Insurance Quotes On A Car

Obtaining insurance quotes for your vehicle is an essential step in ensuring you have adequate coverage for your car and understanding the costs associated with auto insurance. The process can vary depending on your location, the type of vehicle you own, and your personal circumstances. In this comprehensive guide, we will delve into the world of insurance quotes for cars, providing you with valuable insights and practical steps to navigate the process effectively.

Understanding Insurance Quotes

Insurance quotes are estimates provided by insurance companies that outline the potential cost of an insurance policy. These quotes are tailored to your specific needs and circumstances, taking into account factors such as your vehicle’s make and model, your driving history, and the coverage options you require. By obtaining multiple quotes, you can compare different insurance providers and find the most suitable and cost-effective coverage for your car.

Factors Influencing Insurance Quotes

Several key factors play a significant role in determining the insurance quote you receive. These include:

- Vehicle Type and Value: The make, model, and age of your vehicle impact the quote. High-performance cars or luxury vehicles may have higher insurance costs due to their value and potential for higher repair expenses.

- Driving History: Your driving record is a crucial factor. A clean driving history with no accidents or traffic violations can lead to more favorable quotes. Conversely, a history of accidents or claims may result in higher premiums.

- Coverage Requirements: The level of coverage you choose affects your quote. Comprehensive and collision coverage, which provide protection for various situations, tend to be more expensive than liability-only coverage.

- Personal Information: Your age, gender, and marital status can influence quotes. Insurance companies often consider these factors when assessing risk and setting premiums.

- Location: The area where you live and drive impacts insurance rates. Areas with higher crime rates or a history of frequent accidents may result in higher quotes.

The Quote Comparison Process

To obtain the best insurance quote for your car, it is essential to compare quotes from multiple providers. Here’s a step-by-step guide to help you through the process:

- Gather Information: Before requesting quotes, gather the necessary details about your vehicle, including make, model, year, and any additional features. Also, have your driving record and personal information readily available.

- Research Insurance Companies: Identify reputable insurance companies that offer auto insurance in your area. Consider both local and national providers to ensure a comprehensive comparison.

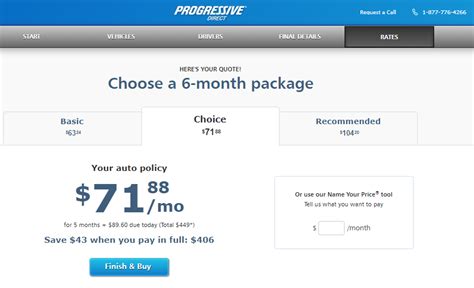

- Request Quotes: Reach out to the selected insurance companies and request quotes. You can do this online, over the phone, or by visiting their offices. Provide accurate and consistent information to ensure an accurate quote.

- Analyze the Quotes: Compare the quotes based on the coverage offered, deductibles, and premiums. Look for any exclusions or limitations in the policies. Consider not only the cost but also the reputation and financial stability of the insurance company.

- Negotiate and Customize: If you find a quote that aligns with your needs, don't hesitate to negotiate. Many insurance companies offer discounts for bundling policies or for safe driving habits. Discuss your options and customize the policy to fit your requirements.

- Choose the Best Option: After careful consideration, select the insurance provider that offers the most comprehensive coverage at a competitive price. Ensure you understand the terms and conditions of the policy before finalizing your decision.

Tips for Lowering Insurance Costs

While insurance quotes are influenced by various factors, there are strategies you can employ to potentially lower your insurance costs:

- Shop Around: As mentioned earlier, comparing quotes from multiple providers is crucial. Don't settle for the first quote you receive. Shopping around can reveal significant differences in prices and coverage options.

- Increase Deductibles: Opting for higher deductibles can lead to lower premiums. However, ensure you can afford the deductible amount in case of an accident or claim.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty discounts. Inquire about available discounts and see if you qualify for any.

- Maintain a Clean Driving Record: A clean driving history is crucial for obtaining favorable insurance quotes. Avoid traffic violations and practice safe driving habits to keep your record clean.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as home or renter's insurance. Bundling can often result in significant savings.

The Importance of Regular Reviews

Insurance quotes and policies should be reviewed periodically to ensure you are still receiving the best coverage and value. Circumstances can change over time, and your insurance needs may evolve. Regular reviews allow you to:

- Assess if your current coverage meets your changing needs.

- Identify potential discounts or promotions offered by your insurance provider.

- Compare your existing policy with new quotes to ensure you are not overpaying.

- Stay updated on any changes in insurance laws or regulations that may impact your policy.

Insurance Quotes: Real-World Examples

To provide a clearer understanding of insurance quotes, let’s explore some real-world scenarios and the factors that influenced the quotes received.

Scenario 1: Young Driver with a Sports Car

Sarah, a 22-year-old, recently purchased a high-performance sports car. Due to her age and the type of vehicle, she anticipated higher insurance costs. Sarah obtained quotes from three insurance companies. The quotes varied significantly, ranging from 2,500 to 3,800 annually. The quotes considered factors such as her driving history (which was clean), the value of her vehicle, and the coverage options she selected.

Scenario 2: Family with Multiple Vehicles

The Johnson family owns three vehicles: a sedan, an SUV, and a minivan. They have a long-standing relationship with their insurance provider and have been bundling their policies for years. When it came time to renew their insurance, they obtained quotes from their current provider and two competitors. The quotes they received were quite similar, with their current provider offering the most competitive rate, taking into account their loyalty and the multi-vehicle discount.

Scenario 3: Mature Driver with a Classic Car

John, a 65-year-old car enthusiast, owns a classic car he uses for occasional weekend drives. Given his mature age and clean driving record, he expected lower insurance costs. However, the classic car’s value and the specialized coverage required for such a vehicle resulted in quotes ranging from 1,200 to 1,500 annually. John chose a policy that offered comprehensive coverage for his classic car at a reasonable price.

The Future of Insurance Quotes

The insurance industry is constantly evolving, and technology is playing a significant role in shaping the future of insurance quotes. Here are some trends and developments to watch out for:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining popularity. These programs track driving behavior and offer discounts to safe drivers. Insurance companies can use real-time data to assess risk more accurately and provide personalized quotes based on an individual’s driving habits.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being utilized to analyze vast amounts of data and identify patterns that can influence insurance quotes. These technologies can help insurance companies make more accurate predictions about risk and offer tailored quotes to customers.

Online Comparison Tools

Online comparison tools and insurance marketplaces are becoming more sophisticated. These platforms allow consumers to easily compare quotes from multiple providers, providing a streamlined and efficient way to find the best insurance deals.

The Rise of Insurtech

Insurtech companies are disrupting the traditional insurance industry with innovative technologies and business models. These startups are leveraging digital platforms, data analytics, and automation to offer faster and more efficient insurance quote processes, often at competitive prices.

Conclusion

Obtaining insurance quotes for your car is a crucial step in ensuring you have adequate coverage and understanding the associated costs. By understanding the factors that influence quotes and following the steps outlined in this guide, you can navigate the insurance quote process effectively. Remember to compare quotes, customize your coverage, and regularly review your policy to stay informed and make the most of your insurance coverage.

Frequently Asked Questions

How often should I review my insurance quotes and policies?

+

It is recommended to review your insurance quotes and policies annually, or whenever your circumstances change significantly. This ensures you stay up-to-date with the best coverage and value available.

Can I get an insurance quote without providing my personal information?

+

Most insurance companies require personal information to provide an accurate quote. However, you can often get a preliminary estimate by providing basic details about your vehicle and coverage preferences.

What is the difference between liability-only coverage and comprehensive coverage?

+

Liability-only coverage provides protection for damage you cause to others’ property or injuries you cause to others. Comprehensive coverage, on the other hand, offers broader protection, including coverage for your own vehicle in various situations, such as accidents, theft, or natural disasters.

Can I switch insurance providers after obtaining a quote?

+

Absolutely! Obtaining quotes allows you to compare different providers and choose the one that best suits your needs. You can switch insurance providers at any time, but ensure you understand the cancellation and transfer process to avoid any gaps in coverage.

How can I improve my chances of getting a lower insurance quote?

+

To increase your chances of obtaining a lower insurance quote, maintain a clean driving record, explore discounts, and consider increasing your deductibles. Additionally, shopping around and comparing quotes from multiple providers is essential to finding the best deal.