Insurance Progressive Insurance

In the ever-evolving landscape of the insurance industry, companies are continually striving to innovate and provide customers with comprehensive coverage and exceptional service. Among these, Progressive Insurance stands out as a prominent player, known for its commitment to customer satisfaction and cutting-edge approaches to risk management.

With a rich history spanning several decades, Progressive has established itself as a leader in the auto insurance market, offering a wide range of policies tailored to meet the diverse needs of its customers. In this article, we delve deep into the world of Progressive Insurance, exploring its history, key offerings, and the innovative strategies that have propelled it to the forefront of the insurance sector.

A Legacy of Innovation: Progressive Insurance’s Journey

Progressive Insurance’s story began in 1937 when it was founded by Joseph Lewis and Jack Green in Ohio, United States. The company’s early years were marked by a revolutionary idea: offering customers the convenience of purchasing auto insurance directly over the phone. This innovative approach challenged the traditional insurance model and laid the foundation for Progressive’s success.

Over the decades, Progressive has expanded its reach and diversified its offerings. It has become a household name in the insurance industry, renowned for its customer-centric approach and commitment to providing affordable, reliable coverage. The company's growth has been fueled by its ability to adapt to changing market dynamics and technological advancements.

Comprehensive Coverage: Progressive’s Insurance Offerings

Progressive Insurance prides itself on its comprehensive suite of insurance products, catering to a wide range of customer needs. Here’s an overview of some of their key offerings:

Auto Insurance

Progressive’s flagship product, auto insurance, offers extensive coverage options. Policyholders can choose from a range of plans, including liability, collision, comprehensive, and personal injury protection. Progressive’s innovative Snapshot program allows drivers to personalize their coverage based on their individual driving habits, providing discounts for safe driving behaviors.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage caused by the policyholder. |

| Collision | Provides coverage for damages to the insured vehicle in an accident. |

| Comprehensive | Covers non-accident related damages such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and passengers. |

Home Insurance

Progressive offers home insurance policies that protect against a wide range of perils, including fire, theft, and natural disasters. Policyholders can customize their coverage to include additional endorsements for specific risks, such as flood or earthquake insurance.

Life Insurance

Progressive’s life insurance policies provide financial protection for policyholders’ loved ones in the event of their passing. The company offers term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifetime coverage with cash value accumulation.

Commercial Insurance

For businesses, Progressive offers commercial insurance solutions, including general liability, property insurance, and business auto insurance. These policies are designed to protect businesses from a variety of risks, ensuring continuity and financial stability.

Progressive’s Digital Transformation: Enhancing the Customer Experience

Progressive Insurance has embraced digital transformation to enhance its customer experience and streamline its operations. The company has invested heavily in technology, developing innovative platforms and tools that have revolutionized the way customers interact with their insurance provider.

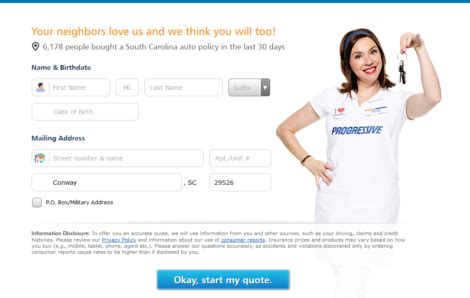

Online Quoting and Policy Management

Progressive’s online platform allows customers to obtain instant quotes for their insurance needs. Policyholders can manage their policies, make payments, and file claims directly from their devices, providing a convenient and efficient experience. The platform also offers educational resources and tools to help customers make informed insurance decisions.

Mobile App

The Progressive mobile app takes the customer experience to the next level. Policyholders can access their policies, file claims, and track their progress in real-time. The app also includes features like accident reporting, roadside assistance, and policy document storage, ensuring customers have all the necessary information at their fingertips.

Telematics and Usage-Based Insurance

Progressive’s Snapshot program is a prime example of its commitment to innovation. This telematics-based insurance program uses a small device installed in the policyholder’s vehicle to track driving behavior. Based on the data collected, drivers can receive personalized insurance rates, encouraging safer driving practices.

Risk Management and Claims Handling: Progressive’s Expertise

Progressive Insurance’s expertise extends beyond providing insurance coverage. The company has a dedicated risk management team that works closely with policyholders to identify and mitigate potential risks. This proactive approach helps customers avoid accidents and reduce their insurance costs.

Risk Assessment and Mitigation

Progressive’s risk management team conducts thorough assessments of policyholders’ properties and businesses to identify potential hazards. They provide recommendations and resources to help customers implement safety measures, reduce the likelihood of accidents, and minimize potential losses.

Claims Handling Process

When it comes to claims, Progressive has streamlined its process to ensure prompt and efficient handling. Policyholders can file claims online or through the mobile app, and the company’s dedicated claims team works tirelessly to resolve them as quickly as possible. Progressive’s claims adjusters are known for their expertise and commitment to fair and transparent assessments.

Progressive’s Commitment to Sustainability and Community

Progressive Insurance understands the importance of corporate social responsibility and has made significant efforts to contribute to sustainable practices and community development.

Environmental Initiatives

The company has implemented various initiatives to reduce its environmental footprint. This includes adopting energy-efficient practices in its operations, promoting paperless transactions, and investing in renewable energy sources. Progressive has also partnered with environmental organizations to support conservation efforts and raise awareness about sustainability.

Community Engagement

Progressive actively engages with local communities through various initiatives. The company supports educational programs, sponsors community events, and provides volunteer opportunities for its employees. Progressive’s commitment to giving back extends beyond financial contributions, fostering a culture of social responsibility.

Future Outlook: Progressive’s Continuous Evolution

As the insurance industry continues to evolve, Progressive Insurance remains at the forefront, embracing new technologies and innovative approaches. The company’s focus on customer satisfaction and its commitment to staying ahead of the curve position it well for future success.

With its digital transformation initiatives, Progressive is well-equipped to meet the changing needs of its customers. The company's investment in data analytics and artificial intelligence will further enhance its ability to provide personalized insurance solutions and efficient claims handling.

Expansion and Diversification

Progressive’s expansion into new markets and diversification of its product offerings will continue to drive its growth. The company is exploring opportunities in emerging insurance sectors, such as cyber insurance and specialty lines, to meet the evolving risks faced by businesses and individuals.

Partnerships and Collaborations

Progressive understands the value of collaborations and partnerships in driving innovation. The company is actively seeking partnerships with startups and established businesses to develop new insurance products and enhance its risk management capabilities. These strategic alliances will enable Progressive to stay at the cutting edge of the insurance industry.

Conclusion: Progressive Insurance’s Impact

Progressive Insurance’s journey from its humble beginnings to becoming a leading insurance provider is a testament to its innovative spirit and customer-centric approach. The company’s commitment to providing comprehensive coverage, embracing digital transformation, and contributing to sustainable practices has solidified its position as a trusted partner for individuals and businesses.

As Progressive continues to evolve, it remains focused on delivering exceptional service and adapting to the changing needs of its customers. With its dedication to innovation and customer satisfaction, Progressive Insurance is poised to shape the future of the insurance industry and continue making a positive impact on the lives of its policyholders.

What makes Progressive Insurance unique compared to other insurance providers?

+

Progressive Insurance stands out for its innovative approach to insurance, offering personalized coverage options like the Snapshot program. Its focus on digital transformation and customer experience sets it apart, providing convenient online and mobile services. Additionally, Progressive’s commitment to risk management and claims handling ensures a proactive and efficient approach to customer support.

How does Progressive’s Snapshot program work, and what are the benefits for policyholders?

+

The Snapshot program uses a small device installed in the vehicle to track driving behavior. It collects data on factors like mileage, driving time, and braking habits. Policyholders can receive personalized insurance rates based on their driving habits, encouraging safer driving and potential savings on premiums. This program promotes a culture of safe driving and provides an incentive for policyholders to be more cautious on the road.

What are some of Progressive’s initiatives in sustainability and community engagement?

+

Progressive has implemented various environmental initiatives, such as adopting energy-efficient practices and investing in renewable energy. The company also actively engages with local communities through educational programs, community event sponsorships, and volunteer opportunities. These efforts demonstrate Progressive’s commitment to social responsibility and its desire to make a positive impact beyond insurance services.