Jewelry Insurance Companies

In the world of precious possessions, jewelry stands out as a unique and valuable asset. From family heirlooms to exquisite designer pieces, these adornments hold not just monetary value but also sentimental and emotional significance. As such, it is imperative to ensure their safety and security. This is where jewelry insurance companies step in, offering specialized coverage to protect these cherished items.

The market for jewelry insurance is vast and varied, with numerous companies providing tailored policies to cater to the diverse needs of jewelry owners. These policies are designed to provide comprehensive protection against a range of risks, ensuring that your precious gems and metals remain safeguarded.

Understanding the Importance of Jewelry Insurance

Jewelry insurance is an essential consideration for anyone who owns valuable jewelry. It offers peace of mind, knowing that your cherished possessions are protected against loss, theft, or damage. Whether you have an engagement ring, a diamond necklace, or a collection of antique jewelry, insuring these items ensures that you can replace or repair them should the unexpected occur.

The need for jewelry insurance extends beyond the financial aspect. Jewelry often carries profound sentimental value, making it irreplaceable. Insuring your jewelry provides an added layer of security, ensuring that your precious memories are protected.

Leading Jewelry Insurance Companies and Their Offerings

The jewelry insurance market boasts a range of reputable companies, each with its unique features and benefits. Here's an in-depth look at some of the leading players and their offerings:

Chubb Insurance

Chubb is renowned for its comprehensive jewelry insurance policies. Their plans offer coverage for a wide range of jewelry, including engagement rings, wedding bands, and fine jewelry collections. Chubb's policies provide protection against theft, loss, and damage, ensuring that your jewelry is safeguarded in various situations.

One of the standout features of Chubb's jewelry insurance is their All Risks Coverage. This means that your jewelry is covered against all unforeseen circumstances, providing you with the highest level of protection. Additionally, Chubb offers flexible coverage limits, allowing you to tailor your policy to the value of your jewelry collection.

Chubb also provides a Valuation Service to ensure that your jewelry is insured for its true value. Their expert gemologists assess and value your jewelry, ensuring that you receive adequate coverage. Furthermore, Chubb's policies include Worldwide Coverage, meaning your jewelry is protected no matter where you are.

| Coverage Type | Details |

|---|---|

| All Risks | Protects against theft, loss, and damage |

| Valuation Service | Expert assessment for accurate coverage |

| Worldwide Coverage | Protection regardless of location |

Jeweler's Mutual Insurance Group

Jeweler's Mutual is a specialist insurance provider, focusing exclusively on jewelry and jewelry-related businesses. Their Personal Jewelry Insurance policies are designed to offer comprehensive coverage for individuals with valuable jewelry collections.

Jeweler's Mutual stands out for its Flexibility and Customization. They allow you to tailor your policy to your specific needs, ensuring that you only pay for the coverage you require. Their plans include coverage for Accidental Damage, Mysterious Disappearance, and Worldwide Travel, ensuring your jewelry is protected during all your journeys.

Additionally, Jeweler's Mutual provides a Lost Jewelry Recovery Service, which assists in recovering or replacing lost jewelry items. This service is a unique offering that sets them apart from other insurance providers.

| Coverage Type | Details |

|---|---|

| Accidental Damage | Covers repairs or replacements |

| Mysterious Disappearance | Protects against theft or loss |

| Worldwide Travel | Coverage during international trips |

| Lost Jewelry Recovery Service | Assistance in recovering or replacing lost items |

State Farm Insurance

State Farm offers a comprehensive Personal Articles Policy (PAP) specifically designed for valuable possessions like jewelry. Their PAP provides All-Risk Coverage, ensuring your jewelry is protected against a wide range of potential risks.

One of the key advantages of State Farm's jewelry insurance is their Replacement Cost Coverage. This means that in the event of a claim, you will receive the full cost to replace your jewelry, ensuring you can purchase a similar item of the same quality.

State Farm also offers a Jewelry Inspection Service, where their experts can assess your jewelry to ensure it is adequately insured. This service helps to maintain the value of your jewelry and ensures you have the correct coverage.

| Coverage Type | Details |

|---|---|

| All-Risk Coverage | Protects against various risks |

| Replacement Cost Coverage | Replaces items with similar quality |

| Jewelry Inspection Service | Expert assessment for accurate coverage |

Key Considerations When Choosing a Jewelry Insurance Company

When selecting a jewelry insurance company, there are several crucial factors to consider. These factors will ensure that you choose a policy that best suits your needs and provides the highest level of protection for your valuable jewelry.

Coverage Options

First and foremost, assess the coverage options provided by the insurance company. Look for comprehensive coverage that includes protection against theft, loss, and damage. Some policies may offer additional coverage for specific situations, such as mysterious disappearance or worldwide travel. Ensure that the coverage limits are adequate for your jewelry's value.

Valuation Services

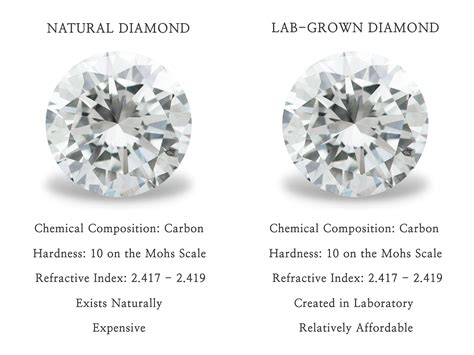

It is essential to insure your jewelry for its true value. Look for insurance companies that provide professional valuation services. These services ensure that your jewelry is accurately assessed, allowing you to receive the correct coverage and ensuring you are not underinsured.

Claims Process

Understanding the claims process is crucial. Research the insurance company's claims procedure, including the time it takes to process claims and the steps involved. Look for companies with a simplified claims process, ensuring that you can receive compensation quickly and efficiently in the event of a loss.

Additional Benefits

Some jewelry insurance companies offer additional benefits that can enhance your coverage. These may include lost jewelry recovery services, replacement cost coverage, or even discounts on jewelry repairs or maintenance. Consider these benefits when comparing insurance providers to find the best fit for your needs.

Expert Tips for Maximizing Jewelry Insurance Coverage

To ensure you get the most out of your jewelry insurance, here are some expert tips to consider:

- Regularly Update Your Policy: As your jewelry collection grows or its value increases, ensure you update your policy accordingly. This ensures that you always have adequate coverage.

- Keep Detailed Records: Maintain a comprehensive record of your jewelry, including purchase receipts, appraisals, and photographs. These records can be invaluable in the event of a claim.

- Consider All-Risk Coverage: Opt for insurance policies that offer all-risk coverage. This type of coverage provides protection against a wide range of unforeseen circumstances, ensuring your jewelry is adequately safeguarded.

- Use Reputable Jewelers: When purchasing jewelry, opt for reputable jewelers who provide accurate valuations and certifications. This ensures that your jewelry is valued correctly and can be easily replaced if needed.

- Regularly Inspect Your Jewelry: Schedule regular inspections with a professional jeweler to ensure your jewelry is in good condition. This can help identify any potential issues and ensure your insurance coverage remains valid.

Frequently Asked Questions

How often should I update my jewelry insurance policy?

+It is recommended to review and update your jewelry insurance policy annually or whenever there is a significant change in your jewelry collection's value. This ensures that your coverage remains adequate and up-to-date.

<div class="faq-item">

<div class="faq-question">

<h3>Can I insure antique or vintage jewelry?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many jewelry insurance companies offer coverage for antique and vintage jewelry. However, it is important to provide accurate details and valuations for these unique pieces to ensure proper coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I lose my jewelry while traveling internationally?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you have a jewelry insurance policy with <strong>Worldwide Coverage</strong>, your jewelry is protected even when you're traveling internationally. However, it is essential to check the specific terms and conditions of your policy for any exclusions or limitations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I insure a custom-designed jewelry piece?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Jewelry insurance policies often cover custom-designed pieces. It is crucial to have the piece professionally appraised and to provide detailed information to your insurance provider to ensure proper coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I file a claim with my jewelry insurance company?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The claims process varies depending on the insurance company. Typically, you will need to contact your insurer, provide details of the loss or damage, and submit supporting documentation such as police reports or appraisals. It is advisable to review your policy's claims procedure beforehand.</p>

</div>

</div>

</div>

Choosing the right jewelry insurance company is a crucial step in protecting your valuable possessions. By understanding the offerings of leading providers and considering key factors, you can make an informed decision. Remember, jewelry insurance is not just about financial protection but also about safeguarding the precious memories and sentiments attached to these exquisite adornments.