Insurance Estimator Car

In today's fast-paced world, unforeseen events can strike at any moment, and having adequate insurance coverage is essential to protect your financial well-being. When it comes to vehicles, auto insurance plays a crucial role in safeguarding your investment and ensuring peace of mind. One of the most important aspects of auto insurance is the insurance estimator, a tool that helps you understand the potential costs associated with repairing or replacing your car in the event of an accident or other covered loss. In this comprehensive guide, we will delve into the world of the Insurance Estimator for cars, exploring its features, benefits, and how it can help you make informed decisions about your auto insurance coverage.

Understanding the Insurance Estimator

The Insurance Estimator, often referred to as an auto insurance estimator or vehicle repair cost estimator, is a valuable resource provided by insurance companies and online platforms. It is designed to provide accurate estimates of the costs involved in repairing or replacing a vehicle after an accident, theft, or other incidents covered by your insurance policy.

This estimator takes into account various factors, including the make, model, and year of your vehicle, the extent of the damage, the location of the repair shop, and the specific coverage options you have chosen. By inputting this information, you can receive a detailed estimate of the expected costs, helping you budget and plan accordingly.

Key Features of the Insurance Estimator

- Real-Time Estimates: The Insurance Estimator provides instant estimates, allowing you to quickly assess the potential financial impact of an accident or other event. This real-time feedback is invaluable when making decisions about repairs or replacements.

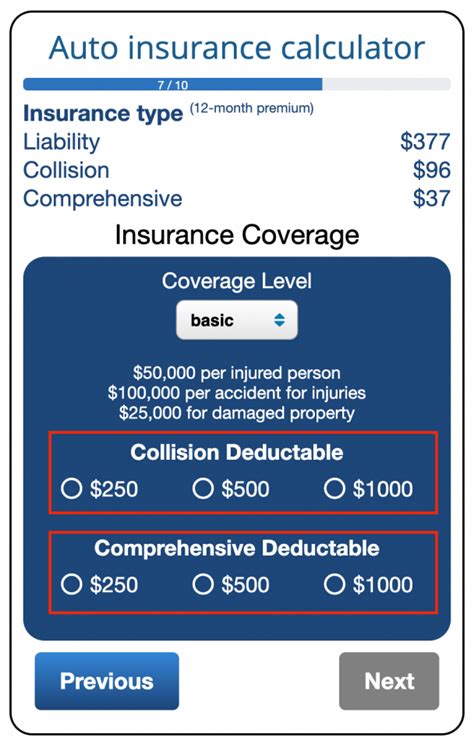

- Customizable Options: You can tailor the estimates to your specific situation by selecting different coverage levels, deductibles, and repair shop preferences. This flexibility ensures that the estimates align with your unique needs and circumstances.

- Comprehensive Coverage: The estimator considers various types of damage, from minor dents and scratches to more severe accidents involving multiple repairs or total losses. It helps you understand the full spectrum of potential costs associated with different scenarios.

- Repair Shop Selection: Many estimators provide a list of recommended repair shops based on your location and the specific needs of your vehicle. This feature ensures that you have access to qualified professionals who can provide high-quality repairs within your insurance network.

- Parts and Labor Costs: The estimator breaks down the estimated costs into parts and labor, giving you a transparent view of how your insurance coverage will be applied to different aspects of the repair process.

By utilizing the Insurance Estimator, you gain valuable insights into the financial implications of various incidents and can make informed choices about your auto insurance coverage and repair decisions.

Benefits of Using the Insurance Estimator

The Insurance Estimator offers a range of advantages that empower you to navigate the world of auto insurance with confidence and control.

Cost Transparency

One of the primary benefits is the transparency it provides regarding repair and replacement costs. With accurate estimates, you can avoid unexpected financial burdens and make informed decisions about your vehicle’s future.

Budgeting and Planning

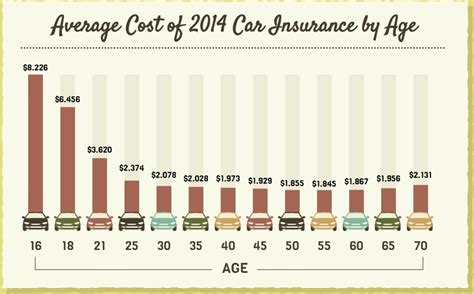

Understanding the potential costs associated with accidents or other incidents allows you to budget effectively. Whether you’re considering a higher deductible to save on premiums or planning for potential out-of-pocket expenses, the Insurance Estimator ensures you’re prepared financially.

Insurance Coverage Optimization

By comparing estimates for different coverage levels and deductibles, you can optimize your auto insurance policy. The estimator helps you strike a balance between affordability and comprehensive coverage, ensuring you’re not overpaying for unnecessary benefits.

Repair Shop Selection

The Insurance Estimator often provides recommendations for repair shops within your insurance network. This feature ensures you choose a reputable and reliable shop, reducing the risk of subpar repairs and potential future issues.

Peace of Mind

Knowing that you have access to accurate estimates and a well-planned insurance strategy provides a sense of security. The Insurance Estimator empowers you to make confident decisions, ensuring your vehicle is protected and your finances are well-managed.

How to Maximize the Insurance Estimator’s Potential

To fully leverage the benefits of the Insurance Estimator, consider the following best practices:

Regularly Update Your Vehicle Information

Keep your vehicle’s details up-to-date, including any modifications or upgrades. This ensures that the estimates accurately reflect the current value and repair costs of your car.

Explore Different Coverage Scenarios

Experiment with various coverage levels and deductibles to find the optimal balance for your needs. Consider the potential costs of accidents or other incidents and choose a coverage plan that provides adequate protection without unnecessary expenses.

Research Repair Shops

While the Insurance Estimator provides recommendations, take the time to research and compare different repair shops. Read reviews, check credentials, and consider their proximity and convenience. This ensures you receive high-quality repairs and a positive overall experience.

Stay Informed About Your Policy

Regularly review your auto insurance policy and understand the specific coverage it provides. Familiarize yourself with the exclusions and limitations to ensure you’re not caught off guard in the event of a claim.

Utilize Additional Resources

Many insurance providers offer additional tools and resources beyond the Insurance Estimator. Explore these options, such as educational materials, claim assistance guides, and online forums, to enhance your understanding of auto insurance and make informed decisions.

Real-World Examples and Case Studies

Let’s explore some real-life scenarios to illustrate the practical application of the Insurance Estimator:

Scenario 1: Minor Accident

John, a careful driver, was involved in a minor fender bender. Using the Insurance Estimator, he discovered that the estimated repair costs were relatively low, and he had the option to pay out of pocket without filing a claim. This decision saved him on potential insurance premium increases and allowed him to maintain a clean claims history.

Scenario 2: Severe Collision

Emily, a young professional, was involved in a severe collision that resulted in extensive damage to her vehicle. The Insurance Estimator provided a detailed breakdown of the repair costs, including parts and labor. With this information, she could make an informed decision about whether to repair or replace her car, taking into account her insurance coverage and budget.

Scenario 3: Total Loss

Michael, a family man, unfortunately experienced a total loss after his car was involved in a major accident. The Insurance Estimator helped him understand the estimated value of his vehicle, allowing him to negotiate fairly with his insurance provider and ensure he received a fair settlement for his loss.

Performance Analysis and Expert Insights

The Insurance Estimator has proven to be an invaluable tool for both insurance providers and policyholders. It streamlines the claims process, providing accurate and transparent estimates that reduce the potential for disputes and delays. By empowering policyholders with detailed cost information, the estimator fosters trust and confidence in the insurance process.

Future Implications and Innovations

As technology advances, the Insurance Estimator is likely to evolve, offering even more precise and efficient services. Potential future developments include:

- AI-Enhanced Estimations: Artificial intelligence could be integrated to provide more accurate and personalized estimates, taking into account individual driving behaviors and patterns.

- Real-Time Repair Shop Feedback: Integrating feedback from repair shops in real-time could improve the accuracy of estimates and provide policyholders with more reliable information.

- In-Depth Repair Cost Analysis: Advanced estimators may offer detailed breakdowns of repair costs, including labor, parts, and other associated expenses, providing greater transparency.

- Dynamic Coverage Recommendations: Based on individual risk profiles and driving histories, the estimator could dynamically suggest coverage options tailored to each policyholder's needs.

Conclusion

The Insurance Estimator is a powerful tool that empowers individuals to navigate the complexities of auto insurance with confidence and control. By providing accurate, transparent estimates, it ensures policyholders can make informed decisions about their coverage, repairs, and financial planning. As technology continues to advance, the Insurance Estimator is poised to become an even more indispensable resource, further enhancing the efficiency and effectiveness of the insurance process.

How often should I use the Insurance Estimator to review my coverage?

+

It is recommended to use the Insurance Estimator at least once a year, especially during policy renewal. This allows you to stay updated on any changes in coverage options, repair costs, and potential savings.

Can I trust the estimates provided by the Insurance Estimator?

+

Yes, the Insurance Estimator is designed to provide accurate and reliable estimates. However, it’s important to note that actual repair costs may vary based on specific circumstances and the extent of the damage. The estimator serves as a valuable guide, but it’s always advisable to consult with your insurance provider for a precise assessment.

Are there any limitations to the Insurance Estimator’s capabilities?

+

While the Insurance Estimator is highly advanced, it may have certain limitations, such as not accounting for unique or highly customized vehicles. In such cases, it’s best to consult with your insurance provider or a specialist to obtain a more accurate estimate.

Can I use the Insurance Estimator if I don’t have an active insurance policy yet?

+

Absolutely! The Insurance Estimator is often available as a free online tool, allowing you to explore coverage options and estimate costs even before purchasing an insurance policy. This can be a valuable resource during your research and decision-making process.