Affordable Commercial Auto Insurance

Commercial auto insurance is a vital aspect of running a business, particularly for those operating fleets of vehicles or using personal vehicles for commercial purposes. It provides crucial protection against the unique risks associated with business-related transportation. However, finding affordable commercial auto insurance can be a challenging task for many businesses, especially small and medium-sized enterprises with limited resources. This comprehensive guide aims to shed light on the complexities of commercial auto insurance, offering expert insights and strategies to secure the best coverage at competitive rates.

Understanding Commercial Auto Insurance

Commercial auto insurance is a specialized type of insurance policy designed to protect businesses that utilize vehicles in their operations. Unlike personal auto insurance, commercial policies cater to the unique needs of businesses, covering a range of vehicles from single-person vans to large commercial trucks. The primary purpose of this insurance is to provide financial protection in the event of accidents, lawsuits, or other incidents involving business-owned or operated vehicles.

The coverage offered by commercial auto insurance policies can be tailored to the specific needs of the business. This may include liability coverage, which protects against bodily injury and property damage claims arising from accidents; physical damage coverage, which covers the cost of repairing or replacing damaged vehicles; and medical payments coverage, which provides for the medical expenses of injured parties, regardless of fault.

Additionally, commercial auto insurance policies can also include personal injury protection (PIP) or uninsured/underinsured motorist coverage, depending on the state and the specific requirements of the business. These coverages offer further protection for policyholders and their employees in the event of an accident.

Key Components of Commercial Auto Insurance Policies

- Liability Coverage: This is the foundation of any commercial auto insurance policy. It protects the business from claims made by third parties for bodily injury or property damage resulting from an accident involving a company vehicle.

- Physical Damage Coverage: This coverage is crucial for protecting the business’s investment in its vehicles. It covers the cost of repairing or replacing vehicles damaged in an accident, including those caused by vandalism, theft, or natural disasters.

- Medical Payments Coverage: Also known as MedPay, this coverage provides for the medical expenses of injured parties, regardless of who is at fault in an accident. It can help cover the cost of emergency treatment, hospital stays, and other medical services.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the business and its employees if they are involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Personal Injury Protection (PIP): PIP coverage, available in some states, provides additional benefits for policyholders and their passengers, including medical expenses, lost wages, and other related costs.

Each of these components can be customized to fit the specific needs and budget of the business. For instance, businesses can choose higher liability limits to provide greater protection against potential lawsuits, or they can opt for deductibles to reduce their premium costs.

Factors Affecting Commercial Auto Insurance Rates

The cost of commercial auto insurance can vary significantly depending on several factors. Understanding these factors is essential for businesses aiming to secure affordable coverage.

Vehicle Type and Usage

The type of vehicles a business operates and how they are used play a significant role in determining insurance rates. Generally, larger vehicles, such as trucks and vans, tend to be more expensive to insure due to their higher repair and replacement costs. Additionally, vehicles used for more hazardous activities, such as transporting hazardous materials or engaging in high-risk jobs, will also attract higher premiums.

| Vehicle Type | Average Annual Premium |

|---|---|

| Passenger Cars | $1,500 - $2,000 |

| Vans | $2,000 - $3,000 |

| Trucks | $3,000 - $5,000 |

Furthermore, the usage of the vehicle can also impact insurance rates. For instance, vehicles used for long-haul transportation or those that frequently travel in high-risk areas may face higher premiums due to the increased exposure to potential accidents.

Driver Profile and History

The driving records of the business’s drivers are a critical factor in determining insurance rates. Drivers with clean records, free from accidents or serious traffic violations, are generally considered lower risk and can help keep insurance premiums down. Conversely, drivers with a history of accidents or traffic violations may significantly increase the cost of commercial auto insurance.

The age and experience of drivers can also influence insurance rates. Younger, less experienced drivers are often considered higher risk and may lead to higher premiums. Similarly, drivers with a history of drug or alcohol-related offenses can significantly impact insurance costs.

Coverage Limits and Deductibles

The coverage limits chosen by the business will directly affect the cost of the insurance policy. Higher coverage limits provide greater financial protection but also result in higher premiums. On the other hand, opting for higher deductibles can reduce premium costs, as the business assumes a larger portion of the risk.

It's important for businesses to strike a balance between the coverage they need and the premiums they can afford. By carefully considering their coverage limits and deductibles, businesses can find a policy that offers adequate protection without breaking the bank.

Strategies for Securing Affordable Commercial Auto Insurance

Securing affordable commercial auto insurance requires a strategic approach. Here are some expert tips and strategies to help businesses navigate the complex world of commercial auto insurance and find the best coverage at the most competitive rates.

Shop Around and Compare Quotes

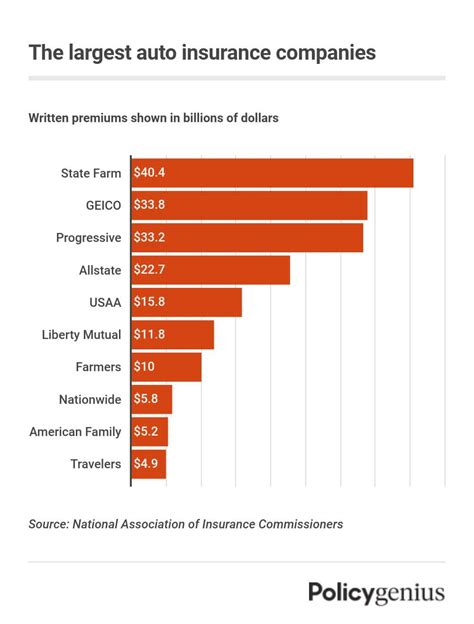

One of the most effective ways to find affordable commercial auto insurance is to shop around and compare quotes from multiple insurance providers. Each insurer has its own unique underwriting guidelines and pricing structures, so getting quotes from a variety of sources can help businesses identify the most competitive rates.

When comparing quotes, it's important to ensure that the policies being compared offer similar coverage levels. This allows for an apples-to-apples comparison and helps businesses identify the best value for their money.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when businesses purchase multiple policies from them. For instance, a business that already has general liability or property insurance with a particular insurer may be eligible for a discount on their commercial auto insurance policy if they choose to bundle these policies together.

By bundling policies, businesses not only save money on their insurance premiums but also streamline their insurance management process. It's a win-win situation that simplifies insurance administration and reduces overall costs.

Implement Risk Management Strategies

Implementing effective risk management strategies can help reduce the likelihood of accidents and claims, which in turn can lead to lower insurance premiums. This may include investing in driver training programs to improve driver safety, implementing rigorous vehicle maintenance schedules to keep vehicles in good condition, and adopting safe driving policies such as prohibiting the use of cell phones while driving.

By demonstrating a commitment to safety and risk mitigation, businesses can often negotiate better insurance rates. Insurance providers recognize that businesses with strong risk management practices are less likely to file claims, making them more attractive clients.

Review and Adjust Coverage Regularly

Insurance needs can change over time, so it’s important for businesses to regularly review their commercial auto insurance policies and adjust coverage as necessary. This may involve increasing or decreasing coverage limits, changing deductibles, or adding new vehicles to the policy.

Regular policy reviews also provide an opportunity to shop around for better rates. As the business's needs and circumstances evolve, the insurance landscape may also change, offering new opportunities for cost savings.

The Role of Insurance Brokers

Insurance brokers can be invaluable resources for businesses seeking affordable commercial auto insurance. They are experts in the insurance industry and have access to a wide range of insurance providers and policies. By working with a broker, businesses can leverage their expertise and connections to find the best coverage at the most competitive rates.

Expertise and Industry Knowledge

Insurance brokers have a deep understanding of the insurance market and the various coverage options available. They can provide valuable insights into the different types of commercial auto insurance policies, helping businesses make informed decisions about their coverage needs.

Brokers stay up-to-date with the latest trends and developments in the insurance industry, ensuring that businesses have access to the most current and relevant information. This expertise can be especially beneficial for businesses that may not have the time or resources to stay abreast of industry changes.

Access to Multiple Insurance Providers

One of the biggest advantages of working with an insurance broker is their ability to access a wide range of insurance providers. Brokers have established relationships with numerous insurers, allowing them to shop around on behalf of their clients and find the best coverage options.

By working with multiple insurers, brokers can negotiate better rates and terms for their clients. They can also help businesses compare policies from different providers, ensuring that the chosen policy offers the best value for the business's unique needs.

Personalized Service and Support

Insurance brokers provide personalized service and support to their clients. They work closely with businesses to understand their specific needs and goals, and then tailor insurance solutions to meet those needs. This level of customization ensures that businesses receive the coverage they require without paying for unnecessary extras.

Brokers also provide ongoing support throughout the policy term. They can assist with policy changes, claims submissions, and any other insurance-related issues that may arise. This comprehensive support can be a significant advantage for businesses, providing peace of mind and ensuring that their insurance needs are always met.

Conclusion: Securing the Best Coverage at Competitive Rates

Affordable commercial auto insurance is within reach for businesses that take a strategic approach to their insurance needs. By understanding the factors that influence insurance rates, implementing effective risk management strategies, and leveraging the expertise of insurance brokers, businesses can secure the best coverage at competitive rates.

Commercial auto insurance is a critical aspect of any business's risk management plan. By taking the time to carefully evaluate their coverage options and negotiate the best terms, businesses can protect their assets, safeguard their operations, and ensure the long-term success and sustainability of their enterprises.

How often should I review my commercial auto insurance policy?

+It’s recommended to review your policy annually or whenever your business circumstances change significantly. This ensures that your coverage remains up-to-date and aligned with your current needs.

Can I save money on my commercial auto insurance by increasing my deductible?

+Yes, increasing your deductible can lead to lower insurance premiums. However, it’s important to ensure that the increased deductible is affordable in the event of a claim.

What are some common discounts available for commercial auto insurance policies?

+Common discounts include bundle discounts for multiple policies, safe driver discounts, and safety equipment discounts. It’s worth discussing potential discounts with your insurance provider.