What Is Car Gap Insurance

Car Gap insurance, or Guaranteed Asset Protection insurance, is a specialized type of coverage designed to safeguard policyholders from potential financial losses arising from the total loss or theft of a vehicle. This insurance product fills a crucial gap in standard automotive insurance policies, ensuring that policyholders are not left with a substantial financial burden should their vehicle be declared a total loss by their insurance provider.

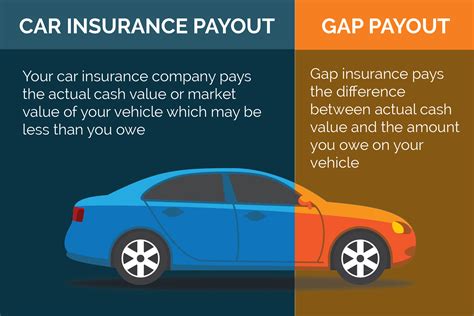

The need for Gap insurance stems from the inherent discrepancy between a vehicle's market value and the amount still owed on its financing or lease agreement. This disparity can occur due to various factors, including depreciation, mileage, and market fluctuations. Gap insurance aims to bridge this financial gap, providing coverage for the difference between the vehicle's insured value and the outstanding balance on the financing or lease.

Understanding the Basics of Car Gap Insurance

Gap insurance is an optional coverage that can be purchased alongside a standard auto insurance policy. It is particularly beneficial for individuals who have purchased a vehicle on credit or are leasing it, as it protects them from the potential financial repercussions of a total loss.

When a vehicle is involved in an accident or is stolen and deemed a total loss, the insurance company typically pays out the actual cash value (ACV) of the vehicle at the time of the incident. However, the ACV may not cover the full amount owed on the loan or lease, leaving the policyholder responsible for the remaining balance. This is where Gap insurance steps in to provide crucial financial protection.

Key Benefits of Car Gap Insurance

- Financial Protection: Gap insurance ensures that policyholders are not left with a substantial financial liability in the event of a total loss. It covers the difference between the vehicle’s insured value and the outstanding balance, providing peace of mind and financial security.

- Depreciation Coverage: Vehicles depreciate rapidly, especially in the first few years of ownership. Gap insurance takes into account this depreciation, ensuring that policyholders are not penalized for owning a vehicle that has lost value over time.

- Lease and Loan Protection: This insurance is particularly advantageous for individuals who have leased a vehicle or are making loan repayments. It protects them from having to pay off the remaining balance of a vehicle they no longer possess.

Gap insurance is typically offered by insurance companies, dealerships, and financing institutions. The cost of the coverage can vary depending on several factors, including the type of vehicle, the amount of coverage needed, and the duration of the policy.

How Car Gap Insurance Works

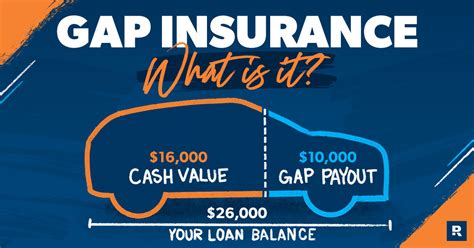

In the event of a total loss, the policyholder’s standard auto insurance policy will initially pay out the ACV of the vehicle. This amount is then used to settle any outstanding balance on the vehicle’s loan or lease. If there is a remaining balance after this settlement, Gap insurance steps in to cover the difference.

For example, imagine a policyholder has a vehicle with an ACV of $20,000, but they still owe $25,000 on the loan. Their standard auto insurance policy will pay out $20,000, which covers the loan balance. However, this leaves a $5,000 gap, which is where Gap insurance would provide coverage.

| Vehicle Value | Outstanding Balance | Gap Insurance Coverage |

|---|---|---|

| $20,000 | $25,000 | $5,000 |

It's important to note that Gap insurance is typically valid for the entire duration of the loan or lease, providing continuous coverage against financial losses.

Who Should Consider Car Gap Insurance

Gap insurance is particularly beneficial for individuals who find themselves in the following situations:

- Recent Vehicle Purchases: If you have recently purchased a new or used vehicle, especially with financing, Gap insurance can provide crucial financial protection during the initial years when depreciation is highest.

- Leasing a Vehicle: Lease agreements often have strict mileage and wear-and-tear regulations. If you exceed these limits or cause significant damage to the vehicle, you may be responsible for additional costs. Gap insurance can help cover these expenses in the event of a total loss.

- High-Mileage Vehicles: Vehicles with high mileage tend to depreciate more rapidly. Gap insurance can bridge the gap between the vehicle's depreciated value and the outstanding loan balance, ensuring you're not left with a substantial financial burden.

Factors to Consider When Purchasing Car Gap Insurance

When considering Gap insurance, it’s important to weigh the following factors:

- Cost: Gap insurance can vary in price depending on the provider and the level of coverage required. It's essential to shop around and compare quotes to find the most cost-effective option.

- Coverage Period: Gap insurance policies often have specific coverage periods, typically aligned with the duration of the loan or lease. Ensure that the policy covers the entire period of your financing or lease agreement.

- Vehicle Eligibility: Some insurance providers may have restrictions on the types of vehicles eligible for Gap insurance. Check with your provider to ensure your vehicle meets the necessary criteria.

- Exclusions: Like any insurance policy, Gap insurance may have certain exclusions or limitations. Carefully review the policy documents to understand what is and isn't covered.

The Future of Car Gap Insurance

As the automotive industry continues to evolve, so too does the landscape of insurance coverage. Gap insurance is likely to remain a crucial component of automotive insurance, especially with the increasing popularity of vehicle leasing and financing options. Additionally, as technology advances and vehicles become more complex, the potential for total losses due to mechanical failures or technological issues may rise, further emphasizing the importance of Gap insurance.

Moreover, with the rise of electric vehicles (EVs) and autonomous driving technologies, the insurance industry may need to adapt its coverage to accommodate these new technologies. Gap insurance may play a significant role in protecting policyholders from the unique financial risks associated with these innovative vehicles.

Conclusion

Car Gap insurance is a specialized form of coverage that provides vital financial protection for policyholders in the event of a total loss or theft of their vehicle. It bridges the gap between the vehicle’s insured value and the outstanding balance on a loan or lease, ensuring that policyholders are not left with a substantial financial liability. With the evolving nature of the automotive industry, Gap insurance is set to remain a crucial component of comprehensive automotive insurance portfolios.

How much does Car Gap insurance typically cost?

+The cost of Gap insurance can vary depending on several factors, including the vehicle’s value, the level of coverage needed, and the policy’s duration. On average, Gap insurance can range from 200 to 600 for a one-year policy. However, it’s essential to obtain quotes from multiple providers to find the most cost-effective option.

Can I purchase Gap insurance at any time during my loan or lease?

+Gap insurance is typically most beneficial when purchased early on in the loan or lease term. However, some providers may offer Gap insurance even after the initial purchase or lease. It’s best to consult with your insurance provider or dealership to understand your options.

What happens if I sell my vehicle before the Gap insurance policy expires?

+If you sell your vehicle before the Gap insurance policy expires, you may be able to cancel the policy and receive a prorated refund for the remaining coverage period. However, this process can vary depending on the provider, so it’s advisable to review the policy terms and conditions or consult with your insurance provider.