Is Car Insurance Required

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers and their vehicles. While the specific requirements and regulations vary from country to country, and even between states or provinces within a country, it is crucial to understand the necessity and implications of car insurance.

Understanding the Legal Requirements

In most jurisdictions, having car insurance is not just a matter of personal choice but a legal obligation. Governments implement these requirements to ensure the safety and financial stability of their citizens on the roads. The primary purpose of mandatory car insurance is to protect individuals from the potentially devastating financial consequences of accidents and other unforeseen events.

Compulsory Insurance Coverages

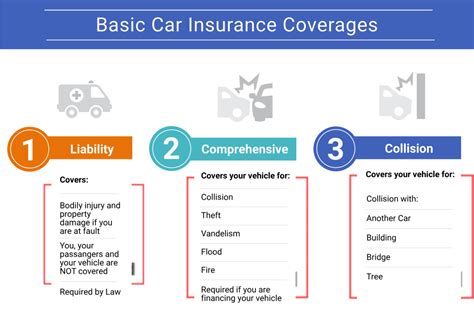

The exact types of insurance coverage that are compulsory differ based on location. However, there are some commonalities across various regions. Typically, liability insurance is a fundamental requirement. This type of insurance covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident.

Some jurisdictions also mandate personal injury protection (PIP) or medical payments coverage, which provide compensation for medical expenses and lost wages resulting from an accident, regardless of fault. Additionally, uninsured/underinsured motorist coverage may be required to protect policyholders from financial loss caused by drivers who lack adequate insurance.

| Insurance Type | Description |

|---|---|

| Liability Insurance | Covers bodily injury and property damage caused to others. |

| Personal Injury Protection (PIP) | Provides compensation for medical expenses and lost wages. |

| Uninsured/Underinsured Motorist Coverage | Protects against financial loss from drivers with insufficient insurance. |

Penalties for Non-Compliance

Failing to comply with the legal requirements for car insurance can result in severe penalties. These may include fines, license suspension, or even vehicle impoundment. In some cases, drivers caught without the necessary insurance coverage might face legal action, especially if they are involved in an accident.

The Benefits of Car Insurance

Beyond the legal obligations, car insurance offers a range of benefits that make it an indispensable aspect of vehicle ownership.

Financial Protection and Peace of Mind

One of the most significant advantages of car insurance is the financial protection it provides. In the event of an accident, the policyholder can rest assured that their insurance coverage will help cover the costs of repairs, medical expenses, and potential legal fees. This protection extends not only to the policyholder but also to any passengers or third parties involved in the incident.

Furthermore, car insurance offers peace of mind, knowing that one is prepared for unexpected events on the road. Whether it's a minor fender bender or a more severe collision, having insurance can significantly reduce the stress and financial burden associated with such incidents.

Additional Coverage Options

While the legal requirements typically focus on liability and personal injury protection, many insurance providers offer a range of optional coverage enhancements. These can include comprehensive coverage, which protects against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. Collision coverage is another popular option, providing coverage for damage to the insured vehicle in an accident, regardless of fault.

Additionally, policyholders can often customize their insurance plans with add-ons like rental car coverage, roadside assistance, or gap insurance, which covers the difference between the vehicle's actual value and the amount owed on a lease or loan in case of a total loss.

| Optional Coverage | Description |

|---|---|

| Comprehensive Coverage | Protects against non-collision incidents like theft or natural disasters. |

| Collision Coverage | Covers damage to the insured vehicle in an accident. |

| Rental Car Coverage | Provides compensation for rental expenses while the insured vehicle is being repaired. |

| Roadside Assistance | Offers emergency services like towing or battery jump-starts. |

| Gap Insurance | Covers the gap between a vehicle's value and outstanding lease/loan balance. |

Accident Response and Claims Management

Car insurance providers often offer comprehensive support and resources to policyholders in the event of an accident. This can include guidance on reporting the incident, navigating the claims process, and accessing necessary repairs or medical attention. Many insurance companies also provide access to a network of preferred repair shops and medical professionals, ensuring efficient and reliable services.

Choosing the Right Car Insurance

When selecting a car insurance policy, it’s crucial to consider one’s specific needs and circumstances. Factors such as the type of vehicle, driving history, location, and desired coverage levels all play a role in determining the most suitable insurance plan.

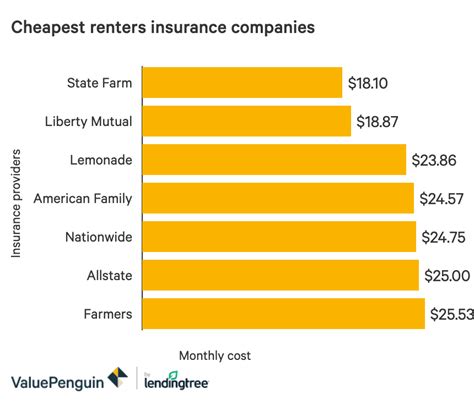

Comparing Insurance Providers

Researching and comparing different insurance providers is essential to finding the best fit. Policyholders should consider factors like coverage options, premiums, customer service, and the financial stability of the insurance company. Online tools and resources can aid in comparing quotes and understanding the features and benefits of various insurance plans.

Customizing Coverage

Most insurance providers allow policyholders to customize their coverage to align with their unique needs. This might involve adjusting deductibles, selecting specific coverage limits, or adding optional enhancements. By tailoring the insurance plan, policyholders can ensure they have adequate protection without paying for unnecessary coverage.

Understanding Exclusions and Limitations

It’s crucial to carefully review the terms and conditions of any insurance policy to understand the exclusions and limitations. These can vary widely between providers and coverage types. For instance, some policies may exclude certain types of damage or incidents, while others might have restrictions on coverage for specific locations or situations.

The Future of Car Insurance

As technology continues to advance, the car insurance industry is also evolving. The rise of autonomous vehicles and connected car technologies is prompting insurers to adapt and innovate. New risk assessment models, data-driven pricing, and usage-based insurance policies are becoming more prevalent, offering personalized coverage options based on individual driving behaviors and habits.

Additionally, the integration of telematics and other advanced technologies is allowing insurers to gather more precise data on driving patterns, vehicle usage, and accident scenarios. This data-driven approach is expected to lead to more accurate risk assessments and potentially lower insurance premiums for safe drivers.

Frequently Asked Questions

What happens if I drive without car insurance?

+Driving without car insurance is illegal in most jurisdictions and can result in severe penalties. These may include fines, license suspension, vehicle impoundment, and even legal action if involved in an accident.

Can I get car insurance for a leased vehicle?

+Yes, you can purchase car insurance for a leased vehicle. In fact, it’s typically a requirement of the lease agreement. Your insurance policy should cover the leased vehicle and its components, providing protection against damage, theft, and other incidents.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever there are significant changes in your circumstances, such as a new vehicle, a move to a different location, or a change in marital status. Regular reviews ensure your coverage remains adequate and aligned with your needs.

Can I switch car insurance providers mid-policy term?

+Yes, you can switch car insurance providers at any time. However, it’s essential to understand the cancellation policies and potential fees associated with ending your existing policy early. Ensure you have the new policy in place before canceling the old one to avoid any coverage gaps.