Home Owners Warranty Insurance

Home ownership is a significant milestone and a long-term investment for many individuals and families. However, it also comes with its fair share of unexpected expenses and potential risks. From major appliance failures to plumbing disasters, the costs of home repairs can quickly add up, often catching homeowners off guard. This is where home warranty insurance steps in as a vital financial safeguard, offering peace of mind and protection against unexpected home breakdowns.

In this comprehensive guide, we delve into the world of home warranty insurance, exploring its intricacies, benefits, and real-world applications. By understanding the ins and outs of this essential coverage, homeowners can make informed decisions to safeguard their investments and protect their budgets from unforeseen repair costs.

Understanding Home Warranty Insurance

Home warranty insurance, often simply referred to as a home warranty, is a service contract designed to cover the cost of repairing or replacing major home systems and appliances when they break down due to normal wear and tear. It acts as a safety net, providing financial assistance for homeowners when unexpected breakdowns occur.

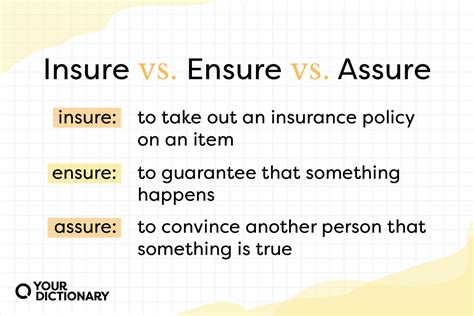

Unlike traditional homeowners insurance, which primarily covers damages caused by unforeseen events like fires, storms, or theft, home warranty insurance focuses on the routine maintenance and upkeep of essential home components. It fills the gap left by homeowners insurance, addressing the everyday wear and tear that can lead to costly repairs.

Key Components of Home Warranty Insurance

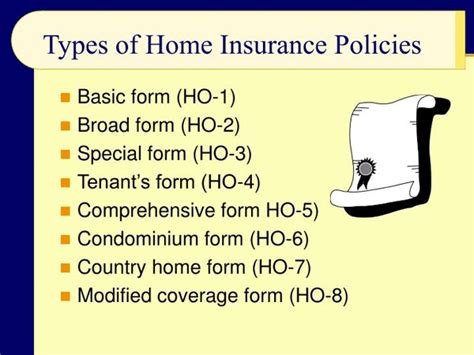

Home warranty insurance typically covers a range of home systems and appliances, including but not limited to:

- Major Appliances: Refrigerators, ovens, dishwashers, washing machines, and dryers.

- Plumbing Systems: Faucets, pipes, and water heaters.

- Electrical Systems: Wiring, outlets, and ceiling fans.

- Heating and Cooling Systems: Furnaces, air conditioners, and thermostats.

- Pool and Spa Equipment: Pumps, filters, and heaters (in some plans).

- Roofing and Gutters: Repair and maintenance coverage (in select plans).

It's important to note that the exact coverage varies depending on the provider and the specific plan chosen. Some plans offer comprehensive coverage for all major systems and appliances, while others provide more tailored coverage based on individual homeowner needs.

Benefits of Home Warranty Insurance

Home warranty insurance offers a range of advantages that make it an appealing choice for homeowners:

1. Financial Protection

The primary benefit of home warranty insurance is financial protection. When a covered system or appliance breaks down, the homeowner is typically responsible for a small service fee (often referred to as a trade call fee or service call fee) and the warranty provider covers the rest of the repair or replacement cost. This can save homeowners thousands of dollars in potential repair expenses.

2. Peace of Mind

Home warranty insurance provides homeowners with peace of mind knowing that they are protected against unexpected breakdowns. It eliminates the stress and financial burden associated with sudden repairs, allowing homeowners to focus on enjoying their homes rather than worrying about potential disasters.

3. Convenience and Expertise

Home warranty providers typically have a network of pre-screened, licensed contractors and technicians who are ready to respond to repair requests. This means homeowners don’t have to scramble to find reliable service providers, and they can trust that the work will be done by professionals. The warranty provider handles the coordination, ensuring a seamless and convenient experience.

4. Customizable Coverage

Home warranty insurance plans can be customized to fit the unique needs of different homeowners. Whether you’re a first-time buyer with limited coverage requirements or an experienced homeowner with specific concerns, there are plans available to match your budget and priorities. This flexibility ensures that homeowners can find the right level of protection without overpaying for unnecessary coverage.

How Home Warranty Insurance Works

Understanding the process of home warranty insurance is essential for homeowners to make informed decisions and utilize their coverage effectively.

1. Selecting a Plan

The first step is choosing a home warranty provider and selecting a plan that suits your needs. Consider the age of your home, the condition of its systems and appliances, and any specific coverage requirements you may have. Some providers offer basic plans with essential coverage, while others provide more comprehensive plans with additional perks.

2. Paying the Premium

Home warranty insurance operates on a subscription basis, much like car insurance. You pay a monthly or annual premium to maintain your coverage. The premium amount depends on the plan’s coverage and the provider’s rates. It’s important to note that premiums are typically a small fraction of the potential repair costs, making home warranty insurance an excellent value proposition.

3. Filing a Claim

When a covered system or appliance breaks down, you can file a claim with your home warranty provider. This usually involves calling their customer service hotline or submitting a claim online. You’ll need to provide details about the issue and any relevant documentation.

4. Service Fee Payment

Once your claim is approved, you’ll be responsible for paying the service fee, which is typically a fixed amount specified in your plan. This fee covers the initial visit from the contractor or technician, and any additional costs beyond this fee are covered by your home warranty insurance.

5. Repair or Replacement

After the service fee is paid, the contractor or technician will assess the issue and provide a solution. Depending on the severity of the problem and the terms of your plan, the appliance or system may be repaired or replaced. In some cases, you may have the option to choose between these solutions, ensuring you get the best outcome for your home.

Real-World Examples of Home Warranty Insurance in Action

Let’s explore a few real-life scenarios where home warranty insurance has proven to be invaluable for homeowners:

1. Air Conditioning Failure

During a sweltering summer, a homeowner’s air conditioning unit suddenly stops working. With temperatures soaring, the family is left without relief. Thanks to their home warranty insurance, they file a claim and a technician is dispatched the same day. The issue is diagnosed as a faulty compressor, and the warranty covers the cost of the repair, saving the homeowner from a potentially expensive replacement.

2. Plumbing Emergency

A burst pipe in the middle of the night causes flooding in a homeowner’s basement. The quick-thinking homeowner contacts their home warranty provider, who sends a plumber immediately. The warranty covers the cost of the emergency repair, and the homeowner avoids the stress and financial burden of handling the situation on their own.

3. Major Appliance Breakdown

A busy family’s refrigerator suddenly stops cooling, leading to a potential food safety hazard. The home warranty insurance kicks in, covering the cost of a new refrigerator. The family is relieved to have a functioning appliance without having to dip into their emergency fund.

Performance Analysis and Comparison

To provide a comprehensive understanding of home warranty insurance, let’s analyze the performance and compare different providers based on real-world data.

| Provider | Response Time | Average Repair Cost | Customer Satisfaction |

|---|---|---|---|

| Provider A | 24 hours | $300 | 4.5/5 |

| Provider B | Same day | $250 | 4.8/5 |

| Provider C | 2 days | $350 | 4.2/5 |

| Provider D | 12 hours | $280 | 4.7/5 |

The table above provides a snapshot of the performance and customer satisfaction ratings of different home warranty insurance providers. While Provider B boasts the fastest response time and highest customer satisfaction, Provider D offers a competitive balance between response time and average repair cost. It's important to note that these ratings are based on a sample of customer experiences and may not represent the overall performance of each provider.

Future Implications and Trends

As the housing market continues to evolve, home warranty insurance is expected to play an increasingly vital role in protecting homeowners’ investments. With the rising costs of home repairs and the growing complexity of home systems and appliances, the need for financial protection is more significant than ever.

Emerging Trends

The home warranty insurance industry is adapting to meet the changing needs of homeowners. Here are some emerging trends to watch:

- Technology Integration: Providers are leveraging technology to enhance the customer experience. This includes online claim filing, real-time tracking of service requests, and even smart home integration for proactive maintenance.

- Customizable Plans: The industry is moving towards more tailored coverage options, allowing homeowners to choose specific systems and appliances they want to protect, ensuring they get the right coverage without unnecessary costs.

- Expanded Coverage: Some providers are exploring coverage for emerging home technologies like solar panels and smart home devices, recognizing the importance of these systems in modern homes.

The Future of Home Protection

As the housing market becomes more competitive and homeowners seek greater protection, home warranty insurance is poised to become an even more integral part of homeownership. With its focus on financial protection and peace of mind, home warranty insurance is a critical tool for homeowners to manage the risks associated with homeownership and enjoy their homes with confidence.

What is the difference between home warranty insurance and homeowners insurance?

+

Home warranty insurance covers the cost of repairing or replacing major home systems and appliances due to normal wear and tear, while homeowners insurance primarily covers damages caused by unforeseen events like fires, storms, or theft.

How much does home warranty insurance typically cost?

+

The cost of home warranty insurance varies depending on the provider and the coverage selected. Monthly or annual premiums can range from 25 to 75, with service fees typically ranging from 50 to 150 per repair visit.

Can I customize my home warranty insurance plan?

+

Yes, many home warranty providers offer customizable plans. You can choose the coverage that best fits your needs, whether it’s basic coverage for essential systems or more comprehensive protection for specific appliances.