Insurance Government

The insurance industry, a vital component of the global economy, plays a pivotal role in mitigating risks and ensuring financial security for individuals, businesses, and governments alike. This article delves into the complex relationship between insurance and government, exploring the regulatory landscape, the impact on the industry, and the broader implications for society.

Regulating the Insurance Industry: A Global Perspective

Insurance regulation is a critical aspect of government oversight, aimed at protecting consumers, promoting market stability, and ensuring the solvency of insurance companies. The regulatory framework varies across jurisdictions, reflecting diverse cultural, economic, and political contexts.

Key Regulatory Bodies

In the United States, the insurance industry is primarily regulated at the state level by departments of insurance or similar bodies. These agencies enforce laws and regulations that govern insurance practices, including rate setting, policy standards, and consumer protection. At the federal level, entities like the Federal Insurance Office (FIO) play a role in monitoring systemic risks and promoting insurance market stability.

Conversely, in Europe, insurance regulation is largely centralized at the European Union (EU) level. The Solvency II regime, introduced in 2016, sets stringent capital and solvency requirements for insurance companies operating within the EU. This harmonized approach aims to ensure a level playing field and enhance consumer protection across the region.

Regulatory Challenges and Innovations

The insurance industry’s regulatory landscape is constantly evolving to address emerging risks and technological advancements. For instance, the rise of InsurTech startups, leveraging digital technologies to disrupt traditional insurance models, has prompted regulators to adapt their frameworks to accommodate these innovative business models.

Moreover, the COVID-19 pandemic has highlighted the importance of regulatory agility. Governments and regulatory bodies have had to swiftly adapt their policies to address the unique challenges posed by the pandemic, such as business interruption coverage and the need for greater flexibility in insurance products and services.

Government Influence on Insurance Practices

Government policies and mandates significantly shape the insurance industry’s practices and offerings. These influences range from mandatory coverage requirements to public-private partnerships that address specific societal needs.

Mandatory Insurance Programs

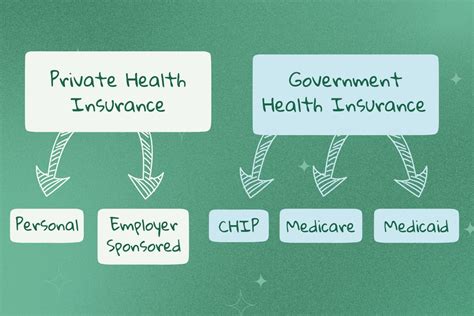

Many governments mandate certain types of insurance coverage to protect citizens and ensure societal stability. For instance, most states in the US require drivers to carry auto insurance to cover liability for bodily injury and property damage. Similarly, in Europe, many countries have universal healthcare systems that are partially funded by mandatory health insurance contributions.

| Country | Mandatory Insurance |

|---|---|

| United States | Auto Insurance (most states) |

| Germany | Public Health Insurance |

| Japan | Earthquake Insurance |

Public-Private Partnerships

Government collaboration with the private insurance sector is a common approach to addressing risks that are either too large or too uncertain for the private sector to manage alone. These partnerships often involve the government providing reinsurance or backstop coverage for catastrophic events like natural disasters or terrorist attacks.

For example, the US government's National Flood Insurance Program (NFIP) is a partnership between the Federal Emergency Management Agency (FEMA) and private insurers. The NFIP provides flood insurance to property owners in flood-prone areas, with FEMA setting the rates and standards while private insurers handle the administration and claims.

The Impact of Government Policies on Insurance Companies

Government policies and regulations significantly influence the strategies, operations, and financial health of insurance companies. These impacts can be both positive and negative, depending on the specific policies and the industry’s ability to adapt.

Regulatory Compliance and Costs

Insurance companies must invest significant resources to comply with regulatory requirements. These costs can include legal fees, IT infrastructure upgrades, and additional staffing to manage compliance. While these costs can be burdensome, they are necessary to ensure the industry operates ethically and responsibly.

Policy Mandates and Market Opportunities

Government mandates can create new market opportunities for insurance companies. For instance, the Affordable Care Act (ACA) in the US, which expanded healthcare coverage to millions of Americans, led to significant growth in the health insurance market. Insurance companies had to adapt their offerings and marketing strategies to comply with the new regulations and capitalize on the expanded market.

Risk Mitigation and Resilience

Government intervention in insurance markets can help mitigate systemic risks and enhance industry resilience. For example, government-backed reinsurance programs can provide a financial safety net for insurers facing catastrophic losses. These programs can stabilize the market, prevent insurer failures, and ensure that policyholders are protected even in the event of large-scale disasters.

The Future of Insurance and Government Relations

The insurance industry and government entities will continue to have a symbiotic relationship, each influencing the other’s strategies and outcomes. As the world faces increasing risks from climate change, technological advancements, and global pandemics, the role of insurance in providing financial protection and resilience will become even more critical.

Emerging Risks and Regulatory Adaptation

Governments and regulators will need to adapt their frameworks to address emerging risks. For instance, the rise of cyber threats and the increasing frequency of extreme weather events will require regulators to develop new standards and guidelines to ensure insurance products adequately address these risks.

Digital Transformation and Regulatory Sandboxes

The insurance industry’s digital transformation will continue to reshape the regulatory landscape. Regulatory sandboxes, which allow insurers to test innovative products and services in a controlled environment, will likely become more common. These sandboxes provide a safe space for insurers to experiment with new technologies and business models while ensuring consumer protection.

Global Collaboration and Standardization

As the world becomes more interconnected, global collaboration and standardization in insurance regulation will become increasingly important. International organizations like the International Association of Insurance Supervisors (IAIS) play a vital role in promoting consistency and cooperation among regulators worldwide. This collaboration ensures a harmonized approach to addressing cross-border risks and maintaining a stable global insurance market.

How do government regulations impact insurance rates?

+Government regulations can directly influence insurance rates by setting minimum standards for coverage, determining acceptable rate increases, and mandating certain benefits. These regulations can impact the cost of doing business for insurers, which may be passed on to consumers in the form of higher premiums.

What is the role of insurance in disaster relief efforts?

+Insurance plays a crucial role in disaster relief by providing financial protection to individuals and businesses affected by catastrophic events. It helps them recover and rebuild, reducing their financial burden. Additionally, insurers often collaborate with governments and NGOs to coordinate response efforts and ensure prompt claims processing.

How do government-backed reinsurance programs work?

+Government-backed reinsurance programs provide a financial backstop to primary insurers in the event of large-scale catastrophes. These programs, often set up in response to major disasters, aim to stabilize the insurance market and ensure insurers have the capacity to pay claims. They can be funded by governments, insurers, or a combination of both.