Insurance Agent License Verification

Verifying Insurance Agent Licenses: A Comprehensive Guide

When it comes to navigating the complex world of insurance, trust is paramount. Ensuring that the insurance agents we engage with are duly licensed and authorized is not just a matter of legal compliance but a critical step towards safeguarding our financial interests. This comprehensive guide aims to demystify the process of verifying insurance agent licenses, empowering consumers to make informed decisions and fostering a transparent insurance landscape.

Understanding the Importance of License Verification

License verification for insurance agents is akin to a safety net in the insurance industry. It serves as a crucial checkpoint to ensure that individuals representing insurance companies possess the necessary qualifications, expertise, and adherence to ethical standards. Here's why it matters:

- Legal Compliance: Every state has its own set of regulations governing the insurance industry. License verification ensures that agents meet these legal requirements, preventing unauthorized practice and potential scams.

- Consumer Protection: By verifying licenses, consumers can rest assured that they are dealing with legitimate professionals. This protects against fraud and ensures that agents have the necessary knowledge to provide accurate advice and services.

- Quality Assurance: Licensed insurance agents are held to high standards. They must stay updated with industry changes, ensuring that the advice and policies they offer remain relevant and beneficial to clients.

- Ethical Practice: Licensing bodies often impose ethical guidelines that agents must follow. Verification ensures that agents maintain professional conduct, putting the interests of clients first.

The Process of License Verification

License verification for insurance agents involves a systematic process that can vary slightly between states. Here's a step-by-step breakdown of the typical procedure:

Step 1: Identify the Licensing Authority

Each state has its own regulatory body or department responsible for licensing insurance professionals. Start by identifying the specific agency that oversees insurance licensing in your state. This information is often available on the official state government website or through a quick online search.

Step 2: Access the License Verification Portal

Most licensing authorities provide an online portal or database where you can verify insurance agent licenses. These portals are designed to be user-friendly and accessible to the public. Simply navigate to the designated website and look for the “License Verification” or “Agent Search” section.

Step 3: Enter Agent Details

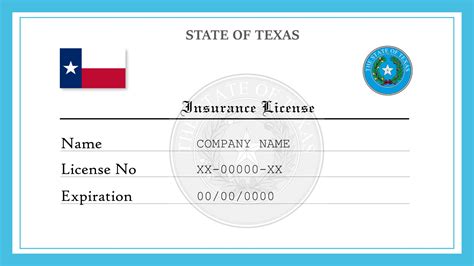

On the verification portal, you’ll be prompted to enter specific details about the insurance agent whose license you wish to verify. This typically includes the agent’s name, license number, or other unique identifiers. The more precise the information, the more accurate the search results.

Step 4: Review License Status and Details

Once you’ve submitted the search query, the verification portal will display the license status and relevant details about the agent. This information often includes:

- License Number: A unique identifier for the agent's license.

- License Type: Indicates whether the license is for life insurance, property and casualty insurance, or a combination of both.

- License Status: Shows whether the license is active, suspended, expired, or revoked. This is a critical piece of information, as an active license is a prerequisite for legitimate practice.

- Issue and Expiration Dates: Provides the dates when the license was issued and when it will expire, ensuring you're dealing with an up-to-date license.

- Agent's Contact Information: Includes the agent's address, phone number, and email, allowing for easy communication if needed.

Step 5: Cross-Check with Additional Sources (if needed)

In some cases, you might want to cross-reference the information obtained from the primary verification portal with other sources. This could include checking the agent’s license status on the National Association of Insurance Commissioners (NAIC) website or verifying their membership with professional associations like the National Association of Insurance and Financial Advisors (NAIFA) or the Society of Certified Insurance Counselors (CIC). These organizations often maintain their own directories and verification systems.

Interpreting License Status

Understanding the different license statuses is crucial for making informed decisions. Here's a breakdown of common license statuses and what they mean:

- Active: The agent's license is valid and they are authorized to sell insurance products. This is the ideal status you want to see when verifying an agent's license.

- Suspended: The agent's license is temporarily inactive due to various reasons, such as non-compliance with continuing education requirements, disciplinary actions, or unresolved legal issues. Agents with suspended licenses should not be conducting business.

- Expired: The license has reached its expiration date and needs to be renewed. Agents with expired licenses are not authorized to practice until they renew their license.

- Revoked: This is the most severe status, indicating that the agent's license has been permanently taken away due to serious violations or unethical practices. Agents with revoked licenses should not be trusted with your insurance needs.

Advanced License Verification Techniques

While the basic steps outlined above cover the standard license verification process, there are additional techniques and tools that can provide a more comprehensive view of an insurance agent's credentials and reputation.

Using Public Records and Databases

Beyond the official license verification portals, there are public records and databases that can provide additional insights into an agent’s history and performance. These sources can include:

- State Insurance Department Complaint Records: Many state insurance departments maintain public records of complaints filed against insurance agents and companies. Checking these records can reveal any past issues or disputes involving the agent.

- Court Records: Court records, which are often accessible online, can provide information about legal cases involving insurance agents. This can include lawsuits, judgments, or other legal actions that may reflect on the agent's trustworthiness.

- Professional Association Directories: As mentioned earlier, professional associations like NAIFA and CIC maintain their own directories. These directories often provide additional details about an agent's qualifications, designations, and membership status, offering a more comprehensive view of their professional standing.

Online Reputation and Review Platforms

In today’s digital age, online reputation and review platforms have become powerful tools for assessing the credibility of professionals, including insurance agents. While these platforms should be used with caution, they can provide valuable insights:

- Google Reviews: Google Business Profiles often include reviews from clients who have interacted with the insurance agent. These reviews can offer a glimpse into the agent's customer service, expertise, and overall reputation.

- Specialized Review Websites: Websites like Yelp, Trustpilot, or industry-specific review platforms can provide detailed reviews and ratings from clients who have worked with the agent. These platforms often allow for more in-depth feedback and can reveal patterns of behavior or areas of excellence.

Social Media and Professional Networks

Social media platforms and professional networking sites can offer a unique perspective on an insurance agent’s reputation and expertise. Here’s how they can be utilized:

- LinkedIn Profiles: Insurance agents often maintain detailed LinkedIn profiles, highlighting their qualifications, experience, and professional achievements. Scrutinizing these profiles can provide valuable insights into their background and areas of specialization.

- Social Media Engagement: Checking an agent's social media presence, particularly on platforms like Facebook, Twitter, or industry-specific groups, can reveal their level of engagement with the community, their knowledge-sharing activities, and their overall digital footprint.

Conclusion: Empowering Consumers Through License Verification

Verifying insurance agent licenses is a critical step towards building trust and transparency in the insurance industry. By following the steps outlined in this guide and utilizing the various tools and resources available, consumers can confidently assess the legitimacy and qualifications of insurance agents. This not only protects consumers from potential scams and unethical practices but also ensures that they receive the highest quality of service and advice.

As the insurance landscape continues to evolve, license verification remains a cornerstone of consumer protection. By staying informed and proactive, we can collectively foster an environment where ethical practices thrive, and consumers can make informed decisions about their insurance needs.

What happens if I find an agent with a suspended or revoked license?

+If you discover that an insurance agent’s license is suspended or revoked, it’s important to refrain from engaging with them. Suspended or revoked licenses indicate serious issues, and continuing to work with such agents may put your financial interests at risk. Instead, report the agent to the relevant state insurance department and seek advice from a trusted, licensed agent.

Are there any differences in license verification procedures between states?

+Yes, while the basic principles of license verification remain consistent, the specific procedures can vary between states. Each state has its own licensing authority and regulations. Therefore, it’s essential to familiarize yourself with the unique procedures of your state or consult a local insurance expert for guidance.

How often should I verify an insurance agent’s license?

+While there’s no set frequency, it’s good practice to verify an insurance agent’s license whenever you’re considering a significant insurance transaction or if you have any concerns about their legitimacy. Additionally, regular license verification can help you stay informed about any changes in the agent’s status or qualifications.

Can I verify the license of an insurance agent who operates across state lines?

+Verifying the license of an agent who operates across state lines can be a bit more complex. You’ll need to check the licensing status in each state where the agent is actively selling insurance. This may involve accessing multiple state licensing portals or contacting the relevant state insurance departments directly.