Life Insurance Policy Whole

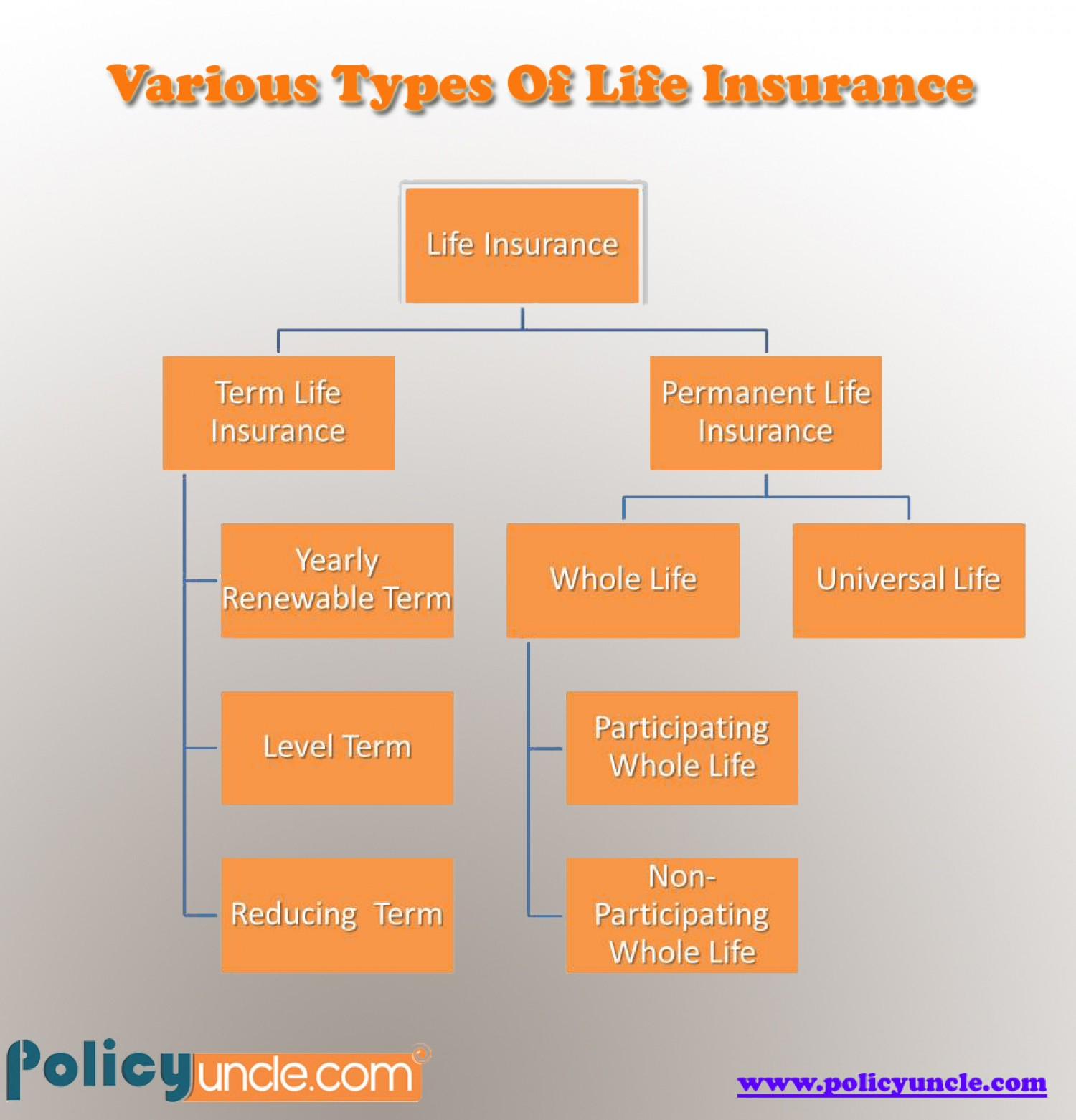

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. With various types of life insurance policies available, understanding the nuances and benefits of each can be crucial in making informed decisions. In this comprehensive guide, we delve into the world of whole life insurance, a popular and permanent form of coverage, to help you navigate its features, advantages, and considerations.

The Fundamentals of Whole Life Insurance

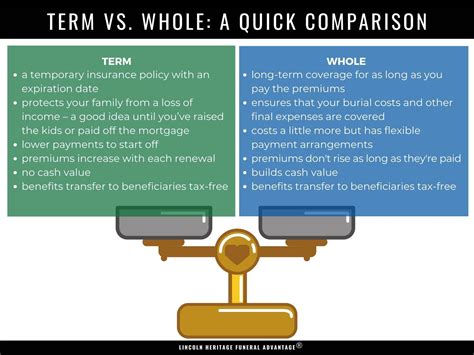

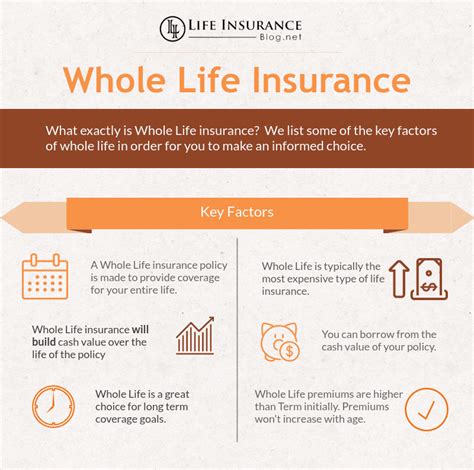

Whole life insurance, also known as permanent life insurance, is a type of policy that offers coverage for the entire lifetime of the insured individual. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as the policyholder continues to pay the premiums. This unique characteristic makes it an attractive option for those seeking long-term financial protection and stability.

The key components of a whole life insurance policy include a death benefit, cash value accumulation, and guaranteed premiums. The death benefit is the amount paid out to the beneficiaries upon the insured's passing, providing financial support during a challenging time. The cash value, on the other hand, is a savings component that grows over time and can be accessed by the policyholder through loans or withdrawals, offering flexibility and potential tax benefits.

One of the significant advantages of whole life insurance is its guaranteed premiums. Unlike some other forms of life insurance, where premiums can increase over time, whole life insurance premiums remain fixed throughout the policy's duration. This predictability allows policyholders to budget effectively and ensures long-term affordability.

Understanding the Cash Value Component

The cash value aspect of whole life insurance is a crucial feature that sets it apart from other types of coverage. This component functions as a savings account within the policy, accumulating value over time. The cash value grows through a combination of premium payments and investment earnings, and it is tax-deferred, meaning it grows without immediate tax implications.

Policyholders have several options when it comes to utilizing the cash value. They can borrow against it, taking out a loan that is secured by the policy. The loan and its interest accrue against the policy's cash value, but the loan amount itself is not taxable. Alternatively, policyholders can withdraw a portion of the cash value, which reduces the death benefit and the policy's cash value accordingly. These features provide flexibility and can be particularly advantageous in times of financial need or when planning for retirement.

It's important to note that borrowing or withdrawing from the cash value may impact the policy's overall performance and the death benefit. Therefore, careful consideration and consultation with financial advisors are recommended to ensure the best use of this feature.

The Investment Aspect of Cash Value

The growth of the cash value is influenced by the investment performance of the insurance company. Most whole life insurance policies offer a guaranteed minimum interest rate on the cash value, providing a stable foundation for growth. However, many policies also offer the potential for higher returns through variable investment options, where the cash value is tied to the performance of specific investment portfolios.

| Investment Type | Description |

|---|---|

| Fixed Interest | A guaranteed interest rate applied to the cash value, offering stability but potentially lower returns. |

| Variable Investments | Linked to the performance of specific investment portfolios, offering potential for higher returns but with market risk. |

The choice between fixed and variable investments depends on the policyholder's risk tolerance and financial goals. While variable investments may provide higher growth potential, they also carry market risk, making them a more suitable option for those with a longer investment horizon.

Whole Life Insurance Premiums and Affordability

One of the standout features of whole life insurance is its guaranteed premiums. Unlike term life insurance, where premiums can increase significantly over time, whole life insurance premiums remain level throughout the policy’s duration. This predictability allows policyholders to plan their finances effectively and ensures long-term affordability.

The cost of whole life insurance premiums can vary based on several factors, including the policyholder's age, health, and lifestyle. Younger individuals tend to pay lower premiums, as they are less likely to have health concerns and are expected to live longer. Additionally, those with healthier lifestyles and no major health issues may qualify for preferred rates.

Premium Payment Options

Whole life insurance policies offer flexibility in premium payment options. Policyholders can choose to pay premiums annually, semi-annually, quarterly, or even monthly, depending on their financial situation and preferences. This customization allows for greater control over cash flow and budgeting.

It's important to note that while whole life insurance premiums are guaranteed to remain level, the policy itself may have additional fees and expenses associated with its administration and management. These costs are typically factored into the overall premium and are disclosed in the policy documentation.

The Role of Whole Life Insurance in Financial Planning

Whole life insurance plays a significant role in comprehensive financial planning. Its long-term nature and guaranteed benefits make it an attractive option for those seeking to protect their loved ones and ensure financial stability.

One of the primary benefits of whole life insurance is its death benefit. In the unfortunate event of the policyholder's passing, the death benefit provides a lump-sum payment to the beneficiaries, which can be used to cover immediate expenses, pay off debts, or fund long-term financial goals. This financial support can be crucial in helping loved ones navigate a difficult time and maintain their standard of living.

Estate Planning and Wealth Transfer

Whole life insurance is often utilized in estate planning strategies. The death benefit can be structured to provide a significant sum to heirs, helping to minimize estate taxes and ensure a smooth wealth transfer. The cash value component of the policy can also be utilized to pay for estate planning expenses or to fund charitable donations, providing tax benefits and allowing for a meaningful legacy.

Furthermore, whole life insurance can be an effective tool for business owners. It can be used to fund buy-sell agreements, ensuring that the business can continue operating smoothly in the event of a key owner's passing. It can also provide liquidity to cover estate taxes or buy out heirs who may not be interested in continuing the business.

Considerations and Alternatives

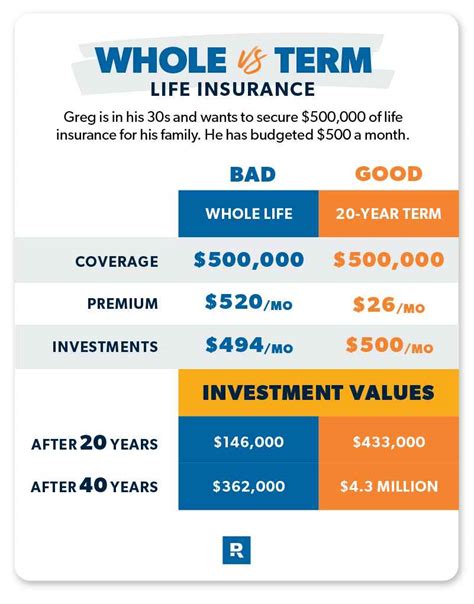

While whole life insurance offers numerous benefits, it may not be the ideal choice for everyone. The primary consideration is cost. Whole life insurance premiums can be significantly higher than term life insurance, especially for younger individuals. Those with limited financial resources may find term life insurance a more affordable option for short-term coverage needs.

Additionally, the cash value component of whole life insurance may not be as attractive to those seeking purely investment opportunities. While the cash value grows over time, it may not offer the same potential for growth as other investment vehicles, such as stocks or mutual funds. However, the combination of insurance coverage and savings makes whole life insurance a versatile financial tool.

Comparing Whole Life and Term Life Insurance

When deciding between whole life and term life insurance, it’s essential to consider one’s financial goals and the duration of coverage needed. Term life insurance is often more affordable and provides coverage for a specified period, typically ranging from 10 to 30 years. It is an excellent option for those seeking temporary coverage, such as during child-rearing years or while paying off a mortgage.

On the other hand, whole life insurance offers permanent coverage and the potential for long-term savings. It is ideal for those seeking lifelong protection and the ability to build cash value over time. The decision ultimately depends on individual financial circumstances and long-term goals.

Conclusion: Navigating the Whole Life Insurance Landscape

Whole life insurance is a valuable tool in the financial planning arsenal, offering permanent coverage, guaranteed premiums, and the potential for cash value accumulation. Its versatility and long-term nature make it an attractive option for those seeking financial security and stability.

When considering whole life insurance, it's crucial to consult with financial advisors and insurance professionals to ensure a comprehensive understanding of the policy's features, benefits, and potential drawbacks. By carefully evaluating one's financial goals and needs, individuals can make informed decisions and secure the financial protection they deserve.

What is the primary difference between whole life and term life insurance?

+Whole life insurance provides permanent coverage with guaranteed premiums and cash value accumulation. Term life insurance, on the other hand, offers coverage for a specified period (e.g., 10-30 years) and typically has lower premiums but no cash value component.

How does the cash value in whole life insurance work?

+The cash value in whole life insurance functions as a savings account within the policy. It grows through premium payments and investment earnings, offering flexibility through loans or withdrawals. Policyholders should consider the potential impact on the death benefit and overall policy performance when accessing the cash value.

Is whole life insurance suitable for everyone?

+Whole life insurance may not be the best choice for everyone due to its higher premiums compared to term life insurance. Those with limited financial resources or short-term coverage needs may find term life insurance more suitable. It’s essential to assess individual financial goals and circumstances before deciding on a life insurance policy.