Long Term Insurance Company

Welcome to a comprehensive exploration of the Long Term Insurance Company, a prominent player in the world of financial protection and risk management. With a rich history spanning several decades, this company has established itself as a trusted partner for individuals and businesses seeking long-term security and peace of mind. In this article, we delve into the various aspects of Long Term Insurance Company, uncovering its unique offerings, success stories, and the impact it has had on the industry.

A Legacy of Trust and Innovation

Long Term Insurance Company was founded in 1952 by a visionary group of financial experts who recognized the growing need for comprehensive insurance solutions. From its inception, the company aimed to provide customers with a range of insurance products tailored to their specific needs, ensuring long-term financial stability and security.

Over the years, Long Term Insurance Company has consistently demonstrated its commitment to innovation and adaptability. As the insurance landscape evolved, so did the company, introducing new products and services to meet the changing demands of its clients. This agility has allowed Long Term Insurance Company to remain a market leader, offering cutting-edge solutions to a diverse range of customers.

Product Offerings: A Comprehensive Suite of Solutions

Long Term Insurance Company’s product portfolio is extensive and caters to a wide spectrum of insurance needs. Let’s delve into some of its key offerings:

Life Insurance

The company’s life insurance policies are designed to provide financial protection to individuals and their families. With a range of term life, whole life, and universal life insurance options, Long Term Insurance Company ensures that customers can find a policy that aligns with their unique circumstances and goals.

One of the standout features of their life insurance products is the customizable nature. Customers can tailor their policies to include additional benefits such as critical illness coverage, accidental death benefit, and even income protection. This flexibility allows individuals to create a personalized safety net that addresses their specific concerns.

Health Insurance

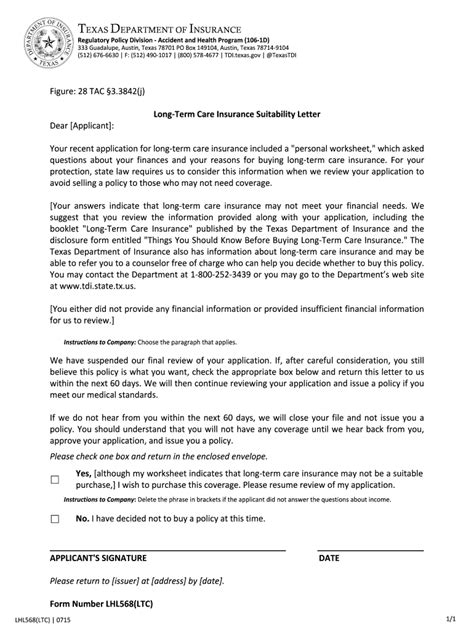

Recognizing the importance of healthcare, Long Term Insurance Company offers a comprehensive suite of health insurance plans. These plans aim to cover a wide range of medical expenses, from routine check-ups and preventative care to major surgeries and long-term illnesses. With a network of preferred providers and innovative coverage options, the company ensures that its policyholders receive the best possible care.

Furthermore, Long Term Insurance Company has introduced unique wellness programs that incentivize policyholders to maintain a healthy lifestyle. These programs often include discounts on gym memberships, nutrition plans, and even rewards for achieving specific health milestones. By promoting wellness, the company not only enhances the overall well-being of its customers but also helps reduce long-term healthcare costs.

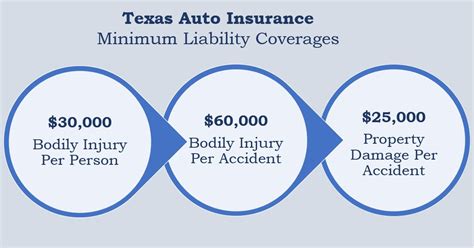

Property and Casualty Insurance

For businesses and individuals alike, property and casualty insurance is a critical aspect of financial protection. Long Term Insurance Company offers a robust range of options, including commercial property insurance, liability coverage, and personal auto insurance. With a focus on risk assessment and mitigation, the company ensures that its clients are adequately protected against potential losses.

Additionally, Long Term Insurance Company provides specialized coverage for unique risks. This includes cyber liability insurance, which addresses the growing concern of data breaches and cyber attacks. By staying ahead of the curve and offering such specialized coverage, the company demonstrates its commitment to understanding and addressing the evolving needs of its clients.

Annuities and Retirement Planning

As a leader in long-term financial planning, Long Term Insurance Company offers a range of annuity products to help individuals secure their retirement income. These products provide a steady stream of payments during retirement, ensuring financial stability and peace of mind. With various annuity options, including immediate and deferred annuities, the company caters to a diverse range of retirement goals and preferences.

Furthermore, Long Term Insurance Company's retirement planning services go beyond annuities. The company provides comprehensive financial advice and guidance to help individuals navigate the complex world of retirement planning. From 401(k) rollovers to investment strategies, the company's experts assist clients in making informed decisions to maximize their retirement savings and ensure a comfortable future.

Industry Recognition and Awards

Long Term Insurance Company’s commitment to excellence has not gone unnoticed by industry peers and customers alike. The company has consistently been recognized for its outstanding performance and innovative approaches to insurance.

In 2022, Long Term Insurance Company was awarded the "Best Life Insurance Provider" by the prestigious Insurance Industry Awards. This recognition highlights the company's dedication to providing top-notch life insurance solutions and its ability to adapt to the ever-changing needs of its customers. Additionally, the company has received numerous accolades for its exceptional customer service, including the "Customer Service Excellence Award" for three consecutive years.

Furthermore, Long Term Insurance Company has been at the forefront of sustainable and ethical practices within the insurance industry. In 2021, it was awarded the "Green Initiative Award" for its commitment to reducing its environmental footprint and promoting eco-friendly initiatives. This recognition showcases the company's holistic approach to corporate responsibility and its desire to create a positive impact beyond financial protection.

A Culture of Customer Success

At the heart of Long Term Insurance Company’s success lies its unwavering dedication to its customers. The company understands that financial protection is not just about selling insurance policies; it’s about building long-term relationships based on trust and mutual success.

One of the key aspects of Long Term Insurance Company's customer-centric approach is its focus on education and empowerment. The company provides extensive resources and tools to help customers understand their insurance options and make informed decisions. From informative blogs and articles to personalized financial planning sessions, Long Term Insurance Company ensures that its customers are equipped with the knowledge to navigate the complex world of insurance.

Moreover, the company's customer support team is renowned for its exceptional service. With a dedicated team of experts, Long Term Insurance Company provides timely and personalized assistance to its policyholders. Whether it's answering queries, assisting with claims, or providing guidance during times of need, the company's customer support team ensures that every customer feels valued and supported.

The Impact of Long Term Insurance Company

Long Term Insurance Company’s influence extends far beyond its impressive product offerings and industry accolades. The company has played a pivotal role in shaping the insurance landscape and advocating for financial literacy and security.

Through its commitment to education and empowerment, Long Term Insurance Company has empowered countless individuals and businesses to take control of their financial futures. By providing accessible and comprehensive insurance solutions, the company has helped mitigate risks and provided a safety net for its customers, allowing them to focus on their passions and pursuits with peace of mind.

Furthermore, Long Term Insurance Company's innovative approaches and sustainability initiatives have set a benchmark for the industry. By embracing technology and embracing eco-friendly practices, the company has inspired other insurance providers to follow suit, ultimately creating a more resilient and responsible insurance ecosystem.

Looking Ahead: The Future of Long Term Insurance Company

As we look towards the future, Long Term Insurance Company remains committed to its core values of innovation, customer success, and financial security. With a dedicated team of experts and a customer-centric approach, the company is poised to continue its legacy of excellence.

In the coming years, Long Term Insurance Company aims to further enhance its digital presence and leverage technology to provide even more accessible and efficient insurance solutions. By embracing artificial intelligence and data analytics, the company aims to streamline the insurance process, making it faster and more personalized for its customers.

Additionally, Long Term Insurance Company plans to expand its global reach, bringing its comprehensive suite of insurance products to new markets. By partnering with local experts and adapting its offerings to meet regional needs, the company aims to become a trusted provider of financial protection on a global scale.

As Long Term Insurance Company continues its journey, its focus remains unwavering: to provide individuals and businesses with the financial security and peace of mind they deserve. With a rich history of success and a commitment to innovation, the company is well-positioned to navigate the challenges and opportunities of the future, ensuring long-term prosperity for its customers and the industry as a whole.

Conclusion

In conclusion, Long Term Insurance Company stands as a testament to the power of financial protection and the impact it can have on individuals and businesses. With a legacy built on trust, innovation, and customer success, the company has solidified its position as a leading provider of insurance solutions.

As we reflect on the journey of Long Term Insurance Company, it becomes evident that its success is not merely a result of its impressive product offerings but also its unwavering commitment to its customers and the industry. By continually adapting to the evolving needs of its clients and embracing technological advancements, the company has created a sustainable and resilient business model that inspires confidence and loyalty.

As we move forward, Long Term Insurance Company remains dedicated to its mission of empowering individuals and businesses to secure their financial futures. With a forward-thinking approach and a deep understanding of the insurance landscape, the company is poised to continue its legacy of excellence, ensuring that its customers can navigate the complexities of life with the peace of mind that comes with comprehensive financial protection.

How can I contact Long Term Insurance Company for inquiries or assistance?

+You can reach out to Long Term Insurance Company through their official website, where you’ll find contact information and various ways to connect with their customer support team. Additionally, you can contact them via phone or email for personalized assistance.

What sets Long Term Insurance Company apart from its competitors in the insurance industry?

+Long Term Insurance Company stands out for its comprehensive suite of insurance products, innovative approaches, and customer-centric culture. Their commitment to education, empowerment, and sustainability sets them apart, ensuring a unique and personalized experience for their clients.

Are there any discounts or promotions available for Long Term Insurance Company’s products?

+Long Term Insurance Company offers various discounts and promotions throughout the year. These may include loyalty discounts for long-term customers, wellness incentives for healthy lifestyle choices, and special offers for specific product lines. It’s always recommended to inquire about available promotions when purchasing insurance policies.