How Much Do You Usually Get For Social Security Insurance

The amount of Social Security benefits you receive is a topic of great interest and importance for individuals planning their retirement or seeking financial security. This comprehensive article aims to delve into the intricacies of Social Security Insurance (SSI) benefits, providing an in-depth analysis of the factors that influence the benefit amounts and offering valuable insights to help readers understand their potential entitlement.

Understanding Social Security Insurance Benefits

Social Security Insurance, often referred to as SSI, is a federal program in the United States designed to provide financial assistance to individuals who are aged, blind, or disabled and have limited income and resources. It is a crucial safety net for many Americans, ensuring a basic level of financial support during their retirement years or in times of disability.

The SSI program is distinct from the Social Security Retirement Benefits, which are based on an individual's earnings history. SSI, on the other hand, is a needs-based program, meaning the amount of benefits one receives is determined by their financial need rather than their work record. This makes SSI an essential component of the Social Security system, ensuring that those with limited means can still access vital financial support.

Factors Influencing SSI Benefit Amounts

The calculation of SSI benefits is a complex process that takes into account several key factors. These factors are used to determine an individual’s financial need and, consequently, the amount of SSI benefits they are entitled to receive. Here are the primary factors that influence SSI benefit amounts:

- Income: The SSI program has strict income limits. If an individual has countable income, such as earnings from work, pensions, or other sources, this will affect their SSI benefit amount. The Social Security Administration (SSA) considers both earned income and unearned income when determining an individual's countable income. Generally, the higher the countable income, the lower the SSI benefit.

- Resources: In addition to income, the SSA also considers an individual's resources, which include assets such as bank accounts, real estate, and vehicles. Each state has its own resource limits, and if an individual's resources exceed these limits, it can impact their SSI benefit eligibility or amount.

- Living Arrangements: The SSA adjusts SSI benefits based on an individual's living arrangements. For instance, if an individual lives in a community setting or receives in-kind support and maintenance, their SSI benefit may be reduced.

- Marital Status: Being married can impact an individual's SSI benefit. If a spouse or eligible partner has income or resources, this can affect the SSI benefit amount for both individuals.

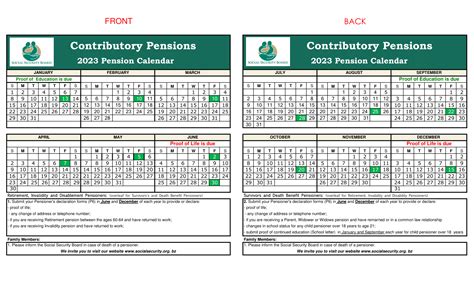

- State Supplementation: Some states provide additional SSI benefits, known as state supplementation, to increase the total benefit amount. The availability and amount of state supplementation vary from state to state.

The SSI benefit calculation is not a simple formula. It involves a detailed assessment of an individual's financial situation, and the SSA uses complex rules and guidelines to determine the exact benefit amount. As a result, it is essential for individuals to understand these factors and how they may impact their SSI benefits.

| Factor | Description |

|---|---|

| Income | Earned and unearned income that affects benefit amounts. |

| Resources | Assets and property that can influence eligibility and benefit amounts. |

| Living Arrangements | Housing and support arrangements that impact benefit adjustments. |

| Marital Status | The financial situation of a spouse or eligible partner can affect individual benefits. |

| State Supplementation | Additional benefits provided by some states to increase total SSI amounts. |

Determining Your SSI Benefit Amount

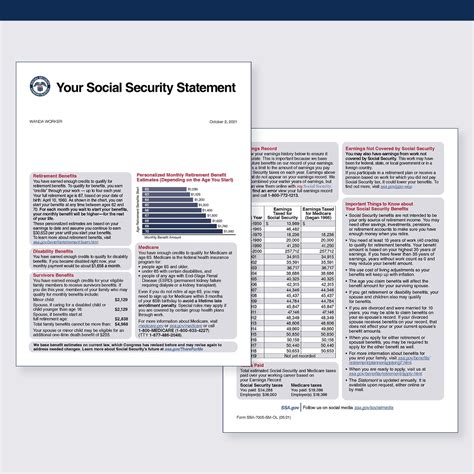

Calculating your potential SSI benefit amount is a critical step in understanding your financial security. While the exact calculation is complex and requires detailed financial information, here’s a simplified overview to give you a basic understanding of the process.

Step-by-Step Guide to Calculating SSI Benefits

- Determine Countable Income: Start by calculating your countable income. This includes most types of income, such as wages, pensions, Social Security benefits, and certain types of assistance. However, some income, like tax refunds and one-time payments, is not counted.

- Subtract Exclusions: Certain types of income are excluded from the countable income calculation. These exclusions can include a portion of your earned income, some types of food assistance, and shelter costs. Subtract these exclusions from your countable income.

- Calculate Monthly Income: Divide your remaining countable income by the number of months in the assessment period. This gives you your monthly countable income.

- Subtract Deeming Amounts: If you live with a sponsor who is providing financial support, the SSA may deem a portion of the sponsor’s income as your own. Subtract these deemed amounts from your monthly countable income.

- Compare with Federal Benefit Rate: The Federal Benefit Rate (FBR) is the maximum SSI benefit amount. If your countable income is less than the FBR, you are eligible for SSI benefits. The amount you receive will be the difference between your countable income and the FBR.

It's important to remember that this is a simplified guide, and the actual calculation involves many more details and considerations. For an accurate assessment of your potential SSI benefit, it's best to consult the official resources provided by the Social Security Administration or seek advice from a qualified professional.

Real-Life Examples of SSI Benefit Calculations

Let’s look at a few scenarios to better understand how SSI benefits are calculated in practice.

- Example 1: John, a single individual, has an annual countable income of $8,000 and no deemed income. The FBR for an individual is $841 per month. John's monthly countable income is $666.67 ($8,000 / 12 months). Since this is less than the FBR, John is eligible for SSI benefits. His monthly SSI benefit would be $174.33 ($841 - $666.67).

- Example 2: Maria, a married individual, has a countable income of $10,000 per year and her spouse has a countable income of $5,000. The couple's deemed income is $2,000. The FBR for a couple is $1,262 per month. Maria's monthly countable income is $833.33 ($10,000 / 12 months), and her spouse's is $416.67 ($5,000 / 12 months). Their combined countable income is $1,250 ($833.33 + $416.67). After subtracting the deemed income of $2,000, their monthly countable income is $0. Therefore, they are eligible for the full FBR of $1,262 in SSI benefits.

Maximizing Your SSI Benefits

Understanding how to maximize your SSI benefits is crucial for ensuring you receive the financial support you’re entitled to. While the primary focus of SSI is on meeting basic needs, there are strategies you can employ to potentially increase your benefit amount.

Strategies to Increase SSI Benefits

- Exploit Income and Resource Limits: SSI has income and resource limits, and understanding these limits can help you structure your finances to maximize your benefits. For example, you may be able to reduce your countable income by investing in certain types of assets or using financial tools that reduce taxable income.

- State Supplementation: As mentioned earlier, some states provide additional SSI benefits. If you live in one of these states or are considering a move, researching and understanding state supplementation can help you receive a higher total benefit amount.

- Consider Living Arrangements: The SSA adjusts SSI benefits based on living arrangements. If you live in a community setting or receive in-kind support and maintenance, your SSI benefit may be reduced. However, there are strategies you can employ to potentially mitigate these reductions, such as ensuring that you are contributing to your share of the living expenses.

- Marriage and SSI: If you’re married, your spouse’s income and resources can affect your SSI benefit. However, there are certain circumstances where marriage can actually increase your combined SSI benefits. For instance, if your spouse has higher countable income and you have limited resources, marriage can result in a higher total SSI benefit.

It's important to note that while these strategies can help maximize your SSI benefits, they should be implemented with caution and within the boundaries of the law. Misrepresenting your financial situation or engaging in illegal activities to increase your SSI benefits can result in severe penalties, including loss of benefits and legal repercussions.

Future Implications and Policy Changes

The Social Security system, including SSI, is subject to ongoing policy discussions and potential legislative changes. Understanding these potential changes is crucial for individuals relying on SSI benefits to plan for their future financial security.

Potential Policy Changes and Their Impact

There are several proposed changes to the SSI program that could impact benefit amounts and eligibility. Here are some key potential changes and their potential implications:

- Income and Resource Limits: Proposed changes to the income and resource limits could affect the number of individuals eligible for SSI benefits and the amount they receive. For instance, if the income limits are lowered, more individuals with lower incomes may become eligible for SSI, but those with slightly higher incomes may lose their benefits.

- Inflation Adjustments: The current cost-of-living adjustments (COLAs) ensure that SSI benefits keep pace with inflation. However, there are proposals to change the COLA calculation method, which could result in slower growth of SSI benefits over time.

- State Supplementation: The availability and amount of state supplementation vary widely across states. There have been discussions about standardizing or eliminating state supplementation, which could significantly impact the total benefit amounts for individuals in states that currently provide supplementation.

- Living Arrangements: The SSA's policies regarding living arrangements and their impact on SSI benefits are often complex and can lead to inequities. Proposed changes to these policies could simplify the process and ensure more consistent treatment of individuals with similar living situations.

It's important to stay informed about these potential policy changes, as they can have a significant impact on your SSI benefits. Engaging with advocacy groups, staying updated through official government channels, and seeking professional advice can help you navigate these changes and ensure you receive the benefits you're entitled to.

Conclusion

Understanding your Social Security Insurance benefits is a critical component of financial planning, especially for those who rely on SSI for their basic needs. By grasping the factors that influence SSI benefit amounts, learning how to calculate these benefits, and employing strategies to maximize them, individuals can ensure they receive the financial support they need and deserve.

The SSI program is a vital safety net for many Americans, and staying informed about potential policy changes is essential for navigating the complex landscape of Social Security benefits. With careful planning and a thorough understanding of the system, individuals can make the most of their SSI benefits and secure their financial future.

How often are SSI benefits adjusted for cost-of-living increases?

+SSI benefits are typically adjusted annually for cost-of-living increases. These adjustments are based on the increase in the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers (CPI-W), ensuring that benefits keep pace with inflation.

Are there any restrictions on how SSI benefits can be used?

+There are no restrictions on how SSI benefits can be used. Recipients are free to use their benefits for any legal purpose, including daily living expenses, medical costs, or personal financial needs.

Can SSI benefits be combined with other types of Social Security benefits?

+Yes, SSI benefits can be combined with other types of Social Security benefits, such as Social Security Retirement Benefits or Social Security Disability Insurance (SSDI). However, there may be income limits or other restrictions that impact the total combined benefit amount.