Libery Car Insurance

Liberty Mutual Insurance is a well-established insurance company that has been in the industry for over a century, providing various insurance products to individuals and businesses across the United States. With its focus on car insurance, Liberty has built a strong reputation and offers comprehensive coverage options to cater to diverse customer needs. In this article, we delve into the world of Liberty Car Insurance, exploring its history, coverage options, claims process, customer satisfaction, and more, to help you make informed decisions about your auto insurance needs.

A Legacy of Trust: Liberty Mutual’s Journey

Liberty Mutual Insurance has a rich history dating back to 1912 when it was founded as the Massachusetts Employees Insurance Association. Over the decades, the company has evolved and expanded its reach, becoming a leading provider of insurance products. Today, Liberty Mutual is recognized as one of the largest property and casualty insurers in the United States, with a global presence.

The company's journey to success is marked by a commitment to innovation and customer satisfaction. Liberty Mutual has consistently introduced new products and services to meet the changing needs of its customers. In the realm of car insurance, they have developed a range of coverage options to provide drivers with the protection they require, whether it's for everyday commuting or specialized vehicles.

Comprehensive Coverage Options

Liberty Car Insurance offers a comprehensive range of coverage options to suit different lifestyles and driving habits. Whether you’re a safe driver seeking basic liability coverage or an enthusiast with a classic car collection, Liberty has tailored policies to meet your needs.

Liability Coverage

Liberty Mutual’s liability coverage is designed to protect policyholders from financial burdens arising from accidents they cause. This coverage includes bodily injury liability and property damage liability, ensuring that you’re covered for medical expenses and property repairs resulting from an at-fault accident.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured individuals in an accident you cause. |

| Property Damage Liability | Pays for repairs or replacement of damaged property in an accident you're responsible for. |

Collision and Comprehensive Coverage

For added protection, Liberty offers collision and comprehensive coverage. Collision coverage steps in when your vehicle collides with another vehicle or object, while comprehensive coverage provides protection against non-collision incidents such as theft, vandalism, and natural disasters.

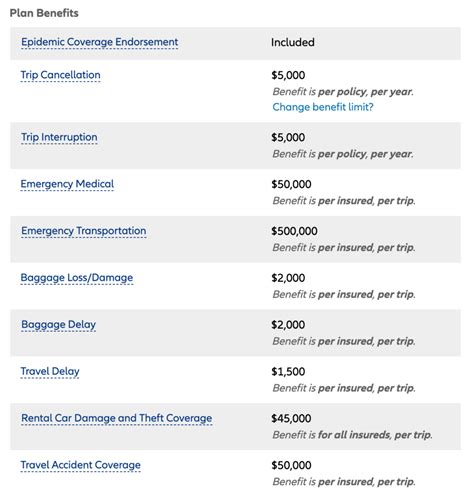

Additional Coverages

Liberty Car Insurance goes beyond the basics, offering a range of additional coverages to enhance your policy. These include:

- Uninsured/Underinsured Motorist Coverage: Protects you from financial losses if involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

- Rental Car Reimbursement: Provides rental car coverage if your vehicle is undergoing repairs due to a covered incident.

- Gap Coverage: Helps cover the difference between your car's actual cash value and the balance of your loan or lease in case of a total loss.

Personalized Discounts and Savings

Liberty Mutual understands that every driver’s situation is unique, which is why they offer a variety of discounts to help policyholders save on their car insurance premiums. These discounts are designed to reward safe driving habits, loyalty, and other specific circumstances.

Discounts Offered by Liberty Car Insurance

- Multi-Policy Discount: Combining your auto insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

- Multi-Car Discount: If you insure more than one vehicle with Liberty, you may be eligible for a discount.

- Safe Driver Discount: Maintaining a clean driving record and avoiding accidents can lead to reduced premiums.

- Advanced Driver Assistance Discounts: Having certain safety features in your vehicle, such as lane departure warning or collision avoidance systems, may qualify you for discounts.

- Loyalty Discount: Long-term customers often receive rewards for their loyalty, with discounts increasing over time.

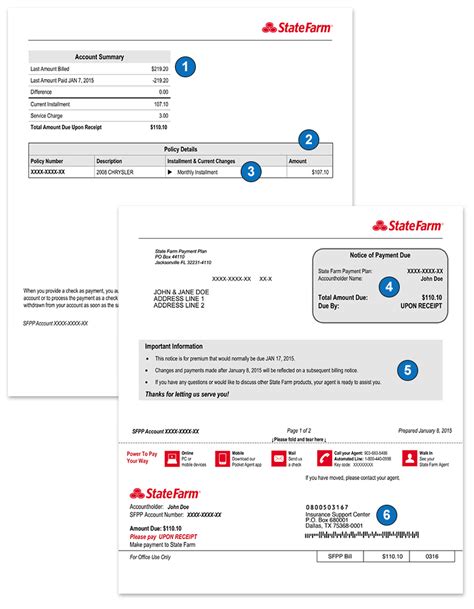

The Claims Process: A Smooth Journey to Recovery

One of the critical aspects of car insurance is the claims process. Liberty Mutual strives to make the claims experience as seamless as possible, ensuring that policyholders receive prompt and efficient assistance when they need it most.

Steps in Liberty’s Claims Process

- Reporting the Claim: Policyholders can report claims online, via phone, or through the Liberty Mobile app. Liberty’s 24⁄7 customer service ensures that you can reach out anytime.

- Claim Assessment: Liberty’s claims adjusters thoroughly evaluate each claim, taking into account the policy coverage and the circumstances of the incident.

- Repair or Settlement: Depending on the nature of the claim, Liberty may arrange for repairs at their network of trusted repair shops or provide a settlement to cover the cost of repairs or replacement.

- Quick and Efficient Resolution: Liberty aims to resolve claims promptly, understanding the importance of getting your vehicle back on the road or receiving the necessary compensation.

Customer Satisfaction and Awards

Liberty Mutual’s dedication to customer satisfaction has not gone unnoticed. The company has received numerous accolades and recognition for its outstanding service.

Accolades for Liberty Car Insurance

- J.D. Power named Liberty Mutual as one of the top performers in the 2022 U.S. Auto Insurance Study, earning recognition for its excellent customer service and claims handling.

- The company has consistently received high ratings from leading insurance rating agencies, assuring customers of its financial stability and reliability.

- Liberty’s commitment to innovation and customer-centric approach has earned it a place among the top insurance providers in the United States.

Digital Tools and Resources

In today’s digital age, Liberty Mutual understands the importance of providing customers with convenient and accessible tools. Their online platform and mobile app offer a range of features to enhance the insurance experience.

Digital Features and Benefits

- Online Policy Management: Policyholders can easily view and manage their policies, make payments, and update personal information through the Liberty website or mobile app.

- Digital Claims Reporting: The mobile app allows you to report claims quickly and efficiently, often with the option to upload photos and videos of the incident.

- Policy Comparison: Liberty’s tools enable you to compare different coverage options and premiums, helping you make informed decisions about your insurance needs.

- Real-Time Updates: Stay informed about the status of your claim and receive notifications through the digital platforms, ensuring transparency throughout the process.

Comparative Analysis: Liberty Car Insurance vs. Competitors

To truly understand the value of Liberty Car Insurance, it’s essential to compare it with other leading providers in the industry. While each insurer has its strengths and unique offerings, Liberty stands out in several key areas.

Coverage Options and Customer Service

When it comes to coverage options, Liberty Mutual offers a comprehensive range, ensuring that drivers can find a policy that suits their needs. Additionally, their focus on customer service and claims handling sets them apart. Liberty’s commitment to providing prompt and efficient assistance has earned them a reputation for excellence in this area.

Discounts and Savings

Liberty Car Insurance provides a competitive advantage with its extensive list of discounts. Whether you’re a safe driver, have multiple policies with Liberty, or utilize advanced driver assistance features, you can potentially save a significant amount on your premiums. This makes Liberty an attractive choice for budget-conscious drivers without compromising on coverage.

Digital Experience and Convenience

In an era where convenience is paramount, Liberty’s digital tools and resources enhance the overall insurance experience. From online policy management to digital claims reporting, Liberty ensures that customers can access their insurance information and services anytime, anywhere. This level of accessibility and ease of use is a significant advantage in today’s fast-paced world.

Future Implications and Industry Trends

The insurance industry is constantly evolving, and Liberty Mutual is well-positioned to adapt to these changes. With a focus on innovation and technology, the company is likely to continue enhancing its digital offerings, making insurance more accessible and user-friendly.

Additionally, Liberty's commitment to sustainability and social responsibility is expected to play a more significant role in the future. As consumers become more environmentally conscious, insurance providers that align with these values may gain a competitive edge. Liberty's initiatives in this area could further strengthen its brand and attract a wider customer base.

Conclusion: A Trusted Companion on the Road

Liberty Car Insurance offers a comprehensive and reliable solution for drivers seeking peace of mind on the road. With its rich history, extensive coverage options, and focus on customer satisfaction, Liberty Mutual has established itself as a leading provider in the industry. From personalized discounts to a seamless claims process, Liberty ensures that its policyholders are well-protected and supported throughout their journey.

As you navigate the world of car insurance, consider Liberty Mutual as a trusted companion, offering the coverage and support you need to drive with confidence. Whether you're a cautious commuter or an adventurous explorer, Liberty has the tools and expertise to keep you and your vehicle safe.

How do I get a quote for Liberty Car Insurance?

+Obtaining a quote from Liberty Car Insurance is straightforward. You can start by visiting their official website and using their online quote tool. Provide your basic information, such as your name, address, and vehicle details. Liberty’s system will generate a personalized quote based on your inputs. Alternatively, you can reach out to their customer service team via phone or email for assistance.

What sets Liberty Car Insurance apart from other providers?

+Liberty Car Insurance stands out for several reasons. Firstly, their comprehensive coverage options cater to a wide range of driver needs. Additionally, their focus on customer service and claims handling ensures a smooth and efficient experience. Liberty’s personalized discounts and digital tools also add value, making it a competitive choice in the insurance market.

Can I customize my Liberty Car Insurance policy to fit my specific needs?

+Absolutely! Liberty understands that every driver has unique requirements. Their policies are highly customizable, allowing you to choose the coverage levels and add-ons that fit your lifestyle and budget. Whether you need basic liability coverage or additional protections for a classic car, Liberty can tailor a policy just for you.

How does Liberty’s claims process compare to other insurers?

+Liberty’s claims process is designed to be efficient and customer-centric. With 24⁄7 accessibility and a dedicated team of claims adjusters, they aim to resolve claims promptly. Their online and mobile app features also streamline the process, allowing for quick reporting and updates. Liberty’s focus on claims handling has earned them recognition and a reputation for excellence in this area.

Are there any additional perks or benefits associated with Liberty Car Insurance?

+Yes, Liberty Car Insurance offers several perks and benefits to enhance your insurance experience. These include access to their extensive network of trusted repair shops, discounts on rentals through their partnerships, and loyalty rewards for long-term customers. Additionally, their digital tools provide real-time updates and convenient policy management, making insurance more accessible and user-friendly.