Insurance Marketplace Utah

Welcome to the comprehensive guide on the Insurance Marketplace in Utah, a state known for its stunning natural beauty and diverse landscapes. As an expert in the insurance industry, I will take you on a journey through the unique landscape of insurance options available to Utah residents, providing you with an in-depth understanding of the market, its offerings, and how to navigate it effectively.

The insurance landscape in Utah is a dynamic and competitive environment, offering a wide array of choices to individuals, families, and businesses. From health insurance to auto coverage, home insurance, and beyond, the Utah Insurance Marketplace presents both opportunities and challenges for those seeking adequate protection. This guide aims to demystify the process, offering valuable insights and practical tips to ensure you make informed decisions that align with your specific needs.

Understanding the Utah Insurance Market

Utah boasts a robust insurance market, characterized by a diverse range of providers, policies, and coverage options. This diversity stems from the state’s commitment to fostering a competitive environment, which benefits consumers by driving down prices and increasing the variety of offerings.

The Utah Insurance Department plays a pivotal role in regulating and overseeing the market. Their primary objectives include protecting consumers from unfair practices, ensuring insurance companies operate financially sound, and promoting a competitive environment that benefits policyholders. Their efforts have resulted in a stable and reliable insurance market, providing Utah residents with peace of mind and assurance.

Key Players in the Utah Insurance Industry

The Utah insurance market is home to a plethora of insurance carriers, each with its unique offerings and specialties. Some of the major players include Allstate, State Farm, Farmers Insurance, and Progressive, who collectively dominate the auto and home insurance sectors. These companies offer competitive rates and comprehensive coverage options, making them popular choices among Utah residents.

In the health insurance arena, UnitedHealthcare, BlueCross BlueShield of Utah, and SelectHealth are prominent players. These companies provide a range of health plans, catering to individual needs and budgets. From affordable individual plans to comprehensive family coverage, these providers ensure Utahns have access to quality healthcare.

| Insurance Type | Leading Carriers |

|---|---|

| Auto Insurance | Allstate, State Farm, Farmers Insurance, Progressive |

| Home Insurance | Allstate, State Farm, Farmers Insurance, Liberty Mutual |

| Health Insurance | UnitedHealthcare, BlueCross BlueShield of Utah, SelectHealth |

Insurance Options in Utah

Utah residents have a wide array of insurance options at their disposal, each tailored to meet specific needs. Whether you’re looking for auto, home, health, life, or business insurance, the Utah Insurance Marketplace has you covered. Let’s delve into some of these options and explore what they entail.

Auto Insurance

Auto insurance is a legal requirement in Utah, and for good reason. It provides financial protection against physical damage, bodily injury, and liability arising from road accidents. In Utah, the minimum liability coverage required is 25,000 for bodily injury or death per person, 65,000 for bodily injury or death per accident, and $15,000 for property damage.

However, many Utahns opt for more comprehensive coverage, including collision and comprehensive coverage, which provide protection for damage to your vehicle, regardless of fault. Additionally, personal injury protection (PIP) and uninsured/underinsured motorist coverage are often included to ensure adequate protection.

When shopping for auto insurance in Utah, it's essential to compare quotes from multiple providers. Factors such as your driving history, the type of vehicle you drive, and your geographic location can significantly impact your premium. By comparing quotes, you can find the best coverage at the most competitive rate.

Home Insurance

Home insurance is another vital aspect of protecting your assets in Utah. This type of insurance provides coverage for your home and its contents against a variety of perils, including fire, theft, and natural disasters. It also offers liability protection in case someone is injured on your property.

In Utah, the average cost of home insurance is around $1,300 per year, but this can vary significantly depending on factors like the location, size, and construction of your home. Additionally, the frequency of natural disasters in your area can impact your premium. For instance, Utah's susceptibility to wildfires and flash floods may increase insurance costs for those living in high-risk areas.

When choosing home insurance, it's crucial to understand the specific coverage you need. For instance, if you have high-value possessions like jewelry or artwork, you may need to purchase additional coverage to ensure they're adequately protected.

Health Insurance

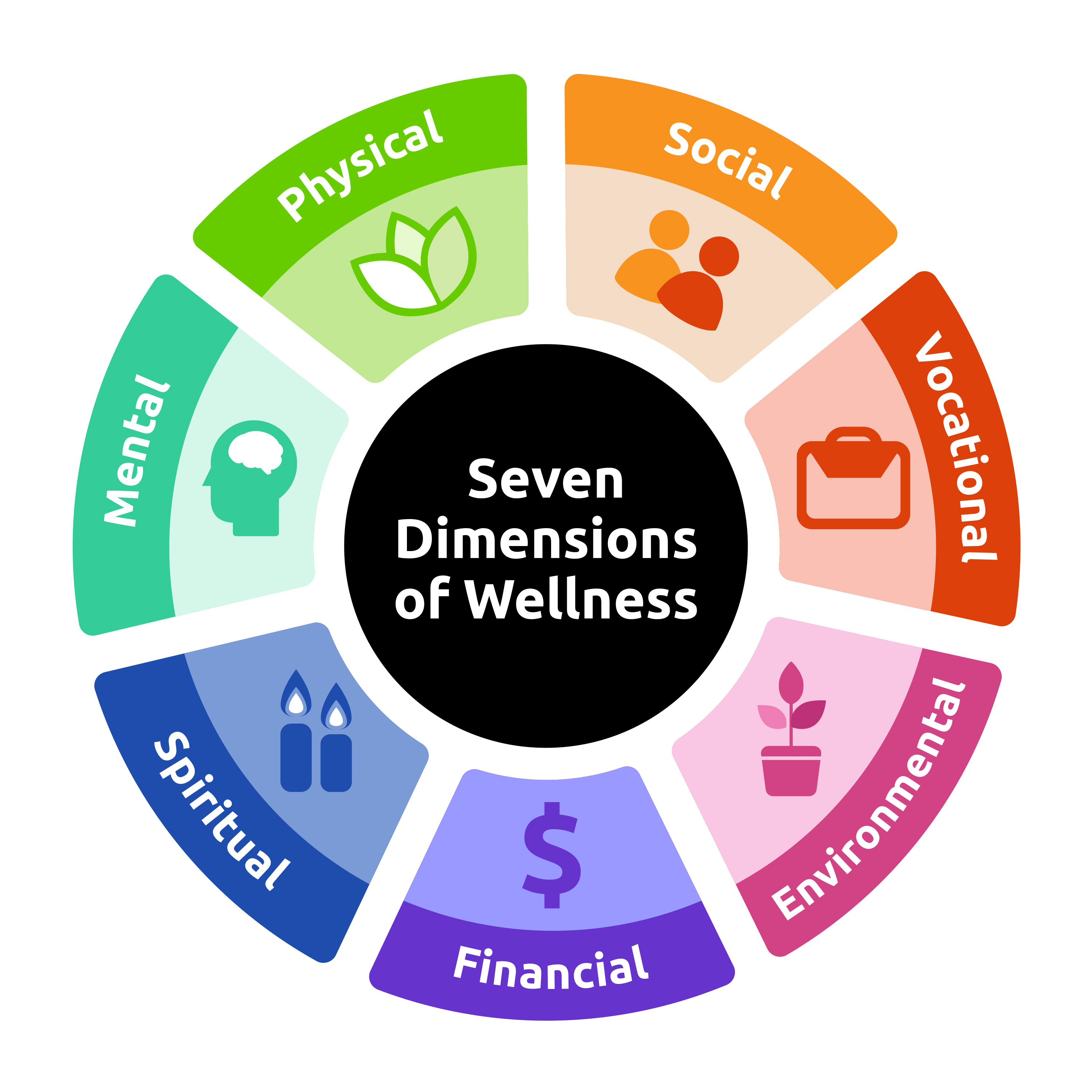

Health insurance is a crucial aspect of life, and in Utah, there are numerous options available. The state’s healthcare system is robust, with a range of providers offering various plans to cater to different needs and budgets.

For individuals and families, there are individual market plans, which provide flexibility and personalized coverage. These plans can be purchased directly from insurance companies or through the state's health insurance marketplace, HealthifyUtah. The marketplace offers a user-friendly platform to compare plans, ensuring you find the best fit for your healthcare needs.

Additionally, Utah residents can opt for employer-sponsored health insurance plans. These plans are often more comprehensive and cost-effective, as employers often contribute to the premium. For those who are self-employed or work for small businesses, there are also small group market plans available, which offer similar benefits to employer-sponsored plans.

Medicaid and the Children's Health Insurance Program (CHIP) are also available in Utah, providing coverage for low-income individuals and families. These programs offer essential healthcare services, ensuring that all Utah residents have access to quality medical care.

Navigating the Utah Insurance Marketplace

With so many options available, navigating the Utah Insurance Marketplace can be daunting. However, with the right approach and tools, the process can be streamlined and efficient. Here are some tips to help you navigate the market effectively.

Research and Compare

Before making any insurance decisions, it’s crucial to research and compare various options. This involves understanding your specific needs and the coverage required, as well as comparing quotes from multiple providers. Online comparison tools and insurance brokers can be valuable resources in this process.

When comparing quotes, pay attention to the coverage details and not just the price. Ensure that the policies you're considering offer the level of protection you need. Additionally, check for any discounts or incentives that can reduce your premium.

Understand Your Needs

Every individual or family has unique insurance needs. Whether it’s auto, home, health, or life insurance, understanding your specific requirements is crucial. Consider factors like your lifestyle, assets, and potential risks to determine the coverage you need.

For instance, if you have a long daily commute or live in an area with high traffic, you may require more comprehensive auto insurance coverage. Similarly, if you own a home in a high-risk area for natural disasters, you'll need a robust home insurance policy.

Utilize Online Resources

The internet is a powerful tool when it comes to insurance. There are numerous online resources, such as insurance comparison websites and the Utah Insurance Department’s official website, that can provide valuable information and guidance.

These resources often offer detailed explanations of insurance policies, coverage options, and potential discounts. They can also provide insights into the reputation and financial stability of insurance providers, helping you make informed decisions.

Seek Professional Advice

While online resources are invaluable, sometimes it’s beneficial to seek professional advice. Insurance brokers and agents can provide personalized guidance, taking into account your specific circumstances and needs. They can offer expert advice on the best policies and coverage options, ensuring you’re adequately protected.

Additionally, if you have complex insurance needs or are facing unique challenges, such as a history of claims or a high-risk occupation, an insurance professional can provide tailored solutions.

The Future of Insurance in Utah

The insurance landscape in Utah is constantly evolving, driven by technological advancements, changing consumer needs, and regulatory updates. As we look to the future, several trends and developments are shaping the industry.

Digital Transformation

The insurance industry in Utah, like many others, is experiencing a digital transformation. Insurance providers are increasingly adopting digital technologies to enhance their services and improve the customer experience. This includes online policy management, digital claims processing, and the use of artificial intelligence for risk assessment and fraud detection.

For consumers, this means faster and more efficient services, as well as increased convenience. With digital tools, you can manage your insurance policies, file claims, and access support 24/7, all from the comfort of your home.

Focus on Customer Experience

Insurance providers in Utah are placing a growing emphasis on customer experience. This involves providing personalized services, streamlined processes, and enhanced communication channels. Many companies are investing in customer support teams and implementing feedback loops to ensure they meet and exceed customer expectations.

As a result, consumers can expect more responsive and attentive service, with insurance providers going the extra mile to ensure their needs are met.

Embracing Sustainability

With a growing focus on sustainability and environmental responsibility, insurance providers in Utah are adapting their policies and practices. This includes offering incentives for eco-friendly behaviors, such as discounts for electric vehicles or homes with renewable energy systems.

Additionally, insurance companies are developing new products and services that cater to the needs of a more sustainable world. For instance, there's an increasing trend of insurance providers offering coverage for electric vehicles, solar panels, and other green technologies.

Regulatory Updates

The Utah Insurance Department regularly updates its regulations to ensure the market remains fair, competitive, and consumer-friendly. These updates often include changes to coverage requirements, consumer protection measures, and insurance company obligations.

As a consumer, staying informed about these regulatory changes is essential. It ensures you understand your rights and obligations and helps you make informed decisions when choosing insurance policies.

Conclusion

The Insurance Marketplace in Utah offers a wealth of opportunities and choices for residents. With a diverse range of insurance providers, policies, and coverage options, Utahns can find the protection they need to navigate life’s uncertainties. By understanding the market, researching options, and seeking professional advice when needed, you can ensure you’re adequately protected while making the most of the competitive insurance landscape.

As the insurance industry continues to evolve, Utah's Insurance Marketplace will remain a dynamic and consumer-centric environment, ensuring Utah residents have access to quality insurance products and services.

What is the average cost of auto insurance in Utah?

+The average cost of auto insurance in Utah is around $1,200 per year. However, this can vary significantly depending on factors like your driving history, the type of vehicle you drive, and your geographic location.

How do I find the best health insurance plan in Utah?

+To find the best health insurance plan in Utah, start by understanding your specific healthcare needs and budget. Compare plans available on the HealthifyUtah marketplace, and consider factors like network providers, coverage limits, and out-of-pocket costs. You can also consult with an insurance broker or agent for personalized advice.

Are there any discounts available for home insurance in Utah?

+Yes, there are several discounts available for home insurance in Utah. These can include discounts for having multiple policies with the same insurer, having safety features like smoke detectors or security systems, or being a loyal customer for a certain number of years. It’s always worth asking your insurance provider about potential discounts.