Insurance Limits

Insurance limits are a fundamental aspect of the insurance industry, playing a crucial role in defining the scope and extent of coverage provided by various policies. These limits, often expressed as monetary values, establish the maximum amount an insurer is liable to pay under specific circumstances. Understanding insurance limits is essential for policyholders, as it directly impacts their financial protection and peace of mind. In this comprehensive guide, we will delve into the world of insurance limits, exploring their significance, types, and how they affect different insurance policies.

The Importance of Insurance Limits

Insurance limits are a critical component of any insurance contract. They serve as a financial safety net, ensuring that policyholders have a clear understanding of the extent of their coverage. By setting these limits, insurers can manage their risk exposure effectively, allowing them to provide coverage to a larger number of individuals and businesses.

The presence of insurance limits also encourages policyholders to take a proactive approach to risk management. When individuals and businesses are aware of the limits, they are more likely to take preventive measures to mitigate risks, thereby reducing the likelihood and impact of potential claims. This shared responsibility between insurers and policyholders fosters a culture of safety and awareness.

Types of Insurance Limits

Insurance limits can vary significantly based on the type of insurance policy and the specific coverage it provides. Here are some common types of insurance limits:

Per-Occurrence Limits

Per-occurrence limits, also known as occurrence limits, represent the maximum amount an insurer will pay for a single event or incident covered by the policy. For example, a property insurance policy may have a per-occurrence limit of 1 million, meaning the insurer will pay up to 1 million for damages caused by a single fire, storm, or other covered event.

Aggregate Limits

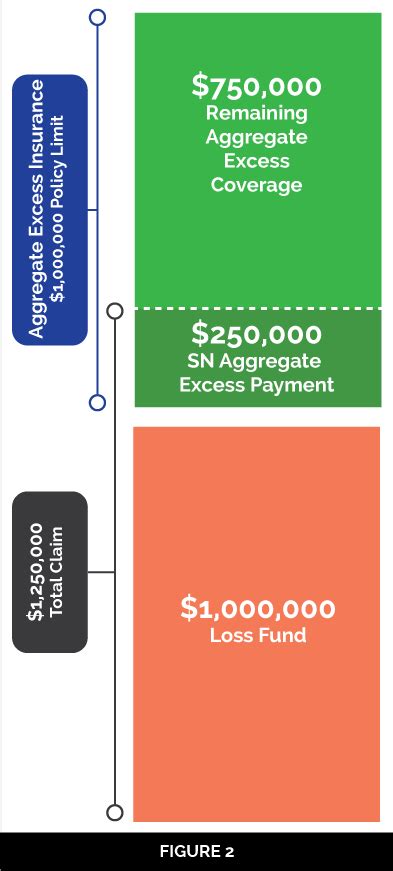

Aggregate limits, or policy limits, refer to the total amount an insurer will pay for all covered events or incidents during a specific policy period, typically a year. These limits are often higher than per-occurrence limits and are designed to protect insurers from excessive financial exposure. If a policyholder experiences multiple claims in a year, the aggregate limit ensures that the insurer’s liability is capped at a predetermined amount.

Sub-Limits

Sub-limits are specific limits set for certain types of coverage within a policy. These limits apply to particular risks or categories of losses. For instance, a homeowner’s insurance policy may have a sub-limit for jewelry theft, limiting the insurer’s liability to a specific amount for stolen jewelry. Sub-limits help insurers manage their risk and provide tailored coverage for different scenarios.

Deductibles and Co-Insurance

While not technically insurance limits, deductibles and co-insurance are important aspects of insurance policies. A deductible is the amount the policyholder must pay out of pocket before the insurer covers any costs. Co-insurance, on the other hand, is a percentage of the claim that the policyholder is responsible for paying. These mechanisms further manage risk and encourage policyholders to be prudent in their claims.

How Insurance Limits Affect Different Policies

Insurance limits can vary significantly across different types of insurance policies, reflecting the unique risks and coverage needs associated with each.

Health Insurance

Health insurance policies often have complex limit structures. These may include annual or lifetime limits for specific procedures or treatments, as well as out-of-pocket maximums that cap the amount an individual must pay for healthcare expenses in a given year. Understanding these limits is crucial for individuals to manage their healthcare costs effectively.

Auto Insurance

Auto insurance policies typically have limits for liability coverage, which protects the policyholder if they are found at fault in an accident. These limits are usually expressed as three numbers, such as 100/300/100, representing the maximum amount the insurer will pay for bodily injury per person, total bodily injury per accident, and property damage, respectively. Higher limits provide greater financial protection but may also result in higher premiums.

Homeowners Insurance

Homeowners insurance policies have per-occurrence limits for property damage and liability. Additionally, they often include sub-limits for specific types of property, such as jewelry, fine art, or electronics. Policyholders should carefully review these limits to ensure they have adequate coverage for their valuable possessions.

Business Insurance

Business insurance policies, such as general liability insurance and commercial property insurance, have limits tailored to the specific risks faced by businesses. These limits can vary significantly based on the nature of the business and the industry. It’s essential for business owners to work with insurance professionals to determine appropriate limits that align with their unique needs.

Setting Appropriate Insurance Limits

Determining the right insurance limits is a critical task for both insurers and policyholders. Insurers use actuarial data and risk assessments to set limits that are financially viable while providing sufficient coverage. Policyholders, on the other hand, should consider their personal or business needs, potential risks, and the financial impact of various scenarios to choose limits that offer adequate protection.

Working with insurance brokers or agents can be beneficial in this process, as they can provide expert guidance and help policyholders understand the implications of different limits. Additionally, regularly reviewing and adjusting insurance limits as personal or business circumstances change is essential to maintaining appropriate coverage.

The Future of Insurance Limits

As the insurance industry continues to evolve, the concept of insurance limits is likely to undergo transformations as well. With advancements in technology and data analytics, insurers may develop more dynamic and personalized limit structures. These could adapt to the unique needs and risk profiles of individual policyholders, offering a more tailored approach to coverage.

Additionally, the rise of parametric insurance, which triggers payouts based on predefined parameters rather than individual claims, may influence the traditional concept of insurance limits. Parametric insurance could provide faster payouts and simplify the claims process, potentially impacting how limits are set and managed.

💡 Expert Insight: Insurance limits are a crucial component of any insurance policy, and understanding them is essential for both insurers and policyholders. By setting appropriate limits, insurers can manage risk effectively, while policyholders can ensure they have adequate coverage for their needs. As the industry evolves, the concept of insurance limits may become more dynamic and personalized, adapting to the unique risks and circumstances of individuals and businesses.

FAQ

What happens if I exceed my insurance limits in a claim?

+If you exceed your insurance limits in a claim, you will be responsible for any costs that exceed the policy’s limit. It’s important to review your policy’s limits and consider purchasing higher limits if you believe your current coverage may be insufficient.

Can insurance limits be increased or decreased during the policy period?

+Yes, insurance limits can often be adjusted during the policy period. Policyholders can request changes to their limits by contacting their insurer or insurance broker. However, it’s important to note that changing limits may impact the policy’s premium.

How do insurance limits affect my premium costs?

+Insurance limits directly impact the cost of your premium. Higher limits typically result in higher premiums, as insurers assume greater financial risk. Conversely, lower limits may lead to lower premiums, but they may not provide sufficient coverage for your needs.