Job Insurance

Job insurance, also known as unemployment insurance, is a vital safety net for individuals facing unexpected job loss. In today's dynamic and sometimes uncertain job market, having a robust understanding of job insurance and its benefits is essential. This article aims to provide an in-depth exploration of job insurance, covering its history, mechanics, eligibility criteria, and the benefits it offers to those who need it most.

The Evolution of Job Insurance: A Brief Historical Perspective

The concept of job insurance has its roots in the early 20th century, arising from a growing awareness of the vulnerabilities faced by workers in an increasingly industrialized world. The Great Depression of the 1930s played a pivotal role in shaping modern unemployment insurance programs. During this period, high unemployment rates highlighted the need for a social safety net to protect workers and their families.

In the United States, the Social Security Act of 1935 established the foundation for federal unemployment insurance, with individual states given the responsibility of administering and funding the programs. This federal-state partnership has been a hallmark of unemployment insurance in the US ever since.

Over the decades, job insurance programs have evolved to adapt to changing economic landscapes and societal needs. They have expanded to cover a broader range of workers, including those in part-time and contingent employment, and have introduced more flexible eligibility criteria to ensure a wider net of protection.

How Job Insurance Works: An Overview of the Mechanics

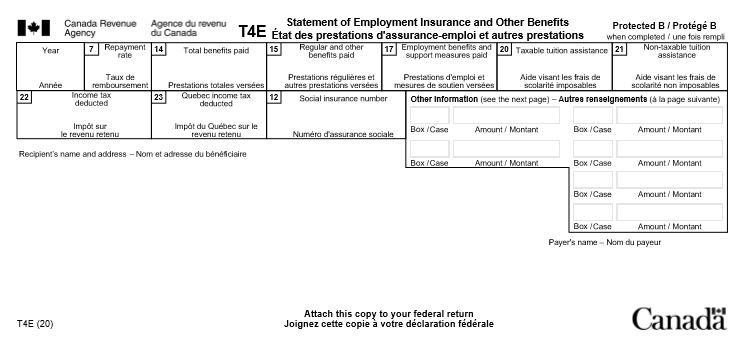

Job insurance, at its core, is a mutual agreement between workers, employers, and the government. Workers contribute a small portion of their earnings through payroll taxes, while employers also contribute a share. These funds are then pooled to provide temporary financial assistance to individuals who become unemployed through no fault of their own.

When a worker becomes unemployed, they can apply for job insurance benefits. The process typically involves verifying their eligibility, which includes demonstrating that they have lost their job through no fault of their own, such as a company closure or layoff. They must also meet certain work and wage requirements during a base period, which is usually the most recent 12 to 18 months of employment.

Once eligibility is established, the worker receives a weekly benefit amount, which is typically a fraction of their previous earnings. The duration of these benefits varies by state and can range from a few months to over a year. These payments provide a financial buffer, allowing the individual time to search for a new job without immediate financial strain.

The Role of State Agencies

Each state has its own unemployment insurance agency, which administers the program on behalf of the federal government. These agencies are responsible for determining eligibility, calculating benefit amounts, and disbursing payments to eligible individuals. They also provide a range of reemployment services, including job search assistance, career counseling, and training opportunities to help individuals find new employment.

Funding and Sustainability

The funding for job insurance programs comes from a combination of federal and state tax revenues. At the federal level, the Unemployment Trust Fund, which is part of the Social Security Administration, manages the Federal Unemployment Tax and provides states with funds to administer their programs. States also levy their own unemployment taxes on employers to contribute to the funding pool.

To ensure the sustainability of these programs, states often have reserve funds and trust funds that can be tapped during periods of high unemployment. These reserves are built up during times of low unemployment, when there are fewer claims being made on the system.

Eligibility Criteria: Who Qualifies for Job Insurance Benefits

Eligibility for job insurance benefits is typically determined by a set of criteria that varies slightly from state to state. However, there are some common factors that apply across the board.

Work and Wage Requirements

To qualify for job insurance, individuals must have earned a certain amount of wages during a specified period, known as the base period. This base period is typically the first four of the last five completed calendar quarters before the individual files a claim. For example, if a person files a claim in January 2023, the base period would be the four quarters from October 1, 2021, to September 30, 2022.

During this base period, the individual must have earned a minimum amount of wages, which is set by each state. This ensures that the person has a recent history of employment and has contributed to the unemployment insurance system. The exact amount required varies by state, but it is typically a minimum of a few thousand dollars earned during the base period.

Separation from Employment

Individuals must also have separated from their employment through no fault of their own. This means that they did not quit voluntarily or get fired for misconduct. Acceptable reasons for separation include company closures, layoffs due to economic conditions, or other circumstances beyond the worker’s control.

Able and Available for Work

To receive job insurance benefits, individuals must be both able and available for work. This means they must be physically and mentally capable of performing their previous job or a similar job and must be actively seeking employment. They cannot refuse suitable work opportunities without a good reason, such as family obligations or health issues.

Active Job Search

Job insurance programs typically require individuals to actively search for employment while receiving benefits. This involves applying for jobs, attending interviews, and participating in job fairs or other employment-related activities. Some states may also require individuals to register with their state employment service and attend reemployment services workshops.

Benefits of Job Insurance: A Financial Safety Net and More

Job insurance provides more than just financial assistance during periods of unemployment. It offers a range of benefits that can help individuals navigate the challenges of job loss and re-entry into the workforce.

Financial Support

The primary benefit of job insurance is the financial support it provides during a time of need. Unemployment benefits offer a temporary income stream, helping individuals meet their basic needs and maintain financial stability while they search for a new job. This support can be crucial for covering living expenses, paying bills, and avoiding financial hardship.

| State | Maximum Weekly Benefit Amount |

|---|---|

| Alabama | $275 |

| Alaska | $620 |

| Arizona | $240 |

| Arkansas | $309 |

| California | $450 |

The weekly benefit amount an individual receives is typically a percentage of their previous earnings, up to a state-defined maximum. This amount is designed to provide a reasonable level of support without discouraging individuals from finding new employment.

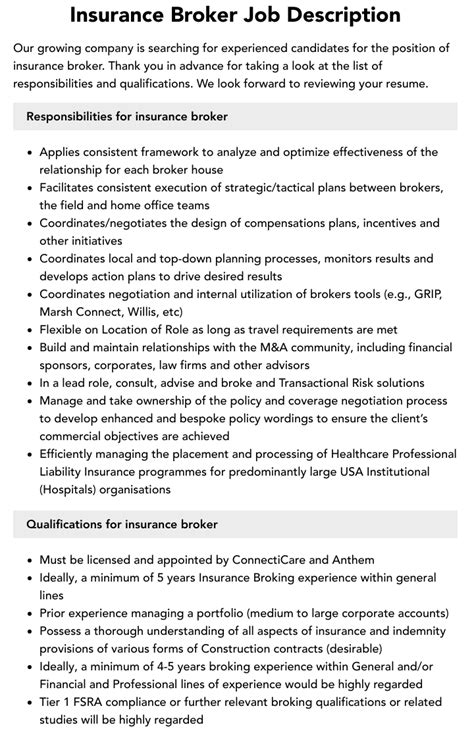

Reemployment Services

Job insurance programs often provide a range of reemployment services to help individuals get back on their feet and into the workforce. These services can include:

- Job Search Assistance: Help with crafting resumes, cover letters, and job applications, as well as guidance on job search strategies and resources.

- Career Counseling: One-on-one sessions with career counselors who can assess an individual's skills, interests, and goals to help them identify suitable career paths and opportunities.

- Training and Education: Funding for training programs, workshops, or courses to help individuals upgrade their skills or acquire new ones, making them more competitive in the job market.

- Job Fairs and Recruitment Events: Access to job fairs, networking events, and other recruitment opportunities where individuals can meet potential employers and explore job openings.

Extended Benefits and Emergency Assistance

In times of high unemployment, states may offer extended benefits to individuals who have exhausted their regular job insurance benefits. These extended benefits provide additional weeks of financial support to help individuals bridge the gap until they can find a new job.

Additionally, some states provide emergency assistance programs for individuals who have no other means of support and are in dire financial straits. These programs can offer temporary cash assistance, food stamps, or other forms of relief to help individuals meet their most basic needs.

Conclusion: Job Insurance as a Crucial Social Safety Net

Job insurance is a cornerstone of social welfare, providing a vital safety net for individuals facing unexpected job loss. It offers not only financial support but also a range of services and resources to help individuals re-enter the workforce and rebuild their financial stability. By understanding the mechanics and benefits of job insurance, individuals can better navigate the challenges of unemployment and take advantage of the support systems in place to help them through this difficult time.

As the job market continues to evolve, the role of job insurance remains critical in protecting workers and promoting economic stability. It is a system designed to support individuals and families during periods of transition, ensuring that no one is left behind when it comes to economic opportunity and security.

How often can I receive job insurance benefits?

+You can typically receive job insurance benefits once every 12 months. This means if you exhaust your benefits and find a new job, you may be eligible for benefits again if you become unemployed from that new job within a year.

Can I receive job insurance benefits if I quit my job voluntarily?

+Generally, no. Job insurance benefits are designed for individuals who become unemployed through no fault of their own. If you quit your job voluntarily, you may not be eligible for benefits unless you can demonstrate compelling reasons, such as health issues or family obligations.

What happens if I’m denied job insurance benefits?

+If you are denied job insurance benefits, you have the right to appeal the decision. The appeal process involves a hearing where you can present your case and provide additional evidence to support your eligibility. It’s important to carefully review the denial notice and follow the instructions for appealing the decision.

Are there any restrictions on how I use my job insurance benefits?

+Yes, there are certain restrictions on how you can use your job insurance benefits. For example, you cannot use these benefits to start your own business or invest in the stock market. The funds are intended solely for your basic living expenses while you are unemployed and actively seeking new employment.

How long do I have to wait before receiving job insurance benefits?

+The waiting period for job insurance benefits varies by state. In most states, there is a one-week waiting period, during which you are not eligible to receive benefits. This waiting period does not count towards your benefit duration, so it effectively reduces the total number of weeks you can receive payments.