Insurance Liability Car

Insurance liability for car owners is a critical aspect of automotive ownership, ensuring financial protection in the event of accidents and other unforeseen circumstances. This article aims to provide an in-depth analysis of car insurance liability, covering its definition, coverage, benefits, and implications for policyholders. By understanding the intricacies of insurance liability, car owners can make informed decisions to safeguard their assets and ensure peace of mind on the road.

Understanding Insurance Liability

Insurance liability, in the context of car insurance, refers to the legal responsibility of the policyholder to compensate others for injuries, damages, or losses caused by their vehicle. This liability coverage is a fundamental component of comprehensive car insurance policies, offering financial protection against third-party claims arising from accidents or other incidents.

When a car owner purchases liability insurance, they are essentially agreeing to transfer the financial risk associated with causing harm or damage to others onto their insurance provider. In exchange for regular premium payments, the insurance company promises to cover the costs associated with such incidents, up to the limits specified in the policy.

Key Components of Insurance Liability

Insurance liability for cars typically consists of two main types of coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other related costs if the policyholder’s vehicle causes injury to another person. It protects the policyholder from potentially devastating financial consequences of such accidents.

- Property Damage Liability: This aspect of insurance liability covers the cost of repairing or replacing property damaged by the policyholder’s vehicle. This can include damage to other vehicles, buildings, fences, or any other property involved in an accident.

Additionally, some policies may offer optional coverages such as:

- Uninsured/Underinsured Motorist Coverage: This provides protection if the at-fault driver in an accident is uninsured or doesn't have sufficient insurance to cover the costs.

- Medical Payments Coverage: This coverage helps pay for medical expenses for the policyholder and their passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): PIP coverage, available in some states, covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of fault.

The specific coverages and limits available will depend on the insurance provider and the state's regulations. It's essential for car owners to carefully review their policy documents and understand the extent of their coverage to ensure adequate protection.

Benefits of Insurance Liability

Insurance liability coverage offers several critical benefits to car owners, including:

Financial Protection

The primary benefit of insurance liability is financial protection. In the event of an accident, the costs associated with injuries and property damage can be substantial. Insurance liability coverage ensures that the policyholder is not left with unaffordable expenses, providing a safety net against potentially devastating financial consequences.

Legal Defense

Insurance liability coverage also includes legal defense in the event of a lawsuit. If the policyholder is sued for damages resulting from an accident, the insurance company will provide legal representation and cover the costs of the lawsuit, up to the policy limits. This aspect of liability coverage can be especially crucial in protecting the policyholder’s assets and reputation.

Peace of Mind

Knowing that one has insurance liability coverage provides peace of mind while driving. Policyholders can feel more confident and secure, knowing that they are protected against the financial and legal implications of causing harm or damage to others. This peace of mind can enhance overall driving experience and reduce stress on the road.

Factors Affecting Insurance Liability

Several factors can influence the cost and coverage of insurance liability, including:

State Regulations

Each state has its own regulations regarding minimum liability coverage requirements. These requirements dictate the minimum amounts of coverage that car owners must carry to legally operate a vehicle on public roads. It’s essential for policyholders to understand their state’s regulations and ensure they meet the minimum coverage standards.

Driving Record

Insurance companies consider the policyholder’s driving record when determining liability coverage costs. A clean driving record with no accidents or violations can lead to more affordable premiums, while a history of accidents or traffic violations may result in higher rates.

Vehicle Type and Usage

The type of vehicle and its intended usage can also impact insurance liability costs. For instance, high-performance sports cars or vehicles used for business purposes may have higher liability premiums due to the increased risk associated with their operation.

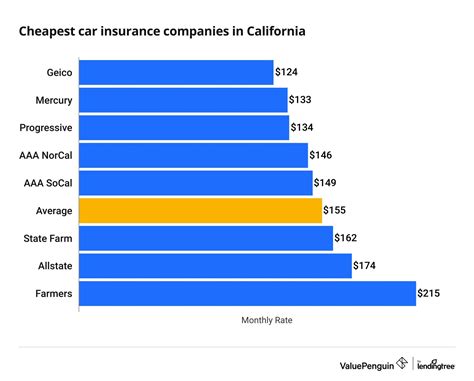

Insurance Provider and Policy Terms

Different insurance providers offer varying levels of coverage and pricing. Policyholders should compare multiple providers to find the best fit for their needs and budget. Additionally, the specific terms and conditions of a policy, such as deductibles and coverage limits, can significantly impact the overall cost and protection offered.

Case Study: Real-World Application of Insurance Liability

To illustrate the importance and benefits of insurance liability coverage, let’s consider a real-world scenario:

Imagine a policyholder, John, who is involved in a car accident while driving his sedan. The accident results in significant injuries to the other driver and extensive damage to both vehicles. Without insurance liability coverage, John would be responsible for paying all medical expenses, vehicle repairs, and potentially legal fees associated with the accident. These costs could easily amount to tens of thousands of dollars, putting a severe financial strain on John and his family.

However, with comprehensive insurance liability coverage, John's insurance provider steps in to cover these costs. The insurance company pays for the other driver's medical treatment, vehicle repairs, and any legal fees associated with the accident. John is protected from financial ruin and can focus on his recovery and getting back on the road.

This case study demonstrates how insurance liability coverage provides essential financial protection, peace of mind, and legal defense for car owners. By transferring the risk of causing harm or damage to their insurance provider, policyholders can drive with confidence, knowing they are protected in the event of an accident.

Future Implications and Industry Trends

The landscape of insurance liability is continually evolving, influenced by technological advancements, changing regulations, and shifting consumer needs. Here are some key trends and future implications to consider:

Autonomous Vehicles and Liability

As autonomous vehicles become more prevalent, the question of liability in accidents involving these vehicles arises. Insurance companies and policymakers are actively discussing and shaping regulations to determine liability in such cases. It’s likely that insurance policies will need to adapt to cover the unique risks and responsibilities associated with autonomous driving.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer customized premiums based on an individual’s actual driving habits. This technology can provide more accurate risk assessments and potentially reduce insurance costs for safe drivers.

Data Analytics and Risk Assessment

Advanced data analytics and machine learning are transforming the way insurance companies assess risk. By analyzing vast amounts of data, insurance providers can make more accurate predictions about potential risks and adjust premiums accordingly. This can lead to more tailored insurance products and improved risk management for policyholders.

Increased Focus on Preventative Measures

In addition to financial protection, insurance companies are increasingly promoting preventative measures to reduce the likelihood of accidents. This includes offering discounts for safety features, providing resources for driver education, and encouraging the use of advanced driver-assistance systems (ADAS) to improve road safety.

Conclusion

Insurance liability for cars is a vital aspect of automotive ownership, providing essential financial protection and peace of mind for policyholders. By understanding the components, benefits, and factors influencing insurance liability, car owners can make informed decisions to safeguard their assets and ensure their safety on the road. As the industry continues to evolve, staying abreast of the latest trends and developments in insurance liability is crucial for making well-informed choices about automotive insurance.

What is the difference between insurance liability and comprehensive coverage?

+Insurance liability coverage specifically addresses financial responsibility for injuries and property damage caused by the policyholder’s vehicle to others. On the other hand, comprehensive coverage provides protection for the policyholder’s own vehicle, covering damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal collisions.

Is insurance liability coverage mandatory for all car owners?

+Yes, insurance liability coverage is mandatory for car owners in most states. Each state has its own regulations regarding minimum liability coverage requirements, which dictate the minimum amounts of coverage that car owners must carry to legally operate a vehicle on public roads. It’s crucial to understand and comply with these state-specific requirements.

How do I choose the right insurance liability limits for my policy?

+Choosing the right insurance liability limits depends on various factors, including your financial situation, the value of your assets, and your risk tolerance. It’s generally recommended to opt for higher liability limits to ensure sufficient protection against potential claims. Consult with an insurance professional to determine the appropriate limits for your specific circumstances.