Insurance Liability Coverage

Insurance liability coverage is an essential aspect of personal and business protection, offering crucial financial safeguards against various risks and potential liabilities. This article aims to delve into the intricacies of insurance liability coverage, providing a comprehensive guide for individuals and businesses to navigate this complex yet vital topic. From understanding the fundamentals to exploring real-world applications, we will uncover the importance of liability insurance and its role in safeguarding against unforeseen events.

Understanding the Fundamentals of Insurance Liability Coverage

At its core, insurance liability coverage provides a financial safety net for individuals and businesses, offering protection against legal claims and financial losses arising from accidental injuries, property damage, or other specified events. This type of insurance serves as a vital risk management tool, helping policyholders mitigate the potential financial consequences of unforeseen circumstances.

The scope of liability insurance can vary significantly, depending on the specific policy and the nature of the risks it covers. Generally, liability coverage extends to three main categories: personal injury, property damage, and contractual liability. Personal injury coverage safeguards policyholders against claims arising from bodily injury, illness, or emotional distress caused to others. Property damage liability, on the other hand, protects against claims resulting from damage to the property of others. Lastly, contractual liability coverage extends to losses arising from breaches of contract, ensuring that policyholders are financially protected even when contractual obligations are not met.

It is important to note that liability insurance policies typically come with specific exclusions and limitations. These exclusions outline situations or events that are not covered by the policy, ensuring that policyholders understand the boundaries of their coverage. Common exclusions may include intentional acts, professional services, and certain types of property damage. Understanding these exclusions is crucial for policyholders to assess their risk exposure accurately and make informed decisions regarding additional coverage or risk management strategies.

Types of Insurance Liability Coverage

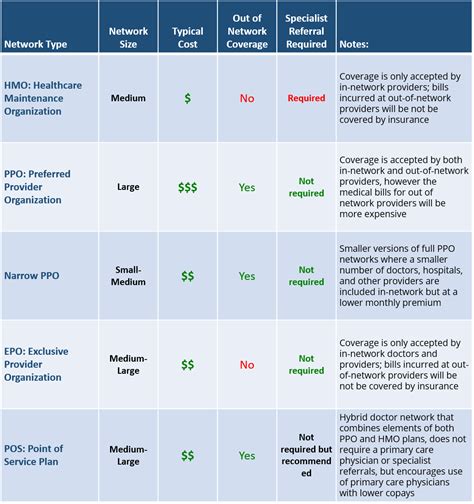

Insurance liability coverage encompasses a wide range of policies, each tailored to address specific risks and industries. Understanding the different types of liability coverage is essential for individuals and businesses to identify the most suitable options for their unique needs.

General Liability Insurance

General liability insurance is a broad form of liability coverage that offers protection against a wide range of common risks. This type of insurance is particularly beneficial for small businesses and professionals, as it provides coverage for bodily injury, property damage, personal and advertising injury, and medical expenses. General liability insurance acts as a safety net, ensuring that businesses can continue to operate smoothly even in the face of unexpected accidents or lawsuits.

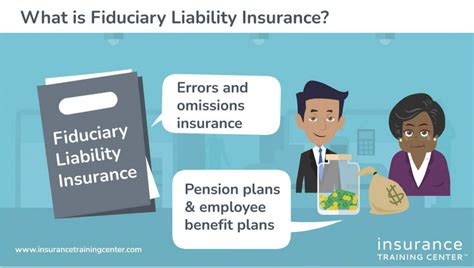

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is specifically designed for professionals such as doctors, lawyers, accountants, and consultants. This type of insurance safeguards against claims arising from mistakes, negligence, or failures in providing professional services. Professional liability insurance is crucial for professionals who provide advice or services to others, as it protects them from potential financial losses resulting from errors or omissions in their work.

Product Liability Insurance

Product liability insurance is tailored for businesses that manufacture, distribute, or sell products. This type of insurance provides coverage against claims arising from defects in the products sold by the business. Product liability insurance is essential for businesses to mitigate the financial risks associated with product recalls, lawsuits, or other legal actions resulting from product defects or failures.

Cyber Liability Insurance

With the increasing reliance on technology and the rise of cyber threats, cyber liability insurance has become an essential coverage for businesses and individuals. This type of insurance provides protection against a wide range of cyber risks, including data breaches, cyber extortion, and network security failures. Cyber liability insurance helps policyholders manage the financial implications of cyber incidents, including the costs of investigation, legal fees, and potential liability claims.

Real-World Applications of Insurance Liability Coverage

Insurance liability coverage finds its application in a multitude of scenarios, demonstrating its importance in protecting individuals and businesses from potential financial disasters. Let’s explore some real-world examples where liability insurance has played a crucial role.

Personal Injury Claims

Imagine a scenario where a customer slips and falls on a wet floor in a retail store. The customer sustains serious injuries and files a lawsuit against the store owner, seeking compensation for medical expenses, pain and suffering, and lost wages. In this case, the store owner’s liability insurance policy steps in, providing coverage for the legal costs, medical expenses, and potential settlement or judgment. Without liability insurance, the store owner could face significant financial strain and even the risk of bankruptcy.

Property Damage Claims

Consider a construction company that accidentally damages a neighbor’s property during a renovation project. The neighbor files a claim for the cost of repairs and seeks compensation for the inconvenience caused. Here, the construction company’s liability insurance policy covers the cost of repairs, ensuring that the neighbor receives fair compensation. Without liability insurance, the construction company could face significant financial losses and potential legal consequences.

Professional Negligence Claims

In the case of a medical professional, such as a doctor or dentist, liability insurance becomes even more crucial. Imagine a situation where a patient suffers harm due to a medical error or negligence. The patient may file a malpractice lawsuit, seeking compensation for their injuries and the associated medical expenses. In this scenario, the medical professional’s liability insurance policy provides coverage for legal fees, potential settlements, and even the cost of defending against the lawsuit. Without liability insurance, the medical professional could face devastating financial consequences.

The Benefits and Importance of Insurance Liability Coverage

Insurance liability coverage offers a multitude of benefits that extend beyond the mere financial protection it provides. Let’s delve into the key advantages and explore why liability insurance is an essential component of personal and business risk management.

Financial Protection

At its core, liability insurance serves as a financial safety net, providing policyholders with the means to cover legal costs, settlements, and judgments resulting from covered claims. In an increasingly litigious society, the potential for lawsuits and legal claims is ever-present. Without liability insurance, individuals and businesses could face significant financial burdens, leading to financial strain or even bankruptcy. Liability insurance ensures that policyholders can continue to operate smoothly, even in the face of unexpected legal challenges.

Peace of Mind

Having liability insurance provides policyholders with a sense of security and peace of mind. Knowing that they are protected against potential liabilities allows individuals and businesses to focus on their core activities without the constant worry of unforeseen risks. Liability insurance acts as a risk management tool, enabling policyholders to mitigate potential losses and plan for the future with confidence. With liability coverage in place, policyholders can sleep easier at night, knowing that they have taken proactive steps to safeguard their financial well-being.

Risk Management and Mitigation

Liability insurance is not just about financial protection; it also plays a crucial role in risk management and mitigation. By identifying and understanding the risks associated with their activities, individuals and businesses can make informed decisions about the level of coverage they require. Liability insurance allows policyholders to assess their exposure to various risks and take appropriate measures to minimize potential losses. This proactive approach to risk management ensures that policyholders can effectively manage their liabilities and protect their financial interests.

Compliance and Legal Requirements

In certain industries and professions, liability insurance is not just a recommended option but a legal requirement. For example, medical professionals, contractors, and businesses operating in highly regulated industries may be mandated by law to carry specific types of liability insurance. By complying with these requirements, individuals and businesses can avoid legal penalties and maintain their professional standing. Liability insurance ensures that policyholders meet the necessary standards and provides them with the necessary coverage to fulfill their legal obligations.

How to Choose the Right Insurance Liability Coverage

Selecting the appropriate insurance liability coverage is a critical decision that requires careful consideration. To ensure that individuals and businesses choose the right coverage, it is essential to follow a comprehensive evaluation process. Here are some key steps to guide you through the selection process.

Assess Your Risks

The first step in choosing the right liability insurance is to thoroughly assess your unique risks and exposures. Consider the nature of your business, the products or services you offer, and the potential liabilities associated with your operations. Identify the specific risks that are most relevant to your industry and assess the likelihood and potential impact of these risks. By understanding your risk profile, you can make informed decisions about the type and level of coverage you require.

Understand Your Policy Options

Liability insurance policies come in various forms, each tailored to address specific risks. It is crucial to familiarize yourself with the different types of liability coverage available, such as general liability, professional liability, product liability, and cyber liability insurance. Research and understand the scope and limitations of each policy, including the specific risks they cover and any potential exclusions. By understanding your policy options, you can make an informed choice that aligns with your unique needs and circumstances.

Evaluate Coverage Limits

When selecting liability insurance, it is essential to evaluate the coverage limits offered by different policies. Coverage limits refer to the maximum amount that the insurance company will pay for a covered claim. It is crucial to choose a policy with adequate coverage limits to ensure that you are protected against potential high-value claims. Consider the nature of your business, the potential severity of claims, and the financial impact they could have on your operations. By selecting a policy with appropriate coverage limits, you can mitigate the risk of financial losses exceeding your insurance coverage.

Consider Deductibles and Co-Insurance

Liability insurance policies often come with deductibles and co-insurance provisions. Deductibles represent the amount that the policyholder must pay out of pocket before the insurance coverage kicks in. Co-insurance, on the other hand, refers to the sharing of covered losses between the policyholder and the insurance company. When selecting liability insurance, it is important to carefully consider the deductibles and co-insurance provisions. Assess your financial capacity to absorb potential out-of-pocket expenses and choose a policy with deductibles and co-insurance arrangements that align with your risk tolerance and financial capabilities.

Review Exclusions and Limitations

Liability insurance policies typically include specific exclusions and limitations that outline the situations or events that are not covered by the policy. It is crucial to carefully review these exclusions and limitations to understand the boundaries of your coverage. By identifying any potential gaps in coverage, you can assess whether additional coverage options or risk management strategies are necessary to protect against specific risks. Reviewing exclusions and limitations ensures that you have a comprehensive understanding of your policy and can make informed decisions about your insurance needs.

Seek Expert Advice

Selecting the right insurance liability coverage can be a complex process, and seeking expert advice can provide valuable insights and guidance. Consider consulting with insurance brokers or agents who specialize in liability insurance. These professionals can assess your unique needs, provide tailored recommendations, and assist you in navigating the complex world of insurance policies. By leveraging their expertise, you can make informed decisions and choose the most suitable liability coverage for your circumstances.

The Future of Insurance Liability Coverage

As the world continues to evolve and new risks emerge, the landscape of insurance liability coverage is also experiencing significant changes. The insurance industry is adapting to the changing risk landscape, developing innovative solutions to address emerging challenges. Let’s explore some of the trends and developments shaping the future of insurance liability coverage.

Emerging Risks and Coverage Innovations

The insurance industry is continuously monitoring emerging risks and developing new coverage options to address these evolving challenges. With the rise of technology and the digital economy, new risks such as cyber attacks, data breaches, and privacy violations have become prominent concerns. In response, insurance companies are introducing specialized cyber liability insurance policies that provide comprehensive coverage for these risks. Additionally, the increasing prevalence of environmental concerns has led to the development of environmental liability insurance, which protects against claims arising from pollution or environmental damage.

Risk Assessment and Data Analytics

Advancements in data analytics and technology are revolutionizing the way insurance companies assess risks and underwrite policies. Insurance providers are leveraging sophisticated data analytics tools to analyze vast amounts of data, enabling them to make more accurate risk assessments. By utilizing data-driven insights, insurance companies can develop more tailored and precise liability coverage options. This shift towards data-driven underwriting enhances the accuracy of risk assessments and allows insurance companies to offer customized policies that align with the unique needs of policyholders.

Collaboration and Partnerships

The insurance industry is witnessing increased collaboration and partnerships between insurance companies, technology providers, and other stakeholders. These collaborations aim to leverage technological advancements and expertise to enhance risk assessment, claims management, and overall customer experience. By partnering with technology companies, insurance providers can integrate innovative solutions such as artificial intelligence, machine learning, and blockchain technology into their operations. These partnerships enable insurance companies to streamline processes, improve efficiency, and deliver more efficient and effective liability coverage solutions.

Embracing Sustainability and Environmental Concerns

With growing awareness of environmental sustainability and climate change, the insurance industry is also adapting to address these critical concerns. Insurance providers are developing new products and initiatives that promote sustainability and support environmentally responsible practices. For example, some insurance companies offer incentives or discounts to policyholders who adopt sustainable measures or implement green technologies. Additionally, insurance providers are actively engaging in initiatives to reduce their own environmental impact, such as implementing energy-efficient practices and adopting sustainable business models.

Regulatory Changes and Industry Trends

The insurance industry is subject to constant regulatory changes and evolving industry trends. As governments and regulatory bodies adapt to the changing risk landscape, new regulations and guidelines are introduced to govern the insurance sector. Insurance companies must stay abreast of these changes to ensure compliance and maintain their operational integrity. Additionally, industry trends, such as the increasing demand for personalized insurance solutions and the shift towards digital insurance platforms, are shaping the future of insurance liability coverage. By staying attuned to these trends, insurance providers can remain competitive and meet the evolving needs of their policyholders.

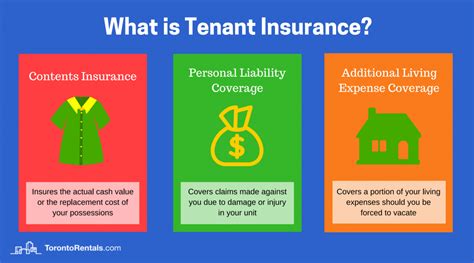

What is the difference between liability insurance and property insurance?

+Liability insurance and property insurance are distinct types of coverage, each serving different purposes. Liability insurance provides protection against legal claims and financial losses arising from accidental injuries, property damage, or other specified events. It covers the policyholder’s legal liability for damages caused to others. On the other hand, property insurance safeguards against physical damage or loss to the policyholder’s own property, such as their home, business premises, or personal belongings. Property insurance provides financial protection in the event of theft, fire, natural disasters, or other covered perils.

How much does insurance liability coverage typically cost?

+The cost of insurance liability coverage can vary significantly depending on several factors, including the type of policy, the level of coverage, the industry or profession, and the policyholder’s specific risk profile. General liability insurance for small businesses typically ranges from a few hundred to a few thousand dollars annually. However, for more specialized liability coverage, such as professional liability or product liability insurance, the cost can be higher, often in the thousands of dollars. It is important to note that the cost of liability insurance is influenced by the policy limits, deductibles, and the specific risks associated with the policyholder’s activities.

Are there any situations where liability insurance may not cover claims?

+Yes, liability insurance policies often include specific exclusions and limitations that outline situations where claims may not be covered. Common exclusions include intentional acts, such as fraud or criminal behavior, professional services rendered outside the scope of the policy, and certain types of property damage, such as damage resulting from war or nuclear incidents. It is crucial for policyholders to carefully review the exclusions and limitations outlined in their policy to understand the boundaries of their coverage and identify any potential gaps.