Insurance Medicare Supplemental

The world of healthcare and insurance is vast and often complex, with numerous plans, policies, and options available to individuals. One such option that plays a crucial role in ensuring comprehensive healthcare coverage for retirees is Medicare Supplemental Insurance, also known as Medigap. This article aims to delve into the intricacies of Medigap, exploring its benefits, coverage, and the impact it has on the healthcare landscape for senior citizens.

Understanding Medicare Supplemental Insurance (Medigap)

Medigap, as the name suggests, is a supplemental insurance plan designed to fill the gaps left by original Medicare, a federal health insurance program primarily for people aged 65 or older, and some younger people with disabilities. Original Medicare, consisting of Part A (hospital insurance) and Part B (medical insurance), covers a wide range of healthcare services, but it doesn’t cover all costs, leaving potential gaps in coverage that can lead to significant out-of-pocket expenses.

This is where Medigap steps in. Medigap policies, offered by private insurance companies, are designed to cover these gaps, providing additional financial protection to Medicare beneficiaries. These policies offer standardized benefits, ensuring that regardless of the insurance company, the coverage for a particular Medigap plan is the same across the board.

The Benefits of Medicare Supplemental Insurance

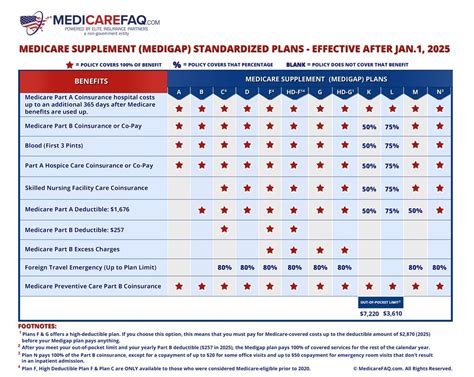

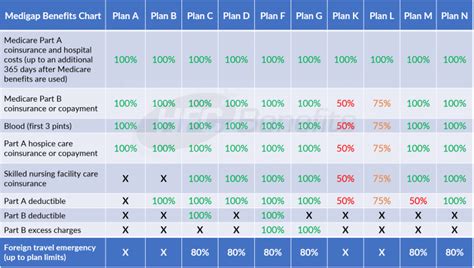

Medigap policies offer a wide array of benefits, each designed to address specific healthcare needs and financial concerns. These benefits can include coverage for Medicare Part A deductible, Part B coinsurance, and copayments, as well as additional services like foreign travel emergency care.

| Medigap Plan | Benefits Covered |

|---|---|

| Plan A | Part A deductible, Part B coinsurance, blood deductible |

| Plan B | Plan A benefits + Part B deductible |

| Plan C | Plan B benefits + foreign travel emergency care |

| Plan D | Plan C benefits + additional Part B coverage |

| ... | ... |

Each plan offers a unique set of benefits, allowing individuals to choose the plan that best suits their healthcare needs and budget. For instance, Plan A, the most basic Medigap plan, covers the Part A deductible and coinsurance for Part A services. On the other hand, Plan F, often considered the most comprehensive plan, covers all the gaps in original Medicare, including Part B deductible and excess charges.

Enrolling in Medicare Supplemental Insurance

Enrollment in Medigap is a straightforward process, typically offered during specific enrollment periods. The most common enrollment period is the Initial Medigap Enrollment Period, which begins the month you turn 65 and are enrolled in Medicare Part B. During this period, you can enroll in any Medigap plan available in your state without undergoing a medical underwriting process.

Other enrollment periods include the Guaranteed Issue Rights, which often occur when you lose your group health plan coverage or when you switch from a Medicare Advantage Plan back to original Medicare. During these periods, insurance companies are required to sell you any Medigap policy they offer, regardless of your health status.

Cost and Premiums of Medigap Plans

The cost of Medigap plans varies depending on several factors, including the specific plan, the insurance company, and the individual’s location and age. Generally, premiums are higher for plans with more comprehensive coverage and for older individuals. However, it’s important to remember that Medigap plans have no network restrictions, meaning policyholders can use any doctor, hospital, or other healthcare provider that accepts Medicare.

Additionally, Medigap policies do not have a maximum out-of-pocket limit, unlike some other insurance plans. This means that once the policyholder's out-of-pocket expenses reach a certain point, the insurance company will cover the remaining costs for the rest of the year. However, it's crucial to understand that these expenses do not carry over from year to year.

The Impact of Medicare Supplemental Insurance on Healthcare

Medigap policies have a significant impact on the healthcare landscape for senior citizens. By offering comprehensive coverage, Medigap ensures that retirees have access to the necessary healthcare services without worrying about excessive out-of-pocket expenses. This not only promotes better health outcomes but also reduces the financial burden on retirees, allowing them to lead a more secure and comfortable life.

Moreover, Medigap policies contribute to the overall stability of the healthcare system by reducing the financial strain on Medicare. With Medigap covering the gaps in original Medicare, there is less financial pressure on the federal health insurance program, ensuring its sustainability and accessibility for all eligible individuals.

The Future of Medicare Supplemental Insurance

As the healthcare landscape continues to evolve, so too will Medicare Supplemental Insurance. With ongoing debates and policy changes, the future of Medigap is likely to see some transformations. One potential change is the introduction of a standardized Medigap plan, which would simplify the enrollment process and make it easier for individuals to understand and compare plans.

Additionally, there may be shifts in the cost structure of Medigap plans, with potential changes to premium amounts and the introduction of more affordable options. These changes could make Medigap more accessible to a wider range of individuals, ensuring that more retirees can benefit from this crucial supplemental insurance.

Conclusion

Medicare Supplemental Insurance, or Medigap, plays a vital role in the healthcare journey of senior citizens. By filling the gaps in original Medicare, Medigap ensures that retirees have access to comprehensive healthcare coverage, promoting better health and financial security. With its standardized benefits and enrollment periods, Medigap provides a reliable and accessible option for retirees seeking additional healthcare protection.

As we look towards the future, it's clear that Medigap will continue to evolve, adapting to the changing needs and policies of the healthcare system. Whether through standardized plans or more affordable options, Medigap will remain a crucial component of healthcare for retirees, ensuring their well-being and financial stability.

What is the difference between Medicare and Medigap?

+Medicare is a federal health insurance program for people aged 65 or older, while Medigap (Medicare Supplemental Insurance) is a private insurance plan designed to fill the gaps in original Medicare coverage.

Are there any enrollment periods for Medigap plans?

+Yes, there are specific enrollment periods for Medigap plans, including the Initial Medigap Enrollment Period and Guaranteed Issue Rights periods. During these periods, individuals can enroll in Medigap plans without undergoing medical underwriting.

Do Medigap plans cover prescription drugs?

+No, Medigap plans do not cover prescription drugs. For prescription drug coverage, individuals need to enroll in a separate Medicare Part D plan.