Insurance Companies In Texas

The insurance landscape in Texas is diverse and dynamic, offering a range of options for residents and businesses. Texas is known for its competitive insurance market, with numerous providers offering various coverage types. In this comprehensive article, we delve into the world of insurance companies in Texas, exploring their offerings, services, and the unique factors that influence the insurance sector in the Lone Star State.

Understanding the Texas Insurance Market

Texas boasts one of the largest and most complex insurance markets in the United States. With a diverse population and a vast geographical area, the state presents a unique set of challenges and opportunities for insurance providers. From the bustling cities of Houston and Dallas to the rural regions, the insurance needs of Texans vary significantly.

The Texas Department of Insurance (TDI) plays a crucial role in regulating and overseeing the insurance industry within the state. They ensure that insurance companies operate ethically and provide fair and competitive rates to consumers. TDI's involvement creates a stable environment for both insurance companies and policyholders.

Key Factors Influencing Texas Insurance

- Natural Disasters: Texas is no stranger to natural calamities, including hurricanes, tornadoes, and severe weather events. These occurrences significantly impact the insurance market, influencing rates and coverage options.

- Population Growth: The state’s rapidly growing population creates a demand for various insurance products, including health, auto, and property insurance.

- Business Environment: Texas’s thriving business sector attracts numerous companies, leading to a robust commercial insurance market.

- State Regulations: The state’s insurance laws and regulations, such as the Texas Windstorm Insurance Association, shape the insurance landscape and protect policyholders.

Major Insurance Companies in Texas

Texas is home to a plethora of insurance providers, both local and national. Let’s explore some of the prominent players in the Texas insurance market:

State Farm

State Farm is a leading insurance provider in Texas, offering a comprehensive range of insurance products. With a strong presence across the state, they cater to individuals and businesses, providing auto, home, life, and business insurance. State Farm’s personalized approach and community involvement make them a trusted choice for many Texans.

| Insurance Type | State Farm Coverage |

|---|---|

| Auto Insurance | Comprehensive coverage, including collision, liability, and medical payments. |

| Homeowners Insurance | Protection for homes and personal property, with optional endorsements for specific risks. |

| Life Insurance | Term and permanent life insurance options with flexible coverage amounts. |

| Business Insurance | Customized coverage for small businesses, including liability, property, and workers' compensation. |

Allstate

Allstate is another major player in the Texas insurance market, offering a wide array of insurance solutions. They provide auto, home, renters, and business insurance, catering to the diverse needs of Texans. Allstate’s innovative digital tools and personalized customer service set them apart in the competitive Texas market.

| Insurance Type | Allstate Coverage |

|---|---|

| Auto Insurance | Comprehensive auto coverage with options for collision, comprehensive, and liability insurance. |

| Homeowners Insurance | Standard and customized home insurance policies, covering dwellings, personal property, and liability. |

| Renters Insurance | Protection for renters, covering personal property and liability risks. |

| Business Insurance | Tailored business insurance packages, including general liability, property, and workers' compensation. |

USAA

USAA stands out as a unique insurance provider, catering specifically to military members, veterans, and their families. With a strong presence in Texas, USAA offers a range of insurance products, including auto, home, life, and health insurance. Their commitment to serving the military community has earned them a reputation for exceptional service and competitive rates.

| Insurance Type | USAA Coverage |

|---|---|

| Auto Insurance | Comprehensive auto insurance with military-friendly benefits and discounts. |

| Homeowners Insurance | Customized home insurance for military families, covering dwellings and personal property. |

| Life Insurance | Term and whole life insurance options, tailored to the needs of military members and veterans. |

| Health Insurance | Affordable health insurance plans, including medical, dental, and vision coverage. |

GEICO

GEICO, a well-known national insurance provider, also operates extensively in Texas. They offer a wide range of insurance products, including auto, homeowners, renters, and umbrella insurance. GEICO’s focus on digital convenience and competitive rates has made them a popular choice among Texans.

| Insurance Type | GEICO Coverage |

|---|---|

| Auto Insurance | Comprehensive auto coverage with options for collision, liability, and personal injury protection. |

| Homeowners Insurance | Protection for homes and personal property, with additional coverage for specific risks. |

| Renters Insurance | Renters insurance for individuals who do not own their residence. |

| Umbrella Insurance | Additional liability coverage to supplement other insurance policies. |

Specialty Insurance Providers in Texas

In addition to the major insurance companies, Texas is home to a variety of specialty insurance providers catering to unique needs.

Farmers Insurance

Farmers Insurance specializes in providing insurance solutions for farmers and ranchers in Texas. They offer tailored coverage for agricultural operations, including crop insurance, livestock insurance, and equipment coverage. Their expertise in the agricultural sector makes them a trusted partner for many rural Texans.

Mercury Insurance

Mercury Insurance focuses on providing auto insurance coverage to high-risk drivers in Texas. They offer specialized policies for individuals with DUI convictions, at-fault accidents, or other driving-related issues. Mercury’s commitment to serving this niche market has made them a valuable resource for those struggling to find affordable auto insurance.

Progressive Insurance

Progressive Insurance is known for its innovative approach to insurance, offering a wide range of coverage options. In Texas, they provide auto, homeowners, renters, and business insurance. Progressive’s focus on customer convenience and digital tools has made them a popular choice, especially among younger Texans.

Navigating the Texas Insurance Landscape

Choosing the right insurance company in Texas can be a daunting task, given the abundance of options. Here are some key considerations to help you make an informed decision:

- Coverage Needs: Assess your specific insurance needs, whether it's auto, home, life, or business insurance. Ensure the provider offers comprehensive coverage tailored to your requirements.

- Rates and Discounts: Compare insurance rates and explore available discounts. Many providers offer discounts for multiple policies, safe driving, or loyalty.

- Customer Service: Research the provider's reputation for customer service and claims handling. Prompt and efficient service can make a significant difference during a claims process.

- Digital Tools: In today's digital age, consider providers who offer convenient online or mobile tools for policy management and claims reporting.

The Future of Insurance in Texas

The insurance landscape in Texas is constantly evolving, driven by technological advancements, changing consumer preferences, and regulatory developments. Here are some key trends and predictions for the future of insurance in the Lone Star State:

- Increased Digitalization: Insurance companies will continue to enhance their digital offerings, providing more convenient and efficient services through online platforms and mobile apps.

- Personalized Insurance: With the advancement of data analytics, insurance providers will offer more personalized policies, tailoring coverage to individual needs and risk profiles.

- Sustainable Insurance Practices: As environmental concerns rise, insurance companies may focus on sustainable practices, offering incentives for eco-friendly choices and supporting green initiatives.

- Regulatory Changes: The Texas insurance market is subject to regulatory changes, which can impact coverage options and rates. Staying informed about these changes is crucial for policyholders.

Frequently Asked Questions

What are the average insurance rates in Texas?

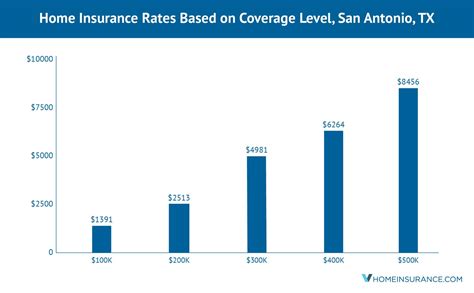

+Insurance rates in Texas can vary significantly based on factors such as location, age, driving record, and the type of coverage. On average, Texans pay around 1,200 for auto insurance annually, while homeowners insurance can range from 1,500 to $2,500 per year. It’s essential to compare rates from multiple providers to find the best deal.

Are there any state-specific insurance requirements in Texas?

+Yes, Texas has specific insurance requirements for drivers. Every vehicle owner must carry at least liability insurance, including bodily injury and property damage coverage. Additionally, Texas requires drivers to carry personal injury protection (PIP) insurance to cover medical expenses after an accident.

How can I save money on insurance in Texas?

+To save money on insurance in Texas, consider the following strategies: bundle multiple policies with the same provider, maintain a clean driving record, increase your deductibles, explore discounts for safety features or good grades, and regularly review and compare insurance rates from different companies.

What should I do if I’m involved in an accident in Texas?

+If you’re involved in an accident in Texas, ensure your safety and that of others first. Then, contact the police to file a report, exchange information with the other driver(s), and promptly notify your insurance company. Follow their instructions for filing a claim and provide any necessary documentation.