Get Auto Insurance Now

The world of auto insurance can be a complex and often confusing landscape for many drivers. With a myriad of policies, providers, and coverage options available, it's easy to feel overwhelmed when navigating the process of obtaining the right auto insurance. This guide aims to provide a comprehensive overview, helping you understand the ins and outs of auto insurance and offering expert insights to make informed decisions.

Understanding Auto Insurance: The Fundamentals

Auto insurance is a legal requirement in most states, providing financial protection in the event of an accident, theft, or other vehicle-related incidents. It’s a contract between you and the insurance provider, wherein you pay a premium, and in return, the provider agrees to cover certain types of losses as outlined in your policy.

Key Components of Auto Insurance

- Liability Coverage: This is the most basic form of auto insurance, covering the cost of damages you cause to others in an accident. It includes bodily injury liability and property damage liability.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle caused by incidents other than collisions, such as theft, vandalism, weather events, or collisions with animals.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or enough insurance to cover the damages.

Each state has its own minimum requirements for auto insurance coverage, but these may not be sufficient to fully protect you and your assets. It's important to assess your individual needs and consider additional coverage options to ensure comprehensive protection.

Factors Influencing Auto Insurance Rates

Insurance providers use a variety of factors to calculate your auto insurance premium. These can include:

- Your age, gender, and marital status.

- Your driving record and history of accidents or violations.

- The make, model, and year of your vehicle.

- The primary use of your vehicle (e.g., commuting, business, pleasure)

- Your annual mileage.

- Your credit score.

- The coverage limits and deductibles you choose.

By understanding these factors, you can make informed decisions to potentially lower your insurance premiums. For instance, maintaining a clean driving record, opting for higher deductibles, or choosing a vehicle with safety features can all impact your rates.

Choosing the Right Auto Insurance Provider

With a multitude of insurance providers in the market, selecting the right one can be a daunting task. It’s important to consider a provider’s reputation, financial stability, and customer service in addition to the cost of their policies.

Evaluating Insurance Providers

Start by researching the top auto insurance providers in your state. Look for companies with a strong financial rating, indicating their ability to pay out claims. Check online reviews and customer feedback to gauge their service quality and responsiveness.

Consider the provider's range of coverage options and their flexibility in customizing policies. Some providers offer specialized coverage for unique situations, such as classic car insurance or insurance for ridesharing drivers.

| Provider | Financial Rating | Customer Satisfaction |

|---|---|---|

| State Farm | A++ (Superior) | 4.5/5 |

| GEICO | A++ (Superior) | 4.3/5 |

| Progressive | A+ (Excellent) | 4.2/5 |

| Allstate | A+ (Excellent) | 4.1/5 |

| Liberty Mutual | A+ (Excellent) | 4.0/5 |

These ratings and scores are based on independent financial and customer satisfaction assessments, offering a snapshot of each provider's overall performance.

Comparing Coverage and Premiums

Once you’ve narrowed down your list of potential providers, it’s time to compare their coverage options and premiums. Get quotes from at least three providers to ensure you’re getting the best value.

Look for providers that offer customizable policies, allowing you to choose the coverage limits and deductibles that fit your budget and needs. Consider any discounts they offer, such as multi-policy discounts, good driver discounts, or discounts for safety features in your vehicle.

Maximizing Your Auto Insurance Coverage

Obtaining the right auto insurance coverage involves more than just meeting the minimum legal requirements. It’s about ensuring you have adequate protection for your specific needs and circumstances.

Assessing Your Coverage Needs

Evaluate your personal situation and the value of your assets. If you have significant assets, you may want to consider higher liability limits to protect yourself from potential lawsuits. If you frequently drive in areas prone to natural disasters or have an older vehicle, comprehensive coverage becomes even more crucial.

Consider your personal injury risks and the cost of medical care in your area. Personal Injury Protection (PIP) or Medical Payments coverage can provide crucial financial support in the event of an accident.

Exploring Additional Coverage Options

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or enough insurance to cover the damages. It’s especially important in states with a high percentage of uninsured drivers.

- Roadside Assistance: Provides emergency services such as towing, flat tire changes, or fuel delivery. It can be a lifesaver in unexpected situations and is often available as an add-on to your policy.

- Rental Car Coverage: Covers the cost of renting a vehicle while your car is being repaired after an insured incident. This can be a valuable addition, especially if you rely heavily on your vehicle for daily activities or business.

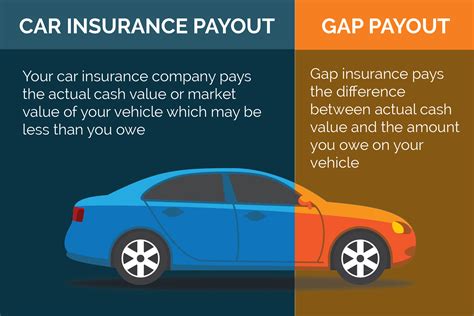

- Gap Insurance: Bridges the gap between what your insurance company pays if your car is totaled and what you still owe on your auto loan or lease. It’s particularly beneficial if you’ve financed your vehicle or are making lease payments.

The Claims Process: What to Expect

Understanding the claims process is a critical aspect of auto insurance. It’s how you’ll receive financial support in the event of an accident or other covered incident.

Reporting an Auto Insurance Claim

When an accident occurs, the first step is to ensure the safety of yourself and others involved. If possible, move your vehicle to a safe location to prevent further accidents. Then, contact the police to file a report, which can be crucial evidence for your insurance claim.

Notify your insurance provider as soon as possible after the accident. Most providers offer 24/7 claims reporting, and many allow you to initiate the process online or via their mobile app.

Gather as much information as you can about the accident, including photos of the scene and any damage, contact details of witnesses, and the other driver's insurance information. This information will be vital when filing your claim.

The Claims Investigation Process

Once you’ve reported your claim, the insurance provider will initiate an investigation. This process can vary depending on the complexity of the claim and the nature of the incident.

The insurer may assign an adjuster to handle your claim. They'll review the details of the accident, assess the damage, and determine the value of the claim. This may involve an inspection of your vehicle or a review of the police report.

During the investigation, it's important to provide any additional information or documentation requested by the adjuster. This can help expedite the process and ensure a fair and accurate assessment of your claim.

Resolving Your Claim

After the investigation, the insurance provider will make a determination on your claim. They’ll either approve the claim, offering a settlement amount, or deny the claim, providing reasons for their decision.

If your claim is approved, the insurer will provide you with the settlement amount. This can be paid directly to you, to a repair shop of your choice, or to a rental car company if you've included rental car coverage in your policy.

If your claim is denied, you have the right to appeal the decision. This process can vary depending on the insurer and the reasons for the denial. It's important to review the denial notice carefully and gather any additional evidence or information that may support your claim.

Tips for a Smooth Claims Experience

Navigating the claims process can be less stressful with proper preparation and knowledge. Here are some tips to ensure a smoother experience:

- Document everything: Take photos of the accident scene and any damage to your vehicle. Keep a record of conversations with the insurance provider and the other party involved.

- Understand your policy: Familiarize yourself with the terms and conditions of your policy, including the coverage limits and deductibles. This can help you understand your rights and responsibilities during the claims process.

- Choose a reputable repair shop: If your vehicle requires repairs, choose a reputable and licensed repair shop. Some insurers have preferred repair shops that offer discounts or warranties on their work. Ensure the shop provides a detailed estimate and keeps you informed throughout the repair process.

- Keep records: Maintain a file of all documents related to your claim, including the police report, photos, correspondence with the insurer, and repair estimates. This can be helpful if any issues arise during the claims process.

- Stay in touch: Keep the insurance provider updated on any changes or developments related to your claim. If you move or your contact details change, inform the insurer to ensure timely communication.

Future of Auto Insurance: Trends and Innovations

The auto insurance industry is continually evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into some of the trends shaping the future of auto insurance.

Telematics and Usage-Based Insurance

Telematics devices installed in vehicles can track driving behavior, including speed, acceleration, and braking. This data is used by insurers to offer usage-based insurance policies, where premiums are calculated based on individual driving habits. This technology encourages safer driving and can lead to significant savings for responsible drivers.

Artificial Intelligence and Machine Learning

AI and machine learning are being utilized to streamline the claims process. These technologies can automate certain tasks, such as damage assessment and claim triage, leading to faster and more efficient claim resolutions. Additionally, AI can analyze vast amounts of data to identify patterns and predict future risks, helping insurers offer more personalized and accurate coverage.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is being explored for its potential to enhance data security and transparency in the insurance industry. It can provide a secure and tamper-proof way to store and share insurance-related data, including policy information, claims history, and vehicle ownership records.

Connected Car Technology

With the rise of connected car technology, vehicles are becoming more integrated with insurance providers. This technology can enable real-time data sharing, allowing insurers to offer more dynamic and personalized policies. For instance, connected cars can provide real-time driving data, enabling insurers to offer discounts for safe driving behaviors.

FAQ

What happens if I’m at fault in an accident but don’t have liability insurance?

+

If you’re at fault in an accident and don’t have liability insurance, you’ll be personally responsible for all the damages caused. This can result in significant financial consequences, including lawsuits and liens on your assets. It’s crucial to have liability insurance to protect yourself and your assets in such situations.

How can I lower my auto insurance premiums?

+

There are several ways to potentially lower your auto insurance premiums. Maintaining a clean driving record, opting for higher deductibles, and choosing a vehicle with safety features can all impact your rates. Additionally, some providers offer discounts for good driving habits, safe vehicles, or multiple policies with the same insurer.

What is a deductible, and how does it work?

+

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and your vehicle sustains 3,000 worth of damage in an accident, you’ll pay the first 500, and your insurance provider will cover the remaining 2,500. Choosing a higher deductible can often lead to lower premiums, but it’s important to ensure you can afford the deductible in the event of a claim.