Low Car Insurance Companies

Finding affordable car insurance is a priority for many vehicle owners, as it can significantly impact their monthly expenses. While the cost of car insurance varies greatly depending on factors like location, driving history, and vehicle type, there are certain companies that have gained a reputation for offering competitive rates. This article aims to explore these low car insurance companies, providing an in-depth analysis of their offerings, coverage options, and the factors that contribute to their affordability.

Understanding the Low Car Insurance Market

The car insurance market is highly competitive, with numerous providers vying for customers. However, not all insurance companies are created equal, and some have managed to stand out by offering more affordable rates without compromising on coverage quality. These low car insurance companies have found ways to optimize their business models, streamline processes, and pass on the savings to their customers.

Key Factors Affecting Insurance Rates

Before delving into specific companies, it’s essential to understand the factors that influence car insurance rates. These include:

- Location: Insurance rates can vary significantly between different states and even within cities. This is primarily due to variations in traffic density, accident rates, and local laws.

- Driver Profile: Your age, gender, driving record, and credit score all play a role in determining insurance rates. Younger drivers and those with a history of accidents or traffic violations tend to pay higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Sports cars and luxury vehicles often have higher insurance premiums due to their higher repair costs and increased likelihood of theft.

- Coverage Selection: The level of coverage you choose, including liability, collision, comprehensive, and additional options like rental car reimbursement, also affects your overall insurance cost.

Exploring Low Car Insurance Companies

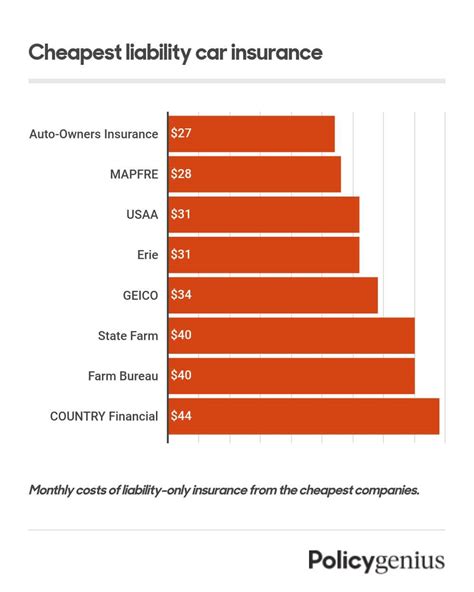

Now, let’s take a closer look at some of the car insurance companies known for their competitive rates and comprehensive coverage options.

State Farm

State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products, including auto, home, life, and health insurance. They are known for their extensive network of local agents, providing personalized service and tailored insurance plans.

Key Features:

- Competitive Rates: State Farm is often considered one of the more affordable options, especially for those with a clean driving record. They offer discounts for multiple policies, safe driving, and good student status.

- Comprehensive Coverage: State Farm provides standard liability coverage, as well as optional coverage for collision, comprehensive, rental car, and roadside assistance.

- Digital Services: State Farm has embraced digital technology, offering a mobile app for policy management, claims tracking, and roadside assistance.

Geico

Geico, or the Government Employees Insurance Company, has built its reputation on offering affordable insurance to government employees and their families. However, they have since expanded their customer base to include the general public.

Key Features:

- Low Rates: Geico is renowned for its competitive rates, often providing some of the lowest premiums in the market. They offer discounts for safe driving, military service, and multiple policies.

- Digital Convenience: Geico has a strong online presence, allowing customers to manage their policies, file claims, and access roadside assistance through their website and mobile app.

- Personalized Quotes: Geico provides customized quotes based on individual needs, ensuring customers only pay for the coverage they require.

Progressive

Progressive is a well-known insurance provider that has revolutionized the industry with its innovative approaches to insurance. They offer a wide range of insurance products and are known for their customer-centric business model.

Key Features:

- Name Your Price Tool: Progressive’s unique feature allows customers to set their desired insurance price and receive quotes for coverage options that fit their budget.

- Discounts: Progressive offers a variety of discounts, including multi-policy, safe driver, and snapshot discounts, which reward safe driving habits.

- Digital Innovation: Progressive has invested heavily in digital technology, providing an intuitive mobile app and online platform for policy management and claims processing.

Esurance

Esurance is an online insurance company that has disrupted the traditional insurance model by offering a fully digital experience. They are known for their efficient processes and competitive rates.

Key Features:

- Online Convenience: Esurance operates entirely online, allowing customers to get quotes, purchase policies, and manage their insurance from the comfort of their homes.

- Affordable Rates: Esurance is often one of the most affordable options, especially for tech-savvy individuals who prefer a digital insurance experience.

- Personalized Coverage: Esurance offers customized coverage options, allowing customers to choose the level of protection that suits their needs and budget.

USAA

USAA, or the United Services Automobile Association, is a unique insurance provider that caters specifically to military members, veterans, and their families. They have built a strong reputation for excellent customer service and competitive rates.

Key Features:

- Military Focus: USAA offers insurance products tailored to the needs of military personnel, including discounts for safe driving and military deployment.

- Comprehensive Coverage: USAA provides standard auto insurance coverage, as well as additional options like rental car coverage, roadside assistance, and gap insurance.

- Excellent Customer Service: USAA is renowned for its exceptional customer service, with a dedicated team of military-experienced agents.

Factors to Consider When Choosing Low Car Insurance Companies

While low rates are an attractive feature, there are other crucial factors to consider when selecting a car insurance provider. Here are some key considerations:

- Coverage Options: Ensure the company offers the coverage you need, whether it’s basic liability or more comprehensive protection.

- Discounts: Look for insurance providers that offer discounts based on your specific circumstances, such as safe driving, good student status, or multiple policies.

- Claims Process: Research the company’s claims handling process to ensure they provide efficient and fair resolution in the event of an accident.

- Customer Service: Excellent customer service is invaluable. Look for companies with responsive agents and easy-to-use digital platforms.

- Financial Stability: Check the company’s financial rating to ensure they are financially stable and capable of paying claims.

The Future of Low Car Insurance

The car insurance industry is continuously evolving, and low car insurance companies are adapting to meet the changing needs of customers. Here are some trends and predictions for the future:

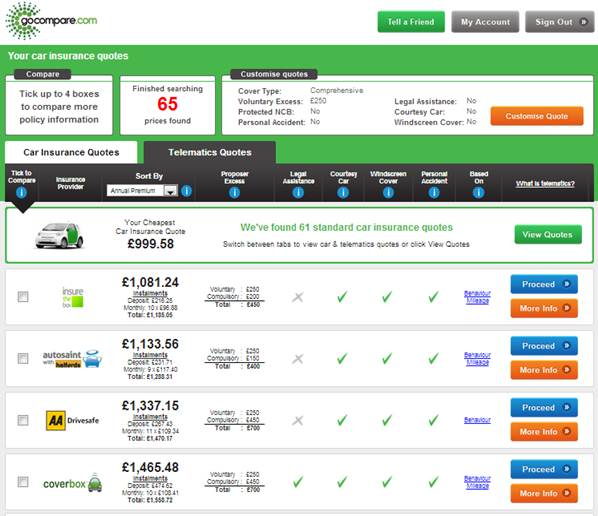

- Telematics and Usage-Based Insurance: With the advancement of technology, insurance companies are increasingly using telematics to track driving behavior and offer personalized insurance rates based on actual usage.

- Digital Transformation: The shift towards digital insurance is expected to continue, with more companies embracing online platforms and mobile apps for a seamless customer experience.

- Personalized Insurance: Insurance providers are likely to offer even more tailored coverage options, allowing customers to customize their policies based on their specific needs and preferences.

- Focus on Customer Experience: Low car insurance companies will continue to prioritize customer satisfaction, offering efficient claims processes and responsive customer service.

FAQ

How can I get the best car insurance rates?

+To get the best rates, compare quotes from multiple insurance providers, consider bundling policies, and take advantage of discounts for safe driving, good student status, and multiple policies.

What are some common discounts offered by low car insurance companies?

+Common discounts include safe driver discounts, military discounts, good student discounts, and multi-policy discounts. Some companies also offer discounts for specific occupations or affiliations.

How can I ensure my car insurance provider is financially stable?

+Check the company’s financial rating with reputable rating agencies like AM Best or Standard & Poor’s. A strong financial rating indicates the company’s ability to pay claims.