Minimum Auto Insurance

Auto insurance is a critical aspect of owning a vehicle, providing financial protection in case of accidents, theft, or other unforeseen events. While having insurance is mandatory in most places, the specific requirements and costs can vary greatly. This article aims to delve into the world of auto insurance, exploring the concept of minimum coverage, its implications, and how it affects drivers and their wallets.

Understanding Minimum Auto Insurance Coverage

Minimum auto insurance coverage refers to the least amount of insurance coverage that drivers are legally required to carry in a particular state or region. These requirements are set by local laws and regulations to ensure that all drivers on the road have a basic level of financial protection in the event of an accident. The exact details of minimum coverage can vary widely, and it’s essential for drivers to understand their specific state’s requirements to avoid any legal issues or financial penalties.

The concept of minimum coverage is designed to protect not only the insured driver but also other drivers, passengers, and pedestrians involved in an accident. It provides a safety net, ensuring that there is at least some financial assistance available to cover damages and injuries sustained in an accident. While it may not cover all potential costs, it serves as a crucial foundation for road safety and financial responsibility.

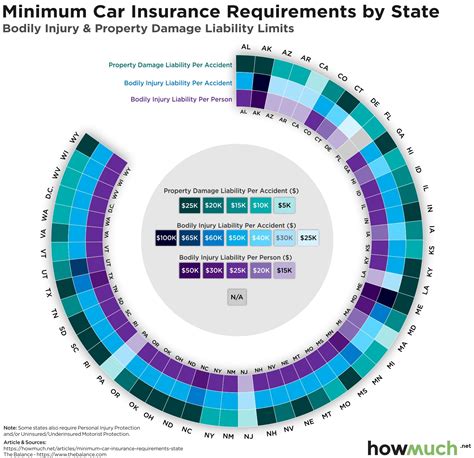

State-by-State Differences

One of the most significant aspects of minimum auto insurance coverage is its variability across different states. Each state has its own unique set of laws and regulations, which can result in vastly different requirements for drivers. For instance, some states may only require liability coverage, while others may also mandate personal injury protection (PIP) or uninsured/underinsured motorist coverage.

| State | Minimum Liability Coverage |

|---|---|

| California | 15/30/5 |

| Texas | 30/60/25 |

| New York | 25/50/10 |

| Florida | 10/20/10 (no-fault state) |

| Illinois | 25/50/20 |

In the table above, you can see the minimum liability coverage required in different states. The numbers represent bodily injury liability and property damage liability, with the first two numbers referring to the maximum amount the insurance company will pay per person and per accident, respectively, and the third number indicating the property damage liability coverage.

Factors Influencing Minimum Coverage Costs

The cost of minimum auto insurance coverage can vary significantly, influenced by a multitude of factors. Understanding these factors can help drivers make informed decisions and potentially reduce their insurance expenses.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. For instance, sports cars or high-performance vehicles often come with higher insurance premiums due to their higher risk profiles. Similarly, vehicles used for business purposes or as part of a ride-sharing service may also attract higher rates.

Driver’s Profile

Your personal driving record and history play a significant role in determining insurance costs. Drivers with a clean record and no prior accidents or traffic violations are often rewarded with lower premiums. Conversely, those with a history of accidents or moving violations may face higher insurance costs, as they are considered a higher risk to insure.

Location and Mileage

The area where you live and drive can also affect your insurance rates. Urban areas with higher populations and traffic volumes often have higher insurance costs due to increased accident risks. Additionally, the number of miles you drive annually can impact your insurance rates, as more miles driven generally correlate with a higher risk of accidents.

Insurance Provider and Coverage Options

The insurance company you choose and the coverage options you select can greatly influence your insurance costs. Different providers offer varying rates and discounts, so it’s essential to shop around and compare quotes. Additionally, while minimum coverage is a legal requirement, you may want to consider additional coverage options to ensure more comprehensive protection.

| Insurance Provider | Minimum Coverage Quote |

|---|---|

| Allstate | $650/year |

| Geico | $580/year |

| Progressive | $720/year |

| State Farm | $600/year |

| Esurance | $590/year |

The table above showcases the minimum coverage quotes offered by different insurance providers. These quotes are based on a standard profile and can vary depending on individual circumstances.

The Impact of Minimum Coverage on Drivers

While minimum auto insurance coverage is a legal requirement, it’s essential to understand its potential limitations and how it can impact drivers. Insufficient coverage can lead to financial difficulties and legal complications in the event of an accident.

Financial Risks

In the event of a severe accident, minimum coverage may not be enough to cover all the damages and injuries sustained. This can leave the insured driver liable for the remaining costs, which can be significant. For instance, medical expenses for serious injuries or property damage to multiple vehicles can quickly exceed the limits of minimum coverage.

Legal Implications

Insufficient insurance coverage can also lead to legal issues. In some cases, drivers may be held personally liable for damages and injuries that exceed their insurance coverage. This can result in lawsuits and financial judgments, which can have long-lasting consequences for the driver’s financial well-being.

Peace of Mind and Road Safety

On the other hand, having adequate insurance coverage provides peace of mind and contributes to overall road safety. Drivers with comprehensive insurance are more likely to feel secure on the road, knowing that they have the financial protection needed in case of an accident. This sense of security can also lead to safer driving behaviors, as drivers are less likely to engage in risky maneuvers or drive distracted.

Maximizing Your Auto Insurance Coverage

While minimum coverage is a legal requirement, there are strategies drivers can employ to maximize their insurance coverage and protect themselves financially.

Understand Your Needs

Take the time to assess your specific needs and circumstances. Consider factors such as your driving history, the value of your vehicle, and the potential risks you face on the road. This self-assessment can help you determine the appropriate level of coverage needed to adequately protect yourself and your assets.

Compare Quotes and Providers

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from different providers. Insurance companies offer varying rates and discounts, so it’s essential to explore your options. Additionally, consider seeking advice from insurance brokers or agents who can provide personalized recommendations based on your needs.

Consider Additional Coverage

While minimum coverage is a legal requirement, it’s often advisable to consider additional coverage options. These can include comprehensive coverage, collision coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These additional coverages can provide more comprehensive protection and peace of mind in the event of an accident.

| Coverage Type | Description |

|---|---|

| Comprehensive Coverage | Covers damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions. |

| Collision Coverage | Covers damages to your vehicle resulting from a collision with another vehicle or object. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages resulting from an accident, regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance. |

Conclusion

Understanding minimum auto insurance coverage and its implications is crucial for every driver. While it serves as a legal requirement, minimum coverage may not provide sufficient protection in certain situations. By familiarizing yourself with your state’s specific requirements, assessing your individual needs, and exploring additional coverage options, you can ensure you have the right level of insurance to protect yourself and your assets.

FAQ

What happens if I drive without minimum insurance coverage?

+Driving without minimum insurance coverage is illegal and can result in serious consequences. If caught, you may face fines, license suspension, or even criminal charges. Additionally, you’ll be personally liable for any damages or injuries caused in an accident, which can lead to significant financial hardships.

How can I reduce my auto insurance costs while still maintaining adequate coverage?

+There are several strategies to reduce insurance costs while maintaining adequate coverage. These include shopping around for quotes, comparing providers, and considering discounts. Additionally, maintaining a clean driving record and opting for higher deductibles can also lead to lower premiums. However, it’s essential to strike a balance between cost savings and adequate protection.

Are there any discounts available for auto insurance coverage?

+Yes, many insurance providers offer a variety of discounts to their customers. Common discounts include safe driver discounts, good student discounts, multi-policy discounts (if you bundle your auto insurance with other policies like homeowners or renters insurance), and loyalty discounts for long-term customers. It’s worth inquiring about these discounts when obtaining quotes.

What should I do if I’m involved in an accident and my insurance coverage is insufficient?

+If you’re involved in an accident and your insurance coverage is insufficient, it’s important to contact your insurance provider immediately to discuss your options. They may be able to guide you through the process of filing a claim and assist in exploring additional coverage options. It’s crucial to cooperate fully with your insurance company and provide all necessary information to ensure a smooth claims process.