Best Quotes Auto Insurance

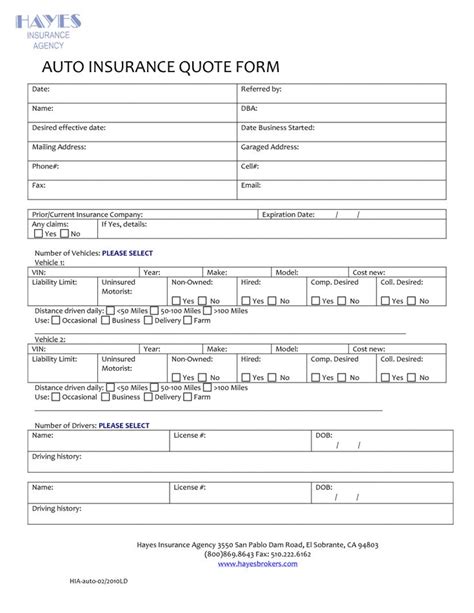

Finding the best quotes for auto insurance can be a daunting task, especially with the myriad of options available in the market. This comprehensive guide aims to simplify the process, providing you with the tools and insights to secure the most suitable and cost-effective coverage for your vehicle.

The Importance of Auto Insurance Quotes

Auto insurance is a critical aspect of vehicle ownership, providing financial protection against potential accidents, theft, and other unforeseen events. Obtaining multiple quotes allows you to compare coverage options, premiums, and additional benefits offered by various insurers. This process ensures you receive the best value for your money and the peace of mind that comes with adequate insurance coverage.

Factors Influencing Auto Insurance Quotes

Several factors play a pivotal role in determining the quotes you receive for auto insurance. Understanding these factors can help you tailor your search and negotiate better rates.

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance rates. Additionally, the primary usage of your vehicle, such as commuting, business, or pleasure, can also affect your premium. For instance, a sports car used for daily commuting might attract higher rates compared to a sedan primarily used for occasional pleasure trips.

| Vehicle Type | Usage | Estimated Premium |

|---|---|---|

| Sports Car | Daily Commute | $1,500 - $2,000 |

| Sedan | Occasional Pleasure | $1,200 - $1,500 |

| SUV | Business Travel | $1,300 - $1,800 |

Driver Profile and History

Your driving record and personal profile are crucial in determining your insurance rates. Insurers consider factors such as your age, gender, driving experience, and any past accidents or traffic violations. For example, young drivers under 25 often face higher premiums due to their lack of experience, while mature drivers over 55 may benefit from lower rates.

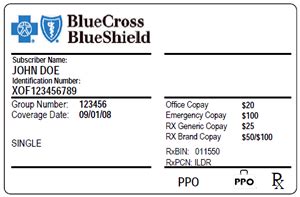

Coverage Requirements

The level of coverage you require is another significant factor. Basic liability coverage is the minimum required by law, but you may also want to consider comprehensive and collision coverage for additional protection. Factors like the value of your vehicle, your financial situation, and the risk factors in your area will influence the type and level of coverage you choose.

Tips for Getting the Best Auto Insurance Quotes

Now that we’ve explored the key factors, here are some practical tips to help you secure the best auto insurance quotes.

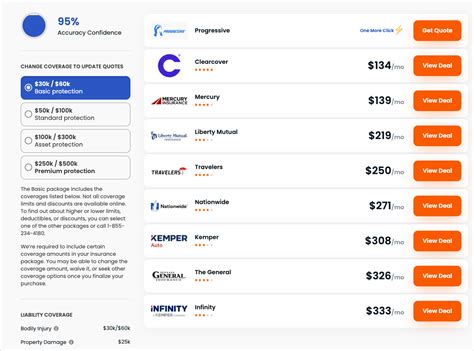

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to compare quotes from multiple insurers. Online comparison tools can be particularly useful for this, allowing you to quickly assess a range of options. Remember, different insurers may offer varying benefits and discounts, so a thorough comparison is essential.

Consider Bundle Discounts

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same insurer. Many insurers offer substantial discounts when you bundle multiple policies, which can significantly reduce your overall insurance costs.

Explore Discount Opportunities

Insurers often provide a variety of discounts to attract and retain customers. These discounts can be based on factors like your driving record, vehicle safety features, and even your profession or educational background. Be sure to ask about available discounts and how you can qualify for them.

Maintain a Good Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance premiums low. Avoid traffic violations and accidents to maintain a good record. If you have a minor violation or accident, consider taking defensive driving courses to improve your driving skills and potentially reduce the impact on your insurance rates.

Understanding the Fine Print

While comparing quotes and premiums is essential, it’s equally important to understand the fine print of your insurance policy. Different policies may have varying coverage limits, deductibles, and exclusions. Ensure you comprehend these details to avoid any surprises in the event of a claim.

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount your insurer will pay out for a covered claim. Deductibles, on the other hand, are the amount you must pay out-of-pocket before your insurance coverage kicks in. Higher deductibles can lead to lower premiums, but you’ll need to pay more upfront in the event of a claim. Choose coverage limits and deductibles that align with your financial situation and risk tolerance.

Exclusions and Restrictions

Every insurance policy has certain exclusions and restrictions. These are situations or events that are not covered by your policy. For example, damage caused by natural disasters like floods or earthquakes may not be covered by a standard auto insurance policy. Review these exclusions carefully to ensure your policy meets your specific needs.

Future Implications and Trends

The auto insurance landscape is continually evolving, influenced by technological advancements and changing consumer behaviors. Here’s a glimpse into the future of auto insurance and how it may impact your coverage options.

Telematics and Usage-Based Insurance

Telematics technology allows insurers to track and analyze your driving behavior in real-time. Usage-based insurance, or pay-as-you-drive insurance, uses telematics data to assess your risk profile and set your premiums accordingly. This technology rewards safe drivers with lower premiums and provides insurers with more accurate risk assessments.

Automated Vehicles and Insurance

The rise of autonomous vehicles is expected to revolutionize the auto insurance industry. With fewer accidents attributed to human error, insurers may need to adjust their coverage models and premiums. However, until fully autonomous vehicles become widespread, the transition period may present challenges in determining liability and setting insurance rates.

Environmental Considerations

Environmental factors, such as climate change and extreme weather events, are increasingly influencing auto insurance rates. Insurers are now factoring in these risks when setting premiums, particularly for regions prone to natural disasters. As a result, drivers in high-risk areas may face higher insurance costs.

Conclusion

Securing the best auto insurance quotes involves a careful balance of understanding your needs, comparing options, and staying informed about industry trends. By following the tips and insights outlined in this guide, you can navigate the complex world of auto insurance with confidence, ensuring you receive the coverage and value you deserve.

What is the average cost of auto insurance in the US?

+

The average cost of auto insurance in the US varies widely depending on factors such as location, vehicle type, and driving history. However, the national average for a full coverage policy is around 1,674 per year, while the average liability-only policy costs approximately 565 annually.

How can I lower my auto insurance premiums?

+

There are several ways to reduce your auto insurance premiums. These include maintaining a clean driving record, taking advantage of available discounts (such as good student or loyalty discounts), raising your deductible, and shopping around for the best rates.

What factors influence the cost of my auto insurance policy?

+

The cost of your auto insurance policy is influenced by various factors, including your age, gender, driving record, location, vehicle type, and coverage limits. Additionally, your credit score and claims history can also impact your premiums.

Do I need to carry comprehensive and collision coverage on my vehicle?

+

Whether you need comprehensive and collision coverage depends on your specific circumstances and the value of your vehicle. These coverages provide protection against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. If your vehicle is older or has a lower resale value, you may choose to carry only liability coverage to save on premiums.

What is the process for filing an auto insurance claim?

+

The process for filing an auto insurance claim typically involves notifying your insurer as soon as possible after an accident or incident. You’ll need to provide details about the event, including any injuries, property damage, and witness information. Your insurer will then assess the claim and determine the appropriate course of action, which may include repairs, replacement, or financial compensation.