Liability Insurance Cost For Small Business

For small business owners, understanding and managing risks is crucial for long-term success. One of the most important aspects of risk management is having adequate liability insurance coverage. The cost of liability insurance can vary significantly depending on various factors, and it's essential to navigate these factors to ensure your business is properly protected without breaking the bank.

Understanding Liability Insurance

Liability insurance, often referred to as general liability insurance, is a fundamental type of coverage that every small business should consider. It provides protection against claims arising from bodily injury, property damage, personal and advertising injury, and medical payments.

The primary purpose of liability insurance is to shield your business from financial ruin in the event of a lawsuit or claim. It covers the costs associated with defending your business in court and pays for damages or settlements if your business is found liable.

Key Components of Liability Insurance:

- Bodily Injury: Covers claims related to physical injuries caused by your business activities.

- Property Damage: Protects against claims resulting from damage to third-party property.

- Personal and Advertising Injury: Covers libel, slander, copyright infringement, and other similar claims.

- Medical Payments: Pays for reasonable and necessary medical expenses for individuals injured on your business premises.

Having comprehensive liability insurance is especially critical for small businesses, as a single lawsuit or claim can potentially bankrupt an unprotected business. It is a fundamental risk management tool that should be a priority for any business owner.

Factors Influencing Liability Insurance Cost

The cost of liability insurance for small businesses is influenced by a multitude of factors. Understanding these factors can help business owners make informed decisions when shopping for insurance coverage.

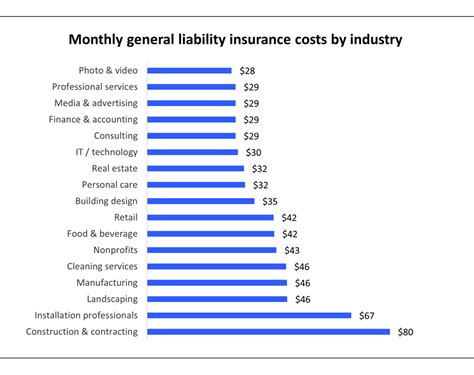

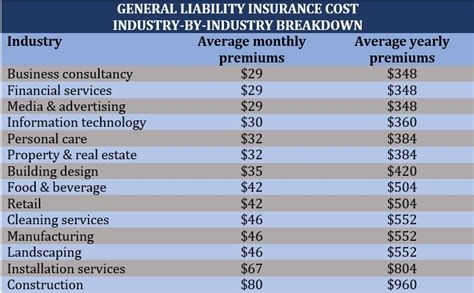

Industry and Business Type

Different industries carry varying levels of risk. For instance, a construction business is likely to face higher liability risks compared to a graphic design studio. The specific activities and services your business offers also play a significant role. For example, a gym owner may face higher risks related to bodily injury claims compared to an accounting firm.

Location

The geographic location of your business can impact insurance costs. Areas with higher population density or a history of frequent lawsuits may result in higher premiums. Additionally, the specific location of your business premises, such as being in a high-crime area, can also influence rates.

Business Size and Revenue

Larger businesses with higher revenue typically face greater exposure to risk and may require more extensive coverage. As a result, their liability insurance premiums are often higher. Small businesses with lower revenue may have more affordable options, but it’s crucial to ensure the coverage meets their specific needs.

Claims History

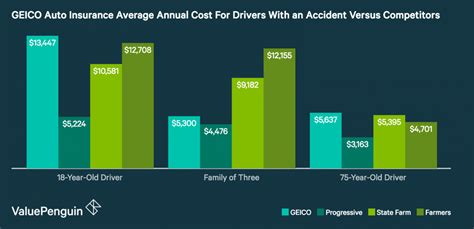

Insurance providers heavily consider a business’s claims history when determining premiums. Businesses with a history of frequent claims or large payouts may be seen as higher risks and could face increased premiums or even difficulty finding coverage.

Coverage Limits and Deductibles

The coverage limits you choose directly impact your premium. Higher limits generally result in higher premiums. Additionally, selecting a higher deductible can lower your premium, but it means you’ll pay more out of pocket if a claim occurs.

| Coverage Limit | Premium Cost |

|---|---|

| $1 Million | $700 - $1,200 |

| $2 Million | $1,200 - $1,800 |

| $3 Million | $1,800 - $2,500 |

The table above provides a general idea of the relationship between coverage limits and premium costs. However, actual costs can vary based on the specific factors mentioned above.

Strategies to Reduce Liability Insurance Costs

While the cost of liability insurance is influenced by various factors, there are strategies small business owners can employ to potentially reduce their premiums.

Bundling Policies

Consider bundling your insurance policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies, such as combining liability insurance with property insurance or workers’ compensation insurance.

Risk Management and Loss Control

Implementing effective risk management strategies can not only mitigate potential risks but also lead to lower insurance premiums. This could include:

- Regular safety audits and training for employees.

- Installing security systems or implementing safety protocols.

- Maintaining a clean and organized workplace.

- Developing a comprehensive incident response plan.

Negotiate and Shop Around

Don’t be afraid to negotiate with insurance providers. Shop around and compare quotes from multiple insurers. You might find significant variations in premiums for similar coverage, so it’s worth the effort to explore your options.

Choose a Higher Deductible

Opting for a higher deductible can result in lower premiums. However, this strategy requires careful consideration, as you’ll need to ensure you have sufficient funds to cover the deductible in the event of a claim.

Case Study: Comparing Liability Insurance Costs

Let’s consider a case study to illustrate the variation in liability insurance costs based on different business profiles.

Business Profile 1: Jane’s Bakery

Jane operates a small bakery in a suburban area. Her business has been in operation for 5 years with no claims history. The bakery primarily serves the local community and has an annual revenue of $250,000.

For Jane's bakery, the average cost of liability insurance is estimated to be $800 to $1,200 per year for a $1 million coverage limit. This estimate considers the low-risk nature of her business and her favorable claims history.

Business Profile 2: TechStart Inc.

TechStart is a startup technology firm located in an urban area. They provide software development services and have been in operation for 2 years. The company has an annual revenue of $500,000 and a small claims history related to copyright infringement.

Given the nature of their business and their claims history, TechStart can expect to pay $1,500 to $2,000 per year for a $1 million coverage limit. This higher premium is due to the increased risk associated with their industry and the claims history.

Business Profile 3: BuildR Construction

BuildR is a construction company specializing in residential projects. They have been in business for 10 years and have an annual revenue of $1.5 million. BuildR has a history of claims related to property damage and bodily injury, primarily due to the nature of their work.

Due to the high-risk nature of their industry and their claims history, BuildR can expect to pay a premium of $3,000 to $4,500 per year for a $2 million coverage limit. This example highlights the significant impact that industry and claims history can have on insurance costs.

The Future of Liability Insurance for Small Businesses

As the business landscape continues to evolve, so too will the landscape of liability insurance. Small businesses can expect to see an increasing focus on risk assessment and management as insurers strive to provide more tailored coverage options.

With advancements in technology, insurers are now able to leverage data analytics and artificial intelligence to more accurately assess risks. This shift is likely to result in more precise pricing models, allowing small businesses to access coverage that better aligns with their specific needs.

Additionally, the rise of insurtech (insurance technology) startups is expected to disrupt the traditional insurance industry. These startups are bringing innovative solutions, such as on-demand insurance and usage-based coverage, which could offer more flexibility and affordability for small businesses.

However, it's important for small business owners to remain vigilant in their risk management efforts. While insurance coverage is essential, it should be seen as a last line of defense. Prioritizing safety, implementing robust risk management strategies, and maintaining a strong safety culture within the business are key to long-term success and financial stability.

Conclusion

Navigating the world of liability insurance for small businesses can be complex, but understanding the factors that influence cost and implementing strategic approaches can make a significant difference. By staying informed, comparing options, and actively managing risks, small business owners can secure the coverage they need without straining their finances.

What is the average cost of liability insurance for small businesses?

+The average cost of liability insurance for small businesses can vary widely based on factors such as industry, location, revenue, and claims history. However, as a general guideline, you can expect to pay anywhere from 500 to 3,000 annually for a $1 million coverage limit. It’s important to note that these figures are just estimates, and actual costs can be higher or lower depending on your specific circumstances.

How often should I review my liability insurance coverage and premiums?

+It’s a good practice to review your liability insurance coverage and premiums at least once a year, or whenever there are significant changes to your business operations, such as expansion, relocation, or new services offered. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

What happens if I can’t afford the liability insurance premium quoted to me?

+If the quoted premium seems unaffordable, it’s important to remember that you have options. You can explore different insurers to find more competitive rates, negotiate with your current insurer to see if they can offer a better deal, or consider adjusting your coverage limits or deductibles to make the premium more manageable. It’s crucial not to forego insurance altogether, as the financial consequences of an uninsured liability claim can be devastating.