market is the requirement for auto insurance. California is one of a few states that mandate drivers to carry liability insurance. This means that all registered vehicles must have at least the minimum level of liability coverage to operate legally on state roads. While this requirement adds a layer of complexity for drivers seeking affordable insurance, it also provides a foundation for comparison and ensures a certain level of financial protection for all motorists.

In addition to auto insurance, California residents also have access to a wide range of other insurance products, including homeowners', renters', health, and life insurance. The state's diverse geography, from coastal cities to mountainous regions, influences the types of insurance policies sought by residents. For instance, homeowners in areas prone to natural disasters like earthquakes or wildfires may require specialized coverage, which can impact the overall cost of their insurance.

Factors Influencing Insurance Costs in California

Understanding the factors that impact insurance costs is crucial for Californians seeking affordable coverage. Several key elements contribute to the overall price of insurance policies in the state, and being aware of these factors can help consumers make informed decisions and potentially reduce their insurance expenses.

Demographics and Location

California’s vast size and diverse population mean that insurance costs can vary significantly depending on where you live. Urban areas, for instance, may have higher insurance rates due to factors like increased traffic congestion and higher crime rates. On the other hand, rural areas might offer lower rates but may have limited access to certain types of insurance coverage.

Your personal demographics, such as age, gender, and marital status, also play a role in determining insurance costs. Younger drivers, for example, are often considered higher risk and may face higher insurance premiums. Similarly, your driving history and claims record can significantly impact your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher costs.

Coverage and Deductibles

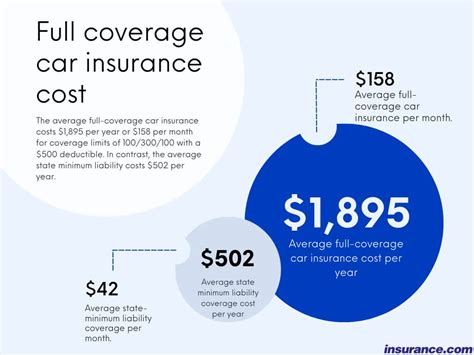

The type and extent of coverage you choose will directly affect your insurance costs. Comprehensive policies that offer a wide range of coverage, such as collision, liability, and comprehensive coverage for auto insurance, will typically be more expensive than basic liability-only policies. However, it’s essential to strike a balance between coverage and cost to ensure you have adequate protection without paying for coverage you may not need.

Deductibles are another critical factor in determining insurance costs. A higher deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower premiums. Conversely, a lower deductible will generally result in higher premiums. It's important to choose a deductible amount that aligns with your financial situation and comfort level, ensuring you have the necessary coverage without straining your finances.

Discounts and Bundling

Insurance providers often offer discounts to encourage certain behaviors or to reward loyal customers. Common discounts include safe driver discounts for maintaining a clean driving record, good student discounts for young drivers with high grades, and multi-policy discounts when you bundle multiple insurance types with the same provider. Taking advantage of these discounts can significantly reduce your insurance costs over time.

Additionally, bundling your insurance policies can lead to substantial savings. Many insurance companies offer discounts when you purchase multiple policies, such as bundling auto and home insurance or life and health insurance. This not only simplifies your insurance management but also provides a more comprehensive financial safety net.

Tips for Finding Low-Cost Insurance in California

Navigating the California insurance market to find affordable coverage requires a strategic approach. Here are some expert tips to help you secure low-cost insurance in the Golden State:

Shop Around and Compare

The California insurance market is highly competitive, with numerous providers offering a wide range of policies. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal. Online insurance marketplaces and comparison websites can be valuable tools for quickly obtaining multiple quotes and assessing the market.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional perks or exclusions. Ensure that you're comparing apples to apples by evaluating policies with similar coverage levels and terms. This thorough comparison process will help you identify the insurer that offers the best combination of coverage and cost for your specific needs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that tailors insurance premiums to your actual driving behavior. With usage-based insurance, your insurance provider tracks your driving habits, such as miles driven, time of day, and driving behavior, to determine your premium. This can be an excellent option for safe, low-mileage drivers who may see significant savings.

While usage-based insurance may not be suitable for everyone, it's worth considering if you're confident in your safe driving habits and don't rack up many miles on the road. By demonstrating responsible driving behavior, you can potentially unlock significant savings on your auto insurance premiums.

Explore Government-Sponsored Programs

California offers several government-sponsored programs aimed at making insurance more accessible and affordable for certain segments of the population. For example, the California Low Cost Automobile Insurance Program (CLCA) provides qualified low-income drivers with comprehensive auto insurance coverage at significantly reduced rates. This program can be a lifesaver for those who may struggle to afford standard insurance rates.

Additionally, the California Earthquake Authority (CEA) provides earthquake insurance coverage for California homeowners at competitive rates. Given the state's seismic activity, earthquake insurance is a crucial consideration for many residents. Exploring these government-sponsored programs can help you secure essential coverage at more affordable rates.

Optimize Your Policy Regularly

Insurance costs can fluctuate over time due to various factors, including changes in your personal circumstances, market conditions, and insurer policies. Regularly reviewing and optimizing your insurance policy can help you stay on top of these changes and ensure you’re always getting the best value for your money.

Consider reviewing your insurance policy annually or whenever you experience significant life changes, such as moving to a new location, purchasing a new vehicle, or getting married. These events can impact your insurance needs and may provide opportunities for cost savings or coverage upgrades. By staying proactive and keeping your policy optimized, you can maintain a balance between comprehensive coverage and affordable premiums.

Case Study: Successful Strategies for Low-Cost Insurance

To illustrate the practical application of these tips, let’s explore a case study of a California resident, Sarah, who successfully navigated the insurance market to secure affordable coverage for her family.

Sarah, a young professional living in Los Angeles, was determined to find low-cost insurance for her family without compromising on coverage. She started by shopping around and comparing quotes from multiple insurers, both online and through local brokers. By thoroughly evaluating the market, she was able to identify an insurer that offered comprehensive auto and home insurance coverage at a competitive rate.

Recognizing her safe driving habits and low annual mileage, Sarah also explored usage-based insurance options. After installing a telematics device in her vehicle, she demonstrated her responsible driving behavior and unlocked significant savings on her auto insurance premiums. This strategy not only rewarded her safe driving but also provided an incentive to maintain her safe driving habits.

Furthermore, Sarah took advantage of bundling by combining her auto and home insurance policies with the same insurer. By doing so, she qualified for a substantial multi-policy discount, further reducing her overall insurance costs. Additionally, she explored government-sponsored programs and discovered that her income qualified her family for the CLCA program, providing them with comprehensive auto insurance coverage at a significantly reduced rate.

By implementing these strategies, Sarah successfully secured low-cost insurance for her family, demonstrating the effectiveness of a proactive and well-informed approach to insurance shopping. Her experience highlights the importance of understanding the California insurance market, leveraging discounts and bundling options, and exploring government-sponsored programs to achieve affordable and comprehensive coverage.

Future Outlook and Industry Trends

The insurance industry in California is continuously evolving, driven by technological advancements, changing consumer preferences, and regulatory updates. Staying informed about these trends can help consumers anticipate shifts in the market and make more informed decisions about their insurance coverage.

One notable trend is the increasing adoption of digital insurance platforms. Insurance providers are investing in online portals and mobile apps to enhance the customer experience and streamline the insurance shopping and claims process. These digital platforms often offer real-time quotes, policy management tools, and simplified claims submission, making it more convenient for consumers to access and manage their insurance policies.

Another emerging trend is the rise of personalized insurance. Insurance providers are leveraging data analytics and artificial intelligence to offer more tailored insurance products. By analyzing individual risk factors and behavior patterns, insurers can provide customized coverage options that better align with consumers' specific needs. This shift towards personalized insurance has the potential to unlock new opportunities for cost savings and improved coverage.

Additionally, the focus on sustainability and environmental responsibility is gaining traction in the insurance industry. Many insurers are developing green initiatives and offering incentives for policyholders who adopt sustainable practices. For example, some insurers provide discounts for electric vehicle owners or offer incentives for homeowners who install energy-efficient upgrades. As sustainability becomes an increasingly important consideration for consumers, insurance providers are adapting their offerings to meet these evolving demands.

Conclusion

Securing low-cost insurance in California requires a combination of knowledge, strategy, and a willingness to explore various options. By understanding the unique dynamics of the California insurance market, leveraging discounts and bundling opportunities, and staying informed about industry trends, Californians can navigate the insurance landscape with confidence and find affordable coverage that meets their needs.

Whether you're a seasoned insurance shopper or new to the California market, the insights and strategies outlined in this article can serve as a valuable guide. By implementing these expert tips and staying proactive in your insurance management, you can achieve the balance between comprehensive coverage and affordable premiums, ensuring your financial security and peace of mind.

FAQ

What is the average cost of auto insurance in California?

+

The average cost of auto insurance in California varies depending on factors such as location, driving history, and coverage levels. According to recent data, the average annual premium for auto insurance in the state is approximately 1,500. However, this can range significantly, with some drivers paying as little as 1,000 or as much as $3,000 or more.

Are there any specific laws or regulations I should be aware of when purchasing insurance in California?

+

Yes, California has several unique laws and regulations that impact the insurance market. One notable example is the requirement for drivers to carry proof of financial responsibility, typically in the form of liability insurance. Additionally, California has specific laws regarding uninsured motorist coverage, personal injury protection (PIP), and other mandatory coverage types.

How can I reduce my insurance costs if I have a poor driving record or multiple claims?

+

Improving your driving record and reducing claims can help lower your insurance costs over time. Consider taking defensive driving courses or completing traffic school to improve your driving skills and reduce points on your record. Additionally, maintaining a clean claims history by avoiding accidents and minimizing claims can signal to insurers that you are a lower-risk driver, potentially leading to lower premiums.

Are there any resources available to help low-income Californians access affordable insurance coverage?

+

Yes, California offers several resources and programs to assist low-income residents in accessing affordable insurance coverage. The California Low Cost Automobile Insurance Program (CLCA) is a notable example, providing qualified low-income drivers with comprehensive auto insurance coverage at significantly reduced rates. Additionally, the Covered California program offers subsidized health insurance plans for eligible individuals and families.