Insurance For Jewellery

Jewellery, a timeless expression of style and sentiment, often holds immense value, both monetarily and sentimentally. Protecting these precious items is essential, and that's where insurance steps in. In this comprehensive guide, we'll delve into the world of jewellery insurance, exploring the nuances, benefits, and considerations to help you make an informed decision.

Understanding Jewellery Insurance

Jewellery insurance is a specialized form of property insurance designed to safeguard your valuable jewellery pieces. It provides financial protection against various risks, including theft, loss, damage, and even mysterious disappearance. With the right policy, you can ensure that your cherished jewellery is covered, giving you peace of mind and protecting your investment.

The need for jewellery insurance arises from the unique nature of these possessions. Unlike other valuables, jewellery often carries a high resale value, making it an attractive target for thieves. Additionally, the intricate craftsmanship and delicate materials used in jewellery can make them susceptible to damage or loss. A jewellery insurance policy offers a tailored solution to these specific risks.

The Benefits of Jewellery Insurance

Choosing to insure your jewellery comes with a multitude of advantages. Firstly, it provides comprehensive coverage for your valuable pieces. Whether it’s an engagement ring, a family heirloom, or a statement necklace, you can rest assured knowing they are protected.

Secondly, jewellery insurance offers replacement value coverage. This means that in the unfortunate event of a loss or damage, the insurance provider will reimburse you for the full value of the jewellery, allowing you to replace it with a similar item. This is especially crucial for high-end or vintage pieces that may be challenging to replicate.

Additionally, jewellery insurance policies often include global coverage. This feature ensures that your jewellery is protected not only at home but also during travel, providing you with added security and flexibility.

Key Considerations for Jewellery Insurance

When exploring jewellery insurance options, several factors come into play. Firstly, it’s essential to understand the scope of coverage. Different policies may offer varying levels of protection, so it’s crucial to review the fine print and ensure that the policy aligns with your specific needs.

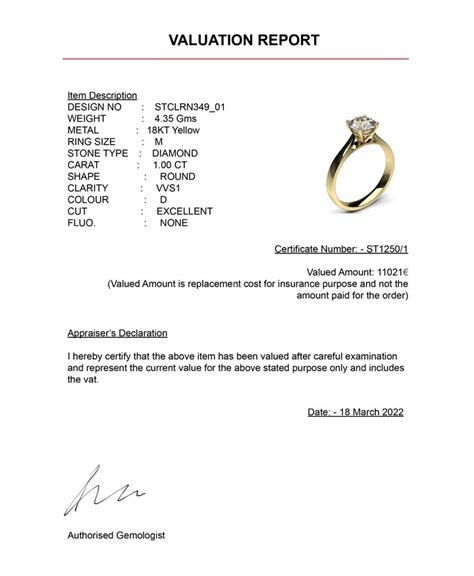

Another critical consideration is appraisal and valuation. Accurate documentation of your jewellery's value is essential for insurance purposes. Consider having your pieces professionally appraised to ensure an accurate assessment of their worth. This step is vital in case of a claim, as it provides evidence of the jewellery's value.

Additionally, policy limits and deductibles are important factors to consider. Policy limits refer to the maximum amount an insurer will pay for a covered loss, while deductibles are the portion of the loss you must cover yourself. Understanding these limits and deductibles helps you choose a policy that suits your budget and provides adequate coverage.

| Jewellery Insurance Provider | Coverage Highlights |

|---|---|

| Provider X | Specializes in high-end jewellery, offering worldwide coverage with no deductible for loss or damage. |

| Provider Y | Known for flexible policies, allowing customization based on individual needs. Includes coverage for accidental damage. |

| Provider Z | Provides comprehensive coverage with an option for enhanced protection against mysterious disappearance. |

The Process of Insuring Your Jewellery

Insuring your jewellery is a straightforward process that involves several key steps. Firstly, identify the items you wish to insure. This step is crucial, as it helps you assess the value and specific needs of each piece.

Next, obtain appraisals for your jewellery. A professional appraisal provides an accurate and detailed description of each item, including its materials, craftsmanship, and estimated value. This documentation is essential for insurance purposes and can be used as proof of ownership and value in case of a claim.

Once you have identified your jewellery and obtained appraisals, it's time to shop around for insurance providers. Compare different policies, considering factors such as coverage limits, deductibles, and any additional benefits or exclusions. Look for providers with a solid reputation and a track record of prompt claim settlements.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a critical step in ensuring your jewellery is adequately protected. Consider the following factors when making your decision:

- Reputation and Financial Stability: Choose an insurer with a strong reputation and a solid financial standing. This ensures that the provider will be able to honor your claims in the future.

- Coverage Options: Look for providers that offer a range of coverage options to suit your specific needs. Consider factors such as replacement value, coverage limits, and any unique requirements you may have.

- Claim Process: Research the insurer's claim process and reputation for prompt and fair settlements. Read reviews and seek recommendations from others who have insured their jewellery.

- Additional Benefits: Some providers offer extra perks, such as coverage for temporary jewellery or additional discounts. Evaluate these benefits to determine if they align with your needs.

Remember, the right insurance provider should offer not only comprehensive coverage but also a seamless and reliable claim process. Take the time to research and compare options to find the best fit for your valuable jewellery.

Common Misconceptions About Jewellery Insurance

There are several common misconceptions surrounding jewellery insurance that can lead to confusion or misinformation. Let’s address some of these misconceptions to provide clarity:

Myth: Jewellery Insurance is Too Expensive

One prevalent misconception is that jewellery insurance is prohibitively expensive. While it’s true that the cost of insurance can vary based on the value and type of jewellery, it’s essential to consider the value of your pieces and the potential financial loss in the event of theft, loss, or damage. Jewellery insurance provides peace of mind and can be a worthwhile investment to protect your valuable assets.

Myth: Homeowners Insurance Covers Jewellery

Another common misconception is that homeowners insurance automatically covers jewellery. While homeowners insurance may provide some coverage for jewellery, it often has limitations and may not offer the level of protection you require. Jewellery insurance policies are specifically designed to provide comprehensive coverage, ensuring your precious items are adequately protected.

Myth: Jewellery Insurance is Only for High-End Pieces

Some individuals believe that jewellery insurance is solely necessary for high-end or luxury pieces. However, jewellery insurance can be beneficial for a wide range of items, including family heirlooms, sentimental pieces, and even everyday jewellery. Regardless of the value, insuring your jewellery ensures that you are financially protected in the event of an unfortunate loss or damage.

Tips for Maximizing Your Jewellery Insurance Coverage

To ensure you get the most out of your jewellery insurance policy, consider the following tips:

Regularly Update Your Policy

Jewellery collections often evolve over time, with new pieces being added or existing ones gaining value. To maintain adequate coverage, regularly update your insurance policy to reflect any changes in your collection. This ensures that your insurance aligns with the current value of your jewellery.

Secure Your Jewellery Properly

While insurance provides financial protection, taking preventive measures to secure your jewellery can further reduce the risk of loss or theft. Invest in a high-quality safe or vault to store your valuable pieces. Additionally, consider installing security systems or alarms to deter potential thieves.

Understand Your Policy’s Exclusions

It’s crucial to thoroughly understand the exclusions and limitations of your jewellery insurance policy. Some policies may exclude coverage for certain types of jewellery, such as costume jewellery or items with specific materials. By familiarizing yourself with these exclusions, you can make informed decisions about which pieces to insure and ensure that your coverage is comprehensive.

Real-Life Case Studies: Jewellery Insurance in Action

To illustrate the importance and benefits of jewellery insurance, let’s explore a couple of real-life case studies:

Case Study 1: Theft Recovery

Ms. Smith, a jewellery enthusiast, had her home broken into, resulting in the theft of several valuable pieces. Fortunately, she had insured her jewellery collection with a reputable provider. The insurance company promptly assisted her in filing a claim, and with the help of the detailed appraisals and photographs she provided, they were able to reimburse her for the full value of the stolen items. Ms. Smith’s experience highlights the importance of insurance in recovering from theft and ensuring financial stability.

Case Study 2: Accidental Damage

Mr. Johnson, a busy professional, accidentally dropped his engagement ring while rushing to a meeting. The ring suffered significant damage, requiring repair. Fortunately, he had insured his jewellery, including coverage for accidental damage. With the help of his insurance provider, he was able to have the ring repaired without incurring substantial costs. This case study emphasizes the value of insurance in covering unexpected incidents and preserving sentimental pieces.

Future Trends in Jewellery Insurance

The world of jewellery insurance is constantly evolving, and several trends are shaping the future of this industry. Here’s a glimpse into what we can expect:

Technology Integration

Insurance providers are increasingly leveraging technology to enhance the insurance experience. From digital appraisals to blockchain-based ownership verification, technology is streamlining the insurance process. Expect to see more innovative solutions that simplify documentation, improve security, and provide efficient claim management.

Personalized Coverage

The future of jewellery insurance lies in personalized coverage options. Insurers are recognizing the unique needs of individual jewellery collectors and are offering tailored policies. This trend allows for more flexibility and ensures that each collector’s specific requirements are met, providing a higher level of satisfaction and protection.

Sustainable and Ethical Considerations

With a growing focus on sustainability and ethical practices, jewellery insurance providers are also adapting. Expect to see policies that promote sustainable and ethical sourcing of jewellery materials. Additionally, insurers may offer incentives or discounts for eco-friendly or ethically sourced pieces, encouraging responsible practices within the industry.

Frequently Asked Questions

How much does jewellery insurance typically cost?

+The cost of jewellery insurance varies depending on factors such as the value of your jewellery, the coverage limits, and the provider. On average, you can expect to pay a percentage of the jewellery’s value as a premium, with rates typically ranging from 0.5% to 1% of the insured amount.

Can I insure vintage or antique jewellery?

+Yes, jewellery insurance policies often cover vintage and antique pieces. However, it’s crucial to obtain a professional appraisal to accurately assess their value and ensure proper coverage. Some insurers may require additional documentation or have specific guidelines for insuring antique jewellery.

What happens if I need to make a claim for my jewellery insurance?

+In the event of a claim, you will need to contact your insurance provider and provide them with the necessary documentation, such as an appraisal report, photographs, and any other relevant information. The insurance company will then assess the claim and, if approved, reimburse you for the covered loss or damage according to the terms of your policy.

Are there any exclusions or limitations in jewellery insurance policies?

+Yes, jewellery insurance policies may have certain exclusions and limitations. Common exclusions include loss due to natural disasters, war, or intentional damage. Additionally, there may be limitations on coverage for certain types of jewellery, such as loose gemstones or specific high-risk items. It’s important to carefully review your policy to understand any exclusions or limitations that may apply.

Can I add my jewellery to my existing homeowners or renters insurance policy?

+While homeowners or renters insurance policies may provide some coverage for jewellery, it is often limited and may not offer the level of protection you desire. It’s recommended to consider a dedicated jewellery insurance policy to ensure comprehensive coverage. Consult with your insurance provider to understand your options and make an informed decision.

Jewellery insurance is an essential consideration for anyone who owns valuable jewellery. By understanding the benefits, considerations, and process of insuring your jewellery, you can make an informed decision to protect your cherished possessions. Remember, the right insurance policy provides peace of mind and financial security, ensuring that your jewellery remains a source of joy and sentiment for years to come.