Licensed Insurance Agents

Licensed insurance agents play a crucial role in the insurance industry, serving as trusted advisors and advocates for individuals and businesses alike. These professionals possess the knowledge and expertise to navigate the complex world of insurance, offering guidance and personalized solutions to protect their clients' financial well-being. In this comprehensive guide, we will delve into the world of licensed insurance agents, exploring their qualifications, responsibilities, and the impact they have on the industry.

The Role and Qualifications of Licensed Insurance Agents

Licensed insurance agents are highly skilled professionals who undergo rigorous training and education to obtain their licenses. The requirements for becoming a licensed insurance agent vary depending on the jurisdiction and the type of insurance they intend to sell. However, certain fundamental qualifications are common across the industry.

Most aspiring insurance agents must complete pre-licensing education, which typically involves studying insurance principles, regulations, and specific product knowledge. This education equips them with a strong foundation in insurance concepts, enabling them to make informed recommendations to their clients. Additionally, many agents pursue advanced certifications to specialize in specific areas such as life insurance, health insurance, or property and casualty insurance.

To obtain their licenses, insurance agents must pass rigorous examinations administered by state regulatory bodies. These exams assess their understanding of insurance laws, ethical standards, and the practical application of insurance principles. The licensing process ensures that agents possess the necessary knowledge and skills to provide competent and ethical advice to their clients.

Licensed insurance agents are required to maintain their licenses through ongoing education and compliance with industry regulations. Continuing education courses keep them up-to-date with evolving insurance products, market trends, and legal changes. This commitment to lifelong learning ensures that agents can provide their clients with the most current and relevant advice.

Responsibilities and Services Offered by Licensed Insurance Agents

Licensed insurance agents wear many hats, assuming a range of responsibilities to serve their clients effectively. Here are some key areas in which they provide valuable assistance:

Policy Selection and Personalization

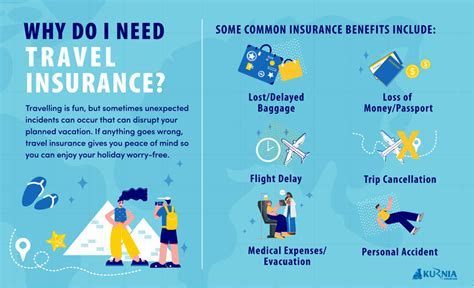

One of the primary responsibilities of licensed insurance agents is to help their clients choose the right insurance policies. They analyze their clients’ unique needs, risk profiles, and financial situations to recommend policies that provide adequate coverage. Whether it’s life insurance, health insurance, auto insurance, or business insurance, agents ensure that their clients have the appropriate protection tailored to their specific circumstances.

Licensed insurance agents excel at explaining complex insurance concepts in simple terms. They educate their clients about the coverage options available, the benefits and limitations of each policy, and the potential financial implications. By breaking down these complexities, agents empower their clients to make informed decisions and select policies that align with their goals and priorities.

Policy Customization and Add-Ons

Insurance policies often come with various customization options and add-ons. Licensed insurance agents guide their clients through these choices, helping them understand the value and relevance of each feature. Whether it’s adding riders to a life insurance policy or selecting specific coverages for a business insurance plan, agents ensure that their clients have the flexibility to create a policy that meets their specific needs.

Additionally, agents stay updated on new insurance products and enhancements, allowing them to present their clients with the latest options. This proactive approach ensures that clients have access to the most innovative and beneficial insurance solutions available in the market.

Claims Assistance and Advocacy

When clients face the unfortunate situation of having to file an insurance claim, licensed insurance agents step in to provide invaluable support. They guide their clients through the claims process, ensuring that all necessary documentation is gathered and submitted accurately. Agents act as advocates for their clients, working closely with insurance companies to facilitate timely and fair claim settlements.

Licensed insurance agents also play a crucial role in helping clients understand the intricacies of their insurance policies during the claims process. They clarify coverage limitations, explain the steps involved, and provide guidance on any potential challenges that may arise. Their expertise and familiarity with the insurance landscape make them trusted advisors during these challenging times.

Risk Assessment and Mitigation

Licensed insurance agents are trained to assess and mitigate risks. They conduct thorough evaluations of their clients’ assets, liabilities, and potential exposures to identify areas where insurance coverage is necessary. By understanding their clients’ specific circumstances, agents can recommend strategies to minimize risks and protect their financial interests.

Agents also educate their clients about risk management practices, such as implementing safety measures, maintaining proper maintenance, and following industry best practices. By empowering their clients with this knowledge, agents contribute to a culture of risk awareness and proactive prevention.

The Impact of Licensed Insurance Agents on the Industry

Licensed insurance agents have a significant impact on the insurance industry as a whole. Their expertise and dedication to client service drive the industry forward, shaping its evolution and success.

Consumer Education and Empowerment

Licensed insurance agents are at the forefront of consumer education. Through their personalized guidance and tailored recommendations, they empower individuals and businesses to make informed decisions about their insurance needs. By demystifying complex insurance concepts and providing clarity, agents enable their clients to take control of their financial security.

The consumer education provided by licensed insurance agents extends beyond policy selection. They educate their clients about the importance of regular policy reviews, keeping them informed about changes in their coverage needs as their circumstances evolve. This proactive approach ensures that clients are always adequately protected.

Innovation and Product Development

The feedback and insights provided by licensed insurance agents play a vital role in shaping the development of new insurance products. Insurance companies rely on agents’ real-world experiences and client interactions to understand market trends, emerging risks, and consumer preferences. This collaboration drives innovation and ensures that insurance products remain relevant and responsive to changing needs.

Licensed insurance agents also contribute to product development by identifying gaps in existing coverage options. They bring valuable insights from their interactions with clients, highlighting areas where additional protection is required. By working closely with insurance companies, agents help create innovative products that address these gaps and provide comprehensive solutions.

Regulatory Compliance and Ethical Practice

Licensed insurance agents are held to high standards of ethical conduct and regulatory compliance. Their commitment to acting in their clients’ best interests ensures that the insurance industry maintains its integrity. Agents adhere to strict codes of conduct, avoiding conflicts of interest and providing unbiased advice.

By prioritizing ethical practice, licensed insurance agents build trust and confidence among their clients. This trust is essential for maintaining long-term relationships and fostering a positive reputation for the industry. Agents serve as ambassadors of ethical conduct, setting a high standard for themselves and their peers.

Industry Growth and Stability

The expertise and professionalism of licensed insurance agents contribute to the overall growth and stability of the insurance industry. Their ability to provide personalized guidance and risk management strategies helps individuals and businesses navigate financial uncertainties. By ensuring that their clients are adequately protected, agents drive the demand for insurance products and services, fostering industry growth.

Additionally, licensed insurance agents play a crucial role in mitigating risks and minimizing losses for insurance companies. Through their proactive risk assessment and mitigation strategies, agents help reduce the likelihood of costly claims. This contributes to the overall stability of the insurance industry, allowing companies to manage their exposures effectively.

The Future of Licensed Insurance Agents

As the insurance industry continues to evolve, licensed insurance agents will remain at the forefront of providing personalized advice and support. With advancements in technology and changing consumer preferences, agents will adapt and embrace new tools and platforms to enhance their services.

The future of licensed insurance agents lies in their ability to leverage technology while maintaining the human connection that is integral to their profession. By utilizing digital platforms for efficient policy management, claims processing, and client communication, agents can provide a seamless and convenient experience while still offering the personalized touch that clients value.

Furthermore, licensed insurance agents will continue to play a pivotal role in educating clients about emerging risks and innovative insurance solutions. As the world becomes increasingly complex, agents will guide their clients through the evolving landscape, helping them navigate new challenges and opportunities. Their expertise and guidance will remain invaluable as clients seek protection in an ever-changing environment.

Conclusion

Licensed insurance agents are indispensable professionals in the insurance industry. Their expertise, ethical conduct, and commitment to client service make them trusted advisors and advocates. Through their personalized guidance, licensed insurance agents empower individuals and businesses to make informed decisions, ensuring their financial well-being is protected.

As the insurance landscape continues to evolve, licensed insurance agents will remain at the forefront, adapting to new technologies and market trends. Their role in consumer education, innovation, and regulatory compliance will continue to shape the industry, driving its growth and stability. With their knowledge and dedication, licensed insurance agents will continue to make a positive impact on the lives of their clients and the insurance industry as a whole.

How do I become a licensed insurance agent?

+To become a licensed insurance agent, you typically need to meet certain educational requirements, complete pre-licensing education courses, and pass a licensing exam administered by your state’s regulatory body. The specific steps may vary depending on your location and the type of insurance you wish to sell. It’s recommended to research the licensing requirements in your state and consider pursuing advanced certifications to specialize in specific insurance areas.

What are the benefits of working with a licensed insurance agent?

+Licensed insurance agents offer numerous benefits to their clients. They provide personalized guidance, helping individuals and businesses find the right insurance policies to protect their financial interests. Agents educate their clients about insurance concepts, explain policy options, and advocate for fair claim settlements. Additionally, they stay updated on industry changes, ensuring their clients have access to the latest and most relevant insurance solutions.

Can licensed insurance agents assist with policy comparisons and recommendations?

+Absolutely! Licensed insurance agents are trained to compare and analyze various insurance policies to find the best fit for their clients’ needs. They consider factors such as coverage limits, premiums, and policy exclusions to provide tailored recommendations. Agents can also explain the differences between insurance companies and help clients make informed decisions based on their specific circumstances.

What happens if I need to file an insurance claim? How can a licensed insurance agent help?

+Licensed insurance agents play a crucial role during the claims process. They guide their clients through the steps required to file a claim, ensuring that all necessary documentation is submitted accurately. Agents act as advocates, working with insurance companies to facilitate timely and fair claim settlements. They also provide valuable insights into the claim process, helping clients understand their rights and responsibilities.

Are licensed insurance agents obligated to act in their clients’ best interests?

+Yes, licensed insurance agents are held to a high standard of ethical conduct and are required to act in their clients’ best interests. They adhere to strict codes of conduct, avoiding conflicts of interest and providing unbiased advice. Agents prioritize their clients’ financial well-being and work to ensure they receive the coverage and protection they need.