Washington State Insurance

Washington State, nestled in the Pacific Northwest region of the United States, boasts a unique landscape of lush forests, majestic mountains, and vibrant cities. With its diverse geography and thriving industries, it's no surprise that the insurance sector plays a vital role in safeguarding the interests of individuals, businesses, and communities across the state.

In this comprehensive guide, we delve into the intricacies of Washington State Insurance, exploring its regulatory framework, key players, and the impact it has on the lives and livelihoods of Washingtonians. By understanding the nuances of this essential industry, we can navigate the complex world of insurance with confidence and make informed decisions to protect what matters most.

The Regulatory Landscape: A Foundation for Trust

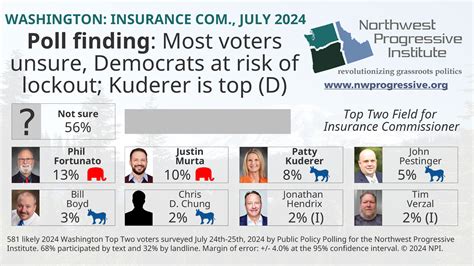

At the heart of Washington State Insurance lies a robust regulatory system, designed to ensure fairness, transparency, and consumer protection. The Office of the Insurance Commissioner (OIC), headed by the elected Insurance Commissioner, serves as the primary regulatory authority, overseeing a wide range of insurance-related activities.

The OIC's mandate extends beyond mere oversight. It actively promotes competition, ensures insurer solvency, and provides valuable resources and education to empower consumers. By setting standards and enforcing regulations, the OIC creates a stable and trustworthy environment, fostering confidence in the insurance market.

One of the key responsibilities of the OIC is the approval and regulation of insurance rates. Through rigorous review processes, the OIC ensures that rates are not excessive, inadequate, or unfairly discriminatory. This critical function safeguards consumers from exorbitant premiums and promotes a competitive marketplace where insurers can thrive.

| Key Regulatory Milestones | Impact on Washington State Insurance |

|---|---|

| Enactment of the Washington Insurance Code in 1947 | Provided a comprehensive framework for insurance regulation, setting the foundation for the industry's growth and development. |

| Introduction of the Washington Consumer Protection Act (CPA) in 1961 | Empowered consumers by prohibiting unfair and deceptive practices, fostering a more equitable insurance market. |

| Implementation of the Washington Health Security Act (HSA) in 1993 | Enhanced access to affordable healthcare by mandating coverage for essential health benefits and implementing reforms to control costs. |

Understanding Insurance Coverage in Washington State

Washington State offers a diverse range of insurance products to meet the unique needs of its residents and businesses. From auto and homeowners’ insurance to health, life, and commercial policies, the market caters to various risk profiles and preferences.

For those seeking auto insurance, Washington State requires minimum liability coverage to protect against bodily injury and property damage. However, with the state's diverse driving conditions and potential risks, many opt for comprehensive coverage to ensure adequate protection. The OIC provides valuable resources to help consumers understand their options and make informed choices.

Homeowners in Washington State face a range of risks, from earthquakes to wildfires. As such, comprehensive homeowners' insurance is crucial to protect against property damage and liability. The OIC offers guidance on choosing the right coverage, including tips on understanding deductibles and endorsements to tailor policies to individual needs.

Health Insurance: A Focus on Accessibility and Affordability

Access to quality healthcare is a priority for Washington State, and insurance plays a pivotal role in ensuring residents can obtain the medical care they need. The state has implemented various initiatives to enhance affordability and expand coverage.

The Washington Health Benefit Exchange, also known as WA Healthplanfinder, serves as a central marketplace for individuals and small businesses to compare and purchase health insurance plans. This platform, established under the Affordable Care Act, has helped thousands of Washingtonians find affordable coverage, offering a range of options from multiple insurers.

In addition, Washington State has expanded Medicaid eligibility, providing coverage to low-income individuals and families who may not have otherwise had access to healthcare. This expansion has significantly improved healthcare access and outcomes for vulnerable populations across the state.

The Insurance Industry: Key Players and Contributions

Washington State’s insurance sector is a vibrant and dynamic ecosystem, comprised of a diverse range of insurers, brokers, and other industry professionals. These key players contribute to the state’s economic vitality and play a crucial role in protecting the interests of individuals and businesses.

Among the leading insurance carriers in Washington State, names like State Farm, Allstate, and Progressive stand out. These companies offer a comprehensive range of insurance products, from auto and homeowners' insurance to life and health coverage. Their presence in the state provides residents with a wide array of options, fostering competition and driving innovation.

In addition to insurance carriers, a network of independent insurance brokers operates across Washington State. These brokers serve as trusted advisors, helping individuals and businesses navigate the complex world of insurance. They provide personalized guidance, compare policies from multiple carriers, and ensure their clients obtain the coverage that best meets their unique needs.

The Impact of Insurance on Washington’s Economy

The insurance industry’s contributions to Washington State’s economy are significant and far-reaching. It provides stability and security to individuals and businesses, allowing them to focus on growth and innovation without the fear of financial ruin due to unforeseen events.

Insurance carriers and brokers employ thousands of individuals across the state, creating well-paying jobs and contributing to economic growth. Beyond employment, the industry's economic impact extends to tax revenue, as insurers contribute significantly to state and local coffers through premiums and other taxes.

Furthermore, the insurance industry plays a vital role in facilitating economic development. By providing coverage for businesses, insurers enable companies to take risks, expand operations, and create new opportunities. This, in turn, stimulates job creation, drives innovation, and strengthens the state's overall economic resilience.

Navigating Claims and Dispute Resolution

While insurance provides essential protection, disputes and claims can arise. Washington State has established a robust system for resolving insurance-related conflicts, ensuring fairness and protecting the rights of policyholders.

For consumers facing disputes with their insurance carriers, the Office of the Insurance Commissioner (OIC) offers a range of resources and assistance. Policyholders can file complaints, seek guidance on their rights, and access mediation services to resolve disputes without resorting to litigation.

In cases where mediation fails to bring about a satisfactory resolution, Washington State provides access to a neutral and independent dispute resolution process. The Washington State Office of Administrative Hearings (OAH) conducts formal hearings to address insurance-related disputes, ensuring a fair and impartial decision-making process.

The Role of Consumer Protection

Washington State is committed to protecting consumers from unfair and deceptive insurance practices. The OIC plays a critical role in enforcing consumer protection laws, ensuring insurers act in good faith and treat policyholders fairly.

Through proactive monitoring and enforcement, the OIC identifies and addresses violations of consumer protection laws. This includes investigating complaints, conducting market conduct exams, and taking legal action against insurers engaging in deceptive practices.

In addition to its regulatory and enforcement functions, the OIC provides valuable educational resources to empower consumers. The agency's website offers a wealth of information, including guides on choosing the right insurance, understanding policy terms, and navigating the claims process. By arming consumers with knowledge, the OIC helps them make informed decisions and advocate for their rights.

The Future of Washington State Insurance: Innovations and Opportunities

As technology advances and consumer expectations evolve, the insurance industry in Washington State is embracing innovation to stay ahead of the curve. Insurers are leveraging digital tools and data analytics to enhance efficiency, personalize coverage, and improve the overall customer experience.

One notable trend is the rise of usage-based insurance (UBI) in the auto insurance sector. UBI policies, which are based on an individual's actual driving behavior, offer the potential for significant savings for safe drivers. By installing telematics devices or using smartphone apps, insurers can track driving habits and reward safe driving with lower premiums.

In the health insurance arena, Washington State is exploring the potential of value-based care models. These innovative approaches focus on delivering high-quality, coordinated care while controlling costs. By incentivizing providers to prioritize patient outcomes and prevent costly complications, value-based care has the potential to transform the healthcare system and improve patient experiences.

Conclusion: A Bright Future for Washington State Insurance

Washington State’s insurance sector is poised for continued growth and innovation, driven by a robust regulatory framework, a dynamic industry, and a commitment to consumer protection. As the state embraces technological advancements and explores new models of care, the insurance industry will play a pivotal role in shaping a brighter and more secure future for Washingtonians.

By staying informed and engaged, consumers can make the most of their insurance coverage, protecting their families, businesses, and communities. With a strong regulatory foundation and a vibrant industry, Washington State Insurance is well-positioned to meet the evolving needs of its residents and businesses, ensuring a stable and prosperous future for all.

What are the mandatory insurance requirements in Washington State for auto and homeowners’ policies?

+For auto insurance, Washington State requires liability coverage with minimum limits of 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $10,000 for property damage. Homeowners’ insurance requirements vary based on the type of dwelling and location, but typically include coverage for the dwelling, personal property, and liability.

How can I find affordable health insurance in Washington State?

+Washington State offers a range of options for affordable health insurance. You can start by visiting the WA Healthplanfinder website, where you can compare plans, check eligibility for subsidies, and enroll in coverage. Additionally, expanding Medicaid eligibility has made healthcare more accessible to low-income individuals and families.

What resources are available for consumers facing insurance disputes in Washington State?

+The Office of the Insurance Commissioner (OIC) provides a range of resources and assistance for consumers facing insurance disputes. You can file complaints, seek guidance on your rights, and access mediation services through the OIC’s website. In cases where mediation is unsuccessful, you can pursue formal hearings through the Washington State Office of Administrative Hearings (OAH).