Insurance Comprehensive

In today's complex and ever-evolving world, having comprehensive insurance coverage is an essential aspect of financial planning and risk management. This article aims to delve into the intricacies of comprehensive insurance, offering a detailed guide to understanding its various facets, benefits, and real-world applications. By exploring the scope, types, and impact of comprehensive insurance, we can better appreciate its significance and make informed decisions to safeguard our assets and livelihoods.

Unveiling the Essence of Comprehensive Insurance

Comprehensive insurance, often referred to as all-risk coverage, is a broad term encompassing various insurance policies designed to offer maximum protection against a wide array of potential risks and losses. Unlike limited or specified coverage policies, comprehensive insurance provides an extensive safety net, mitigating financial losses arising from unforeseen events. This all-encompassing approach makes it an indispensable tool for individuals, businesses, and organizations seeking to secure their future against uncertain events.

The Scope and Reach of Comprehensive Insurance

The scope of comprehensive insurance is vast, covering a myriad of potential risks and perils. It includes protection against natural disasters like floods, hurricanes, and earthquakes, as well as man-made hazards such as fire, theft, and vandalism. Moreover, comprehensive insurance often extends to cover liability risks, providing financial protection in the event of legal claims or lawsuits arising from accidental injuries or property damage caused by the policyholder.

For instance, consider a homeowner's comprehensive insurance policy. It not only covers the physical structure of the home but also extends to protect the contents inside, offering compensation for losses due to burglary, fire, or natural disasters. This level of coverage provides the policyholder with peace of mind, knowing that their home and possessions are safeguarded against a wide range of unforeseen circumstances.

Understanding the Perils Covered

To fully grasp the power of comprehensive insurance, it’s essential to understand the specific perils it covers. These typically include:

- Natural Disasters: Floods, hurricanes, tornadoes, and earthquakes.

- Fire and Explosion: Protection against damage caused by fire, including smoke and water damage.

- Theft and Vandalism: Covers losses due to theft, burglary, or malicious damage to property.

- Accidental Damage: Coverage for unexpected events like a tree falling on your home or a water pipe bursting.

- Liability Risks: Financial protection in case of legal claims or lawsuits arising from accidental injuries or property damage.

Each of these perils can cause significant financial strain, and comprehensive insurance serves as a vital tool to mitigate these risks.

The Benefits of Comprehensive Coverage

The advantages of opting for comprehensive insurance are manifold. Firstly, it offers a sense of security and peace of mind, knowing that you are protected against a wide range of potential risks. Secondly, it can provide significant cost savings in the long run. While comprehensive insurance policies may have higher premiums compared to limited coverage, the potential financial losses they prevent can be far greater. This is especially true for businesses and individuals operating in high-risk environments or those with valuable assets.

Additionally, comprehensive insurance often comes with added benefits and services. For instance, many policies include 24/7 emergency assistance, providing immediate support in the event of a covered loss. Furthermore, some insurers offer loss prevention services, helping policyholders identify and mitigate potential risks before they become costly issues.

| Key Benefits of Comprehensive Insurance |

|---|

| Wide-ranging protection against multiple risks |

| Peace of mind and financial security |

| Potential for long-term cost savings |

| 24/7 emergency assistance and support |

| Loss prevention services and risk mitigation |

Types of Comprehensive Insurance Policies

Comprehensive insurance is not a one-size-fits-all solution. Instead, it comes in various forms, tailored to meet the specific needs and risks of different individuals and businesses. Some of the most common types of comprehensive insurance policies include:

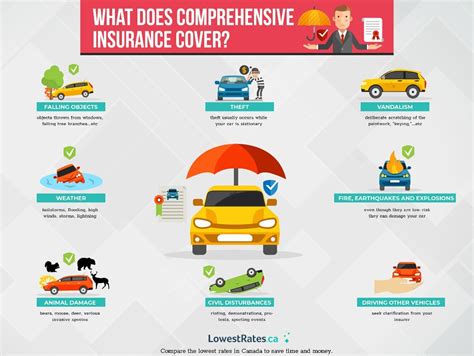

Comprehensive Auto Insurance

This type of policy provides extensive coverage for vehicles, including protection against theft, damage, and liability risks. It often includes collision coverage, which pays for repairs or replacements if your vehicle is involved in an accident, regardless of fault. Comprehensive auto insurance also covers non-collision incidents, such as damage from hail, fire, or vandalism.

Homeowners Comprehensive Insurance

As mentioned earlier, homeowners comprehensive insurance offers extensive protection for the dwelling and its contents. It covers a wide range of perils, including natural disasters, fire, theft, and liability risks. This policy type is especially crucial for homeowners living in areas prone to natural disasters or those with valuable possessions.

Business Comprehensive Insurance

Businesses face a unique set of risks, and comprehensive insurance is often tailored to meet these specific needs. It can cover a business’s property, including buildings, equipment, and inventory, as well as provide liability protection in case of accidents or injuries on the premises. Additionally, business comprehensive insurance may include coverage for business interruption, protecting the company’s income in the event of a covered loss.

Travel Comprehensive Insurance

Travel comprehensive insurance, also known as travel medical insurance, provides extensive coverage for travelers. It offers protection against medical emergencies while abroad, including coverage for hospitalization, emergency medical evacuation, and even trip cancellation or interruption due to unforeseen circumstances.

Real-World Applications and Case Studies

To better understand the impact and importance of comprehensive insurance, let’s explore some real-world scenarios and case studies.

Case Study: Natural Disaster Recovery

Imagine a coastal community that is struck by a devastating hurricane. Homes are damaged, businesses are disrupted, and lives are upended. However, for those with comprehensive insurance policies, the road to recovery is significantly smoother. These policyholders can receive financial assistance to repair or rebuild their homes, replace damaged belongings, and get their lives back on track.

Case Study: Business Continuity

A small business owner, let’s call her Ms. Smith, operates a thriving retail store in a busy city center. One night, a fire breaks out in the building, causing significant damage to her store and the surrounding businesses. Without comprehensive insurance, Ms. Smith might be faced with the daunting task of rebuilding her business from scratch. However, with her comprehensive policy, she can access the necessary funds to repair the damage, restock her inventory, and continue serving her customers, ensuring the long-term survival of her business.

Case Study: Travel Emergency

John, an avid traveler, purchases a comprehensive travel insurance policy before embarking on a backpacking trip across Europe. During his journey, he unfortunately falls ill and requires hospitalization. Thanks to his travel comprehensive insurance, he receives prompt medical attention and is able to cover the costs of his treatment, ensuring a swift recovery without financial strain.

The Future of Comprehensive Insurance

As technology advances and the world becomes increasingly interconnected, the insurance industry is evolving to meet new challenges and opportunities. Comprehensive insurance is no exception, and its future looks promising with the integration of innovative technologies and data analytics.

The Role of Technology

Technology is transforming the insurance landscape, making comprehensive insurance more accessible, efficient, and tailored to individual needs. Insurers are leveraging data analytics and artificial intelligence to offer personalized coverage options and more accurate risk assessments. Additionally, the rise of telematics and connected devices is allowing for real-time monitoring and risk management, particularly in auto and homeowners insurance.

Expanding Coverage Options

The future of comprehensive insurance also involves expanding coverage options to meet the changing needs of policyholders. This includes offering coverage for emerging risks, such as cyber attacks and data breaches, which are becoming increasingly common in the digital age. Additionally, insurers are exploring ways to provide coverage for new technologies, like electric vehicles and renewable energy systems, ensuring that policyholders can protect their investments in sustainable solutions.

FAQ

What is the difference between comprehensive and collision insurance for vehicles?

+Comprehensive insurance for vehicles covers a wide range of perils, including theft, fire, and natural disasters, while collision insurance specifically covers damages caused by your vehicle colliding with another object, such as another car or a tree. Collision insurance is often paired with comprehensive insurance to provide a more complete coverage for your vehicle.

Can I customize my comprehensive insurance policy to fit my specific needs?

+Yes, many comprehensive insurance policies can be customized to meet your specific needs and risks. You can often choose the level of coverage, select additional endorsements or riders to extend your protection, and even tailor certain aspects of the policy, such as deductibles or coverage limits, to fit your budget and preferences.

Are there any exclusions or limitations to comprehensive insurance policies?

+Yes, while comprehensive insurance offers broad protection, it typically has some exclusions and limitations. Common exclusions include normal wear and tear, intentional damage, and mechanical or electrical breakdown. It’s important to carefully review your policy’s terms and conditions to understand what is and isn’t covered.