Long Care Insurance Cost

Long-term care insurance is an essential financial tool that provides individuals and their families with peace of mind, ensuring comprehensive coverage for the costs associated with extended care needs. As the global population ages, the demand for long-term care services is on the rise, making it crucial to understand the costs and benefits of such insurance policies.

Understanding Long-Term Care Insurance Costs

The cost of long-term care insurance is influenced by a multitude of factors, each playing a significant role in determining the premium amount. These factors include the policyholder’s age, health status, location, and the specific benefits and coverage options chosen. Understanding these variables is key to making informed decisions about long-term care insurance.

Age is a critical factor in long-term care insurance costs. Generally, premiums tend to increase with age, as the likelihood of requiring long-term care services rises. However, it is advantageous to purchase a policy at a younger age when health is often better, as this can lead to more affordable premiums over the long term. For instance, a 45-year-old in good health might pay significantly less for long-term care insurance compared to a 65-year-old with pre-existing health conditions.

Health status is another vital consideration. Insurers assess an individual's health through medical underwriting, evaluating factors such as existing medical conditions, lifestyle habits, and family medical history. Those with a clean bill of health may qualify for preferred rates, while those with pre-existing conditions might face higher premiums or even be declined coverage.

The geographical location of the policyholder also influences insurance costs. The cost of long-term care services can vary significantly from one region to another, and this directly impacts insurance premiums. Areas with higher costs of living or specialized care facilities may see higher insurance rates to cover these expenses.

Policy Benefits and Coverage Options

The benefits and coverage options selected in a long-term care insurance policy can greatly impact its cost. Policies offer a range of benefits, including daily benefit amounts, elimination periods, benefit periods, and optional riders. Each of these components contributes to the overall cost of the policy.

Daily benefit amounts refer to the maximum dollar amount an insurance company will pay for covered long-term care services each day. Higher daily benefit amounts provide more comprehensive coverage but also result in higher premiums. Policyholders must carefully consider their needs and financial capacity when selecting a daily benefit amount.

Elimination periods, also known as waiting periods, are the number of days an individual must pay for long-term care services out of pocket before the insurance coverage kicks in. Longer elimination periods often lead to lower premiums, as the policyholder assumes a greater financial responsibility during the initial stages of care. Conversely, shorter elimination periods provide quicker access to insurance benefits but come with higher premiums.

The benefit period is the length of time an insurance company will pay for long-term care services. Policies typically offer benefit periods ranging from a few months to several years or even a lifetime. Longer benefit periods provide more extensive coverage but are more expensive. Policyholders should assess their potential long-term care needs and financial resources to determine the appropriate benefit period.

Optional riders can be added to long-term care insurance policies to enhance coverage. These riders may include inflation protection, which adjusts the daily benefit amount to keep pace with rising healthcare costs, or restoration of benefits, which allows the policy to be reinstated after a claim without the need for additional underwriting. While these riders offer valuable protection, they also increase the policy's cost.

Comparing Long-Term Care Insurance Policies

With a wide range of long-term care insurance policies available, it is essential to compare different options to find the most suitable and cost-effective coverage. Here are some key considerations when comparing policies:

- Coverage Limits: Examine the daily benefit amounts, benefit periods, and overall coverage limits to ensure the policy aligns with your anticipated long-term care needs.

- Elimination Periods: Evaluate the available elimination periods and consider your financial capacity to cover out-of-pocket expenses during this initial period.

- Riders and Optional Benefits: Assess the availability and cost of optional riders, such as inflation protection or restoration of benefits, to enhance your coverage as needed.

- Premiums and Payment Options: Compare the premiums and payment options, including the frequency and flexibility of payments, to find a plan that fits your budget.

- Company Reputation and Financial Strength: Research the reputation and financial stability of the insurance companies offering long-term care policies. A financially secure company ensures the policy's longevity and the timely payment of claims.

It is beneficial to consult with insurance professionals who specialize in long-term care insurance. They can provide valuable insights and personalized recommendations based on your specific circumstances and needs. Additionally, seeking advice from financial advisors or healthcare professionals can further enhance your understanding of the benefits and costs associated with long-term care insurance.

| Factor | Influence on Cost |

|---|---|

| Age | Premiums increase with age, favoring younger policyholders. |

| Health Status | Healthier individuals may qualify for preferred rates; those with pre-existing conditions may face higher premiums. |

| Location | Long-term care costs vary by region, impacting insurance premiums. |

| Policy Benefits | Daily benefit amounts, elimination periods, and benefit periods influence the cost of coverage. |

The Importance of Long-Term Care Insurance

Long-term care insurance plays a vital role in financial planning, offering protection against the potentially catastrophic costs of extended care needs. These policies provide a safety net, ensuring individuals can access the care they require without depleting their savings or relying solely on government assistance.

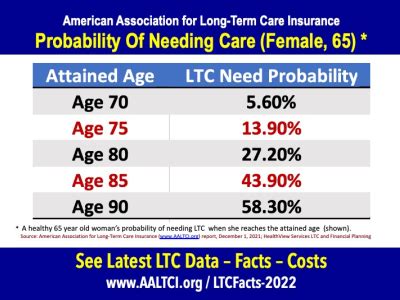

As life expectancy increases, so does the likelihood of requiring long-term care services. These services can be costly, ranging from home healthcare and assisted living facilities to skilled nursing care. Long-term care insurance steps in to cover these expenses, alleviating the financial burden on individuals and their families.

Furthermore, long-term care insurance can provide a sense of control and independence. Policyholders can choose the type and location of care they receive, ensuring their preferences are respected. This level of autonomy is invaluable, allowing individuals to maintain their dignity and quality of life during a vulnerable time.

In addition to the financial and personal benefits, long-term care insurance can also have positive societal impacts. By ensuring individuals have access to necessary care services, the burden on healthcare systems and caregivers can be reduced. This, in turn, can lead to more efficient and effective healthcare delivery, benefiting the wider community.

Future Trends and Implications

The landscape of long-term care insurance is evolving, driven by changing demographics, healthcare advancements, and shifts in societal attitudes toward aging and care. Here are some key trends and their potential implications:

- Aging Population: The global population is aging rapidly, with an increasing number of individuals requiring long-term care. This trend is expected to continue, putting pressure on healthcare systems and driving the demand for long-term care insurance.

- Advancements in Healthcare: Technological advancements and medical breakthroughs are extending life expectancy and improving the quality of care. However, these advancements also contribute to rising healthcare costs, impacting the affordability of long-term care insurance.

- Changing Attitudes Toward Aging: Society's perception of aging is shifting, with a growing focus on active and healthy aging. This shift may influence the demand for long-term care insurance, as individuals seek to maintain their independence and quality of life for longer periods.

- Innovation in Insurance Products: Insurance companies are adapting to changing needs by offering innovative long-term care insurance products. These may include hybrid policies that combine life insurance and long-term care coverage, providing greater flexibility and financial protection.

As the long-term care insurance market continues to evolve, staying informed about these trends and their implications is essential for making well-informed decisions. Policyholders and prospective buyers should regularly review their coverage to ensure it aligns with their changing needs and the evolving landscape of long-term care.

Conclusion

Long-term care insurance is a critical component of financial planning, providing individuals and their families with essential protection against the high costs of extended care needs. By understanding the factors influencing insurance costs and comparing available policies, individuals can make informed decisions to secure adequate coverage without overwhelming their finances.

As the world adapts to an aging population and evolving healthcare landscapes, long-term care insurance will play an increasingly vital role in ensuring access to quality care and maintaining financial stability. With the right coverage in place, individuals can face the future with confidence, knowing they have the support they need to age gracefully and with dignity.

How does long-term care insurance differ from traditional health insurance?

+Long-term care insurance differs from traditional health insurance in its focus on extended care needs. While health insurance typically covers acute medical conditions and short-term treatments, long-term care insurance is designed to provide coverage for ongoing care services, such as assistance with daily living activities, nursing home care, or home healthcare. Long-term care insurance fills a gap left by traditional health insurance policies, ensuring individuals have access to the care they need beyond what is typically covered.

What factors determine the cost of long-term care insurance?

+The cost of long-term care insurance is influenced by various factors, including the policyholder’s age, health status, location, and the specific benefits and coverage options chosen. Premiums tend to increase with age and may be impacted by health conditions. The cost of living and long-term care services in a particular region also play a role in determining insurance premiums. Additionally, the coverage limits, elimination periods, and optional riders selected can significantly impact the overall cost of the policy.

Are there any tax benefits associated with long-term care insurance?

+Yes, long-term care insurance premiums may be tax-deductible for some individuals. The Internal Revenue Service (IRS) allows certain long-term care insurance policies to be treated as a qualified medical expense, making the premiums tax-deductible. However, the deductibility depends on various factors, including the policy’s benefits, the individual’s age, and their tax bracket. It is advisable to consult with a tax professional to understand the specific tax benefits applicable to your situation.

How can I find the best long-term care insurance policy for my needs?

+Finding the best long-term care insurance policy involves careful consideration of your specific needs and financial capacity. It is beneficial to consult with insurance professionals who specialize in long-term care insurance. They can provide personalized recommendations based on your circumstances. Additionally, comparing policies from different insurers, evaluating coverage limits, elimination periods, and optional riders, and considering the financial strength and reputation of the insurance company are crucial steps in finding the most suitable and cost-effective policy.

What should I do if I already have long-term care insurance but my needs change over time?

+If your long-term care needs change, it is important to review your existing policy and assess whether it still aligns with your requirements. You may need to adjust your coverage, especially if your care needs have increased. Contact your insurance provider to discuss your options, which may include adding riders or modifying your policy to ensure it continues to provide adequate protection. Regularly reviewing and updating your long-term care insurance policy is essential to ensure it remains effective as your needs evolve.