Insurance That Covers Wegovy

In the world of weight management and metabolic health, Wegovy, a revolutionary drug, has taken center stage. With its potential to transform lives, it's no surprise that many individuals are seeking insurance coverage for this innovative treatment. This article delves into the realm of insurance policies that offer support for Wegovy, exploring the options available, the coverage details, and the potential impact on individuals seeking to manage their weight and overall health.

Understanding Wegovy and its Significance

Wegovy, also known by its generic name semaglutide, is a prescription medication that has gained prominence in the field of obesity and diabetes management. Developed by Novo Nordisk, this injectable drug works by mimicking the action of a hormone called glucagon-like peptide-1 (GLP-1), which plays a crucial role in regulating blood sugar levels and promoting a feeling of fullness.

The significance of Wegovy lies in its ability to induce substantial weight loss in individuals struggling with obesity. Clinical trials have shown promising results, with participants achieving an average weight loss of up to 15% of their initial body weight over a period of 68 weeks. This drug not only aids in weight reduction but also improves various metabolic markers, reducing the risk of cardiovascular diseases and other obesity-related complications.

The Need for Insurance Coverage

While the potential benefits of Wegovy are undeniable, the cost of this medication can be a significant barrier for many individuals. The average monthly cost of Wegovy treatment ranges from 1,300 to 1,600, making it an expensive proposition for those without adequate insurance coverage. This is where insurance policies that include coverage for Wegovy become crucial, providing a lifeline for individuals seeking to access this innovative treatment.

Insurance Policies Covering Wegovy

The availability of insurance policies that cover Wegovy varies across different regions and healthcare systems. However, several prominent insurance providers have recognized the importance of this medication and have included it in their coverage plans.

Private Health Insurance Plans

Many private health insurance companies now offer plans that specifically cover weight-loss medications like Wegovy. These plans often require a prescription from a licensed healthcare provider and may have certain eligibility criteria, such as a body mass index (BMI) above a specified threshold or the presence of comorbidities like type 2 diabetes.

For instance, Aetna, a leading health insurance provider in the United States, includes Wegovy in its coverage for individuals with a BMI of 30 or higher, or those with a BMI of 27 or higher and one or more weight-related comorbidities. Similarly, Cigna covers Wegovy for eligible members as part of its medical benefits, ensuring access to this treatment for those in need.

Medicare and Medicaid

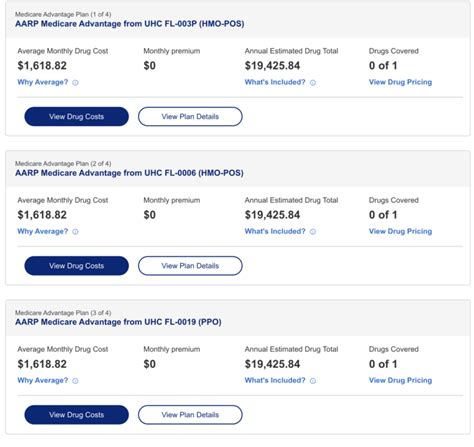

Government-funded healthcare programs like Medicare and Medicaid also play a crucial role in providing coverage for Wegovy. These programs aim to ensure that individuals, especially those with limited financial means, have access to essential medications and treatments.

Medicare Part D, which covers prescription drugs, may include Wegovy as a covered medication for beneficiaries with a valid prescription. However, the coverage and cost-sharing can vary based on the specific Medicare plan and the individual's location. Medicaid, on the other hand, is a state-administered program, and the coverage for Wegovy can differ from state to state. Some states may cover Wegovy under their Medicaid programs, while others may have specific eligibility criteria or require prior authorization.

Employer-Sponsored Health Plans

Many employers offer comprehensive health insurance plans to their employees, and some of these plans now include coverage for weight-loss medications like Wegovy. This is particularly beneficial for individuals who are employed and have access to such employer-sponsored plans.

For example, Blue Cross Blue Shield, a popular insurance provider, covers Wegovy for members with a BMI of 30 or higher, or those with a BMI of 27 or higher and one or more weight-related health conditions. This coverage ensures that employees can access this treatment without bearing the full financial burden.

Coverage Details and Limitations

While insurance coverage for Wegovy is a positive development, it’s essential to understand the details and potential limitations of such policies.

Prescription Requirements

Most insurance policies covering Wegovy require a valid prescription from a licensed healthcare provider. This prescription is typically based on an individual’s medical history, current health status, and the potential benefits of the medication.

Prior Authorization

In some cases, insurance providers may require prior authorization before approving coverage for Wegovy. This process involves the healthcare provider submitting detailed medical information to the insurance company, justifying the need for this specific medication. Prior authorization ensures that the medication is being prescribed appropriately and is necessary for the individual’s treatment plan.

Cost-Sharing and Copays

Even with insurance coverage, individuals may still need to pay a portion of the cost of Wegovy. This can include copayments, deductibles, or coinsurance. The amount of cost-sharing can vary based on the insurance plan and the individual’s coverage level.

| Insurance Provider | Cost-Sharing |

|---|---|

| Aetna | 20% coinsurance up to an annual maximum |

| Cigna | Varies based on plan; may include copays or deductibles |

| Blue Cross Blue Shield | 30% coinsurance for brand-name medications |

Coverage Duration and Renewal

Insurance coverage for Wegovy is often provided for a specific duration, typically aligned with the treatment plan recommended by the healthcare provider. This can range from a few months to a year. To continue the coverage, individuals may need to renew their prescription and provide updated medical information to their insurance provider.

The Impact of Insurance Coverage on Access to Wegovy

The availability of insurance policies that cover Wegovy has a significant impact on individuals’ ability to access this treatment. By reducing the financial barrier, insurance coverage empowers individuals to take control of their weight and overall health.

For those struggling with obesity and its associated health complications, Wegovy offers a ray of hope. Insurance coverage ensures that individuals can afford this treatment, leading to improved weight management and a reduced risk of obesity-related diseases. Additionally, the coverage of Wegovy sends a powerful message—that weight management is a valid and important aspect of healthcare, deserving of insurance support.

Personal Stories

John, a 45-year-old man with a history of obesity and type 2 diabetes, was prescribed Wegovy by his endocrinologist. Thanks to his insurance coverage, he was able to access this treatment without financial strain. Over the course of a year, John achieved a significant weight loss, improving his overall health and reducing his dependence on diabetes medications. He attributes this life-changing transformation to the combination of Wegovy and his insurance coverage.

Sarah, a 32-year-old woman, had struggled with her weight for years, impacting her self-esteem and overall well-being. When her doctor recommended Wegovy, she was hesitant due to the cost. However, with the support of her employer's health plan, which covered Wegovy, she was able to start the treatment. Over time, Sarah noticed not only weight loss but also improved energy levels and a boost in her confidence. She is grateful for the insurance coverage that made this transformation possible.

The Future of Insurance Coverage for Wegovy

As the awareness of Wegovy’s benefits grows, it’s likely that insurance providers will continue to recognize its value and expand coverage options. The positive outcomes and real-life success stories associated with this medication are compelling arguments for its inclusion in insurance plans.

Furthermore, ongoing research and clinical trials are exploring the potential of Wegovy in various health conditions, beyond weight management. As the understanding of this medication's capabilities deepens, insurance coverage is expected to evolve, adapting to the changing landscape of healthcare needs.

Expanding Coverage

Insurance providers may expand their coverage to include a broader range of individuals, beyond those with a high BMI or specific comorbidities. This could involve covering Wegovy for preventive purposes, aiming to reduce the risk of obesity-related complications before they arise. Additionally, as the medication becomes more widely prescribed, insurance companies may negotiate better rates with pharmaceutical manufacturers, potentially leading to reduced costs for individuals.

Inclusion in Public Health Programs

Government-funded health programs like Medicare and Medicaid may further expand their coverage of Wegovy, ensuring that more individuals have access to this treatment. This is particularly important for those who rely on these programs for their healthcare needs.

As the understanding of Wegovy's long-term effects and potential benefits grows, insurance providers and policymakers may prioritize its inclusion in public health initiatives, recognizing its role in promoting overall population health.

Conclusion

Insurance coverage for Wegovy is a significant step towards making this innovative treatment accessible to those who need it. By understanding the available insurance options and their coverage details, individuals can make informed decisions about their healthcare and take control of their weight management journey. With the right insurance support, Wegovy has the potential to transform countless lives, offering a new lease on health and well-being.

Can I get insurance coverage for Wegovy if I don’t have a high BMI or any comorbidities?

+Insurance coverage for Wegovy often depends on specific eligibility criteria, which can include a high BMI or the presence of comorbidities. However, some insurance plans may cover Wegovy for preventive purposes, even without these specific criteria. It’s best to check with your insurance provider to understand your eligibility.

What are the potential side effects of Wegovy, and how do they impact insurance coverage?

+Wegovy may cause side effects such as nausea, vomiting, diarrhea, and constipation. These side effects are generally mild and temporary. Insurance coverage for Wegovy typically does not exclude individuals based on potential side effects, as these can be managed with medical supervision. However, severe or persistent side effects may require additional medical attention and may impact insurance coverage.

How can I find out if my insurance plan covers Wegovy?

+To determine if your insurance plan covers Wegovy, you can contact your insurance provider directly. They can provide specific information about your coverage, including any necessary prior authorization or prescription requirements. Additionally, you can review your insurance plan’s benefits summary or check their website for detailed coverage information.